Capgemini delivers another record performance in 2023

Media relations:Victoire

GruxTel.: +33 6 04 52 16 55victoire.grux@capgemini.com

Investor relations:Vincent

BiraudTel.: +33 1 47 54 50 87vincent.biraud@capgemini.com

Capgemini delivers another record

performance in 2023

-

Revenues of €22,522 million in 2023, up +2.4%

-

Growth at constant exchange rates* of

+4.4% for the full year, and -0.2% in Q4

-

Operating margin* up 30 basis points to

13.3% of revenues

-

+7% increase in net profit, Group share, with normalized

earnings per share* up +8%

-

Organic free cash flow0F*

of €1,963 million

-

Proposed dividend of €3.40 per share

Paris, February 14, 2024 – The

Board of Directors of Capgemini SE, chaired by Paul Hermelin,

convened on February 13 in Paris to review and adopt the

accounts1F1 of the Capgemini Group for the year-ended

December 31, 2023.

Aiman Ezzat, Chief Executive Officer of the

Capgemini Group, said: “2023 was another year of growth for the

Group with improving profitability and a strong cash flow

conversion, despite a slowdown in our industry. Our results

illustrate the strength of our positioning, our agility and our

resilience.

Our clients recognize the value we bring as

their business and technology transformation partner. In 2023, the

Group continued to invest in building the capabilities and

solutions to help them transition to an increasingly digital and

sustainable economy.

This was notably the case for generative AI,

which is top of mind for all large organizations. We are positioned

as a leading player enabling our clients to explore, test and scale

solutions for tangible business impact. Through our €2 billion

investment plan announced last July, we continue to strengthen and

upskill our teams, invest in solutions and leverage a broad

ecosystem of technology partners including Microsoft, Google, AWS,

Salesforce and Mistral AI.

In terms of sustainability offerings, we also

stepped up our efforts in 2023. We continue to help our clients

accelerate their transition towards Net Zero through strategy

definition, business model adaptation and design of sustainable

products and services. 2023 was also an important year on our own

ESG roadmap, with major progress achieved towards a more

sustainable and inclusive world.

The Group is well-equipped to improve its

performance in 2024, while the environment is expected to remain

soft in the first half. This year again, the Group expects to grow,

with the trough in Q1, improve its operating margin and maintain a

superior free cash flow conversion.”

KEY FIGURES

|

(in millions of euros) |

2022 |

2023 |

Change |

|

Revenues |

21,995 |

22,522 |

+2.4% |

|

Operating margin* |

2,867 |

2,991 |

+4% |

|

as a % of revenues |

13.0% |

13.3% |

+30 basis points |

|

Operating profit |

2,393 |

2,346 |

-2% |

|

as a % of revenues |

10.9% |

10.4% |

|

|

Net profit (Group share) |

1,547 |

1,663 |

+7% |

|

Basic earnings per share (€) |

9.09 |

9.70 |

+7% |

|

Normalized earnings per share (€)* |

11.52 a |

12.44 |

+8% |

|

Organic free cash flow* |

1,852 |

1,963 |

+€ 111m |

|

Net cash / (Net debt)* |

(2,566) |

(2,047) |

|

|

a excluding tax expenses of €73 million in 2022 related to the

impact of the US tax reform |

Capgemini delivered a solid performance in 2023

despite the weak economic environment, with results exceeding or in

line with its financial targets for the year.

After two years of record growth, persisting

macroeconomic challenges and rising geopolitical tensions led to a

gradual market slowdown in 2023 that came in line with Group

expectations. Capgemini reported revenues of

€22,522 million in 2023, up +2.4% vs. 2022 published figures.

Constant currency growth* was +4.4%, within the 2023 target range

of +4% to +7%. With acquisitions contributing +0.5 points to

growth, organic growth* (i.e., excluding the impact of currency

fluctuations and changes in Group scope) reached +3.9%.

Bookings totaled

€23,887 million in 2023, a year-on-year increase of +2.6% at

constant exchange rates, representing a book-to-bill ratio of 1.06

for the year, and 1.18 in Q4. This reflects sustained commercial

momentum despite lengthened decision cycles.

While large corporations and organizations hold

firm on their digital and sustainability ambitions, they are

increasingly prioritizing operational agility and cost efficiency.

This translates into strong demand for transformation programs with

short payback, which leverage the Group’s high value-added service

offerings most notably in Intelligent Industry, as well as in

activities driven by Cloud, Data & Artificial Intelligence.

