TIDMVULC

27 November 2023

Vulcan Industries plc

("Vulcan" or the "Company")

Audited Results

Vulcan Industries plc(AQSE: VULC) is pleased to announce its audited results for

the year ended 31 March 2023.

Trading in the Company's shares will resume on Tuesday 28 November 2023, the

first business day following the publication of this announcement.

The full audited financial statements will be uploaded to the Company website. A

further announcement will be made when the financial statements are sent to

shareholders together with a notice of the Annual General Meeting.

Principal activity

Vulcan seeks to acquire and consolidate industrial and renewable SMEs and

projects for value and to enhance performance in part through group synergies,

but primarily by unlocking growth which is not being achieved as a standalone

private company.

Review of business and future developments

On the 1 June 2020, the share capital of the Company was admitted to trading on

the Aquis Stock Exchange Growth Market ("AQSE"). This enables the Company to

raise additional equity to fund its growth and acquisition strategy. Since

admission, the focus has been to restructure the existing businesses to recover

from the financial impact of COVID-19 and lay the foundations to develop the

Group going forward. The initial step in this process was the acquisition on 24

March 2022 of the entire share capital of Aftech Limited ("Aftech"). Aftech

brings additional complementary areas of fabrication skills and product

offering. On 6 March 2023, the Company broadened its activities into the energy

sector with the acquisition of the entire share capital of Forepower Lincoln

(250) Limited ("FPL(250)"). FPL(250) is a 248 MW Battery Energy Storage System

("BESS") project, currently seeking formal planning consent.

COVID-19 had a significant impact on the financial performance of the Group

since admission. The results for the years ended 31 March 2021 and 31 March

2022, reflected the impact of various lock downs and the subsequent.

challenging market conditions. Whilst demand picked up in the second half of the

year ended 31 March 2022, the continued operating losses placed significant

strains on working capital. In particular, M&G Olympic Products Limited ("MGO")

which, like many smaller suppliers to the major construction companies,

struggled to balance the cash flow fluctuations across multiple large projects.

In order to stem continued cash outflows, MGO was disposed of on 30 March 2022.

A strategic review, lead the board to conclude that, in order to lay firm

foundations for future growth, it was necessary to dispose of the remaining loss

making businesses. Both Orca Doors Limited ("Orca") and IVI Metallics Limited

("IVI") were disposed of in July 2022 and Time Rainham Limited ("TRR") was

disposed of in November 2022.

Consequently, the results for Orca, IVI and TRR are disclosed as discontinued

activities and the comparatives for the prior year have been restated

accordingly. The financial results for the Group for the year ending 31 March

2023, show an increase in continuing revenue to £1,165,000 (2022: £46,000) and a

fall in the continuing loss before interest, tax, depreciation, amortization and

impairments to £523,000 (2022: £897,000). After continuing depreciation and

amortization of £59,000 (2022: £nil), impairment charges of £nil (2022: £12,000)

continuing finance costs of £463,000 (2022: £390,000), the Group is reporting a

loss before taxation on continuing activities of £1,020,000 (2022: £1,299,000).

The disposals of Orca, IVI and TRR generated a profit on discontinued activities

of £1,588,000 (2022: Loss £2,389,000) after reporting a loss after tax to the

date of disposal of £216,000 (2022: £3,042,000). The reported profit after tax

for the Group is £639,000 (2022: Loss £3,687,000).

At 31 March 2023, the Group balance sheet shows net assets of £510,000 (2022:

net liabilities £3,155,000).

Outlook

The disposals of the loss making legacy businesses of Orca, IVI and TRR during

the year ended 31 March 2023 added significant benefit to the Group balance

sheet and stemmed continued cash outflows. Since the year end, the Group has

continued to lay the foundations for its future development. The acquisition of

the FPL(250) project has broadened the sectors of Group activities. As announced

on 25 October 2023, the Company has disposed of 49.9% of its holding in FPL

(250) in order to fund the development of the project and value is expected to

be generated as the project moves through the planning process and obtains a

firm connection date to the national grid. The development phase of the project

offers potential to expand the fabrication activities of Aftech. In addition

there is a strong pipeline of further BESS and other opportunities which the

Company will seek to bring into the Group in due course.

The auditors have made reference to going concern in their audit report by way

of a material uncertainty. Their opinion is not modified in respect of this

matter.

Consolidated Statement of

Comprehensive Income

Year ending 31 March 2023 Restated

Year ending

31 March 2022

Note £'000 £'000

Continuing activities

Revenue 1,165 46

Cost of sales (674) (29)

Gross profit 491 17

Operating expenses (849) (609)

Other gains and losses 4 (224) (305)

Impairment charge 5 - (12)

Finance costs 6 (438) (390)

Loss before tax (1,020) (1,299)

Income tax 71 -

Loss for the year from (949) (1,299)

continuing activities

Discontinued activities

Profit / (loss) for the year 7 1,588 (2,388)

from discontinued activities

Profit / (loss) for the year 639 (3,687)

attributable to the owners

of the Company

Other Comprehensive Income - -

for the period

Total Comprehensive Income 639 (3,687)

for the period attributable

to owners of the Company

Earnings per share

Basic and Diluted earnings 8 (0.16) (0.37)

per share for loss from

continuing operations

attributable to the owners

of the Company (pence)

Basic and Diluted earnings 8 0.11 (1.06)

per share loss attributable

to the owners of the Company

(pence)

Consolidated Note At At

Statement of

Financial 31 March 31 March

Position

2023 2022

£'000 £'000

Non-current

assets

Goodwill 9 718 945

Other 9 3,178 317

intangible

assets

Investments 500 500

Property, 131 295

plant and

equipment

Right of use - 403

assets

Total non 4,527 2,460

-current

assets

Current

assets

Inventories 32 252

Trade and 511 833

other

receivables

Cash and bank 2 69

balances

Total current 545 1,154

assets

Total assets 5,072 3,614

Current

liabilities

Trade and (1,344) (2,698)

other

payables

Lease - (125)

liabilities

Borrowings 10 (3,187) (2,968)

