Why is the crypto market down today?

March 10 2025 - 7:31AM

Cointelegraph

The cryptocurrency market erased all gains from President

Trump’s US Crypto Strategic Reserve announcement, plunging by over

14.7% in seven days to reach $2.7 trillion on March 10.

Top cryptocurrencies and their 24-hour performances. Source:

Coin360

Several factors have contributed to the latest drop in crypto

prices, including:

-

Trump’s acknowledgement that his policies will cause short-term

pain to the economy.

-

Investors are risk-off amid the continued outflows from crypto

investment products.

-

TOTAL drops toward the technical target of a descending

triangle.

Trump acknowledges short-term pain for

economy

President Trump’s recent statements have cast a shadow over the

crypto market, tempering the enthusiasm that followed his

pro-crypto rhetoric earlier in 2025.

Key points:

-

Bitcoin (BTC) declined 4% in the last 24

hours.

-

Ether (ETH) is down 3.2% over the last 24

hours to trade just above $2,000.

-

Solana (SOL) and XRP

(XRP) have also recorded losses,

down 7.2% and 4.5%, respectively.

Compounding the issue are the significant liquidations in the

derivatives market.

-

A total of $650.80 million in liquidations has been recorded in

the past 24 hours.

-

Long positions took the hardest hit, with $595.75 million

liquidated.

Crypto market liquidation heatmap. Source:

CoinGlass

-

Bitcoin and Ethereum were the biggest casualties, with $264.22

million and $114.76 million in liquidations, respectively.

-

When long positions are liquidated, traders’ holdings are

automatically sold, increasing market supply and driving prices

lower.

More critically, US President Donald Trump acknowledged that

markets could see short-term pain from his policies, including the

trade tariffs on Canada, Mexico, and China and budget-cutting

plans.

“There could be a little disruption," said

Trump in an interview with Fox News, adding:

“If you look at China, they have a 100-year

perspective… we go by quarters. What we’re doing is building a

foundation for the future.”

The market, which surged post-election on hopes of a

deregulated, crypto-friendly

administration, is now grappling with the reality that Trump’s

broader economic agenda may introduce headwinds before any

crypto-specific benefits materialize.

Investors continue de-risking from crypto

funds

The crypto market’s ongoing correction aligns with the

huge capital

outflows from crypto investment products.

Key takeaways:

-

Digital asset investment products saw outflows for the fourth

week in a row, totaling $876 million during the week ending March

7, as per CoinShares report.

-

This brings outflows to $4.75 billion in the last four weeks,

reducing the year-to-date inflows to $2.6 billion.

-

This indicates institutional investors decreased their exposure

to digital assets.

-

Bitcoin saw the biggest share of outflows, totaling $756

million.

-

Total assets under management have declined by $39 billion from

their peak to the current value of $142 billion, the lowest point

since mid-November 2024.

Capital flows for crypto investment products. Source:

CoinShares

CoinShares head of research James Butterfill attributed this to

“negative sentiment,” suggesting “capitulation” among

investors.

“Although this indicates a slowdown in the pace of

outflows, investor sentiment remains bearish. ”

Additionally, the Crypto Fear & Greed Index plummeted to 10

on March 10, its lowest since July 2022, indicating “extreme

fear.”

The Crypto Fear & Greed Index. Source:

Alternative.me

TOTAL validates descending triangle

From a technical perspective, today’s crypto market’s decline is

part of a correction trend that saw TOTAL—the total market

capitalization of all cryptocurrencies—drop below a descending

triangle pattern.

-

A descending triangle is a bearish continuation pattern, forming

when the price makes lower highs while maintaining a flat support

level at the bottom.

-

The pattern is confirmed when the price breaks below the support

level with high volume and drops by as much as the triangle’s

maximum height.

-

As of March 10, TOTAL had fallen to the pattern’s target of $2.6

trillion at the 50-weekly simple moving average (SMA).

TOTAL/USD weekly chart. Source:

Cointelegraph/TradingView

-

If selling pressure persists, the 100–week SMA at $2 trillion

could become the next downside target.

-

Holding the 50-week SMA as support may strengthen the ongoing

rebound toward the pattern’s lower trendline, aligning with the

$3.1 trillion level.

This article does not

contain investment advice or recommendations. Every investment and

trading move involves risk, and readers should conduct their own

research when making a decision.

...

Continue reading Why is the crypto market down

today?

The post

Why is the crypto market down today? appeared

first on

CoinTelegraph.

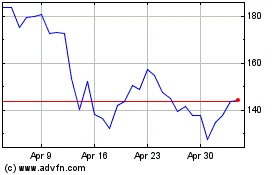

Solana (COIN:SOLUSD)

Historical Stock Chart

From Feb 2025 to Mar 2025

Solana (COIN:SOLUSD)

Historical Stock Chart

From Mar 2024 to Mar 2025