Arcadis Q4 and Full Year 2023 Results: Record quarter performance

and delivery on 2021-2023 targets

PRESS RELEASE

Arcadis Fourth Quarter and Full Year Results

2023Record quarter performance and delivery on

2021-2023 targets

FOURTH QUARTER

- Record Operating EBITA margin1) of 11.4% (Q4‘22: 10.0%)

- Record Q4 Order Intake of €1,028 million resulting in Book to

Bill of 1.09x

- Record Free Cash Flow generation of €208 million (Q4‘22: €146

million)

FULL YEAR

- Delivered on all key strategic targets set for 2021-2023

strategy cycle “Maximizing Impact”

- Operating EBITA margin of 10.4% (FY ‘22: 9.8%)

- Record net revenues of €3.8B (+25% YoY), organic growth of

9.0%2), order intake of €3.9B (+26% YoY)

- Net debt / Operating EBITDA of 1.7x

- Proposed dividend increased by 15% to €0.85 per share (2022:

€0.74)

Amsterdam, 22 February 2024

– Arcadis, the world’s leading company delivering

data-driven sustainable design, engineering, and consultancy

solutions for natural and built assets, reports record fourth

quarter and full year results; delivering on its key strategic

targets set for 2023. Net revenue of

€3.8B for the year driven by 9% organic

growth, operating EBITA improved to 10.4% for the year. Arcadis

proposes to increase its dividend by 15% to €0.85 per

share.

Alan Brookes, CEO Arcadis, said: “Arcadis has

delivered a record breaking fourth quarter and full year 2023

performance, achieving all its key 2021-2023 strategic targets.

During 2023 we successfully finalized the Arcadis IBI and Arcadis

DPS integrations, resulting in significant project wins, pipeline

opportunities and cost synergies. Furthermore, we expanded our

Global Excellence Center capabilities, further standardized and

automated our operating processes and have been more deliberate in

our project choices; focusing closely on growth markets and Key

Clients. Looking forward, our 2024-2026 Strategy “Accelerating a

Planet Positive Future” launched in November 2023 delivers a clear

purpose that is strongly resonating with our clients and people. We

will drive profitable growth by focusing on the sustainable

projects and clients that contribute to our strategic ambition,

expanding our Key Client program and investing in our digital

products and solutions, while enhancing the skills of our people. I

would like to thank all our people for a truly remarkable year with

a record high backlog and continued strong demand outlook. Arcadis

is in a strong position for the future.”

| KEY FIGURES*

(in € millions) |

Full Year |

|

Fourth Quarter |

|

Period ended 31 December 2023 |

2023 |

2022 |

change |

|

2023 |

2022 |

change |

|

Net revenues |

3,759 |

3,019 |

25% |

|

941 |

861 |

9% |

|

Organic growth (%)2) |

9.0% |

8.9% |

|

|

6.5% |

11.2% |

|

|

Operating EBITA1)* |

391 |

294 |

33% |

|

107 |

86 |

25% |

|

Operating EBITA margin (%)1) |

10.4% |

9.8% |

|

|

11.4% |

10.0% |

|

|

Net Income |

160 |

132 |

22% |

|

|

|

|

|

NIfO per share (in €)3) |

2.51 |

2.26 |

11% |

|

|

|

|

|

Net Working Capital (%)4) |

9.3% |

10.0% |

|

|

|

|

|

|

Dividend (proposal) per share (in €) |

0.85 |

0.74 |

15% |

|

|

|

|

|

Free Cash Flow5) |

190 |

173 |

10% |

|

208 |

146 |

42% |

|

Net Debt / Operating EBITDA1) |

1.7x |

2.2x |

|

|

|

|

|

|

Order intake |

3,899 |

3,089 |

26% |

|

1,028 |

871 |

18% |

|

Backlog net revenues |

3,155 |

3,119 |

1% |

|

|

|

|

| Backlog organic

growth (%, yoy)2) |

4.0% |

4.2% |

|

|

|

|

|

|

Voluntary employee turnover6) |

11.7% |

14.2% |

|

|

|

|

|

* The 2023 results as presented in this press release are

unaudited. Most of these metrics are alternative performance

measures; refer to reconciliation to the most directly comparable

IFRS measures provided in “Alternative Performance Measures”

section of “Arcadis 2023 Financial Report” on page 87, available at

Arcadis website:

https://media.arcadis.com/-/media/project/arcadiscom/com/investors/2024/arcadis-2023-financial-report/arcadis-2023-financial-report.pdfAcquisitions

of IBI Group closed on 27th Sept-22, DPS Group on 1st Dec-22.1)

