This Indicator Points To A Bitcoin Bottom, $50K Next Target?

February 16 2022 - 5:00PM

NEWSBTC

Bitcoin has been on a downtrend recently and although it has had

multiple recoveries, it is still a long way off from its all-time

high. There are a number of indicators that point towards bullish

and bearish trends, but mainly seem to stand in the middle. One

indicator seems to point to the further upside coming, adding as

much as $6K to the price of the digital asset. What The Daily OBV

Chart Says A crypto education and market analysis account on

Twitter recently posted a chart mapping out what the daily OBV

chart might be saying for bitcoin. Mapping out previous movements

on this chart, Income Sharks shows that the digital asset has once

again touched an important point that could cause it to grow

further. The last time the cryptocurrency had made this move in the

chart was in July 2021. Related Reading | Bitcoin Dominance

Will Continue To Decline In Favor Of Ethereum, Altcoins, FTX US

President We’ll recall that July/August was an important time

period for the digital asset. This was the first time that bitcoin

had hit the $60,000 price point. It had grown from $30,000 to a new

all-time high in a matter of weeks, all of which started with a

double bottom made by bitcoin on the OBV chart. Now, bitcoin has

once more hit the same pattern and if history is any indicator, it

might be getting ready for another rally. OBV chart shows bitcoin

has hit bottom | Source: Income Sharks As the digital asset has

formed another double bottom on the chart, making a very sharp

bullish double V spike, it could signal that a break above $50,000

is imminent. Not only is this an important signal, but it is also

almost more bullish this time around. And what’s more, this could

very well signal the bottom of the downtrend, suggesting that the

digital asset may begin another bull rally. Bitcoin Starting

Another Uptrend Bitcoin has once again entered another recovery

trend that has put it above $44K. Although it had claimed this

point earlier in the month, bears had successfully pulled it down,

pushing it far away from the $46K price mark that would solidify

its entry into another bull market. The digital asset is now

trading above its 50-day simple moving average. This shows that

bears have lost hold of the market, but doesn’t completely

eliminate the possibility of a slip downwards. Sentiment has skewed

into majority buy but not by much. BTC recovers above $44K |

Source: BTCUSD on TradingView.com From here, the next major

resistance point is at 44,900, where bulls will most likely meet

strong resistance from the bears. Bitcoin still needs to settle

above $46K to eliminate risks of more downside. A slip from its

current price will set it on a path down to $42K, where the 1st

major support level rests at $42,665. Below that would see bulls

fight for control at $41,339. Related Reading | TA: Bitcoin

Fails to Test $45K, Why Dips Could Be Attractive Bitcoin is

currently trading at $44,080 at the time of this writing, after

hitting $44,800 in the early hours of Wednesday. Outlook for the

rest of the trading day remains bullish with BTC expected to close

out the day above $44K once more. Featured image from Finextra,

chart from TradingView.com

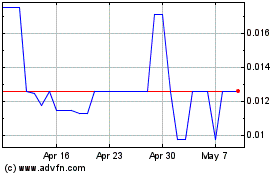

Rally (COIN:RLYUSD)

Historical Stock Chart

From Dec 2024 to Jan 2025

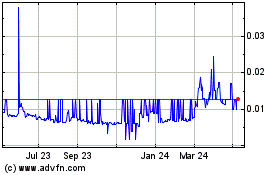

Rally (COIN:RLYUSD)

Historical Stock Chart

From Jan 2024 to Jan 2025

Real-Time news about Rally (Cryptocurrency): 0 recent articles

More Rally News Articles