GUERBET : H1 2024 results.

H1 2024 results

Very dynamic business

activity

- H1

revenue: €419.2m, up 11.8% at

CER1

- A

trajectory driven by all activities and geographical areas

Solid increase in

profitability

- The

restated EBITDA margin2 was 15.4%, compared to 12.7% a

year earlier

-

Operating income almost tripled to €30.3m

Upward revision of annual

guidance

- Revenue:

expected growth of over 9% like-for-like and at CER (>8%

previously)

-

Profitability: restated EBITDA margin rate higher than in 2021

(14.4%)

Villepinte, 25 September 2024, 5.45

p.m.: Guerbet (FR0000032526 GBT), a

global specialist in contrast agents and solutions for medical

imaging, is publishing its consolidated financial statements for

the first half of the current financial year.

On 30 June 2024, the Group’s sales totalled

€419.2m, up 10.7% compared with the same period in 2023. Excluding

the currency effect (-€4.1m), growth in business activity at

constant exchange rates (CER1) came to 11.8%, a change

that included an acceleration in the second quarter (+14.5% at

CER), following an already very positive momentum in the first

quarter (+8.8%).

The EMEA region saw a temporary

freeze on the French market following the reform, on 1 March 2024,

of the supply circuit for contrast products. Business activity

nevertheless increased by 2.4% at CER over the period, with the

decline in Q1 (-6.2% at CER) being fully recovered in Q2

(+11.0%).

In the Americas, revenue at

mid-year was €127.3m, up 29.1% at CER. This performance was driven

by the continuation of the remarkable catch-up initiated in Q4 2023

in the US, as well as by significant market share gains in Latin

America – particularly in Brazil.

In Asia, growth remained strong

in Q1 (+11.5% at CER), despite a slowdown in Q2 largely linked to

the situation in South Korea, affected by a major strike by

doctors.

By business activity, Diagnostic

Imaging revenue increased by 10.7% at CER in H1 2024,

thanks to:

- Very

positive momentum in X-rays (+13.9% at CER),

driven by sales of both Xenetix® and

Optiray®.

- A solid

performance by the IRM division due to an

acceleration in Q2 (+13.5%), notably in the wake of the growth of

Elucirem TM in the US and the first sales in

Germany.

As of 30 June 2024, Interventional

Imaging revenue rose 20.8% at CER, a remarkable change

assisted by a favourable base effect and driven by very positive

momentum for Lipiodol®, in terms of volumes and

prices.

In € millions

Consolidated financial statements (IFRS) |

H1 2023

Published |

H1 2024

Published |

|

Revenue |

378.6 |

419.2 |

|

EBITDA* |

45.9 |

61.0 |

|

% of revenue |

12.1% |

14.6% |

|

Operating income (expense) |

10.3 |

30.3 |

|

% of revenue |

2.7% |

7.2% |

|

Net income/(loss) |

1.3 |

10.0 |

|

% of revenue |

0.4% |

2.4% |

|

Net debt |

342.3 |

364.9 |

** EBITDA = Operating income + net

allowances for depreciation, amortisation and provisions

Solid improvement in operating

profitability and strong increase in net income, to

€10m

During the first half of the year, the Group

posted a strong rise in its EBITDA (+32.9%) to €61.0m, reflecting a

margin rate of 14.6% of revenue. Restated for exceptional costs

related to the optimisation of the operating plan and changes in

the sales model, the EBITDA margin reached 15.4% over the period,

versus 12.7% in the first half of 2023. This improvement was

fuelled by favourable trends in selling prices and the product mix,

as well as continued good financial discipline. Operating income

stood at €30.3m as of 30 June 2024, almost trebling from its level

a year earlier (€10.3m).

Net income came to €10.0m, versus €1.3m in H1

2023. In line with the Group's expectations, it includes a

significant increase in financial expenses, to €11.2m (€3.8m a year

earlier). Lastly, the tax expense more than doubled to €4.7m.

Improved free cash flow compared to last

year

On the balance sheet, equity totalled €389m at

30 June 2024, compared to €378m at the end of 2023. Net debt stood

at €365m, reflecting a net debt/EBITDA ratio of 3.2x, an

improvement from its level a year earlier (3.5x).

In line with traditionally unfavourable

seasonality in the first half of the year, free cash flow (FCF) was

negative, amounting to -€29.1m. This level is significantly better

than in the first half of 2023 (-€72.0m) despite the increase in

working capital requirements linked to strong business activity and

the sustained level of investments to secure future growth.

Maintaining focus on the three strategic

pillars

Having pursued an offensive policy in terms of

business development and innovation in the first half of the year,

Guerbet intends to reach new milestones in the second half of 2024

on each of its three strategic pillars:

- In

Diagnostic Imaging, the ramp-up of the IRM franchise,

based on the Dotarem® / EluciremTM product

pair, is set to continue with its expansion in the US, and now in

Europe; following Germany and the UK, EluciremTM will be

launched in France by the end of the year.

