Australia Eyes Privatization of Public Health and Welfare Payments

February 09 2016 - 12:00AM

Dow Jones News

CANBERRA, Australia—Australia's government is considering a

multibillion-dollar privatization of public health and welfare

payments, as conservatives look for new ways to refill budget

coffers emptied by an economic slowdown and collapsing prices of

the country's resource exports.

In a move that would be risky in a charged election year, due to

the popularity among voters of the country's generous health and

welfare system, Prime Minister Malcolm Turnbull said on Tuesday the

conservatives were looking at outsourcing a range of government

payments worth up to 50 billion Australian dollars (US$35.43

billion).

"The government is as always totally committed to Medicare," Mr.

Turnbull told Parliament. "What we are looking at…is improving the

delivery of government services, looking at ways to take the health

and aged care payment systems into the 21st century."

Treasurer Scott Morrison may test market appetite for a deal

soon after the next national budget statement in May, which could

clarify the future of several privatization offers being looked at

by the conservatives.

Australia is struggling to adjust to a fading resources boom

that is shrinking government coffers. A sharp slowdown in mining

investment has forced the government to look harder for ways to

trim a budget deficit that grew markedly under the previous Labor

administration.

A midyear budget update in December showed that the country's

deficit was expected to widen to A$37.4 billion this fiscal

year—amounting to 2.3% of gross domestic product—while net debt was

forecast to reach A$278.8 billion, or 16.9% of GDP, in 2015-2016,

peaking at 18.5% of GDP in 2017-2018.

Treasury Secretary John Fraser last month warned spending was

too high and tough reductions would need to be made. Outlays in the

fiscal year through June are forecast to be 25.9% of GDP, with

spending for large taxpayer programs such as aged care, health and

unemployment payments still rising. The government wants to limit

spending below 25% of GDP.

But Finance Minister Mathias Cormann has so far shied away from

aggressive privatization programs with national impact like the

U.K. government's £ 1.7 billion (US$2.45 billion) sale of the Royal

Mail, wary of a backlash in a country where voters in far-flung

regional areas worry they will be left worse off.

Mr. Cormann successfully sold private health insurance provider

Medibank Private for A$5.6 billion in 2014. He is also weighing a

sale of the national rail network, which manages assets worth an

estimated A$4.4 billion, stretching across five states. The future

of that offer could also be clarified in the budget.

But conservative allies in Queensland state suffered a shock

first-term election defeat last year after they pursued power

privatizations, a move which a majority of voters had opposed.

The plan being considered by Mr. Turnbull could be even riskier,

leading to criticisms that the conservatives may seek to take the

country's cherished but costly Medicare public health system down a

private health path like the U.S.

"If Malcolm Turnbull wants to make the 2016 federal election a

fight about Medicare, Labor will stand up for Medicare for all

Australians," Labor Opposition Leader Bill Shorten said

Tuesday.

The privatization of Medicare, pharmaceutical and aged-care

payments—allowing the government to save billions of dollars in

operating expenses—would attract keen interest from Australian

companies with large payment systems like communications giant

Telstra and even the Australia Post, still owned by the

government.

Foreign multinationals may also bid, including New Zealand

services provider Serco, Fuji-Xerox and Accenture, the West

Australian newspaper said.

Mr. Turnbull said the Medicare system in particular had lagged

behind digital payment systems used by many private-sector

companies.

To limit political fallout, a privatized payment system would

likely have strict caveats, including no change in current fee

payments and no reductions in public health spending. Mr. Turnbull

has promised no radical reforms without public consultation ahead

of elections which are expected sometime after August.

Write to Rob Taylor at rob.taylor@wsj.com

(END) Dow Jones Newswires

February 09, 2016 00:45 ET (05:45 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

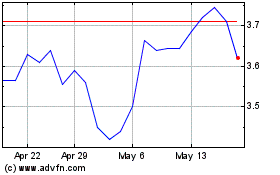

Medibank Private (ASX:MPL)

Historical Stock Chart

From Jan 2025 to Feb 2025

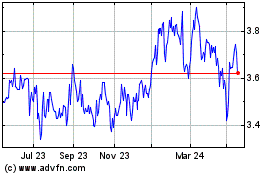

Medibank Private (ASX:MPL)

Historical Stock Chart

From Feb 2024 to Feb 2025