Total current (4,531) (5,791)

liabilities

Non-current

liabilities

Lease - (266)

liabilities

Borrowings 10 - (674)

Deferred tax (31) (38)

liabilities

Total non (31) (978)

-current

liabilities

Total (4,562) (6,769)

liabilities

Net assets / 510 (3,155)

(liabilities)

Equity

Share capital 11 348 211

Shares to be 11 - 293

issued

Share premium 11 9,827 6,645

account

Retained (9,665) (10,304)

earnings

Total equity 510 (3,155)

attributable

to the owners

of the

company

Consolidated statement of changes in equity

Share Shares to Share Retained Total

be issued Premium earnings Equity

Capital

£'000 £'000 £'000 £'000 £'000

At 1 April 2021 112 - 3,946 (6,617) (2,559)

Loss for the year - - - (3,687) (3,687)

Other comprehensive - - - - -

income for the year

Total Comprehensive - - - (3,687) (3,687)

income for the year

Transactions with

shareholders

Issue of shares 99 293 2,699 - 3,091

Total transactions with 99 293 2,699 - 3,091

shareholders for the

year

At 1 April 2022 211 293 6,645 (10,304) (3,155)

Profit for the year - - - 639 639

Other comprehensive - - - - -

income for the year

Total Comprehensive - - - 639 639

income for the year

Transactions with

shareholders

Issue of shares 137 (293) 3,182 - 3,026

Total transactions with 137 (293) 3,182 - 3,026

shareholders for the

year

At 31 March 2023 348 - 9,827 (9,665) 510

Consolidated Statement of Year ending Restated

Cash Flows 31 March

2023 Year ending 31 March 2022

£'000 £'000

Loss for the period from (949) (1,299)

continuing activities

Adjusted for:

Finance costs 463 389

Depreciation of property, 29 1

plant and equipment

Amortisation of intangible 30 104

assets

Impairment of Goodwill and - 369

intangible assets

(Decrease) / increase in - (62)

provisions

Share based payment 100 499

Operating cash flows before (327) 1

movements in working capital

Decrease / (increase) in (6) 5

inventories

Decrease / (increase) in (118) (149)

trade and other receivables

Increase in trade and other 139 327

payables

Cash (used in) / from (312) 184

operating activities

Income tax credit received 28 -

Income tax paid (3) -

Cash (used in) / from (287) 184

operating activities -

continuing

Cash (used in) / from (278) (370)

operating activities -

discontinued

Cash used in operating (565) (186)

activities

Investing activities

Purchases of property, plant (2) -

and equipment

Disposal of subsidiaries - 731 -

net debt retained

Acquisition of subsidiary - 46

net of cash acquired

Cash from / (used in) 729 46

investing activities -

continuing

Cash used in investing - 31

activities - discontinued

Cash from / (used in) 729 77

investing activities

Financing activities

Interest paid (271) (388)

Drawdown of loans and 70 -

borrowings

Repayment of loans and (169) -

borrowings

Proceeds on issue of shares 258 1,041

Net cash from financing (112) 653

activities - continuing

Net cash from financing (119) (561)

activities - discontinued

Net cash from financing (231) 92

activities

Net decrease in cash and (67) (17)

cash equivalents

Cash and cash equivalents at 69 86

beginning of year

Cash and cash equivalents at 2 69

end of year

1. General information

Vulcan Industries PLC is incorporated in England and Wales as a public company

with registered number 11640409.

These financial statements are extracted from the audited financial statements

which have been posted on the Company's web site and do not constitute statutory

accounts.

These financial statements are presented in Sterling and are rounded to the

nearest £'000. which is also the currency of the primary economic environment in

which the Company and Group operate (their functional currency).

2. Significant accounting policies

Going concern

The Group has prepared forecasts covering the period of 12 months from the date

of approval of these financial statements. These forecasts are based on

assumptions such as forecast volumes, selling prices and budgeted cost

reductions. They further take into account working capital requirements and

currently available borrowing facilities.

These forecasts show that following the part disposal of FPL (250) Limited, the

Group is projected to have sufficient cash resources to fund the budgeted

project expenditure and Group overheads. However delays in the planning process

would require additional funding either through additional loan facilities or

through raising cash through capital and project finance transactions to remain

a going concern.

The Group's focus is on continued improvements to operational performance of the

acquisitions made to date with an emphasis on volume growth to increase gross

margins and synergies resulting in cost reductions. On 1 June 2020 the Company

was admitted to trading on the AQSE Growth Market. This has already facilitated

the ability of the Company to raise new equity.

As set out in notes 20, the Group is currently funded by a combination of short

and long-term borrowing facilities. At 31 March 2023 the loans of £1,854,000

were subject to a rolling standstill agreement and £475,000 fell due for

repayment in September 2023. Since the year end their term has been extended and

they now fall due between April and June 2025. The liquidity profile of the

Group's debt is set out in note 27. The factoring facilities, of which £145,000

(2022: £447,000) was fully drawn at 31 March 2023, may be withdrawn with 3

months' notice. As set out in Note 20, on 30 August 2022, the Company has

received a demand under a cross guarantee of the outstanding principal of the

CBIL originally drawn down by IVI. The Company has recognised the obligation as

a liability and is in negotiations to restructure this loan.

Based on the above, whilst there are no contractual guarantees, the directors

are confident that the existing financing will remain available to the Group and

that additional sources of finance will be available. The directors, with the

operating initiatives already in place and funding options available are

confident that the Group will achieve its cash flow forecasts. Therefore, the

directors have prepared the financial statements on a going concern basis.

Nonetheless, the forecasts show that the Group will need to meet its operating

targets and that delays would require further funding to meet its commitments as

they fall due. In addition to this the Group is reliant on maintaining its

existing borrowings. These conditions and events indicate the existence of

material uncertainties that may cast significant doubt upon the Group's ability

to continue as a going concern and the Group may therefore be unable to realise

their assets and discharge their liabilities in the ordinary course of business.