This ongoing shift in Capgemini’s offerings

portfolio towards more value creating services, combined with

strengthened operational efficiency, generated a 40 basis points

increase in gross margin, despite the rising inflation and market

slowdown.

As a result, the operating

margin* increased to 13.3% of revenues, or

€2,991 million, up +4% in value compared to 2022. This

year-on-year improvement of 30 basis points exceeds the target of

0-20 basis points set for 2023.

Other operating income and

expense was a net expense of €645 million, compared

with €474 million in 2022. This increase is mainly attributable to

higher restructuring charges, which increased by €97 million, and

to a change in French accounting practices as set by the French

National Accounting Council (ANC), which resulted in an additional

€63 million non-cash expense related to the annual employee share

ownership plan.

Capgemini’s operating profit

was €2,346 million, or 10.4% of revenues, compared with €2,393

million in 2022.

The net financial expense was

€42 million compared with €129 million in 2022, this evolution

being mainly driven by higher interest income in a context of

rising interest rates.

The income tax expense was €626

million compared with €710 million last year. The effective tax

rate was slightly down at 27.2%, compared with 28.1% in 2022

(excluding €73 million tax expenses related to the impact of the US

tax reform).

Taking into account the share of profits of

associates and non-controlling interests, the Group share

in net profit rose by +7% year-on-year to €1,663 million.

Basic earnings per share increased also by +7% to

€9.70. Normalized earnings per share* was €12.44,

compared with €11.09 in 2022 and €11.52 excluding the tax expenses

related to the impact of the US tax reform.

Organic free cash flow*

amounted to €1,963 million, above the target of “around €1.8

billion” set for the year. Capgemini invested €343 million in

acquisitions during the past year. The Group also paid dividends of

€559 million (€3.25 per share) and allocated

€883 million (net) to share buyback programs. Finally, the

10th employee share ownership plan, which proved highly successful

and thus contributed to maintaining employee shareholding between 8

to 9% of the share capital, led to a gross capital increase of €467

million.

The Board of Directors has decided to recommend

the payment of a dividend of €3.40 per share at the Shareholders’

Meeting of May 16, 2024. The corresponding payout ratio is 35% of

net profit (Group share), in line with the Group’s historical

distribution policy.

OPERATIONS BY REGION

At constant exchange rates, the United

Kingdom and Ireland region (12% of Group revenues)

maintained a robust momentum in 2023 with revenues growing +7.9%.

This performance was primarily driven by the Public Sector as well

as the Consumer Goods & Retail and Manufacturing sectors, while

activities in the Financial Services and TMT sectors were roughly

stable year-on-year. The operating margin reached a record level of

18.6% compared with 18.0% in 2022.

The Rest of Europe region (30%

of Group revenues) also performed well with revenue growth of +7.6%

fueled to a large extent by the Public Sector and the Manufacturing

sector. The Energy & Utilities sector was also buoyant while

growth in Financial Services was limited. The operating margin was

11.7%, up from 11.6% a year earlier.

France (20% of Group revenues)

revenues grew +6.1%, mainly supported by strong growth in the

Manufacturing and Consumer Goods & Retail sectors. TMT was the

only sector to contract in 2023. The operating margin further

improved by 50 basis points year-on-year to 12.6%.

Conversely, revenues in North

America (29% of Group revenues) decreased slightly by

-1.3%. The Manufacturing and Services sectors showed good growth.

Revenue decline was particularly visible in the TMT and Consumer

Goods & Retail sectors, but more limited in the Financial

Services sector. The operating margin was 15.6% as in 2022.

Finally, revenues in the Asia-Pacific

and Latin America region (9% of Group revenues) grew

+4.6%. Growth was mostly driven by the Asia-Pacific region where

Consumer Goods & Retail, Services, Manufacturing and the Public

Sector enjoyed double-digit growth rates, whereas Financial

Services remained virtually stable, and TMT contracted visibly. The

operating margin improved substantially to 12.2% compared with

10.6% the year before.

OPERATIONS BY BUSINESS

At constant exchange rates, Strategy

& Transformation consulting services (9% of Group

revenues) reported a +8.6% growth in total revenues* in 2023. This

sustained momentum illustrates the strength of the Group's

strategic positioning as a partner for its clients' digital and

sustainable ambitions.

Applications & Technology

services (62% of Group revenues and Capgemini’s core business)

reported a +4.5% increase in total revenues.