EBIT(D)A excluding restructuring, integration, acquisition and

divestment costs2) Underlying growth excl. impact of FX,

acquisitions, footprint reductions (e.g. the Middle East),

winddowns or divestments3) Net income before non-recurring items

(e.g. valuation changes of acquisition-related provisions,

acquisition and divestment costs, expected credit loss on

shareholder loans and corporate guarantees, and one-off pension

costs)4) Revised to reflect the adjustments to the provisional

opening balances of acquired entities recognized 31 Dec. 2022 (in

accordance with IFRS 3.49)5) Free Cash flow: Cash Flow from

Operations corrected for Capex and Lease liabilities6) Voluntary

turnover excludes the Middle East as these operations are being

wound down

REVIEW OF THE FOURTH QUARTER 2023Net revenues totaled €941

million, increasing 9% YoY, with currency effects of -3.2% from a

weakening US and Canadian Dollar against the Euro. Organic growth

was 6.5%, driven by all Global Business Areas (GBAs). Growth was

particularly strong in key markets US and Europe, slightly offset

by deliberate project choices at Arcadis DPS and market conditions

in China. Positive momentum in order intake with a step up from the

third quarter, driven by the US, the Netherlands and Australia,

resulted in a Book to Bill of 1.09x for the quarter. Operating

EBITA margin improved to a record high 11.4% (Q4‘22: 10.0%) driven

by operational leverage and an optimized portfolio.

REVIEW OF THE FULL YEAR 2023: PROFIT & LOSS ITEMS AND

BACKLOGNet revenues totaled €3,759 million, increasing 25% YoY,

with currency effects of -2.6%. Organic growth was 9.0%, driven by

all GBAs. The operating EBITA margin increased to 10.4% (FY’22:

9.8%) driven by margin, operating leverage, improvement at the

acquired businesses and materialized cost synergies. Non-operating

costs were €48 million, as a result of integration costs relating

to the 2022 acquisitions, and from portfolio optimizations: ongoing

wind-down of the Middle East operations, merging of the offices and

other restructuring activities.

Net financing expenses were €65 million (FY’22: €24 million) and

increased due to higher interest rates and higher average debt

levels throughout the year. Amortization increased to €59 million

(FY’22: 20 million), mainly driven by acquired intangible assets

amortization such as backlog and customer relationships. Net Income

from Operations increased by 12% to €226 million (FY’22: €202

million), or €2.51 per share (FY’22: €2.26), as a result of higher

revenues, partially offset by higher integration, restructuring,

and net financing expenses.

The net revenue organic backlog growth was 4.0% year on year,

reflecting strong order intake across all key markets, resulting in

a Book to Bill of 1.04x (FY’22: 1.02x).

OPERATIONAL HIGHLIGHTS

RESILIENCE

| (36% of net

revenues) |

|

|

|

|

|

|

|

| in € millions |

Full Year |

|

Fourth Quarter |

|

Period ended 31 December 2023 |

2023 |

2022 |

change |

|

2023 |

2022 |

change |

|

Net revenues |

1,343 |

1,239 |

8% |

|

336 |

330 |

2% |

|

Organic growth2) |

10.6% |

10.3% |

|

|

6.6% |

11.9% |

|

|

Operating EBITA1) |

159 |

134 |

19% |

|

|

|

|

|

Operating EBITA margin (%)1) |

11.8% |

10.8% |

|

|

|

|

|

|

Order intake |

1,457 |

1,304 |

12% |

|

350 |

351 |

0% |

|

Backlog net revenues |

953 |

895 |

7% |

|

|

|

|

|

Backlog organic growth (%, yoy)2) |

11.5% |

7.6% |

|

|

|

|

|

|

Backlog organic growth (%, qtd)2) |

0.8% |

2.0% |

|

|

|

|

|

Resilience continued to perform very strongly across the board,

with outstanding results in North America. Solid order intake was

driven by Water Optimization wins in the UK, as well as increased

Environmental Restoration demand, supported by further tightening

of PFAS regulations in the US and Europe. Margin improvement was

driven by North America, while we continued to invest in our

digital product offering and standardization of processes.

