Capgemini Q3 2024 revenues

Media relations:

Victoire Grux

Tel.: +33 6 04 52 16 55

victoire.grux@capgemini.com

Investor relations:

Vincent Biraud

Tel.: +33 1 47 54 50 87

vincent.biraud@capgemini.com

Capgemini Q3 2024 revenues

-

Q3 2024 revenues of €5,377 million, down -1.6% at constant

exchange rates*

-

9M 2024

revenues of

€16,515 million,

down -2.3% at constant exchange

rates

-

FY 2024 constant currency revenue growth target revised to

-2.0% to -2.4% and operating margin target narrowed to 13.3% to

13.4%

-

FY 2024 organic free cash-flow target confirmed at around

€1.9 billion

Paris, October 30, 2024

– The Capgemini Group reported consolidated revenues

of €5,377 million in Q3 2024, down -1.9% year-on-year on a reported

basis, and down -1.6% at constant exchange rates*.

Aiman Ezzat, Chief Executive Officer of the

Capgemini Group, said: “Our growth improved marginally in Q3

compared to Q2, despite stronger headwinds than anticipated in some

sectors, primarily in Manufacturing. However, we continue to see

recovery in Financial Services and gradually lesser headwinds from

Telco and Tech.

In a market that remains soft overall, we

expect to deliver a similar growth in Q4 while demonstrating the

resilience of our operating margin and organic free cash-flow.

Client demand continues to be driven by operational efficiencies

and cost reduction and we seize their growing appetite for AI and

Gen AI services.

Our positioning as a business and technology

transformation partner, the relevance of our offerings and the

quality of our talent are driving our solid book-to-bill ratio and

growing pipeline of strategic deals. We are also launching a set of

targeted actions to simplify our operations to make the Group more

agile with a stronger emphasis on growth.

Based on Q4 perspectives, we now expect a

full-year constant currency growth rate of -2.0% to -2.4% and

narrow the operating margin target to 13.3% to 13.4%, while the

organic free cash-flow target of around €1.9 billion is

confirmed.”

| |

(in millions of euros) |

|

Change |

Revenues

|

2023

|

2024

|

|

At current

exchange rates |

At constant

exchange rates* |

|

Q3 |

5,480 |

5,377 |

|

-1.9% |

-1.6% |

|

9 months |

16,906 |

16,515 |

|

-2.3% |

-2.3% |

After bottoming out in Q1 2024, Capgemini

activity trends improved again in Q3, but only marginally. The

Group generated revenues of €5,377 million in Q3

2024, down -1.9% year-on-year on a reported basis and -1.6% at

constant exchange rates*. On an organic basis (i.e.,

restated for changes in Group scope and exchange rates), revenues

contracted by -2.1%. For the first nine months of the year, growth

stands at -2.3%, both on a reported basis and at constant exchange

rates.

Clients remained focused on driving efficiencies

through large digital transformation programs, at the expense of

discretionary deals. This is fueling strong demand for Capgemini’s

Cloud and Data & AI/Gen AI services, as well as for digital

core modernization and intelligent supply chain services that are

key focus themes in the current environment.

Bookings totaled €5,222 million

in Q3 2024, down -0.8% at constant exchange rates, leading to a

book-to-bill ratio of 0.97 for the period. Generative AI bookings

amounted to around €600 million over the last 9 months which

represent around 3.5% of Group bookings.

OPERATIONS BY REGION

In the Group’s largest regions, Q3 growth rates

remained similar to Q2. Overall, this reflects the continued

recovery in Financial Services across all regions combined with, as

anticipated, a slowdown in the Manufacturing sector.

At constant exchange rates, revenues in the

North America region (28% of Group revenues in Q3

2024) decreased by -3.9% year-on-year. Financial Services further

improved, yet still posting a year-on-year decline in Q3. Overall,

the revenue contraction was driven by the Consumer Goods &

Retail, Energy & Utilities, and Public sectors.

Revenues in the United Kingdom and

Ireland region (13% of Group revenues) returned to

positive growth at +0.4%. The continued dynamism of the Energy

& Utilities sector and a resilient Manufacturing sector

outweighed the contraction in the Consumer Goods & Retail

sector.

Revenues in France (19% of

Group revenues) decreased by -2.5%. Growth in the Public sector,

along with positive momentum in TMT (Telecoms, Media &

Technology), were more than offset by the slowdown of the

Manufacturing sector.

Revenues in the Rest of Europe

region (31% of Group revenues) increased by +0.6%. Solid growth in

Financial Services, as well as continued dynamism in Energy &

Utilities and Public sector, made up for the contraction in the

Manufacturing and TMT sectors.

Lastly, revenues in the Asia-Pacific and

Latin America region (9% of Group revenues) were down

-2.2%. In the Asia-Pacific region, strong momentum in the Public

sector and improving Financial Services were more than offset by

visible weakness in the Consumer Goods & Retail and

Manufacturing sectors. Growth acceleration in Latin America was

mostly driven by the Consumer Goods & Retail sector.