Finally, Operations &

Engineering services total revenues (29% of Group

revenues) grew +2.8%.

OPERATIONS IN Q4 2023

As expected, the progressive deceleration in

Capgemini revenue growth observed since the beginning of the year

continued in Q4. Group revenues totaled €5,616 million,

virtually stable at -0.2% at constant exchange rates, and -0.9%

when adjusted for Group scope and exchange rate impacts.

At constant exchange rates, revenues in the

United Kingdom and Ireland region grew +2.7% at constant exchange

rates, underpinned by fairly broad-based growth but weighed down by

sizeable contraction in the Financial Services and TMT sectors.

Revenue growth in the Rest of Europe region, which also stood at

+2.7%, was driven by solid momentum in the Energy & Utilities

and Public sectors. In France, the Manufacturing and Energy &

Utilities sectors fueled revenue growth of +2.5%. With revenues

down by -6.6% year-on-year, the deceleration in North America

compared to Q3 growth rates (-4.0% year-on-year) was in line with

Group average, with the largest revenue declines in the Consumer

Goods & Retail and TMT sectors. Finally, revenues in the

Asia-Pacific and Latin America region grew by +1.1% despite the

visible decline in the Financial Services and TMT sectors, thanks

to solid growth in most of the other sectors.

Bookings rose +1.7% in Q4 at constant exchange

rates to reach €6,643 million, corresponding to a book-to-bill

ratio of 1.18.

HEADCOUNT

At December 31, 2023, the Group’s total

headcount stood at 340,400, down by 5% year-on-year.

The onshore workforce decreased slightly at

145,800 employees, down by 2% year-on-year, while the offshore

workforce was down by 7% to 194,600 employees, i.e., 57% of the

total headcount.

BALANCE SHEET

Capgemini continued to strengthen its financial

structure in 2023 on the back of its strong cash flow

generation.

At December 31, 2023, the Group had cash, cash

equivalents and cash management assets of €3.7 billion. After

accounting for borrowings of €5.7 billion and derivative

instruments, Group net debt* is €2.0 billion, down compared with

€2.6 billion at December 31, 2022.

CORPORATE SUSTAINABILITY

In line with the commitments of its ESG

(Environment, Social and Governance) Policy presented in December

2021, Capgemini continued to deliver visible progress on the front

of corporate sustainability in 2023.

Firstly, the Group further strengthened its

position as a leader committed to fostering diversity and inclusion

in various dimensions. On gender diversity specifically, the

proportion of women in the total workforce reached 38.8% at the end

of 2023, up by 1 point year-on-year and almost 6 points since 2019.

The proportion of women among executive leadership positions

reached 26.2%, up by 1.8 points year-on-year and more than 9 points

since 2019.

In human capital development, the Group provided

17.8 million learning hours to employees during the past year,

compared with 17.4 million in 2022. The average number of learning

hours per employee stands at 53.8 hours, up +5% year-on-year in

line with the Group’s commitment.

The scale of impact through digital inclusion

initiatives expanded significantly in 2023. Among the largest

projects in terms of new beneficiaries, the Pi Lab program provides

an easily accessible technology platform to equip Indian teachers

and students with digital skills. Overall, Capgemini’s various

programs and partnerships with leading non-profit organizations

benefited almost 2.5 million individuals in 2023, bringing the

cumulative number of beneficiaries to 4.4 million since

2018.

Regarding environmental sustainability, as a

reminder, Capgemini set in 2022 ambitious near-term (2030) and

long-term (2040) carbon footprint targets. These targets imply

notably a 90% reduction in all emissions (Scope 1, 2 and 3) by 2040

to reach its “net zero emissions” targets as validated by the SBTi

(Science-Based Targets initiative). At the end of 2023, the Group’s

absolute carbon emissions (Scope 1, 2 and 3) have fallen by 30%

against the 2019 baseline. As regards its carbon neutrality target

for own operations by 2025, Capgemini’s operational carbon

emissions2F2 have decreased by 47% since 2019, and by 75% net of

high-quality carbon credits. Among other tangible progress achieved

in 2023, the share of renewable energies in the Group’s electricity

consumption reached 96% compared with 88% in 2022.

In recognition of its continued ESG performance,

the Group’s inclusion in the Dow Jones Sustainability Index (DJSI)

Europe was confirmed at the end of the year. Capgemini also

maintained its position on the “A list” in the 2023 CDP (Carbon

Disclosure Project) assessment, as released in early February

2024.