PLACES

| (40% of net

revenues) |

|

|

|

|

|

|

|

| in € millions |

Full Year |

|

Fourth Quarter |

|

Period ended 31 December 2023 |

2023 |

2022 |

change |

|

2023 |

2022 |

change |

|

Net revenues |

1,509 |

1,017 |

48% |

|

372 |

320 |

16% |

|

Organic growth (%)2) |

2.7% |

4.2% |

|

|

1.4% |

6.5% |

|

|

Operating EBITA |

137 |

93 |

47% |

|

|

|

|

|

Operating EBITA margin (%)1) |

9.1% |

9.1% |

|

|

|

|

|

|

Order intake |

1,479 |

1,003 |

47% |

|

401 |

285 |

41% |

|

Backlog net revenues |

1,504 |

1,573 |

-4% |

|

|

|

|

|

Backlog organic growth (%, yoy)2) |

-2.7% |

0.0% |

|

|

|

|

|

|

Backlog organic growth (%, qtd)2) |

1.3% |

-0.6% |

|

|

|

|

|

Good revenue growth in North America and Europe were somewhat

offset by the effects of deliberate project choices at Arcadis DPS.

Backlog improved in the last quarter with sharp recovery in order

intake, albeit the full year backlog results were impacted by

strategic selectivity of order intake, and market conditions in

China. Pipeline opportunities continued to be strong for our

Advanced Industrial Facilities clients in North America and Europe

on the back of government stimulus, and Arcadis differentiates with

its agility to address fast-evolving needs of those clients. Margin

was supported by strong performance at the acquired businesses, as

well as Advanced Industrial Facilities’ performance, and offset by

the Middle East and China. Excluding the Middle East operating

margin was 10.6% for the full year (FY’22: 9.9%).

MOBILITY

| (22% of net

revenues) |

|

|

|

|

|

|

|

| in € millions |

Full Year |

|

Fourth Quarter |

|

Period ended 31 December 2023 |

2023 |

2022 |

change |

|

2023 |

2022 |

change |

|

Net revenues |

814 |

743 |

10% |

|

207 |

191 |

8% |

|

Organic growth2) |

13.3% |

12.9% |

|

|

11.5% |

16.5% |

|

|

Operating EBITA1) |

91 |

72 |

25% |

|

|

|

|

|

Operating EBITA margin (%)1) |

11.1% |

9.7% |

|

|

|

|

|

|

Order intake |

860 |

751 |

15% |

|

246 |

205 |

20% |

|

Backlog net revenues |

575 |

538 |

7% |

|

|

|

|

|

Backlog organic growth (%, yoy)2) |

9.5% |

5.4% |

|

|

|

|

|

|

Backlog organic growth (%, qtd)2) |

7.7% |

3.2% |

|

|

|

|

|

Revenue growth continued to be strong especially in the US,

Australia and Europe. Collaboration between Intelligence and

Mobility resulted in revenue and backlog growth, with multiple

large wins in the quarter. Electrification trends, alternative

fuels, and the growing transportation challenges across large

cities continued to drive the need for our sustainable, data-driven

mobility offerings. The margin improvement was driven by operating

leverage and standardization efforts, and slightly offset by the

Middle East. When excluding the Middle East, operating margin was

11.8% for the full year (FY’22: 10.4%). INTELLIGENCE

| (3% of net

revenues) |

|

|

|

|

|

| in € millions |

Full Year |

|

Fourth Quarter |

|

Period ended 31 December 2023 |

2023 |

2022 |

change |

|

2023 |

2022 |

change |

|

Net revenues |

94 |

21 |

356% |

|

27 |

21 |

29% |

|

(Proforma) Organic growth2) |

24.5% |

|

|

|

35.8% |

|

|

|

Operating EBITA1) |

11 |

2 |

480% |

|

|

|

|

|

Operating EBITA margin (%)1) |

11.6% |

9.1% |

|

|

|

|

|

|

Order intake |

104 |

31 |

239% |

|

31 |

31 |

0% |

|

Backlog net revenues |

123 |

113 |

9% |

|

|

|

|

|

Backlog organic growth (%, yoy)2) |

8.9% |

|

|

|

|

|

|

|

Backlog organic growth (%, qtd)2) |

3.5% |

|

|

|

|

|

|

Strong organic revenue growth was paralleled by order intake

from large Key Clients, mostly in North America and the UK.

Software products in traffic, travel and transit management, such

as TravelIQ, resulted in good revenues from major US cities.

Continued focus on the leveraging of existing client relationships

resulted in margin improvement, while we continued to invest in

product strategy, development and integration.