OPERATIONS BY

BUSINESS

In Q3 2024, at constant exchange rates, the

growth in Strategy & Transformation services

(9% of the Group’s total revenues* in Q3 2024) further

strengthened to +6.5% year-on-year. This reflects continued client

demand for strategic consulting on their transition towards a more

digital and sustainable model as well as their unwavering interest

in the broad AI and Gen AI opportunities.

In Applications &

Technology services (63% of the Group’s total revenues and

Capgemini’s core business), growth rates improved by 170 basis

points compared to Q2, to -1.2% year-on-year in Q3.

Lastly, Operations &

Engineering total revenues (28% of the Group’s total

revenues) decreased by -3.4% primarily driven by the contraction in

Infrastructure Services and, to a lesser extent, Engineering

services.

HEADCOUNT

The Group’s total headcount stands at 338,900 as

at September 30, 2024, down -1.1% year-on-year and up +0.6% since

the end of June. The offshore workforce stands at 194,400 employees

or 57% of the total headcount.

OUTLOOK

The Group’s financial targets for 2024 are

updated as follows:

- Revenue growth of -2.0% to -2.4% at

constant currency (was -0.5% to -1.5%);

- Operating margin of 13.3% to 13.4%

(was 13.3% to 13.6%);

- Organic free cash-flow of around

€1.9 billion (unchanged).

The inorganic contribution to growth should be

40 basis points.

CONFERENCE CALL

Aiman Ezzat, Chief Executive Officer,

accompanied by Nive Bhagat, Chief Financial Officer, and Olivier

Sevillia, Chief Operating Officer, will present this press release

during a conference call in English to be held today at

8.00 a.m. Paris time (CET). You can follow this conference

call live via webcast at the following link. A replay will also be

available for a period of one year.

All documents relating to this publication will

be posted on the Capgemini investor website at

https://investors.capgemini.com/en/.

PROVISIONAL CALENDAR

February 18,

2025 FY 2024

results

April 29, 2025 Q1

2025 revenues

May 7,

2025 Shareholders’

Meeting

July 30, 2025 H1

2025 results

DISCLAIMER

This press release may contain forward-looking

statements. Such statements may include projections, estimates,

assumptions, statements regarding plans, objectives, intentions

and/or expectations with respect to future financial results,

events, operations and services and product development, as well as

statements, regarding future performance or events. Forward-looking

statements are generally identified by the words “expects”,

“anticipates”, “believes”, “intends”, “estimates”, “plans”,

“projects”, “may”, “would”, “should” or the negatives of these

terms and similar expressions. Although Capgemini’s management

currently believes that the expectations reflected in such

forward-looking statements are reasonable, investors are cautioned

that forward-looking statements are subject to various risks and

uncertainties (including, without limitation, risks identified in

Capgemini’s Universal Registration Document available on

Capgemini’s website), because they relate to future events and

depend on future circumstances that may or may not occur and may be

different from those anticipated, many of which are difficult to

predict and generally beyond the control of Capgemini. Actual

results and developments may differ materially from those expressed

in, implied by or projected by forward-looking statements.

Forward-looking statements are not intended to and do not give any

assurances or comfort as to future events or results. Other than as

required by applicable law, Capgemini does not undertake any

obligation to update or revise any forward-looking statement.

This press release does not contain or

constitute an offer of securities for sale or an invitation or

inducement to invest in securities in France, the United States or

any other jurisdiction.

ABOUT CAPGEMINI

Capgemini is a global business and technology

transformation partner, helping organizations to accelerate their

dual transition to a digital and sustainable world, while creating

tangible impact for enterprises and society. It is a responsible

and diverse group of 340,000 team members in more than 50

countries. With its strong over 55-year heritage, Capgemini is

trusted by its clients to unlock the value of technology to address

the entire breadth of their business needs. It delivers end-to-end

services and solutions leveraging strengths from strategy and

design to engineering, all fueled by its market leading

capabilities in AI, cloud and data, combined with its deep industry

expertise and partner ecosystem. The Group reported 2023 global

revenues of €22.5 billion.

Get the Future You Want |

www.capgemini.com

* *

*

APPENDIX3F1

BUSINESS CLASSIFICATION

- Strategy &

Transformation includes all strategy, innovation and

transformation consulting services.

- Applications &

Technology brings together “Application Services” and

related activities and notably local technology services.

- Operations &

Engineering encompasses all other Group businesses. These

comprise Business Services (including Business Process Outsourcing

and transaction services), all Infrastructure and Cloud services,

and R&D and Engineering services.

DEFINITIONS

Organic growth or like-for-like

growth in revenues is the growth rate calculated at

constant Group scope and exchange rates. The Group scope

and exchange rates used are those for the reported period. Exchange

rates for the reported period are also used to calculate

growth at constant exchange rates.

|

Reconciliation of growth rates |

Q1 2024 |

Q2 2024 |

Q3 2024 |

9M 2024 |

|

Organic growth |

-3.6% |

-2.3% |

-2.1% |

-2.7% |

|

Changes in Group scope |

+0.3 pts |

+0.4 pts |

+0.5 pts |

+0.4 pts |

|

Growth at constant exchange rates |

-3.3% |

-1.9% |

-1.6% |

-2.3% |

|

Exchange rate fluctuations |

-0.2 pts |

+0.4 pts |

-0.3 pts |

-0.0 pts |

|

Reported growth |

-3.5% |

-1.5% |

-1.9% |

-2.3% |

When determining activity trends by business and

in accordance with internal operating performance measures, growth

at constant exchange rates is calculated based on total

revenues, i.e., before elimination of inter-business

billing. The Group considers this to be more representative of

activity levels by business. As its businesses change, an

increasing number of contracts require a range of business

expertise for delivery, leading to a rise in inter-business

flows.

