Arcadis Trading Update Q1 2024: Continued client demand driving

strong pipeline while delivering significant margin expansion

Arcadis First Quarter 2024 Trading

UpdateContinued client demand driving strong

pipeline while delivering significant margin expansion

- Significant multi-year project wins resulted in an order intake

of €1,129 million, organically up by 6.0%, with investment programs

increasingly contributing

- Record backlog net revenues at €3,316 million

- Net revenues of €968 million, organically up by 4.4% despite

1.2 fewer working days

- Operating EBITA margin increased to 10.7% (Q1 ‘23: 9.8%)

Amsterdam, 30 April 2024

– Arcadis, the world’s leading company delivering

data-driven sustainable design, engineering, and consultancy

solutions for natural and built assets, secured significant

multi-year project wins and delivers continued profitable growth in

the first quarter of 2024; with Net Revenues of

€968 million and an improved operating

EBITA of 10.7% (Q1‘23: 9.8%).

Alan Brookes, CEO Arcadis, said: “Arcadis

delivered another strong quarter with significant multi-year

project wins and continued margin expansion. Client demand was

particularly strong in environmental remediation, energy

transition, rail and highways, with projects funded by large

investment programs increasingly contributing to our backlog and

securing revenues for years to come. The need for our complementary

and integrated set of sustainable and digitally enabled services

continues to drive increased levels of business collaboration. Our

long-standing relationships, global expertise and complementary

services allow us to enhance our leading market positions. I am

convinced that with the talent and expertise within the

organization, we are well positioned to seize the market momentum

and deliver profitable growth.”

KEY FIGURES

| in €

millions |

First Quarter |

|

Period ended 31 March 2024 |

2024 |

2023 |

change |

|

Net revenues |

968 |

940 |

3% |

|

Organic growth (%)1) |

4.4% |

12.3% |

|

|

Operating EBITDA2) |

131 |

120 |

8% |

|

Operating EBITDA margin (%) |

13.5% |

12.8% |

|

|

EBITA |

97 |

87 |

11% |

|

EBITA margin (%) |

10.0% |

9.2% |

|

|

Operating EBITA2) |

104 |

92 |

12% |

|

Operating EBITA margin (%) |

10.7% |

9.8% |

|

|

Net Working Capital (%)3) |

11.6% |

12.1% |

|

|

Days Sales Outstanding (days)3) |

64 |

67 |

|

|

Free Cash Flow4) |

-97 |

-108 |

|

|

Net Debt |

963 |

1,072 |

-10% |

|

Order intake |

1,129 |

1,062 |

6% |

|

Organic order intake (%)1) |

6.0% |

10.5% |

|

|

Book-to-Bill5) |

1.17 |

1.13 |

3% |

|

Backlog net revenues |

3,316 |

3,192 |

4% |

|

Backlog organic growth (%, qtd)1) |

4.8% |

3.9% |

|

|

Backlog organic growth (%, yoy)1) |

4.9% |

4.3% |

|

INCOME STATEMENTNet revenues totaled €968 million and increased

organically by 4.4%, despite 1.2 fewer working days in the quarter

compared to last year. Growth was solid in most markets while North

American growth was outstanding. We saw continued strong momentum

in Resilience, Mobility and Intelligence, while project choices at

Places during 2023 resulted in lower growth for this quarter. The

operating EBITA margin improved to 10.7% (Q1‘23: 9.8%) driven by

operating leverage, cost synergies, and the Middle East

winddown.

ORDER INTAKE & BACKLOGOrder intake was strong in the

quarter, growing organically by 6.0% to €1,129 million, resulting

in a strong book-to-bill of 1.17x, and a record backlog of €3,316

million (Q1‘23: €3,192 million). The strong order intake reflected

continued solid client demand for Resilience and Mobility

solutions, offsetting lower intake at Places due to project

selectivity. We continue to see ample opportunities in our project

pipeline or “soft” backlog, while we enhance the positions in our

high-growth end markets and seize the opportunities from

stimulus-driven investments.