BALANCE SHEET & CASH FLOWWe achieved a record low level of

Net Working Capital as percentage of annualized quarterly gross

revenues of 9.3% (Q4’22: 10.0%4)), an outstanding outcome which was

the result of bringing the acquired businesses to the level of the

group while optimizing levels in other areas. As a result, Days

Sales Outstanding (DSO) was reduced to 56 days (Q4’22: 60 days).

Free cash flow was a record high at €208 million for the quarter

resulting in €190 million for the full year (2022: €173 million),

driven by improved performance and disciplined net working capital

management. The strong cash performance resulted in a sharp

deleveraging from 2.2x Net debt / operating EBITDA (2022) to 1.7x

for 2023, well inside the strategic target range of 1.5 – 2.5x. Net

debt decreased to €873 million (Q4’22: €1,012 million).

INTEGRATION FINALIZED WITH REVENUE AND COST SYNERGIES

MATERIALIZINGThe integration of Arcadis IBI and Arcadis DPS was

finalized with cost- and revenue synergies materializing. Cost

synergy realisation is well on track with €5 million cost synergies

already been delivered out of the €20 million identified, and the

remaining to be delivered by the end 2024 through rationalisation

in workplace, IT integration and technology platform improvements,

as well as the rationalisation of overheads, insurance and support

driving operational synergies.

2024-2026 STRATEGY "ACCELERATING A PLANET POSITIVE FUTURE"On

16th November 2023 Arcadis presented its 2024-2026 Strategy

“Accelerating a planet positive future” and its 2026 financial

targets, these include: organic net revenue growth of mid to high

single digits over the cycle, operating EBITA margin of 12.5% in

2026, Net Debt / Operating EBITDA of 1.5 – 2.5x with an

Investment Grade credit rating and a dividend payout ratio of 30 –

40% of Net Income from Operations. ARCADIS KEY FINANCIAL

METRICS*

| in €

millions |

Full Year |

|

Fourth Quarter |

|

Period ended 31 December 2023 |

2023 |

2022 |

change |

|

2023 |

2022 |

change |

|

Gross revenues |

5,003 |

4,029 |

24% |

|

1,289 |

1,178 |

9% |

|

Net revenues |

3,759 |

3,019 |

25% |

|

941 |

861 |

9% |

|

Organic growth (%)2) |

9.0% |

8.9% |

|

|

6.5% |

11.2% |

|

|

Operating EBITDA1) |

506 |

400 |

26% |

|

137 |

116 |

17% |

|

Operating EBITDA margin (%)1) |

13.4% |

13.3% |

|

|

14.5% |

13.5% |

|

|

EBITA |

343 |

233 |

48% |

|

83 |

75 |

11% |

|

EBITA margin (%) |

9.1% |

7.7% |

|

|

8.9% |

8.7% |

|

|

Operating EBITA1) |

391 |

294 |

33% |

|

107 |

86 |

25% |

|

Operating EBITA margin (%)1) |

10.4% |

9.8% |

|

|

11.4% |

10.0% |

|

|

Effective income tax rate |

29% |

31% |

|

|

|

|

|

|

Net Income |

160 |

132 |

22% |

|

|

|

|

|

Net Income from Operations (NifO) |

226 |

202 |

12% |

|

|

|

|

|

NifO per share (in €)3) |

2.51 |

2.26 |

11% |

|

|

|

|

|

Dividend (proposal) per share (in €) |

0.85 |

0.74 |

15% |

|

|

|

|

|

Avg. number of shares (millions) |

89.8 |

89.4 |

1% |

|

|

|

|

|

Net Working Capital (%)4) |

9.3% |

10.0% |

|

|

|

|

|

|

Days Sales Outstanding (days)4) |

56 |

60 |

|

|

|

|

|

|

Free Cash Flow5) |

190 |

173 |

10% |

|

208 |

146 |

42% |

|

Net Debt |

873 |

1,012 |

-14% |

|

|

|

|

|

Net Debt / Operating EBITDA1) |

1.7x |

2.2x |

|

|

|

|

|

|

Order intake |

3,899 |

3,089 |

26% |

|

1,028 |

871 |

18% |

|

Backlog net revenues |

3,155 |

3,119 |

1% |

|

|

|

|

| Backlog organic

growth (%, yoy)2) |

4.0% |

4.2% |

|

|

|

|

|

|

Backlog organic growth (%, qtd)2) |

2.3% |

1.4% |

|

|

|

|

|

|

Voluntary employee turnover6) |

11.7% |

14.2% |

|

|

|

|

|

* The 2023 results as presented in this press release are

unaudited. Most of these metrics are alternative performance

measures; refer to reconciliation to the most directly comparable

IFRS measures provided in “Alternative Performance Measures”

section of “Arcadis 2023 Financial Report” on page 87, available at

Arcadis website:

https://media.arcadis.com/-/media/project/arcadiscom/com/investors/2024/arcadis-2023-financial-report/arcadis-2023-financial-report.pdfAcquisitions

of IBI Group closed on 27th Sept-22, DPS Group on 1st Dec-22.1)