OUTLOOK

The Group’s financial targets for 2024 are:

- Revenue growth of 0% to +3% at

constant currency;

- Operating margin of 13.3% to

13.6%;

- Organic free cash flow of around

€1.9 billion.

The inorganic contribution to growth should be

marginal at the lower end of the target range, and up to 1 point at

the upper end.

CONFERENCE CALL

Aiman Ezzat, Chief Executive Officer,

accompanied by Nive Bhagat, Chief Financial Officer, and Olivier

Sevillia, Chief Operating Officer, will comment on this publication

during a conference call in English to be held today at

8.00 a.m. Paris time (CET). You can follow this conference

call live via webcast at the following link. A replay will also be

available for a period of one year.

All documents relating to this publication will

be posted on the Capgemini investor website at

https://investors.capgemini.com/en/.

PROVISIONAL CALENDAR

April 30,

2024 Q1 2024

revenuesMay 16,

2024 Shareholders’

meetingJuly 26,

2024 H1 2024

results

The dividend payment schedule to be submitted to

the Shareholders’ Meeting for approval would be:

May 29,

2024 Ex-dividend

date on Euronext ParisMay 31,

2024 Payment of the

dividend

DISCLAIMER

This press release may contain forward-looking

statements. Such statements may include projections, estimates,

assumptions, statements regarding plans, objectives, intentions

and/or expectations with respect to future financial results,

events, operations and services and product development, as well as

statements, regarding future performance or events. Forward-looking

statements are generally identified by the words “expects”,

“anticipates”, “believes”, “intends”, “estimates”, “plans”,

“projects”, “may”, “would”, “should” or the negatives of these

terms and similar expressions. Although Capgemini’s management

currently believes that the expectations reflected in such

forward-looking statements are reasonable, investors are cautioned

that forward-looking statements are subject to various risks and

uncertainties (including, without limitation, risks identified in

Capgemini’s Universal Registration Document available on

Capgemini’s website), because they relate to future events and

depend on future circumstances that may or may not occur and may be

different from those anticipated, many of which are difficult to

predict and generally beyond the control of Capgemini. Actual

results and developments may differ materially from those expressed

in, implied by or projected by forward-looking statements.

Forward-looking statements are not intended to and do not give any

assurances or comfort as to future events or results. Other than as

required by applicable law, Capgemini does not undertake any

obligation to update or revise any forward-looking statement.

This press release does not contain or

constitute an offer of securities for sale or an invitation or

inducement to invest in securities in France, the United States or

any other jurisdiction.

ABOUT CAPGEMINI

Capgemini is a global business and technology

transformation partner, helping organizations to accelerate their

dual transition to a digital and sustainable world, while creating

tangible impact for enterprises and society. It is a responsible

and diverse group of 340,000 team members in more than 50

countries. With its strong over 55-year heritage, Capgemini is

trusted by its clients to unlock the value of technology to address

the entire breadth of their business needs. It delivers end-to-end

services and solutions leveraging strengths from strategy and

design to engineering, all fueled by its market leading

capabilities in AI, cloud and data, combined with its deep industry

expertise and partner ecosystem. The Group reported 2023 global

revenues of €22.5 billion.

Get the Future You Want | www.capgemini.com

* *

*

APPENDIX3F3

BUSINESS CLASSIFICATION

- Strategy &

Transformation includes all strategy, innovation and

transformation consulting services.

- Applications &

Technology brings together “Application Services” and

related activities and notably local technology services.

- Operations &

Engineering encompasses all other Group businesses. These

comprise Business Services (including Business Process Outsourcing

and transaction services), all Infrastructure and Cloud services,

and R&D and Engineering services.

DEFINITIONS

Organic growth or like-for-like

growth in revenues is the growth rate calculated at

constant Group scope and exchange rates. The Group scope

and exchange rates used are those for the reported period. Exchange

rates for the reported period are also used to calculate

growth at constant exchange rates.

|

Reconciliation of growth rates |

Q1 2023 |

Q22023 |

Q32023 |

Q42023 |

FY2023 |

|

Organic growth |

+10.1% |

+4.7% |

+2.0% |

-0.9% |

+3.9% |

|

Changes in Group scope |

+0.6 pts |

+0.5 pts |

+0.3 pts |

+0.7 pts |

+0.5 pts |

|

Growth at constant exchange rates |

+10.7% |

+5.2% |

+2.3% |

-0.2% |

+4.4% |

|

Exchange rate fluctuations |

+0.2 pts |

-2.0 pts |

-3.6 pts |

-2.2 pts |

-2.0 pts |

|

Reported growth |

+10.9% |

+3.2% |

-1.3% |

-2.4% |

+2.4% |

When determining activity trends by business and

in accordance with internal operating performance measures, growth

at constant exchange rates is calculated based on total

revenues, i.e., before elimination of inter-business

billing. The Group considers this to be more representative of

activity levels by business. As its businesses change, an

increasing number of contracts require a range of business

expertise for delivery, leading to a rise in inter-business

flows.

