MARKET MOVEMENTS:

--Brent crude oil edged down 0.1% at $84.07 a barrel.

--European benchmark natural gas edged up 0.2% to EUR43.20 a

megawatt hour.

--Gold futures rose 0.8% to $2,019.70 a troy ounce.

--LME three-month copper futures were flat at $8,868.50 a metric

ton.

--Wheat futures fell 0.4% to $6.76 a bushel.

TOP STORY:

Newmont Raises Bid for Australia's Newcrest to $19.5 Billion

Newmont Corp. raised its takeover offer for Newcrest Mining Ltd.

to around $19.5 billion, as it aims to seal what would be the

largest-ever M&A deal in the gold-mining industry.

Newmont's decision to improve its all-stock offer for Newcrest

comes at a time when gold prices are approaching a record high amid

stress in the global banking system and heightened worries over the

economic outlook. The U.S. company had previously had an around $17

billion bid rebuffed by Newcrest, Australia's largest-listed gold

miner.

Newmont is now offering 0.400 of its own shares for each

Newcrest share, Newcrest said in a regulatory filing on Tuesday. In

addition, Newcrest said it is permitted to pay a special dividend

of up to $1.10 a share around the time any deal completes.

After assessing the latest proposal, Newcrest said it would open

its books to Newmont to firm up a binding offer.

OTHER STORIES:

Exxon Deal Hunt Signals Possible Shale M&A Wave

Exxon Mobil Corp.'s hunt for a blockbuster deal in U.S. shale

could kick off a bonanza of deal-making in the oil patch as

drillers look to put large war chests of cash to work.

The oil giant has held preliminary talks with Pioneer Natural

Resources Co. , a Texas fracker with a roughly $52 billion market

capitalization, about a potential acquisition, The Wall Street

Journal reported last week. Exxon, which has been on the prowl in

the Permian Basin for months, has also discussed a potential deal

with at least one other company, the Journal reported.

Such a transaction would send the strongest signal yet that

drillers in the Permian, the hottest U.S. oil field, are set to

bulk up through acquisitions. Oil companies boast healthy balance

sheets that give them the stomach and means to shop for

targets.

The Journal reported there is no formal process between Exxon

and Pioneer, and any deal, if it happens, likely wouldn't come

together until later this year or next year. On Monday, the first

day of trading since the Journal's story, Exxon's stock dropped

less than 1% while Pioneer's stock jumped about 6%.

Investment bankers and analysts have said conditions are ripe

for a deal frenzy in the oil patch this year.

---

Credit Agricole Steps Up EV Leasing as It Seals Stake in

Michelin's Watea

Credit Agricole SA said it has finalized a deal to take a stake

in electric-vehicle rental business Watea as it looks to expand its

EV leasing offer.

The French lender's leasing arm completed the deal with Watea

owner Compagnie Generale des Etablissements Michelin and now has a

30% stake in the business, it said over the Easter weekend. Credit

Agricole didn't set out the financial details of the

transaction.

MARKET TALKS:

Investors Halved Short Positions on Oil Following Saudi-Led

Production Cuts

0752 GMT - Investors sharply slashed short positions on crude

oil and added to longs following a Saudi-led round of production

cuts. Speculative investors' net long position--the balance of

their bullish and bearish bets--jumped by around 73,000 contracts

in the week through April 4, according to data from ICE Futures

Europe. Investors added around 44,000 long positions during that

time and reduced their short positions by almost half, or around

29,000 lots. The changes mean investors hold a net long position of

234,461 lots on Brent crude. (william.horner@wsj.com)

---

Oil Rises Ahead of Supply, Demand Data

0743 GMT - Oil prices edge higher ahead of a week busy with data

on demand. Brent crude oil gains 0.7% to $84.75 a barrel while WTI

adds 0.8% to $80.39 a barrel. The U.S. Energy Information

Administration releases its short-term energy outlook report on

Tuesday, followed by OPEC's monthly report on Thursday and the

International Energy Agency's monthly report on Friday. The oil

market is hungry for information on demand and oil balances after

OPEC+ members made a surprise cut to their production levels.

"Investors are weighing supply tightness against prospects of

slowing demand," says ANZ in a note. (william.horner@wsj.com)

---

Glencore Unlikely to Become Acquisition Target for BHP

0847 GMT - Glencore isn't likely to become an acquisition target

for BHP or any other miner, analysts at Jefferies say in a note.

The commodity mining and trading company has significant exposure

to high-risk regions, such zinc in Kazakhstan, whereas BHP's assets

are located in relatively stable jurisdictions, the analysts say.

Furthermore, its marketing segment wouldn't be a good fit given

jurisdictional risk and a history of regulatory issues, they say.

"A BHP acquisition of Glencore would be problematic from an

antitrust perspective--copper and possibly nickel--even if we

assume Glencore would de-merge its coal business first," the

analysts say. Shares are up 2.9% at 470.70 pence.

(anthony.orunagoriainoff@dowjones.com)

---

Glencore Spinning Off Coal Business Could Unlock Value

0837 GMT - Although Glencore hasn't pushed for a demerger of its

coal business, its plans to merge with Canadian miner Teck

Resources and then demerge the combined company's coal business as

a separate listed entity has "let the cat out of the bag," analysts

at Jefferies say. With or without Teck, a coal spinoff for the

commodity mining and trading company is probable at this point as

this could unlock trapped value, the analysts say. "We believe

Glencore will also continue to hunt for M&A opportunities as

there is a compelling argument to buy rather than build, especially

now as we are still in a weak point of the cycle," the analysts

say. Jefferies rates the stock buy with a 650-pence target price.

(anthony.orunagoriainoff@dowjones.com)

---

Industrial Metals Slip, Gold Lifts as Markets Await Inflation

Data

0729 GMT - Base metal prices are falling while gold futures are

rising as markets look to tomorrow's inflation data - with higher

inflation likely to mean interest rate increases from the U.S.

Federal Reserve. Three-month copper is down 0.3% to $8,838 a metric

ton while aluminum is 0.6%. lower at $2,325 a ton. Gold is up 0.5%

to $2,014.10 a troy ounce. "The macro environment is sending mixed

signals for commodity money flows," says Dave Whitcomb, head of

research at Peak Trading Research in a note. Markets are expecting

a drop in CPI to 5.1% from 6% on month, he says. "Softer inflation

data tomorrow (below 5.0%) would be a bullish tailwind for

commodity markets via a more dovish Fed and a weaker U.S. dollar."

(yusuf.khan@wsj.com)

Write to Barcelona Editors at barcelonaeditors@dowjones.com

(END) Dow Jones Newswires

April 11, 2023 07:30 ET (11:30 GMT)

Copyright (c) 2023 Dow Jones & Company, Inc.

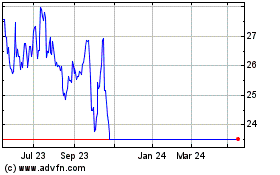

Newcrest Mining (ASX:NCM)

Historical Stock Chart

From Jan 2025 to Feb 2025

Newcrest Mining (ASX:NCM)

Historical Stock Chart

From Feb 2024 to Feb 2025