These financial statements do not include the adjustments that would result if

the Group were unable to continue as a going concern.

The auditors have made reference to going concern by way of a material

uncertainty within their audit report.

Basis of consolidation

The consolidated financial statements incorporate the financial statements of

the Company and entities controlled by the Company (its subsidiaries) made up

for the period ended 31 March 2023. Control is achieved when the Company has the

power:

· over the investee;

· is exposed, or has rights, to variable returns from its involvement with

the investee; and

· has the ability to use its power to affects its returns

The Company reassesses whether or not it controls an investee if facts and

circumstances indicate that there are changes to one or more of the three

elements of control listed above.

Consolidation of a subsidiary begins when the Company obtains control over the

subsidiary and ceases when the Company loses control of the subsidiary.

Specifically, the results of subsidiaries acquired or disposed of during the

period are included in profit or loss from the date the Company gains control

until the date when the Company ceases to control the subsidiary.

Where necessary, adjustments are made to the financial statements of

subsidiaries to bring the accounting policies used into line with the Group's

accounting policies.

All intragroup assets and liabilities, equity, income, expenses and cash flows

relating to transactions between the members of the Group are eliminated on

consolidation.

Business combinations

Acquisitions of businesses are accounted for using the acquisition method. The

consideration transferred in a business combination is measured at fair value,

which is calculated as the sum of the acquisition-date fair values of assets

transferred by the Group, liabilities incurred by the Group to the former owners

of the acquiree and the equity interest issued by the Group in exchange for

control of the acquiree. Acquisition-related costs are recognised in profit or

loss as incurred. At the acquisition date, the identifiable assets (both

tangible and intangible) acquired and the liabilities assumed are recognised at

their fair value at the acquisition date, except that deferred tax assets or

liabilities and assets or liabilities related to employee benefit arrangements

are recognised and measured in accordance with IAS 12 and IAS 19 respectively.

Goodwill is measured as the excess of the sum of the consideration transferred,

the amount of any non-controlling interests in the acquiree, and the fair value

of the acquirer's previously held equity interest in the acquiree (if any) over

the net of the acquisition-date amounts of the identifiable assets acquired and

the liabilities assumed. In the case of asset acquisition, it is the excess of

the sum of the consideration transferred over the net of the acquisition-date

amounts of the identifiable assets acquired and the liabilities assumed.

When the consideration transferred by the Group in a business combination

includes a contingent consideration arrangement, the contingent consideration is

measured at its acquisition-date fair value and included as part of the

consideration transferred in a business combination. Changes in fair value of

the contingent consideration that qualify as measurement period adjustments are

adjusted retrospectively, with corresponding adjustments against goodwill.

Measurement period adjustments are adjustments that arise from additional

information obtained during the `measurement period' (which cannot exceed one

year from the acquisition date) about facts and circumstances that existed at

the acquisition date.

If the initial accounting for a business combination is incomplete by the end of

the reporting period in which the combination occurs, the Group reports

provisional amounts for the items for which the accounting is incomplete. Those

provisional amounts are adjusted during the measurement period (see above), or

additional assets or liabilities are recognised, to reflect new information

obtained about facts and circumstances that existed as of the acquisition date

that, if known, would have affected the amounts recognised as of that date.

Goodwill

Goodwill is initially recognised and measured as set out above.

Goodwill is not amortised but is reviewed for impairment at least annually. For

the purpose of impairment testing, goodwill is allocated to each of the Group's

cash-generating units (or groups of cash-generating units) expected to benefit

from the synergies of the combination. Cash-generating units to which goodwill

has been allocated are tested for impairment annually, or more frequently when

there is an indication that the unit may be impaired. If the recoverable amount

of the cash-generating unit is less than the carrying amount of the unit, the

impairment loss is allocated first to reduce the carrying amount of any goodwill

allocated to the unit and then to the other assets of the unit pro-rata on the

basis of the carrying amount of each asset in the unit. An impairment loss

recognised for goodwill is not reversed in a subsequent period.

On disposal of a cash-generating unit, the attributable amount of goodwill is

included in the determination of the profit or loss on disposal.

Revenue recognition

Revenue is measured at the fair value of the consideration received or

receivable for goods and services provided in the normal course of business, net

of discounts, value added taxes and other sales related taxes.

Performance obligations and timing of revenue recognition:

All of the Group's revenue is derived from selling goods with revenue recognised

at a point in time when control of the goods has transferred to the customer.

This is generally when the goods are collected or delivered to the customer, or

in the case of fabrication project work, when the project has been accepted by

the customer. There is limited judgement needed in identifying the point control

passes: once physical delivery of the products to the agreed location has

occurred, the Group no longer has physical possession, usually it will have a

present right to payment. Consideration is received in accordance with agreed

terms of sale.

Determining the contract price:

The Group's revenue is derived from:

a) sale of goods with fixed price lists and therefore the amount of

revenue to be earned from each transaction is determined by reference to those

fixed prices; or

b) individual identifiable contracts, where the price is defined

Allocating amounts to performance obligations:

For most sales, there is a fixed unit price for each product sold. Therefore,

there is no judgement involved in allocating the price to each unit ordered.

There are no long-term or service contracts in place. Sales commissions are

expensed as incurred. No practical expedients are used.

Government grants

Government grants are recognised in profit or loss on a systematic basis over

the periods in which the Group recognises as expenses the related costs for

which the grants are intended to compensate. Specifically, government grants

whose primary condition is that the Group should purchase, construct or

otherwise acquire non-current assets (including property, plant and equipment)

are recognised as deferred income in the consolidated statement of financial

position and transferred to profit or loss on a systematic and rational basis

over the useful lives of the related assets. Government grants that are

receivable as compensation for expenses or losses already incurred or for the

purpose of giving immediate financial support to the Group with no future

related costs are recognised in profit or loss in the period in which they

become receivable. Furlough claims under the Job Retention Scheme, have been

disclosed as other income and not netted against the related salary expense.

