Sustainable outperformance

- Strong Recurring Net Income up +8.4% per share

- Portfolio valuation stabilized (+0.2% LfL) leading to NTA at

€142.1 per share

- Strong rental uplift captured in both on offices (+14%) and

residences (+15%)

- Sound balance sheet with low LTV at 35% and decreasing

financial expenses

- 2 new emblematic and accretive large development projects to be

launched in Neuilly and Paris City

- Guidance confirmed: RNI per share expected between €6.35 and

€6.40 (i.e. +5.5% to +6.5%)

Regulatory News:

Gecina (Paris:GFC):

Strong Recurring Net

Income growth per share (+8.4% in

H1-2024), for the 3rd consecutive

year

- Centrality: +6.3% LfL rental

growth

- Rental uplift along tenants’ rotation on residential

segment (+15%) and offices (+28% in Paris, +14% in average)

- Indexation still supportive (+5.4%) and roughly stable

occupancy

- Pipeline: accretive contribution

(+€7m)

- Fully pre-let office assets delivered in 2023-2024

(Boétie-Paris CBD and Porte Sud-Montrouge) and one residential

project in Ville d’Avray

- Best in class balance sheet:

decreasing financial expenses (-€8m)

- Stable cost of drawn debt at 1.1%, with optimum hedging

(c.100% until end-2026, and 84% in average until end-2029)

- Net debt lowered by -€0.8bn following disposals since early

2023

Portfolio value stabilized

driven by central locations

- Portfolio valuation up +0.4% LfL (Offices) over 6

months

- Revaluation +2% in Paris City …

- … offsetting still decreasing values outside (-2% La Défense,

-5% secondary locations)

- NTA stable at €142.1 per share (-1% in 6

months)

Preparing future growth

- In an uncertain context, best in class

balance sheet provides agility and capacity to fund development

projects

- Stable LTV at 35.0% (incl. duties) vs. 34.4%

end-2023

- ICR up to 6.7x (vs. 5.9x end-2023)

- €4.1bn extra liquidities covering bonds redemptions

until end-2028

- New emblematic large projects to be

launched, with strong accretive potential in central

locations

- 2 new redevelopment projects in Paris City and Neuilly:

55,000 sq.m to be delivered by 2027. Nearly €280m capex

required for more than €30m potential new rents

- Total « committed » or « to be committed » pipeline requiring

€850m capex from 2024 to 2027, for c.€100m to €120m

potential new rents

- Deploying promising new business approach

on « ready to use » operated offices and residential assets

- Yourplace, a « plug and play » office solution, to be

progressively deployed (5,000 sq.m today), floor by floor in c. 40

assets in Paris, providing extra rental return of more than

+20%

- Fully-amenitized apartments also to be progressively deployed

on residential segment in the coming years, 150 units on going that

way, 600 expected by early 2025

- Energy consumption reduction: -3.4%

further decline in H1, after already strong achievement in 2023,

illustrating Gecina’s CSR leadership

2024 Guidance confirmed

Recurring Net Income expected between €6.35

and €6.40 per share (i.e. +5.5% to +6.5%)

Beñat Ortega, Chief Executive Officer: “The first-half

performance is particularly strong and reflects Gecina’s unique

position, which benefits from both the quality and the very

favorable location of its portfolio, generating organic growth, and

an accretive pipeline, ramping up this growth, as well as a

particularly robust balance sheet, protecting our cost of debt. As

a result, recurrent net income shows a rarely achieved level of

growth with +8.4%. But looking beyond this very solid

performance for the first half of the year, Gecina has an

opportunistic strategic position, with a financial structure able

to not only withstand the uncertainties faced, but also finance

projects to create value and drive growth. While the valuation

of our portfolio stabilized over the first half of this year, we

are increasing our visibility and the rental markets in central

areas are positive, our balance sheet enables us to launch the

development of two major operations, in Paris (Gamma) and Neuilly

(Carreau de Neuilly), which will help drive the Group’s

outperformance over time. Alongside this, we are ramping up the

rollout of new “serviced” offers for both offices and residential,

which will also support the Group’s ability to deliver sustainable

outperformance”.