BALANCE SHEET & CASH FLOWNet working capital as a percentage

of annualized gross revenues improved to 11.6% (Q1‘23:

12.1%) and Days Sales Outstanding (DSO) was 64 days (Q1‘23:

67 days1)). As a result of disciplined working capital

management, free cash flow in the quarter was €-97 million

(Q1‘23: €-108 million), in line with seasonal trends, despite

the first interest payment of €24 million on our Eurobond issued

February 2023.

PERFORMANCE BY GLOBAL BUSINESS AREAS

RESILIENCE

| (37% of net

revenues) |

|

|

|

| in € millions |

First Quarter |

|

Period ended 31 March 2024 |

2024 |

2023 |

change |

|

Net revenues |

354 |

332 |

7% |

|

Organic growth1) |

8.2% |

13.0% |

|

|

Order intake |

449 |

423 |

6% |

|

Backlog net revenues |

1,063 |

980 |

8% |

|

Backlog organic growth (%, qtd)1) |

9.7% |

10.0% |

|

|

Backlog organic growth (%, yoy)1) |

10.8% |

10.6% |

|

Resilience performed strongly across the board, with continued

solid results in our largest markets, North America and the UK.

Multiple significant wins in Water relating to AMP8 in UK,

Environmental Restoration and Energy Transition have substantially

contributed to the quarter’s order intake and provide revenue

visibility for the remainder of the year.

PLACES

| (39% of net

revenues) |

|

|

|

| in € millions |

First Quarter |

|

Period ended 31 March 2024 |

2024 |

2023 |

change |

|

Net revenues |

374 |

388 |

-3% |

|

Organic growth (%)1) |

-1.1% |

8.7% |

|

|

Order intake |

383 |

407 |

-6% |

|

Backlog net revenues |

1,493 |

1,555 |

-4% |

|

Backlog organic growth (%, qtd)1) |

0.0% |

1.3% |

|

|

Backlog organic growth (%, yoy)1) |

-4.0% |

-2.5% |

|

Good revenue growth in North America and Europe was offset by

the effects of strategic refocus on core competencies at Arcadis

DPS and repositioning of China towards project management for

international clients. We saw good order intake in the quarter in

Continental Europe, in particular in data center design for

technology clients and retrofitting of federal client’s assets such

as national hospitals and universities. The pipeline is solid on

the back of tightening regulation and investment programs, such as

the EU Directive on Energy for Buildings and the US Chips Act.

MOBILITY

| (22% of net

revenues) |

|

|

|

| in € millions |

First Quarter |

|

Period ended 31 March 2024 |

2024 |

2023 |

change |

|

Net revenues |

216 |

200 |

8% |

|

Organic growth1) |

8.2% |

15.3% |

|

|

Order intake |

273 |

211 |

30% |

|

Backlog net revenues |

637 |

545 |

17% |

|

Backlog organic growth (%, qtd)1) |

10.3% |

1.8% |

|

|

Backlog organic growth (%, yoy)1) |

18.5% |

4.7% |

|

Mobility revenue growth continued to be strong across solutions

with outstanding results for the US. Stellar backlog growth was

driven by large wins in all key markets on the back of large

government investment programs such as Hudson Tunnel Project of the

Gateway Development Commission and California High-speed Rail in

the US, and Ontario’s Pape Tunnel Underground Stations in Canada.

The pipeline remains strong driven by the need for efficient

transportation systems and our sustainable, data-driven offerings.

Global collaboration and the utilization of Global Excellence

Centers (GECs) is positioning Arcadis well to win large

projects. INTELLIGENCE

| (2% of net

revenues) |

|

|

|

| in € millions |

First Quarter |

|

Period ended 31 March 2024 |

2024 |

2023 |

change |

|

Net revenues |

23 |

21 |

8% |

|

Organic growth1) |

7.2% |

|

|

|

Order intake |

24 |

21 |

14% |

|

Backlog net revenues |

123 |

111 |

11% |

|

Backlog organic growth (%, qtd)1) |

0.3% |

0.0% |

|

|

Backlog organic growth (%, yoy)1) |

9.4% |

|

|

Good revenue growth was achieved especially in North America.

