Large Ethereum Transactions Grow As ETH Breaks Yearly Highs

December 08 2024 - 9:00AM

NEWSBTC

Ethereum (ETH) is making headlines as it trends toward the $4,100

mark, reaching a new yearly high of $4,096. This milestone, just $3

above the previous high set in March, signals a potential

resurgence for the second-largest cryptocurrency by market

capitalization. The price action has caught the attention of

analysts and investors, particularly as Ethereum continues to

outperform expectations in a market dominated by volatility and

uncertainty. Related Reading: Dogecoin About To Enter Phase Of

Explosive Growth – Charts Reveal Massive Breakout Key metrics from

IntoTheBlock shared by analyst Ali Martinez shed light on the

network’s activity, revealing a surge in large Ethereum

transactions. Historically, such increases in transaction volume

have been linked to significant price movements, suggesting that

Ethereum’s current uptrend could have more room to run. These

developments hint at growing interest from institutional players

and high-net-worth investors, further solidifying Ethereum’s

position as a market leader. The next few weeks promise to be

pivotal as Ethereum approaches the year’s end. Will it sustain its

momentum and close the year with a breakout above $4,100? Or will

it face resistance and retrace? With on-chain activity and market

sentiment aligning in Ethereum’s favor, all eyes are on its next

move as traders and investors position themselves for what could be

an exciting close to 2024. Ethereum Transactions Surge With Price

Ethereum continues to dominate market discussions after pushing to

new yearly highs on Friday. The cryptocurrency surged past $4,096,

surpassing its previous peak set in March. This upward momentum has

reignited investor interest, but Ethereum’s price isn’t the only

thing on the rise—its network activity is booming as well.

According to data by analyst Ali Martinez (IntoTheBlock), large

Ethereum transactions are experiencing a significant uptick.

Martinez highlights that weekly transaction volume has skyrocketed

by over 300%, reaching an impressive $17.15 billion yesterday. This

surge in network activity signals increased confidence among

institutional players and high-net-worth investors, who often

precede retail adoption during major bull runs. Such growth in

transaction volume historically correlates with sustained upward

price movements, suggesting Ethereum’s rally may not be over. As

the second-largest cryptocurrency by market cap, ETH appears

well-positioned to continue setting new highs if these trends

persist. Despite this optimism, ETH faces a key milestone ahead—its

all-time high of $4,878, set in November 2021, is still 20% away.

While Ethereum’s recent breakout has invigorated bulls, analysts

caution that reaching and sustaining prices near the ATH will

require significant buy-side pressure and broader market strength.

Related Reading: Cardano Whales Keep Buying – Price Holds Above

Crucial Mark If the current trajectory holds, Ethereum could

approach its ATH sooner than expected, further solidifying its

status as the go-to blockchain for decentralized applications and

financial innovation. For now, investors are closely monitoring

Ethereum’s price action and network data to gauge whether this

rally has the momentum to break new ground or if a pullback is

imminent. ETH Pushing Above $4k Ethereum is currently trading

at $3,960, showing resilience after reaching a local high of $4,096

just two days ago. This rally has brought Ethereum back into the

spotlight, with investors eyeing key levels that could dictate its

next move. A weekly close above the critical $4,000 mark would

signal the highest weekly close for ETH since December 2021, a

major milestone for the second-largest cryptocurrency. Such a close

would reinforce the bullish sentiment surrounding Ethereum,

potentially attracting more buy-side pressure and setting the stage

for a continued rally toward its all-time high of $4,878. On the

flip side, failure to achieve a weekly close above $3,880—its

previous highest weekly close—could indicate waning momentum. In

this scenario, Ethereum may enter a consolidation phase as traders

take profits and the market digests recent gains. Consolidation

below this level would likely keep ETH range-bound in the near

term, with $3,880 and $4,000 acting as pivotal resistance levels.

Related Reading: Dogecoin Still In Consolidation – Analyst Expects

$0,63 If We Get A Breakout The next few days will be crucial as ETH

navigates this critical juncture. A decisive weekly close will

likely determine whether Ethereum extends its current rally or

pauses to consolidate, offering traders opportunities and

challenges in this dynamic market. Featured image from DALL-E,

chart from TradingView

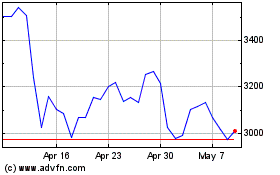

Ethereum (COIN:ETHUSD)

Historical Stock Chart

From Nov 2024 to Dec 2024

Ethereum (COIN:ETHUSD)

Historical Stock Chart

From Dec 2023 to Dec 2024