Excluding restructuring, integration, acquisition and divestment

costs2) Underlying growth excl. impact of FX, acquisitions,

footprint reductions (e.g. the Middle East), winddowns or

divestments3) Net income before non-recurring items (e.g. valuation

changes of acquisition-related provisions, acquisition and

divestment costs, expected credit loss on shareholder loans and

corporate guarantees and one-off pension costs)4) Revised to

reflect the adjustments to the provisional opening balances of

acquired entities recognized 31 Dec. 2022 (in accordance with IFRS

3.49)5) Free Cash flow: Cash Flow from Operations corrected for

Capex and Lease liabilities6) Voluntary turnover excludes the

Middle East as these operations are being wound

down FINANCIAL CALENDAR

- 7 March 2024 – Annual Integrated Report 2023 publication

- 30 April 2024 – First quarter 2024 Trading Update

- 8 May 2024 – Annual General Meeting of Shareholders

- 25 July 2024 – Second quarter and half year 2024 Results

- 31 October 2024 – Third quarter 2024 Trading Update

ARCADIS INVESTOR RELATIONSChristine Disch | +31 (0)615376020 |

christine.disch@arcadis.com

ANALYST WEBCASTToday at 15.00 hours CET:

https://www.arcadis.com/en/investors/investor-calendar/2024/fourth-quarter-and-full-year-2023-results

ABOUT ARCADISArcadis is the world’s leading company delivering

data-driven sustainable design, engineering, and consultancy

solutions for natural and built assets. We are more than 36,000

architects, data analysts, designers, engineers, project planners,

water management and sustainability experts, all driven by our

passion for improving quality of life. As part of our

commitment to accelerating a planet positive future, we work with

our clients to make sustainable project choices, combining digital

and human innovation, and embracing future-focused skills across

the environment, energy and water, buildings, transport, and

infrastructure sectors. We operate in over 30 countries, and in

2023 reported €5.0 billion in gross revenues.

www.arcadis.com

REGULATED INFORMATIONThis press release contains information

that qualifies or may qualify as inside information within the

meaning of Article 7(1) of the EU Market Abuse Regulation.

DISCLAIMERStatements included in this press release that are not

historical facts (including any statements concerning investment

objectives, other plans and objectives of management for future

operations or economic performance, or assumptions or forecasts

related thereto) are forward-looking statements. These statements

are only predictions and are not guarantees. Actual events or the

results of our operations could differ materially from those

expressed or implied in the forward-looking statements.

Forward-looking statements are typically identified by the use of

terms such as “may”, “will”, “should”, “expect”, “could”, “intend”,

“plan”, “anticipate”, “estimate”, “believe”, “continue”, “predict”,

“potential” or the negative of such terms and other comparable

terminology. The forward-looking statements are based upon our

current expectations, plans, estimates, assumptions and beliefs

that involve numerous risks and uncertainties. Assumptions relating

to the foregoing involve judgments with respect to, among other

things, future economic, competitive and market conditions and

future business decisions, all of which are difficult or impossible

to predict accurately and many of which are beyond our control.

Although we believe that the expectations reflected in such

forward-looking statements are based on reasonable assumptions, our

actual results and performance could differ materially from those

set forth in the forward-looking statements.

- Arcadis Q4 and FY 2023 Results Press Release

- Arcadis Q4 and Full Year 2023 Results Presentation

- Arcadis 2023 Financial Report

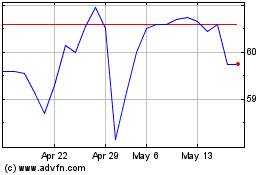

Arcadis NV (EU:ARCAD)

Historical Stock Chart

From Jan 2025 to Feb 2025

Arcadis NV (EU:ARCAD)

Historical Stock Chart

From Feb 2024 to Feb 2025