Operating margin is one of the

Group’s key performance indicators. It is defined as the difference

between revenues and operating costs. It is calculated before

“Other operating income and expense” which include amortization of

intangible assets recognized in business combinations, expenses

relative to share-based compensation (including social security

contributions and employer contributions) and employee share

ownership plan, and non-recurring revenues and expenses, notably

impairment of goodwill, negative goodwill, capital gains or losses

on disposals of consolidated companies or businesses, restructuring

costs incurred under a detailed formal plan approved by the Group’s

management, the cost of acquiring and integrating companies

acquired by the Group, including earn-outs comprising conditions of

presence, and the effects of curtailments, settlements and

transfers of defined benefit pension plans.

Normalized net profit is equal to profit for the

year (Group share) adjusted for the impact of items recognized in

“Other operating income and expense”, net of tax calculated using

the effective tax rate. Normalized earnings per

share is computed like basic earnings per share, i.e.,

excluding dilution.

Organic free cash flow is equal

to cash flow from operations less acquisitions of property, plant,

equipment and intangible assets (net of disposals) and repayments

of lease liabilities, adjusted for cash out relating to the net

interest cost.

Net debt (or net

cash) comprises (i) cash and cash equivalents, as

presented in the Consolidated Statement of Cash Flows (consisting

of short-term investments and cash at bank) less bank overdrafts,

and also including (ii) cash management assets (assets presented

separately in the Consolidated Statement of Financial Position due

to their characteristics), less (iii) short- and long-term

borrowings. Account is also taken of (iv) the impact of hedging

instruments when these relate to borrowings, intercompany loans,

and own shares.

REVENUES BY REGION

| |

Revenues

(in millions of euros) |

|

Year-on-year growth |

| |

Q3 2023 |

Q3 2024 |

|

Reported |

At constant exchange rates |

|

North America |

1,608 |

1,530 |

|

-4.9% |

-3.9% |

|

United Kingdom and Ireland |

676 |

690 |

|

+2.1% |

+0.4% |

|

France |

1,045 |

1,019 |

|

-2.5% |

-2.5% |

|

Rest of Europe |

1,633 |

1,646 |

|

+0.8% |

+0.6% |

|

Asia-Pacific and Latin America |

518 |

492 |

|

-5.0% |

-2.2% |

|

TOTAL |

5,480 |

5,377 |

|

-1.9% |

-1.6% |

| |

Revenues

(in millions of euros) |

|

Year-on-year growth |

| |

9 months

2023 |

9 months

2024 |

|

Reported |

At constant exchange rates |

|

North America |

4,896 |

4,638 |

|

-5.3% |

-4.9% |

|

United Kingdom and Ireland |

2,062 |

2,070 |

|

+0.4% |

-1.8% |

|

France |

3,353 |

3,264 |

|

-2.6% |

-2.6% |

|

Rest of Europe |

5,105 |

5,116 |

|

+0.2% |

+0.1% |

|

Asia-Pacific and Latin America |

1,490 |

1,427 |

|

-4.2% |

-1.9% |

|

TOTAL |

16,906 |

16,515 |

|

-2.3% |

-2.3% |

REVENUES BY BUSINESS

| |

Total revenues*

(% of Group revenues) |

Year-on-year growth at constant exchange rates in total

revenues of the business

|

| |

Q3 2024 |

|

Strategy & Transformation |

9% |

+6.5% |

|

Applications & Technology |

63% |

-1.2% |

|

Operations & Engineering |

28% |

-3.4% |

|

Total revenues*

(% of Group revenues) |

Year-on-year growth at constant exchange rates in total

revenues of the business

|

| |

9 months

2024 |

|

Strategy & Transformation |

9% |

+3.9% |

|

Applications & Technology |

62% |

-2.7% |

|

Operations & Engineering |

29% |

-2.3% |

1 Note that in the appendix, certain

totals may not equal the sum of amounts due to rounding

adjustments.

- Capgemini_-_2024-10-30_-_Q3_2024_Revenues

- Capgemini_Q3_9M_2024_infographics_ENG

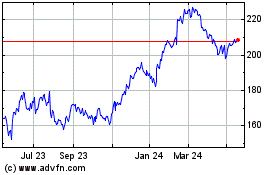

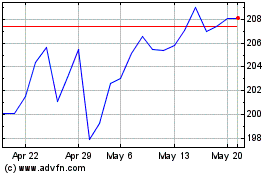

Capgemini (EU:CAP)

Historical Stock Chart

From Jan 2025 to Feb 2025

Capgemini (EU:CAP)

Historical Stock Chart

From Feb 2024 to Feb 2025