Leases

The Group as a lessee

The Group assesses whether a contract is or contains a lease, at inception of

the contract. The Group recognises a right-of-use asset and a corresponding

lease liability with respect to all lease arrangements in which it is the

lessee, except for short-term leases (defined as leases with a lease term of 12

months or less) and leases of low value assets (such as tablets and personal

computers, small items of office furniture and telephones). For these leases,

the Group recognises the lease payments as an operating expense on a straight

-line basis over the term of the lease unless another systematic basis is more

representative of the time pattern in which economic benefits from the leased

assets are consumed.

The lease liability is initially measured at the present value of the lease

payments that are not paid at the commencement date, discounted by using the

rate implicit in the lease. If this rate cannot be readily determined, the

lessee uses its incremental borrowing rate.

Lease payments included in the measurement of the lease liability comprise:

· Fixed lease payments (including in-substance fixed payments), less

any lease incentives receivable;

· Variable lease payments that depend on an index or rate, initially

measured using the index or rate at the commencement date;

· The amount expected to be payable by the lessee under residual

value guarantees;

· The exercise price of purchase options, if the lessee is reasonably

certain to exercise the options; and

· Payments of penalties for terminating the lease, if the lease term

reflects the exercise of an option to terminate the lease.

The lease liability is presented as a separate line in the consolidated

statement of financial position.

The lease liability is subsequently measured by increasing the carrying amount

to reflect interest on the lease liability (using the effective interest method)

and by reducing the carrying amount to reflect the lease payments made.

The Group remeasures the lease liability (and makes a corresponding adjustment

to the related right-of-use asset) whenever:

· The lease term has changed or there is a significant event or change

in circumstances resulting in a change in the assessment of exercise of a

purchase option, in which case the lease liability is remeasured by discounting

the revised lease payments using a revised discount rate.

· The lease payments change due to changes in an index or rate or a

change in expected payment under a guaranteed residual value, in which cases the

lease liability is remeasured by discounting the revised lease payments using an

unchanged discount rate (unless the lease payments change is due to a change in

a floating interest rate, in which case a revised discount rate is used).

· A lease contract is modified and the lease modification is not

accounted for as a separate lease, in which case the lease liability is

remeasured based on the lease term of the modified lease by discounting the

revised lease payments using a revised discount rate at the effective date of

the modification.

The Group did not make any such adjustments during the period presented.

The right-of-use assets comprise the initial measurement of the corresponding

lease liability, lease payments made at or before the commencement day, less any

lease incentives received and any initial direct costs. They are subsequently

measured at cost less accumulated depreciation and impairment losses.

Whenever the Group incurs an obligation for costs to dismantle and remove a

leased asset, restore the site on which it is located or restore the underlying

asset to the condition required by the terms and conditions of the lease, a

provision is recognised and measured under IAS 37 `Provisions, Contingent

liabilities and Contingent assets'. To the extent that the costs relate to a

right-of-use asset, the costs are included in the related right-of-use asset,

unless those costs are incurred to produce inventories.

Right-of-use assets are depreciated over the shorter period of lease term and

useful life of the underlying asset. If a lease transfers ownership of the

underlying asset or the cost of the right-of-use asset reflects that the Group

expects to exercise a purchase option, the related right-of-use asset is

depreciated over the useful life of the underlying asset. The depreciation

starts at the commencement date of the lease.

The right-of-use assets are presented as a separate line in the consolidated

statement of financial position.

The Group applies IAS 36 to determine whether a right-of-use asset is impaired

and accounts for any identified impairment loss as described in the `Property,

Plant and Equipment' policy.

Variable rents that do not depend on an index or rate are not included in the

measurement of the lease liability and the right-of-use asset. The related

payments are recognised as an expense in the period in which the event or

condition that triggers those payments occurs.

Foreign currencies

Transactions in currencies other than the functional currency are recognised at

the rates of exchange on the dates of the transactions. At each balance sheet

date, monetary assets and liabilities are retranslated at the rates prevailing

at the balance sheet date with differences recognised in the Statement of

comprehensive income in the period in which they arise.

Retirement and termination benefit costs

Payments to defined contribution retirement benefit plans are recognised as an

expense when employees have rendered service entitling them to the

contributions. Payments made to state-managed retirement benefit plans are

accounted for as payments to defined contribution plans where the Group's

obligations under the plans are equivalent to those arising in a defined

contribution retirement benefit plan.

There are no defined benefit plans in place.

Taxation

The income tax expense represents the sum of the tax currently payable and

deferred tax.

Current tax

The tax currently payable is based on taxable profit for the year. The Group's

liability for current tax is calculated using tax rates that have been enacted

or substantively enacted by the end of the reporting period.

Deferred tax

Deferred tax is the tax expected to be payable or recoverable on differences

between the carrying amounts of assets and liabilities in the financial

statements and the corresponding tax bases used in the computation of taxable

profit and is accounted for using the liability method. Deferred tax liabilities

are generally recognised for all taxable temporary differences and deferred tax

assets are recognised to the extent that it is probable that taxable profits

will be available against which deductible temporary differences can be

utilised. Such assets and liabilities are not recognised if the temporary

difference arises from the initial recognition of goodwill.

The carrying amount of deferred tax assets is reviewed at each reporting date

and reduced to the extent that it is no longer probable that sufficient taxable

profits will be available to allow all or part of the asset to be recovered.

Deferred tax is calculated at the tax rates that are expected to apply in the

period when the liability is settled or the asset is realized.

Current and deferred tax assets and liabilities are offset when there is a

legally enforceable right to set off.

Property, plant and equipment

Plant, machinery, fixtures and fittings are stated at cost less accumulated

depreciation and accumulated impairment loss.

Depreciation is recognised so as to write off the cost or valuation of assets

less their residual values over their useful lives, using the straight-line

method or reducing balance methods, on the following bases:

Leasehold improvements Over the life of the lease

Plant and machinery 10 per cent - 25 per cent per annum

Fixtures and fittings 10 per cent - 30 per cent per annum

Motor Vehicles 20 per cent - 25 percent per annum

The estimated useful lives, residual values and depreciation method are reviewed

at the end of each reporting period, with the effect of any changes in estimate

accounted for on a prospective basis.