In €m

Jun-23

Jun-24

Current basis

Like-for-like

Offices

266.6

279.3

+4.8%

+6.5%

Residential

66.3

63.8

-3.8%

+5.4%

Gross rental income

332.9

343.1

+3.1%

+6.3%

Recurrent net income (Group share)

216.5

235.1

+8.6%

Per share (€)

2.9

3.2

+8.4%

Dec-23

Jun-24

LTV (including duties)

34.4%

35.0%

EPRA Net Reinstatement Value (NRV) per

share

158.1

156.5

-1.0%

EPRA Net Tangible Assets (NTA) per

share

143.6

142.1

-1.0%

EPRA Net Disposal Value (NDV) per

share

150.1

149.5

-0.4%

About Gecina

As a specialist for centrality and uses, Gecina operates

innovative and sustainable living spaces. A real estate investment

company, Gecina owns, manages and develops a unique portfolio at

the heart of the Paris Region’s central areas, with more than 1.2

million sq.m of offices and more than 9,000 housing units, almost

three-quarters of which are located in Paris City or

Neuilly-sur-Seine. These portfolios are valued at 17.1 billion

euros at end-June 2024.

Gecina has firmly established its focus on innovation and its

human approach at the heart of its strategy to create value and

deliver on its purpose: “Empowering shared human experiences at

the heart of our sustainable spaces”. For our 100,000 clients,

this ambition is supported by our client-centric brand YouFirst. It

is also positioned at the heart of UtilesEnsemble, our program

setting out our solidarity-based commitments to the environment, to

people and to the quality of life in cities.

Gecina is a French real estate investment trust (SIIC) listed on

Euronext Paris, and is part of the SBF 120, CAC Next 20, CAC Large

60 and CAC 40 ESG indices. Gecina is also recognized as one of the

top-performing companies in its industry by leading sustainability

benchmarks and rankings (GRESB, Sustainalytics, MSCI, ISS-ESG and

CDP).

www.gecina.fr

Recurrent net income: robust growth confirmed over the

past three years

In million euros

Jun 30, 2023

Jun 30, 2024

Change (%)

Gross rental income

332.9

343.1

+3.1%

Net rental income

301.3

313.1

+3.9%

Operating margin for other business

1.0

0.8

-25.7%

Services and other income (net)

1.9

0.5

-71.7%

Overheads

(39.7)

(39.4)

-0.8%

EBITDA - recurrent

264.6

275.1

+4.0%

Net financial expenses

(47.5)

(39.4)

-17.1%

Recurrent gross income

217.0

235.7

+8.6%

Recurrent net income from associates

1.1

1.3

+17.3%

Recurrent minority interests

(0.9)

(1.0)

+5.9%

Recurrent tax

(0.8)

(1.0)

+29.9%

Recurrent net income (Group share)

(1)

216.5

235.1

+8.6%

Recurrent net income (Group share) per

share

2.93

3.18

+8.4%

(1) EBITDA after deducting net financial expenses, recurrent

tax, minority interests, including income from associates and

restated for certain non-recurring items, excl. IFRIC 21

Recurrent net income (Group share) is up +8.4% per share

to €3.2, thanks to the combination of robust rental trends and the

optimization of rental expenses, overheads and financial

expenses.

Like-for-like rental

performance: +€19m Growth driven by particularly

favorable rental trends on Gecina’s core markets, reflected in the

rental uplift captured and the positive impacts of indexation.

Operations relating to the

pipeline (deliveries and redevelopments): +€7m in rental

income Recurrent net income (Group share) benefited from the

positive impact of the assets delivered following

redevelopments or long-term renovations. In total, +€7m

of additional rental income was generated by the recent

deliveries of office and residential buildings. These include

the Boétie-Paris CBD and Ville d’Avray buildings, as well as

various buildings relet following long-term renovations (3 Opéra,

Horizons) and, to a lesser extent, the Montrouge-Porte Sud

building, delivered during the second quarter of this year.

Asset disposals: -€16m net

change in rental income The high volume of disposals completed in

2023 (€1.3bn of disposals, with a loss of rental income of around

2.5%) was concentrated primarily at the end of the first half of

the year, with a negative impact on half-year gross rental income,

while also making it possible to achieve a significant reduction in

financial expenses.