Operating margin is one of the

Group’s key performance indicators. It is defined as the difference

between revenues and operating costs. It is calculated before

“Other operating income and expense” which include amortization of

intangible assets recognized in business combinations, expenses

relative to share-based compensation (including social security

contributions and employer contributions) and employee share

ownership plan, and non-recurring revenues and expenses, notably

impairment of goodwill, negative goodwill, capital gains or losses

on disposals of consolidated companies or businesses, restructuring

costs incurred under a detailed formal plan approved by the Group’s

management, the cost of acquiring and integrating companies

acquired by the Group, including earn-outs comprising conditions of

presence, and the effects of curtailments, settlements and

transfers of defined benefit pension plans.

Normalized net profit is equal to profit for the

year (Group share) adjusted for the impact of items recognized in

“Other operating income and expense”, net of tax calculated using

the effective tax rate. Normalized earnings per

share is computed like basic earnings per share, i.e.,

excluding dilution.

Organic free cash flow is equal

to cash flow from operations less acquisitions of property, plant,

equipment and intangible assets (net of disposals) and repayments

of lease liabilities, adjusted for cash out relating to the net

interest cost.

Net debt (or net

cash) comprises (i) cash and cash equivalents, as

presented in the Consolidated Statement of Cash Flows (consisting

of short-term investments and cash at bank) less bank overdrafts,

and also including (ii) cash management assets (assets presented

separately in the Consolidated Statement of Financial Position due

to their characteristics), less (iii) short- and long-term

borrowings. Account is also taken of (iv) the impact of hedging

instruments when these relate to borrowings, intercompany loans,

and own shares.

