Vodafone Ltd. (VOD) and Hutchison Whampoa Ltd. (0013.HK) said

Monday they will merge their Australian mobile telecommunications

businesses in an equal joint venture.

Analysts said the move will give the market's number three and

number four players - both already fast-growing innovators - the

scale to claw more market share from the largest mobile operator,

Telstra Corp. (TLS), and market number two, Singapore

Telecommunications Ltd.'s (Z74.SG) Optus.

The move could also help insulate the pair from a rapidly

deteriorating domestic economy, with discretionary spending on

mobile calls tipped as an area consumers will cut back as the

slowdown bites.

The joint venture, between Vodafone's Australian unit Vodafone

Australia Ltd. and Hutchison 3G Australia Pty. Ltd., a unit of

Hutchison Telecommunications (Australia) Ltd. (HTA.AU), will be

renamed VHA Pty. Ltd.

"This transaction will benefit customers in Australia as it

creates a company with the necessary scale to compete strongly in

the mobile market," said Vittorio Colao, chief executive of

Vodafone.

The combined group will have a market share of between 25% and

27%, Hutchison Australia's current chief executive, Nigel Dews,

told reporters in a phone briefing.

Dews has been named chief executive of the joint venture while

Vodafone's current chief executive for Asia-Pacific and the Middle

East, Nick Read, will be chairman.

Paul Budde, an independent mobile analyst, described the planned

joint venture as a "great step forward."

Dews said joint venture negotiations gathered steam around

December, as the latest downleg of the global financial crisis

pushed Australia to the brink of a recession.

However, company executives Monday downplayed any link between

deteriorating market conditions and the planned tie-up.

"I really don't think the economic climate is relevant to this

proposal. Basically, we looked at the market, we looked at the

strength of Telstra, the strength of Optus, the required

investments to offer the full breadth of products and services, the

comprehensive network we want to offer, the distribution, it's all

about scale," Read said.

Hutchison has a strong base of 3G and contract customers, while

Vodafone has more customers on its second-generation or 2G network

and prepaid customers.

Hutchison Whampoa spokeswoman Laura Cheung said the merger is

aimed at strengthening the companies' positions in a market faced

with "keen competition".

Nevertheless, analysts said that in a rapidly deteriorating

economy, any scale gains are likely to prove invaluable in

insulating the business from the downturn - where margins will come

under pressure as consumers pare back mobile use and delay planned

handset upgrades.

"Mobile is a commodity product, you have to be able to fight on

low margins and you can only do that when you have scale," Budde

said.

Read said the increased scale would help trim overall unit costs

and "allow us to be more competitive in the market place."

The joint venture will create a mobile operator with around six

million customers - four million from Vodafone and two million from

Hutchison - and total combined revenues of around A$4 billion as of

the 12 months ended June 30, 2008.

Telstra Corp., by comparison, has around 9.4 million customers

and Optus around 7.6 million, according to Budde's estimates.

In response to the news of the joint venture, Hutchison

Telecommunications (Australia) Ltd. rose as much as 3.0 cents to

14.5 cents. At 0440 GMT, Hutchison was flat at 11.5 cents, while

Telstra Corp. was up 1 cent at A$3.72, and the S&P/ASX 200

index was up 1%.

Budde said Hutchison has been the best market performer in terms

of growth rates since 2004, although coming off a very low

subscriber base. Hutchison's subscriber base grew by 29% in fiscal

2007-08, compared with 10.6% for Vodafone, 6.4% for Optus, and 1.3%

for incumbent Telstra, Budde estimates.

Monday's deal is subject to approval by Hutchison Australia

shareholders, the Australian Competition & Consumer Commission,

and the Foreign Investment Review Board.

Dews said the companies have spoken with ACCC Chairman Graeme

Samuel, who gave "no assurances" as to how the commission may rule

on the matter.

Analysts don't expect the deal to face any competition hurdles,

although Budde said the ACCC will likely signal it will be more

vigilant in the future for any signs of price collusion, given the

Australian mobile market will be reduced to just three players if

the joint venture goes ahead.

Under the deal, VHA will market its products and services under

the Vodafone brand, but will retain exclusive rights to use

Hutchison's "3" brand in Australia.

Ongoing investment will expand the combined group's third

generation, or 3G, network to reach around 95% of Australia's

population, Vodafone's Colao said.

In recognition of the value difference between the two

businesses, Vodafone will receive a deferred payment of A$500

million from VHA.

The venture is expected to generate synergies worth over A$2

billion, and will be positive for both earnings per share and

earnings before interest and tax, from the first full year post

completion of the deal.

It will be debt-free from the outset, with the exception of the

A$500 million loan note, with Hutchison Australia to retain its

debt on its own balance sheet, Hutchison Australia group finance

director Frank Sixt said.

"The combined scale of this new entity, with the global

strengths of Vodafone and Hutchison, will provide the necessary

elements for a third strong competitor able to compete and invest

long-term in the Australian market place," market research firm

Ovum said in a report.

"At a time when both the industry is changing and there are

questions over economic outlook, the global experience and

expertise of the two parents will be priceless."

Goldman Sachs advised Hutchison Whampoa and Hutchison

Telecommunications. UBS advised Vodafone.

-By Rachel Pannett, Dow Jones Newswires; 61-2-6208-0901;

rachel.pannett@dowjones.com

(Jeffrey Ng in Hong Kong contributed to this story.)

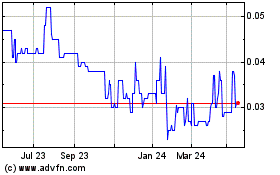

Hutchison Telecommunicat... (ASX:HTA)

Historical Stock Chart

From Dec 2024 to Jan 2025

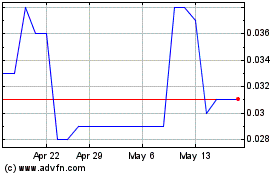

Hutchison Telecommunicat... (ASX:HTA)

Historical Stock Chart

From Jan 2024 to Jan 2025