Wesfarmers to Take Big Impairment Hit

May 24 2016 - 10:40PM

Dow Jones News

SYDNEY—Wesfarmers Ltd. laid bare the potential pitfalls of

owning assets as diverse as department stores and coal mines on

Wednesday, saying it would take impairment charges of up to 2.3

billion Australian dollars (US$1.7 billion) after a slump in demand

for key products.

The biggest write-down of up to A$1.3 billion will be booked

against its discount store Target, which sells everything from

toasters to children's T-shirts, but has been hurt by the arrival

of foreign brands such as Zara and H&M to Australia's main

street in recent years.

Wesfarmers said it would also take a noncash impairment charge

of up to A$850 million against its Curragh coal mine in eastern

Australia's Queensland state, which supplies Asian steel mills and

power plants but has been bloodied by slumping prices of the

commodity.

Wesfarmers is Australia's biggest conglomerate with a market

value of more than A$46 billion, and has long justified a strategy

of owning a diverse range of assets on the grounds that it creates

long-term value for shareholders and provides a hedge against

swings in fortunes of individual businesses.

Its strategy, however, is increasingly unusual in global

business where activist investors in companies have made

'conglomerate' a dirty word. In the U.S., pressure on companies has

intensified to split up and concentrate on the most promising lines

of business.

General Electric Co. has been dismantling its sprawling

financial operations and smaller U.S. companies like Danaher Corp.

and Johnson Controls Inc. have opted to break themselves up.

Wesfarmers owns Australia's biggest supermarket chain, Coles,

and the Australian franchise of U.S. retailer Kmart. It also runs

tire-replacement workshops, office supplies shops, fertilizer

plants, protective equipment suppliers, along with stakes in a

sawmill and an investment bank.

On Wednesday, Wesfarmers said it remained committed to both the

coal-mining business and Target despite the magnitude of the

write-downs which will reduce its earnings in the year through

June, 2016.

"The decisions which we have outlined today reflect more

difficult market conditions in both Target and Curragh, but we

remain confident that operationally we have the right plans to

improve future performances over time," Chief Executive Richard

Goyder said.

Target has aggressively cut prices in a bid to attract shoppers

back to its stores, but the business has continued to struggle.

Last month, Wesfarmers said a probe into accounting irregularities

at Target had found its first-half earnings to be overstated by

A$21 million.

"Whilst Target has made operational progress in recent years,

market competition and disruption has continued to accelerate," Mr.

Goyder said.

Wesfarmers now expects Target to record an underlying A$50

million loss in the current financial year plus A$145 million of

restructuring costs and provisions as management needs to offer

discounts to shift surplus stock that didn't find favor with

shoppers. Its problems have been compounded by unexpectedly warm

autumn weather, particularly in eastern Australia, which has

reduced demand for seasonal ranges like coats and hats.

In the mining industry, Wesfarmers has grappled with thermal

coal prices tumbling by nearly a third over the past two years, as

demand from China cooled and supplies increased from mines planned

when prices were booming.

Wesfarmers' Curragh mine in Queensland's Bowen Basin produces

around 8.5 million metric tons of coking and thermal coal annually,

mostly for sale to Asia. A recent report by industry body the

Queensland Resources Council indicated roughly one third of coal

mines in Queensland are losing money.

Wesfarmers said its final dividend will be determined by the

group's underlying profit, which excludes the impairment charges

but includes the restructuring costs for Target.

Write to Rebecca Thurlow at rebecca.thurlow@wsj.com

(END) Dow Jones Newswires

May 24, 2016 23:25 ET (03:25 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

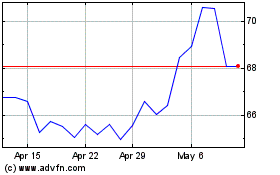

Wesfarmers (ASX:WES)

Historical Stock Chart

From Oct 2024 to Nov 2024

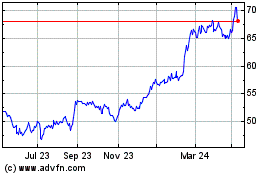

Wesfarmers (ASX:WES)

Historical Stock Chart

From Nov 2023 to Nov 2024