RESULTS BY REGION

| |

Revenues |

|

Year-on-year growth |

|

Operating margin rate |

|

|

2023(in millions of euros) |

|

reported |

at constant exchange rates |

|

2022 |

2023 |

|

North America |

6,462 |

|

-4.1% |

-1.3% |

|

15.6% |

15.6% |

|

United Kingdom and Ireland |

2,709 |

|

+5.8% |

+7.9% |

|

18.0% |

18.6% |

|

France |

4,537 |

|

+6.1% |

+6.1% |

|

12.1% |

12.6% |

|

Rest of Europe |

6,837 |

|

+6.2% |

+7.6% |

|

11.6% |

11.7% |

|

Asia-Pacific and Latin America |

1,977 |

|

-0.4% |

+4.6% |

|

10.6% |

12.2% |

|

TOTAL |

22,522 |

|

+2.4% |

+4.4% |

|

13.0% |

13.3% |

RESULTS BY BUSINESS

| |

Total revenues* |

|

Year-on-year growth |

|

|

2023(% of Group revenues) |

|

At constant exchange rates in Total revenues*

of the business |

|

Strategy & Transformation |

9% |

|

+8.6% |

|

Applications & Technology |

62% |

|

+4.5% |

|

Operations & Engineering |

29% |

|

+2.8% |

SUMMARY INCOME STATEMENT AND OPERATING

MARGIN

|

(in millions of euros) |

2022 |

2023 |

Change |

|

Revenues |

21,995 |

22,522 |

+2.4% |

|

Operating expenses |

(19,128) |

(19,531) |

|

|

Operating margin |

2,867 |

2,991 |

+4% |

|

as a % of revenues |

13.0% |

13.3% |

|

|

Other operating income and expense |

(474) |

(645) |

|

|

Operating profit |

2,393 |

2,346 |

-2% |

|

as a % of revenues |

10.9% |

10.4% |

|

|

Net financial expense |

(129) |

(42) |

|

|

Income tax income/(expense) |

(710) |

(626) |

|

|

Share of profit of associates |

(4) |

(10) |

|

|

(-) Non-controlling interests |

(3) |

(5) |

|

|

Profit for the period, Group share |

1,547 |

1,663 |

+7% |

NORMALIZED AND DILUTED EARNINGS PER

SHARE

|

(in millions of euros) |

2022 |

2023 |

Change |

|

Average number of shares outstanding |

170,251,066 |

171,350,138 |

|

|

BASIC EARNINGS PER SHARE (in

euros) |

9.09 |

9.70 |

+7% |

|

Diluted average number of shares outstanding |

176,019,736 |

177,396,346 |

|

|

DILUTED EARNINGS PER SHARE (in

euros) |

8.79 |

9.37 |

+7% |

|

|

|

|

|

|

(in millions of euros) |

2022 |

2023 |

Change |

|

Profit for the period, Group share |

1,547 |

1,663 |

+7% |

|

Effective tax rate |

28.1% |

27.2% |

|

|

(-) Other operating income and expense, net of tax |

340 |

469 |

|

|

Normalized profit for the period |

1,887 |

2,132 |

+13% |

|

Average number of shares outstanding |

170,251,066 |

171,350,138 |

|

|

NORMALIZED EARNINGS PER SHARE (in euros) |

11.09 |

12.44 |

+12% |

In 2022, the Group recorded a tax expense of €73

million related to the impact of the US tax reform. Taking into

account the average number of shares outstanding, this represented

an amount of €0.43 per share. Adjusted for this tax expense,

normalized earnings per share were therefore €11.52.

CHANGE IN CASH AND CASH EQUIVALENTS AND

ORGANIC FREE CASH FLOW

|

(in millions of euros) |

2022 |

2023 |

|

Net cash from operating activities |

2,517 |

2,525 |

|

Acquisitions of property, plant and equipment and intangible

assets, net of disposals |

(283) |

(254) |

|

Net interest cost |

(71) |

(11) |

|

Repayments of lease liabilities |

(311) |

(297) |

|

ORGANIC FREE CASH FLOW |

1,852 |

1,963 |

|

Other cash flows from (used in) investing and financing

activities |

(1,118) |

(2,126) |

|

Increase (decrease) in cash and cash

equivalents |

734 |

(163) |

|

Effect of exchange rate fluctuations |

(58) |

(115) |

|

Opening cash and cash equivalents |

3,119 |

3,795 |

|

Closing cash and cash equivalents |

3,795 |

3,517 |

NET DEBT

|

(in millions of euros) |

December 31, 2022 |

December 31, 2023 |

|

Cash and cash equivalents |

3,802 |

3,536 |

|

Bank overdrafts |

(7) |

(19) |

|

Cash and cash equivalents |

3,795 |

3,517 |

|

Cash management assets |

386 |

161 |

|

Long-term borrowings |

(5,655) |

(5,071) |

|

Short-term borrowings and bank overdrafts |

(1,102) |

(675) |

|

(-) Bank overdrafts |

7 |

19 |

|

Borrowings, excluding bank overdrafts |

(6,750) |

(5,727) |

|

Derivative instruments |

3 |

2 |

|

NET CASH / (NET DEBT) |

(2,566) |

(2,047) |

ESG PERFORMANCE

See appendix in the press release attached

(PDF)

Note 1: In the table above, 2023 data may

include some estimates and some historical data are restated to

ensure comparability.

Note 2: Employee commuting and business travel

emissions increase in 2023 year-on-year is due to post-pandemic

gradual return to the office and travel.

1 Audit procedures on the consolidated financial

statements have been completed. The auditors are in the process of

issuing their report.2 Corresponding to Scopes 1 and 2, and Scope 3

including emissions linked to employee commuting and business

travel but excluding those from purchased goods and services.3 Note

that in the appendix, certain totals may not equal the sum of

amounts due to rounding adjustments.

In

- Capgemini_-_2024-02-14_-_2023_Annual_Results

- Capgemini_FY_Q42023_infographics_ENG

- Capgemini_FY23_infographics_ESG

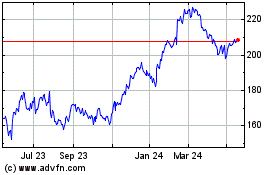

Capgemini (EU:CAP)

Historical Stock Chart

From Oct 2024 to Nov 2024

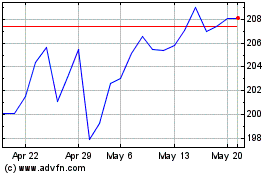

Capgemini (EU:CAP)

Historical Stock Chart

From Nov 2023 to Nov 2024