Right-of-use assets are depreciated over the shorter period of the lease term

and the useful life of the underlying asset. If a lease transfers ownership of

the underlying asset or the cost of the right-of-use asset reflects that the

Group expects to exercise a purchase option, the related right-of-use asset is

depreciated over the useful life of the underlying asset.

Impairment of property, plant and equipment and intangible assets excluding

goodwill

At each reporting date, the Group reviews the carrying amounts of its property,

plant and equipment and intangible assets to determine whether there is any

indication that those assets have suffered an impairment loss. If any such

indication exists, the recoverable amount of the asset is estimated to determine

the extent of the impairment loss (if any). Where the asset does not generate

cash flows that are independent from other assets, the Group estimates the

recoverable amount of the cash-generating unit to which the asset belongs. When

a reasonable and consistent basis of allocation can be identified, corporate

assets are also allocated to individual cash-generating units, or otherwise they

are allocated to the smallest group of cash-generating units for which a

reasonable and consistent allocation basis can be identified.

Recoverable amount is the higher of fair value less costs of disposal and value

in use. In assessing value in use, the estimated future cash flows are

discounted to their present value using a pre-tax discount rate that reflects

current market assessments of the time value of money and the risks specific to

the asset for which the estimates of future cash flows have not been adjusted.

If the recoverable amount of an asset (or cash-generating unit) is estimated to

be less than its carrying amount, the carrying amount of the asset (or cash

-generating unit) is reduced to its recoverable amount. An impairment loss is

recognised immediately in profit or loss, unless the relevant asset is carried

at a revalued amount, in which case the impairment loss is treated as a

revaluation decrease and to the extent that the impairment loss is greater than

the related revaluation surplus, the excess impairment loss is recognised in

profit or loss.

Where an impairment loss subsequently reverses, the carrying amount of the asset

(or cash-generating unit) is increased to the revised estimate of its

recoverable amount, but so that the increased carrying amount does not exceed

the carrying amount that would have been determined had no impairment loss been

recognised for the asset (or cash-generating unit) in prior years. A reversal of

an impairment loss is recognised immediately in profit or loss to the extent

that it eliminates the impairment loss which has been recognised for the asset

in prior years. Any increase in excess of this amount is treated as a

revaluation increase

Inventories

Inventories are stated at the lower of cost and net realisable value. Cost

comprises direct materials and, where applicable, direct labour costs and those

overheads that have been incurred in bringing the inventories to their present

location and condition. Cost is calculated using the weighted average cost

method. Net realisable value represents the estimated selling price less all

estimated costs of completion and costs to be incurred in marketing, selling and

distribution.

Financial instruments

Initial recognition

A financial asset or financial liability is recognised in the statement of

financial position of the Group when it arises or when the Group becomes part of

the contractual terms of the financial instrument.

Financial assets

Financial assets are classified as either financial assets at amortised cost, at

fair value through other comprehensive income ("FVTOCI") or at fair value

through profit or loss ("FVPL") depending upon the business model for managing

the financial assets and the nature of the contractual cash flow characteristics

of the financial asset.

A loss allowance for expected credit losses is determined for all financial

assets, other than those at FVPL, at the end of each reporting period. The Group

applies a simplified approach to measure the credit loss allowance for trade

receivables using the lifetime expected credit loss provision. The lifetime

expected credit loss is evaluated for each trade receivable taking into account

payment history, payments made subsequent to year-end and prior to reporting,

past default experience and the impact of any other relevant and current

observable data. The Group applies a general approach on all other receivables

classified as financial assets. The general approach recognises lifetime

expected credit losses when there has been a significant increase in credit risk

since initial recognition.

The Group derecognises a financial asset when the contractual rights to the cash

flows from the asset expire, or when it transfers the financial asset and

substantially all the risks and rewards of ownership of the asset to another

party. The Group derecognises financial liabilities when the Group's obligations

are discharged, cancelled or have expired.

Trade and other receivables

Trade receivables are accounted for at amortised cost. Trade receivables do not

carry any interest and are stated at their nominal value as reduced by

appropriate expected credit loss allowances for estimated recoverable amounts as

the interest that would be recognised from discounting future cash payments over

the short payment period is not considered to be material. Other receivables are

accounted for at amortised cost and are stated at their nominal value as reduced

by appropriate expected credit loss allowances.

Financial liabilities

The classification of financial liabilities at initial recognition depends on

the purpose for which the financial liability was issued and its

characteristics.

All purchases of financial liabilities are recorded on trade date, being the

date on which the Group becomes party to the contractual requirements of the

financial liability. Unless otherwise indicated the carrying amounts of the

Group's financial liabilities approximate to their fair values.

The Group's financial liabilities consist of financial liabilities measured at

amortised cost and financial liabilities at fair value through profit or loss.

A financial liability (in whole or in part) is derecognised when the Group has

extinguished its contractual obligations, it expires or is cancelled. Any gain

or loss on derecognition is taken to the statement of comprehensive income.

Borrowings

Borrowings are included as financial liabilities on the Group balance sheet at

the amounts drawn on the particular facilities net of the unamortised cost of

financing. Interest payable on those facilities is expensed as finance cost in

the period to which it relates.

Trade and other payables

Trade and other payables are initially recorded at fair value and subsequently

carried at amortised cost.

Fair value measurement

Fair value is the price that would be received to sell an asset or paid to

transfer a liability in an orderly transaction between market participants at

the measurement date.

The fair value measurement is based on the presumption that the transaction to

sell the asset or transfer the liability takes place either in the principal

market for the asset or liability or, in the absence of a principal market, in

the most advantageous market for the asset or liability. The principal or the

most advantageous market must be accessible to the Group.

The fair value of an asset or a liability is measured using the assumptions that

market participants would use when pricing the asset or liability, assuming that

market participants act in their economic best interest.

