Description of Elior Group’s Share Buyback Program

January 29 2025 - 11:54AM

Business Wire

(authorized at the January 28, 2025 Annual

General Meeting)

Regulatory News:

Elior Group (Paris:ELIOR):

I - LEGAL FRAMEWORK OF THE SHARE

BUYBACK PROGRAM

The share buyback program is governed by the applicable laws and

regulations. It was authorized by the shareholders at the Annual

General Meeting of Elior Group (the “Company”) held on

January 28, 2025 (the “AGM”) in the terms mentioned in the

Notice of Meeting as published on December 20, 2024 in the France’s

Official Legal Journal (“BALO”) and displays the features described

below.

The program has been put in place pursuant to a decision taken

by the Company’s Board of Directors on January 28, 2025.

II – PURPOSES OF THE SHARE BUYBACK

PROGRAM

In accordance with the 11th resolution adopted at the AGM, the

share buyback program may be used for the following purposes:

- To cancel all or some of the purchased shares, in connection

with a capital reduction carried out in accordance with the

authorization granted, or to be granted, by the shareholders;

- To hold shares in treasury to be subsequently used in exchange

or as payment in connection with any mergers, demergers, asset

contributions or external growth transactions, provided that the

number of shares purchased for such operations does not exceed 5%

of the Company’s capital;

- To allocate shares on exercise of rights attached to securities

redeemable, convertible, exchangeable or otherwise exercisable for

shares of the Company;

- To hedge the risks arising on the Company’s financial

instrument obligations, particularly the risk of fluctuations in

the Elior Group share price;

- To allocate shares for the implementation of (i) stock option

plans, (ii) free share plans, (iii) employee share ownership plans,

in operations complying with Articles L. 3331-1 et seq. of the

French Labor Code, and/or (iv) grants of shares to employees and/or

officers of the Company or of any related entities;

- To maintain a liquid market for the Company’s shares under a

liquidity contract entered into with an investment services

provider that complies with the practices authorized by the

applicable regulations;

- more generally, to carry out any transactions or market

practices currently authorized or that may be authorized in the

future by the applicable laws and regulations or by the Autorité

des Marchés Financiers.

III - TERMS AND CONDITIONS OF THE SHARE

BUYBACK PROGRAM

Maximum proportion of the Company’s capital: the shares

purchased under the buyback program may not represent more than 10%

of the Company’s capital, determined based on the number of shares

making up the Company’s capital at the date on which the

authorization is used. Future corporate actions that may be carried

out by the Company shall not result in owning, directly or

indirectly through its affiliates, more than 10% of the Company’s

capital.

When shares are bought back for the purpose of maintaining a

liquid market in the Company’s shares, the number of shares taken

into account in order to calculate the cap of 10% of the Company’s

capital corresponds to the number of shares purchased less the

number of shares sold during the authorization period.

In the event of a public offer for its securities, the Company

would suspend the implementation of the buyback program during the

offer period, except for the purpose of complying with an

obligation to deliver securities or carry out a strategic

transaction that the Company committed to and announced before the

launch of the public offer.

Type of shares that may be bought back: ordinary shares

of the Company with a par value of €0.01 each.

Maximum per-share purchase price: €10 (excluding

transaction costs).

Maximum amount that may be invested in the program:

€253,611,809.

Duration of the buyback program: 18 months (from January

28, 2025 to July 27, 2026).

About the Elior Group

Founded in 1991, Elior Group is a world leader in contract

catering and multiservices, and a benchmark player in the business

& industry, local authority, education and health & welfare

markets. With strong positions in eleven countries, the Group

generated €6.053 million in pro forma revenue in fiscal 2023-2024.

Our 133,000 employees cater for 3.2 million people every day at

20,200 restaurants and points of sale on three continents. The

Group’s business model is built on both innovation and social

responsibility. Elior Group has been a member of the United Nations

Global Compact since 2004, reaching advanced level in 2015.

To find out more, visit www.eliorgroup.com /Follow Elior Group

on Twitter: @Elior_Group

View source

version on businesswire.com: https://www.businesswire.com/news/home/20250129225775/en/

Elior Group

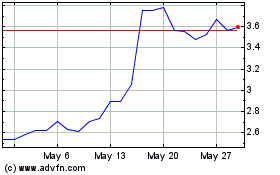

Elior (EU:ELIOR)

Historical Stock Chart

From Jan 2025 to Feb 2025

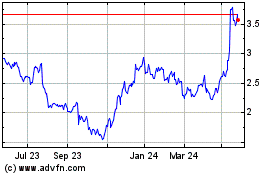

Elior (EU:ELIOR)

Historical Stock Chart

From Feb 2024 to Feb 2025