Quarterly Activities Report

July 31 2019 - 6:00AM

Bannerman Resources Limited (ASX:BMN, NSX:BMN) (“Bannerman” or “the

Company”) is pleased to report on an effective quarter that has

positioned Bannerman and its Etango uranium project very well for

an increase in uranium market activity and associated improvements

in sentiment due to a positive resolution of the section 232 trade

investigation being undertaken in the United States.

HIGHLIGHTS

- Positive section 232 decision announced on 12

July° President Trump decided to take no trade

action, rejecting quota requiring US utilities to procure 25% of

uranium from domestic US sources.° Highly positive outcome

for uranium sector and non-US uranium companies, as it alleviates

concerns that a quota, tariff or other trade action would be

imposed.° Certainty generated by section 232 resolution is

expected to increase uranium market activity, which has been

suppressed since January 2018.° New US Nuclear Fuel Working

Group established as part of s232 decision. Lays the

foundation for further positive outcomes as the Working Group is

directed to “reinvigorate the entire nuclear fuel supply

chain”.

- Important licence renewals

obtained° EPL 3345 renewed for further two

years. EPL 3345 adjoins Etango Mineral Deposit Retention

Licence and the subject of recent reconnaissance drilling.°

Environmental clearance for linear infrastructure renewed for

further three years. Linear infrastructure includes water,

power and transport infrastructure.

- Strong cash balance of A$6.2m at quarter

end

Bannerman’s Chief Executive Officer, Mr Brandon

Munro, said, “We welcome the strong and decisive resolution of the

section 232 trade investigation, which has been a distraction to

the uranium sector for 18 months. This No Action outcome

maintains open access to the US uranium market and is particularly

positive for non-US uranium companies. With a renewed focus on

supply diversity and geo-political risk, Bannerman is particularly

well positioned with its Etango Project situated in Namibia, a

premier uranium development jurisdiction with good bi-lateral

relations with all major uranium consumption markets, including the

US, China, Russia and France. Bannerman is set to benefit from

renewed uranium market activity, with an advanced project of

world-class scale in a premier jurisdiction and robust cash

balance.”

Brandon MunroChief Executive

Officer31 July 2019

For further

information please contact:

|

Brandon MunroChief Executive OfficerPerth, Western

AustraliaTel: +61 (8) 9381 1436info@bannermanresources.com.au |

Robert DaltonCompany SecretaryPerth, Western

AustraliaTel: +61 (8) 9381 1436info@bannermanresources.com.au |

Michael Vaughan (Media)Fivemark PartnersPerth,

Western AustraliaTel: +61 422 602

720michael.vaughan@fivemark.com.au |

|

About Bannerman - Bannerman Resources Limited is

an ASX and NSX listed exploration and development company with

uranium interests in Namibia, a southern African country which is a

premier uranium mining jurisdiction. Bannerman’s principal

asset is its 95%-owned Etango Project situated near Rio Tinto’s

Rössing uranium mine, Paladin’s Langer Heinrich uranium mine and

CGNPC’s Husab uranium mine. A definitive feasibility study has

confirmed the viability of a large open pit and heap leach

operation at one of the world’s largest undeveloped uranium

deposits. From 2015 to 2017, Bannerman conducted a large scale heap

leach demonstration program to provide further assurance to

financing parties, generate process information for the detailed

engineering design phase and build and enhance internal capability.

More information is available on Bannerman’s website at

www.bannermanresources.com. |

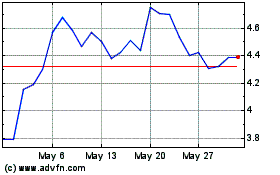

Bannerman Energy (ASX:BMN)

Historical Stock Chart

From May 2024 to Jun 2024

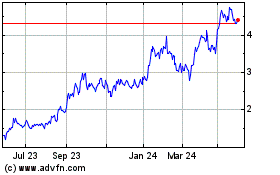

Bannerman Energy (ASX:BMN)

Historical Stock Chart

From Jun 2023 to Jun 2024

Real-Time news about Bannerman Energy Ltd (Australian Stock Exchange): 0 recent articles

More News Articles