Monday’s Crypto Leaderboard: BNB And XRP Surge Past Market Leaders

August 19 2024 - 8:30PM

NEWSBTC

In a significant development, two of the top 10 cryptocurrencies on

the market, Binance Coin (BNB) and XRP, have emerged as the

outperformers this Monday, overshadowing the gains of industry

leaders Bitcoin (BTC) and Ethereum (ETH). XRP Price Analysis XRP,

the token associated with the blockchain company Ripple, has taken

the lead among the top 10 cryptocurrencies surging nearly 6%. The

token’s price reached a near two-week high of $0.6080 earlier on

Monday, coupled with a 197% increase in trading volume over the

past 24 hours, according to CoinGecko data. Despite the XRP price

later retracing to the $0.590 mark, the token’s ability to briefly

consolidate above the critical $0.600 resistance level has raised

hopes among investors. To sustain the current price recovery,

bulls will need to keep a close eye on the next hurdles at $0.6169

and $0.6288. A daily close above these levels could signal a

breakout from the token’s one-month downtrend. Related Reading:

MATIC Price (Polygon) Sets Sights Higher: Can It Gain Bullish

Momentum? Notably, XRP is currently trading above its 200-day and

50-day exponential moving averages (EMAs) at $0.5516 and $0.5716,

marked by the yellow and blue lines, respectively, on the XRP/USDT

daily chart below. As seen in the past uptrends of this year,

these key technical indicators can provide support for the price in

case of a broader market correction that could trigger additional

selling pressure. Binance Coin Surges To Two-Week High Binance Coin

on the other hand, the native token of the leading Binance

exchange, has also seen a surge, jumping 3% in the last 24 hours to

reach a two-week high of $554. This comes after the token dipped as

low as $399 on August 5, during the market’s “Black Monday” event.

Similar to XRP, Binance Coin has also recorded a notable spike in

trading volume, with a 30% increase in the same time frame,

amounting to $800 million as CoinGecko data shows. While the BNB

price currently stands 22.68% below its all-time high of $717

recorded on June 6, the potential breach of the upper resistance on

its daily chart could pave the way for a retest of this

milestone. Related Reading: Ethereum Price Turns Lower: Can

ETH Bounce Back From $2,550? In the near term, the key for the

Binance Coin price is to consolidate above its 200-day EMA placed

at $547, which would then open the door to retest the $574

resistance level, the most notable one on this time frame, before a

potential surge toward $600. Conversely, the previous range low of

$502 experienced at the beginning of the month has acted as a major

support for the Binance Coin token after the August 5 crash,

serving as a key support level in the shorter term for the BNB

price. Ultimately, it remains to be seen whether this surge in

altcoins can be sustained in the face of broader market

uncertainties and a lack of fresh capital flowing into the crypto

space. Featured image from DALL-E, chart from

TradingView.com

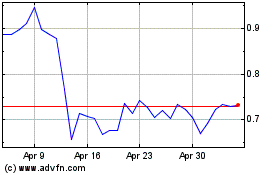

Polygon (COIN:MATICUSD)

Historical Stock Chart

From Oct 2024 to Nov 2024

Polygon (COIN:MATICUSD)

Historical Stock Chart

From Nov 2023 to Nov 2024