Backlog growth was driven by order intake from large Key Clients,

such as Ontario Ministry of Department for our Enterprise Decision

Analytics (EDA) solution and Nevada Department of Transportation

for multiple digital solutions including Travel-IQ. We continue to

invest in collaboration with our other businesses, to leverage

existing relationships and deliver a wide range of digital

solutions and services to our clients.

2024-2026 STRATEGY "ACCELERATING A PLANET POSITIVE FUTURE"On 16

November 2023 Arcadis presented its 2024-2026 Strategy

“Accelerating a planet positive future” and its 2026 financial

targets; these include: organic net revenue growth of mid to high

single digits over the cycle, operating EBITA margin of 12.5% in

2026, Net Debt / Operating EBITDA of 1.5-2.5x with an

Investment Grade credit rating and a dividend payout ratio of

30-40% of Net Income from Operations.

1)Underlying growth excl. impact of FX, acquisitions, footprint

reductions, winddowns or divestments2)EBIT(D)A excluding

restructuring, integration, acquisition, and divestment costs3)2023

revised to reflect the adjustments to the provisional opening

balances of acquired entities recognized 31 Dec. 2022 (in

accordance with IFRS 3.49)4)Free Cash Flow: Cash Flow from

Operations adjusted for Capex and Lease liabilities5)Order Intake /

Net Revenue

FINANCIAL CALENDAR

- 8 May 2024 – Annual General Meeting of Shareholders

- 25 July 2024 – Second quarter and half year 2024 results

- 31 October 2024 – Third quarter 2024 trading update

Please visit

https://www.arcadis.com/en/investors/investor-calendar for more

information on the upcoming investor events.

ARCADIS INVESTOR RELATIONSChristine Disch | +31 (0)615376020 |

christine.disch@arcadis.com

ANALSYT WEBCASTToday at 14:00 CEST:

https://www.arcadis.com/en/investors/investor-calendar/2024/trading-update-q1-2024

ABOUT ARCADISArcadis is the world’s leading company delivering

data-driven sustainable design, engineering, and consultancy

solutions for natural and built assets. We are more than 36,000

architects, data analysts, designers, engineers, project planners,

water management and sustainability experts, all driven by our

passion for improving quality of life. As part of our

commitment to accelerating a planet positive future, we work with

our clients to make sustainable project choices, combining digital

and human innovation, and embracing future-focused skills across

the environment, energy and water, buildings, transport, and

infrastructure sectors. We operate in over 30 countries, and in

2023 reported €5.0 billion in gross revenues.

www.arcadis.com REGULATED INFORMATIONThis press

release contains information that qualifies or may qualify as

inside information within the meaning of Article 7(1) of the EU

Market Abuse Regulation.

DISCLAIMERStatements included in this press release that are not

historical facts (including any statements concerning investment

objectives, other plans and objectives of management for future

operations or economic performance, or assumptions or forecasts

related thereto) are forward-looking statements. These statements

are only predictions and are not guarantees. Actual events or the

results of our operations could differ materially from those

expressed or implied in the forward-looking statements.

Forward-looking statements are typically identified by the use of

terms such as “may”, “will”, “should”, “expect”, “could”, “intend”,

“plan”, “anticipate”, “estimate”, “believe”, “continue”, “predict”,

“potential” or the negative of such terms and other comparable

terminology. The forward-looking statements are based upon our

current expectations, plans, estimates, assumptions and beliefs

that involve numerous risks and uncertainties. Assumptions relating

to the foregoing involve judgments with respect to, among other

things, future economic, competitive and market conditions and

future business decisions, all of which are difficult or impossible

to predict accurately and many of which are beyond our control.

Although we believe that the expectations reflected in such

forward-looking statements are based on reasonable assumptions, our

actual results and performance could differ materially from those

set forth in the forward-looking statements.

- Arcadis Q1 2024 Trading Update Press Release

- Arcadis Q1 2024 Trading Update Presentation

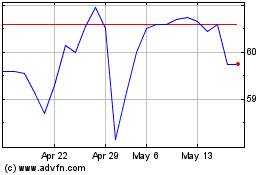

Arcadis NV (EU:ARCAD)

Historical Stock Chart

From Oct 2024 to Nov 2024

Arcadis NV (EU:ARCAD)

Historical Stock Chart

From Nov 2023 to Nov 2024