- In

Interventional Imaging, new prospects are opening up for

Lipiodol® in indications other than liver cancer

treatment, including promising commercial development in vascular

embolisation (+38% in H1 2024 vs. H1 2023).

- In

Artificial Intelligence, the sales roadmap will benefit

from the April launch of the DUOncoTM brand, which

accompanied the launch of the first Guerbet product, its algorithm

dedicated to prostate cancer, integrated into the new Intrasense

Myrian® 2.12 platform.

Upward revision of 2024 financial

targets

These ambitious developments within the product

portfolio, in a context of structurally strong demand for contrast

products, enable the Group to look to the future with

confidence.

In the second half of the financial year, the

growth trajectory is expected to remain strong in all business

segments: X-rays (Optiray® in particular), IRM franchise

(expansion of EluciremTM) and Interventional Imaging

(strong momentum for Lipiodol®). Guerbet also remains

confident about the growth of its operating profitability,

supported by continued price increases and good cost control.

Given these circumstances, the Group is

forecasting sales growth of over 9% in 2024 like-for-like and at

CER (versus >8% previously) and expects its adjusted EBITDA

margin rate to exceed that of 2021 (14.4%). Free cash flow is still

expected to be in positive territory for the full year.

Next event:

Publication of 2024 3rd quarter

revenues

24 October 2024 after market close

About Guerbet

At Guerbet, we build lasting relationships so that we enable people

to live better. That is our purpose. We are a leader in medical

imaging worldwide, offering a comprehensive range of pharmaceutical

products, medical devices, and digital and AI solutions for

diagnostic and interventional imaging. A pioneer in contrast media

for 97 years, with more than 2,920 employees worldwide, we

continuously innovate and devote 10% of our sales to research and

development in four centres in France, the United States and

Israel. Guerbet (GBT) is listed on Euronext Paris (segment B – mid

caps) and generated €786 million in revenue in 2023.

Forward-looking statements

Certain information contained in this press release does not

reflect historical data but constitutes forward-looking statements.

These forward-looking statements are based on estimates, forecasts,

and assumptions, including but not limited to assumptions about the

current and future strategy of the Group and the economic

environment in which the Group operates. They involve known and

unknown risks, uncertainties, and other factors that may result in

a significant difference between the Group’s actual performance and

results and those presented explicitly or implicitly by these

forward-looking statements.

These forward-looking statements are valid only as of the date of

this press release, and the Group expressly disclaims any

obligation or commitment to publish an update or revision of the

forward-looking statements contained in this press release to

reflect changes in their underlying assumptions, events,

conditions, or circumstances. The forward-looking statements

contained in this press release are for illustrative purposes only.

Forward-looking statements and information are not guarantees of

future performance and are subject to risks and uncertainties that

are difficult to predict and are generally beyond the Group’s

control.

These risks and uncertainties include but are

not limited to the uncertainties inherent in research and

development, future clinical data and analyses (including after a

marketing authorization is granted), decisions by regulatory

authorities (such as the US Food and Drug Administration or the

European Medicines Agency) regarding whether and when to approve

any application for a drug, process, or biological product filed

for any such product candidates, and their decisions regarding

labeling and other factors that may affect the availability or

commercial potential of such product candidates. A detailed

description of the risks and uncertainties related to the Group’s

activities can be found in Chapter 4.9 “Risk factors” of the

Group’s Universal Registration Document filed with the AMF (French

financial markets authority) under number D.24-0224 on April

3, 2024, available on the Group’s website (www.guerbet.com).

1 Constant exchange rates: the exchange rate impact was

eliminated by recalculating sales for the period on the basis of

the exchange rates used for the previous financial year.

2 Excluding non-recurring costs related to the optimisation of

the operating plan and changes in the sales model.

Contacts:

Guerbet

Jérôme Estampes, Chief Financial Officer +33 1 45 91 50 00 /

jerome.estampes@guerbet.com

Christine Allard, Head of Communications +33 6 30 11 57 82 /

christine.allard@guerbet.com

Seitosei Actifin

Marianne Py, Financial Communications +33 1 80 48 25 31 /

marianne.py@seitosei-actifin.com

Jennifer Jullia, Press +33.1.56.88.11.19 /

jennifer.jullia@seitosei-actifin.com

- 24 09-25 CP GBT RS VDef 02 EN

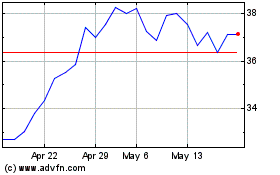

Guerbet (EU:GBT)

Historical Stock Chart

From Oct 2024 to Nov 2024

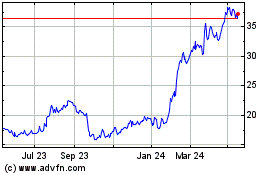

Guerbet (EU:GBT)

Historical Stock Chart

From Nov 2023 to Nov 2024