For all other financial instruments not traded in an active market, the fair

value is determined by using valuation techniques deemed to be appropriate in

the circumstances. Valuation techniques include the market approach (i.e. using

recent arm's length market transactions adjusted as necessary and reference to

the current market value of another instrument that is substantially the same)

and the income approach (i.e. discounted cash flow analysis and option pricing

models making as much use of available and supportable market data as possible).

All assets and liabilities for which fair value is measured or disclosed in the

financial statements are categorised within the fair value hierarchy, described

as follows, based on the lowest level input that is significant to the fair

value measurement as a whole:

Level 1 - Quoted (unadjusted) market prices in active markets for identical

assets or liabilities.

Level 2 - Valuation techniques for which the lowest level input that is

significant to the fair value measurement is directly or indirectly observable.

Level 3 - Valuation techniques for which the lowest level input that is

significant to the fair value measurement is unobservable.

For assets and liabilities that are recognised in the financial statements on a

recurring basis, the Group determines whether transfers have occurred between

levels in the hierarchy by re-assessing the categorisation (based on the lowest

level input that is significant to the fair value measurement as a whole) at the

end of each reporting year.

Provisions

Provisions are recognised when the Group has a present obligation (legal or

constructive) as a result of a past event, it is probable that the Group will be

required to settle that obligation and a reliable estimate can be made of the

amount of the obligation.

Share-based payments

Equity-settled share-based payments to employees and others providing similar

services are measured at the fair value of the equity instruments at the grant

date. The fair value excludes the effect of non-market-based vesting conditions.

The fair value determined at the grant date of the equity-settled share-based

payments is expensed on a straight- line basis over the vesting period, based on

the Group's estimate of the number of equity instruments that will eventually

vest. At each reporting date, the Group revises its estimate of the number of

equity instruments expected to vest as a result of the effect of non-market

-based vesting conditions. The impact of the revision of the original estimates,

if any, is recognised in profit or loss such that the cumulative expense

reflects the revised estimate, with a corresponding adjustment to reserves.

Equity-settled share-based payment transactions with parties other than

employees are measured at the fair value of the goods or services received,

except where that fair value cannot be estimated reliably, in which case they

are measured at the fair value of the equity instruments granted, measured at

the date the entity obtains the goods or the counterparty renders the service.

3. Critical accounting judgements and key sources of estimation uncertainty

In applying the Group's accounting policies, which are described in note 3, the

directors are required to make judgements (other than those involving

estimations) that have a significant impact on the amounts recognised and to

make estimates and assumptions about the carrying amounts of assets and

liabilities that are not readily apparent from other sources. The estimates and

associated assumptions are based on historical experience and other factors that

are considered to be relevant. Actual results may differ from these estimates.

The estimates and underlying assumptions are reviewed on an ongoing basis.

Revisions to accounting estimates are recognised in the period in which the

estimate is revised if the revision affects only that period, or in the period

of the revision and future periods if the revision affects both current and

future periods.

Identified intangible assets

Identified intangible assets arising on acquisition are disclosed in note 14 and

comprise; marketing related assets such as brands and domain names; customer

related assets such as customer relationships, lists and existing order books.

Their existence is established in a post-acquisition review which also estimates

their value and the period over which they are amortised;

Other intangible assets

The BESS project has been valued at costs incurred to date on the project and a

fair value adjustment has been made on acquisition (note 25). The fair valuation

adjustment reflects a discount from comparable market values for similar

projects to take into account the early stage of development.

Carrying value of goodwill, other intangible assets and property plant and

equipment

Impairment reviews for non-current assets are carried out at each balance sheet

date in accordance with IAS 36, Impairment of assets. Reported losses in the

subsidiary companies, were considered to be indications of impairment and a

formal impairment review was undertaken. The review uses a discounted cash flow

model to estimate the net present value of each cash generating unit. Management

consider each operating subsidiary to be a separately identifiable cash

generating unit.

The impairment reviews are sensitive to various assumptions, including the

expected sales forecasts, cost assumptions, capital requirements, and discount

rates among others. The forecasts of future cash flows for each subsidiary were

derived from the operational plans in place. Real prices were assumed to remain

constant at current levels.

Details of the reviews are set out in note 14.

Receivables

In applying IFRS 9 the directors make a judgement in assessing the Group's

exposure to credit risk. The Group has recognised a loss allowance of 100 per

cent against all receivables over 120 days past due where historical experience

has indicated that these receivables are generally not recoverable. The

allowance for expected credit losses follows an internal assessment of customer

credit worthiness and an estimate as to the timing of settlement and is

disclosed in note 19. In addition, the directors have assessed the

recoverability of other receivables on a case by case basis.

Discontinued activities

The Group disposed of Orca, IVI and TRR during the year. The trading loss and

net assets have been derived from the accounting records at the date of

disposal.

4. Other gains and losses

Year ending Restated

31 March

2023 Year ending 31 March 2022

£'000 £'000

Acquisition and 140 25

disposal costs

Loss allowance on 52 104

trade receivables

Government grants (1) (31)

Other expenses 34 187

225 285

Of which relating

to:

Continuing 224 305

activities

Discontinued 1 (20)

activities

225 285

5. Impairment charge

Year ending Restated

31 March

2023 Year ending 31 March 2022

£'000 £'000

Goodwill (note 14) - 1,142

Identified - 571

intangible assets

(note 14)

Other receivables - 327

- 2,040

Of which relating

to:

Continuing - 12

activities

Discontinued - 2,028

activities

- 2,040

6. Finance costs

Year ending Restated

31 March

2023 Year ending 31 March 2022

£'000 £'000

Interest receivable:

Interest on quoted 25 -

bond

25 -

Interest payable:

Interest on bank 426 444

overdrafts and loans

Interest on lease 8 32

liabilities

Loan arrangement fees 68 26

and other finance

costs

502 502

Net Finance costs 477 502

Of which relating to:

Continuing activities 438 389

Discontinued 39 113

activities

477 502

7. Discontinued activities

Year ending Restated

31 March

2023 Year ending 31 March 2022

£'000 £'000

Revenue 943 5,049

Cost of sales (873) (4,061)

Gross margin 70 988

Operating expenses (280) (2,082)

Other Income 33 125

Impairment loss - (2,028)

Finance costs (39) (113)

Loss before tax on (216) (3,110)

discontinued

activities

Tax credit on - 68

discontinued

activities

Loss after tax on (216) (3,042)

discontinued

activities

Profit on disposal of 1,804 654

discontinued

activities

Profit / (loss) on 1,588 (2,388)

discontinued

activities

On 30 March 2022, the Company disposed of M&G Olympic Products Limited. Orca

Doors Limited was disposed of on 18 July 2022, IVI Metallics was disposed of on

31 July 2022 and Time Rainham Limited was disposed of on 8 November 2022

The comparatives in the Consolidated Statement of Comprehensive Income and

Consolidated Statement of Cash Flows and several notes have been restated to

separate continuing and discontinued operations.

8. Earnings per share

Year ending 31 March 2023 Restated

Year ending 31 March 2022

The calculation £'000 £'000

of the basic

earnings per

share is based

on the following

data:

Loss for the

year for the

purposes of

basic loss per

share

attributable to

equity holders

of the Company:

- From (949) (1,299)

continuing

operations

- From 1,588 (2,388)

discontinued

operations

- Total 639 (3,687)

Weighted average 595,784,173 346,819,139

number of

Ordinary Shares

for the purposes

of basic loss

per share

Basic earnings

per share(pence)

- From (0.16p) (0.37p)

continuing

operations

- From 0.27p (0.69p)

discontinued

operations

- Total 0.11p (1.06p)

The Company has issued options over ordinary shares which could potentially

dilute basic loss per share in the future. There is no difference between basic

loss per share and diluted loss per share as the potential ordinary shares are

anti-dilutive. Details of options are set out in note 24.

9. Goodwill and other intangible assets

Goodwill

£'000

Cost

At 31 March 2021 1,721

Recognised on acquisition 718

Disposal (202)

At 31 March 2022 2,237

Disposal (1,519)

At 31 March 2023 718

Accumulated Impairment Losses

At 31 March 2021 150

Impairment charge 1,142

At 31 March 2022 1,292

Disposal (1,292)

At 31 March 2023 -

Carrying value at 31 March 2023 718

Carrying value at 31 March 2022 945

Goodwill arising on acquisition comprises the expected synergies to be realised

form the benefits of being a member of a group rather than stand-alone company.

These include shared services, economies from pooled procurement, leveraging

skillsets across the group and other intangible assets, such as the workforce

knowledge, experience and competences across the group that cannot be recognised

separately as intangible assets.

Other BESS Project Identified intangible assets Total

intangible

assets

£'000 £'000

Cost

At 31 March - 1,067 1,067

2021

Recognised on - 300 300

acquisition

Disposal - (167) (167)

At 31 March - 1,200 1,200

2022

On acquisition 274 - 274

of subsidiary

Recognised on 2,600 - 2,600

acquisition

Additions 34 - 34

Disposal - (900) (900)

At 31 March 2,908 300 3,208

2023

Amortisation

At 31 March - 242 242

2021

Charge for the - 120 120

period

Impairment - 571 571

charge

Disposal - (50) (50)

At 31 March - 883 883

2022

Charge for the - 40 40

period

Disposal (893) (893)

- 30 30

Carrying value 2,908 270 3,178

at 31 March

2023

Carrying value - 317 317

at 31 March

2022

Identified intangible assets arising on acquisition comprise; marketing related

assets such as brands and domain names; customer related assets such as customer

relationships, lists and existing order books. These are amortised, depending

upon the nature of the asset and the business acquired over 1 to 10 years on a

straight-line basis.

BESS Project

£'000

Fair value on acquisition (note 25) 2,874

Additions 34

At 31 March 2023 2,908

Forepower Lincoln (250) Limited is a 248MW Battery Energy Storage System Project

("BESS") which was acquired on 6 March 2023. The value at 31 march 2023

represents the project costs incurred by FPL(250) together with a fair value

adjustment on acquisition of £2.6 million, being the consideration paid by the

company. The fair valuation adjustment reflects a discount from comparable

market values for similar projects to take into account the early stage of

development of the project. On 25 October 2023, the Company disposed of 49.9% of

its holding in FPL (250) in order to fund the development of the project and

value is expected to be generated as the project moves through the planning

process and obtains a firm connection date to the national grid. Further uplifts

in value are expected as project mile-stones are achieved.

The Group tests goodwill and other intangible assets annually for impairment, or

more frequently if there are indications that they might be impaired. Aftech

Limited made a small profit before taxation on consolidation, nonetheless its

result was considered to be an indication of impairment and an impairment review

was undertaken.

The recoverable amount of the goodwill and identified intangible assets is

determined based on a value in use calculation which uses cash flow projections

based on financial budgets approved by the directors covering a six-year period,

and a discount rate of 10% per cent per annum.

Where cash flows have been extrapolated beyond that six-year period, no further

growth has been assumed.

Impairment Year ended 31 March Year ending 31 March 2022

charge

2023

£'000 £'000

Goodwill

IVI Metallics - 548

Limited

Orca Doors - 294

Limited

Romar Process - 300

Engineering

Limited

- 1,142

Identified intangible assets

IVI Metallics Limited - 478

Orca Doors Limited - 8

Romar Process Engineering Limited - 85

- 571

The Company disposed of its shareholdings in IVI and Orca in July 2022.

Accordingly full impairment of goodwill and identifiable intangible assets was

made at 31 March 2022. The Company disposed of its shareholding in Time Rainham

in November 2022. In the prior year, goodwill and identifiable intangible assets

in respect of the acquisition by Time Rainham of the business and assets of

Romar Process Engineering Limited were fully impaired.

In reviewing the goodwill and identified intangible assets attributable to the

acquisition of Aftech Limited the impairment review base case showed that there

was no need for impairment.

Sensitivity analysis

Discount rate: The Group's borrowings have a current nominal rate of interest

ranging from 5% to 18% per annum. It is intended to refinance the loan at 18% at

more reasonable long-term rates. The real rate assumed in these forecasts is

estimated to be 10%, a blended rate, taking into account the timing required to

arrange the refinancing.

In order for a potential impairment to arise, either to goodwill and

identifiable intangible assets arising on acquisition or to non-current assets

in Aftech, forecast sales volumes would have to fall by 1% And if the discount

rate rose to 11%.

10. Borrowings

At 31 At 31 March 2022

March

2023

Non-current liabilities £'000 £'000

Secured

Corona virus business interruption loan (CBIL) - 634

- 634

Unsecured

Bounce back loans (BBL) - 40

- 674

Current liabilities

Secured

Factoring facility 145 447

Other Loans 1,854 1,854

Convertible loan note 475 475

Corona virus business interruption loan 700 182

3,174 2,958

Unsecured

Other loans 13

Bounce back loans - 10

3,187 2,968

3,187 3,642

Other loans of £1,854,000 (2022: £1,854,000) are secured by means of a

debenture, chattels mortgage and cross guarantee entered into by the Company. At

31 March 2023, there was a rolling 12 month standstill agreement in place. Since

the year end the Company extended the term and the principal now falls due for

repayment between April and July 2025.

Since the year end the term of the convertible note has been extended to 30 June

2025. The lender has the right to convert the outstanding principal into

ordinary share of the Company at a price of 1p per share. In the event that the

lender does not exercise its conversion rights by 30 June 2025, the loan shall

become immediately repayable by the Company.

The factoring facility is secured on the trade receivables amounting to £208,000

(2022: £786,000). There is a factoring charge of 1% of the Gross debt and a

discount rate of 5% above bank base rates on net advances. The agreement provide

for 3 months' notice by either party and certain minimum fee levels.

On 31 July 2022, the Company disposed of IVI. Subsequently IVI was put into

administration and the Company received a demand from HSBC for the outstanding

principal under a cross guarantee. The CBIL liability is secured by means of a

debenture entered into by the Company.

The movement in borrowings reconciles to the cash flow statement as follows:

At 31 Discontinued Disposal of Assumed Repaid At 31

subsidiary

March March 2023

2022

£'000 £'000 £'000 £'000 £'000 £'000

Secured 1,854 - - - - 1,854

borrowings

Unsecured - - - 70 (57) 13

borrowing

Convertible 475 - - - - 475

loan note

Factoring 447 (2) (248) - (52) 145

facilities

CBIL and 866 (120) (746) 746 (46) 700

BBLs

Total 3,642 (122) (994) 816 (155) 3,187

borrowings

11. Share capital

Number £'000

Issued and fully paid:

At 31 March 2021 280,786,938 112

Issued during the period 245,547,664 99

At 31 March 2022 526,334,602 211

Issued during the period 344,193,003 137

At 31 March 2023 870,527,605 348

The Company has one class of ordinary share with a nominal value of 0.04p and

which carries no right to fixed income.

Shares issued Number £'000

during the year

For Cash (net of 44,372,354 258

fees)

In settlement of 16,513,216 168

fees and expenses

Acquisition 283,307,433 2,893

consideration

344,193,003 3,319

Share premium £'000

At 31 March 2021 3,946

Premium arising 2,699

on issue of new

equity during the

year

At 31 March 2022 6,645

Premium arising 3,182

on issue of new

equity during the

year

At 31 March 2023 9,827

Shares to be issued £'000

At 31 March 2022 293

Issued during the year (293)

At 31 March 2023 -

At completion of the acquisition of Aftech Limited on 24 March 2022, the Company

did not have sufficient authority to issue all the consideration shares. Once

the authority had been received at the Annual General Meeting held on 13 May

2023, the remaining consideration shares were issued on 16 June 2023.

12. Acquisition of subsidiaries

In the year to 31 March 2023, the Company completed one acquisition:

Forepower Lincoln (250) Limited

On 6 March 2023, the Group purchased the entire share capital of Forepower

Lincoln (250) Limited ("FPL(250)") for £2,600,000 which was satisfied by the

issue and allotment by the Company of 260,000,000 shares at an issue price of 1p

per share. The acquisition has been treated as a business combination. FPL(250)

is a 248MW Battery Energy Storage System ("BESS") project in the early stages of

its planning application. The amounts recognised in respect of the identifiable

assets acquired and liabilities assumed in the acquisition is as set out in the

table below.

Net assets acquired Fair value Adjustments Total

£'000 £'000 £'000

Intangible assets - 274 2,600 2,874

project expenditure

Current liabilities (274) - (274)

- 2,600 2,600

Consideration

Issue of equity 2,600

Total consideration 2,600

Acquisition costs of £1,000 have been included in other gains and losses in the

consolidated statement of profit and loss and comprehensive income.

13. Post balance sheet events

On 25 October 2023, the Company disposed of 49.9% of its holding in FPL (250) in

order to fund the development of the project. Value is expected to be generated

as the project moves through the planning process and obtains a firm connection

date to the national grid.

On 17 May 2023 the Company issued 3,333,333 ordinary shares of £0.0004 each at

£0.0075 per share.

14. Contingent liability

FPL(250) has a consultancy contract concerning the application for a connection

to the national grid in respect of the BESS project. Within 40 days of

receiving planning consent, FPL(250) has an obligation to pay £1.2million to the

contractor and a further £50,000 to another supplier.

This information was brought to you by Cision http://news.cision.com

END

(END) Dow Jones Newswires

November 27, 2023 09:49 ET (14:49 GMT)

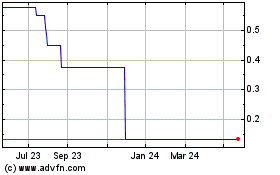

Vulcan Industries (AQSE:VULC)

Historical Stock Chart

From Dec 2024 to Jan 2025

Vulcan Industries (AQSE:VULC)

Historical Stock Chart

From Jan 2024 to Jan 2025