Rental margin up +80bp

Group

Offices

Residential

Rental margin at June 30, 2023

90.5%

93.2%

79.6%

Rental margin at June 30, 2024

91.3%

93.6%

81.0%

The rental margin is up +80bp over 12 months. This increase is

linked primarily to the higher average occupancy rate and costs

being charged back to tenants more effectively.

EBITDA margin up +70bp: overheads under control In a still

inflationary context over the past 12 months, the Group paid

particularly close attention to changes in its overheads. This

focus delivered benefits across all of the Company’s cost areas,

including a reduction in overheads. As a result, the EBITDA margin

shows a significant increase, up +70bp year-on-year.

Net margin up +3.5pts: favorable trend for financial expenses

Financial expenses are down -€8m, reflecting the reduction in the

volume of net debt following the disposals completed at the end of

the first half of 2023, as well as the strategy built by Gecina

over the past few years to hedge the Group’s debt. With an average

cost of drawn debt that remained at 1.1% (1.5% including undrawn

credit lines) and net debt reduced by an average of -€800m between

the start of 2023 and the first half of 2024, Gecina is benefiting

from an accretive contribution from its financial expenses to

recurrent net income growth.

Gross rental income growth, particularly on a

like-for-like basis

Gross rental income

Jun 30, 2023

Jun 30, 2024

Change (%)

In million euros

Current basis

Like-for-like

(%)

(%)

Offices

266.6

279.3

+4.8%

+6.5%

Residential

66.3

63.8

-3.8%

+5.4%

Total gross rental income

332.9

343.1

+3.1%

+6.3%

Like-for-like, rental income growth exceeded the already

high level reported at end-2023, with growth of +6.3% overall (vs.

+6.1% at end-2023) and +6.5% for offices.

The like-for-like performance primarily reflects the impact of

indexation and the rental uplift captured in central sectors:

- Impacts of indexation, for +5.4% -

Rental uplift, contributing +1.2% - Contribution by the

change in the occupancy rate and other marginal effects

stable overall for the first half of 2024 (-0.3%)

On a current basis, rental income is up +3.1%, benefiting

from not only the robust like-for-like rental performance (+€19m),

but also the pipeline’s significant net rental contribution

(+€7m), offsetting the impacts of the volume of disposals,

primarily completed at the end of the first half of 2023

(-€16m).

Offices: positive rental

trends in central areas

Gross rental income- Offices

Jun 30, 2023

Jun 30, 2024

Change (%)

In million euros

Current basis

Like-for-like

Offices

266.6

279.3

+4.8%

+6.5%

Central areas (Paris, Neuilly,

Southern Loop)

194.2

203.6

+4.8%

+7.1%

Paris City

154.7

159.1

+2.9%

+6.0%

Core Western Crescent

39.5

44.5

+12.7%

+11.7%

La Défense

35.2

37.9

+7.7%

+7.7%

Other locations

37.2

37.8

+1.5%

+2.7%

For the first half of this year, the rental market shows an

outperformance by the Paris Region’s most central sectors. The

volume of rental transactions on the Paris Region market for the

first half of 2024 is slightly lower year-on-year (-5%), masking

significant contrasts in trends between the areas.

In Paris for instance, take-up shows an increase of nearly +12%,

with supply close to an all-time low (vacancy rate of 2.7% in

Paris-CBD), while the volume of rental transactions is down -18%

for the rest of the Paris Region.

In this context of a scarcity of supply in central sectors, the

volume of transactions signed by Gecina since the start of the year

(nearly 30,000 sq.m) reflects the spaces available for letting

across its portfolio, helping capture significant rental uplift in

central areas.

Like-for-like office rental income growth came to +6.5%

year-on-year, benefiting from the positive indexation effect

which is continuing to ramp up (+6%), passing on - with a delayed

impact - the return of an inflationary context, as well as the

impact of the positive reversion captured (+1.1%).

Since the start of the year, nearly 30,000 sq.m have been let,

relet or renegotiated. The vast majority of the transactions

carried out during the first half of the year concerned relettings

or renewals of leases.

- Overall, the average reversion captured came to

+14%.

- This performance was driven by central sectors in particular,

with reversion reaching nearly + 28% in Paris City.

- In the most central sectors (86% of

Gecina’s office portfolio) in Paris City, Neuilly-Levallois and

Boulogne-Issy, like-for-like rental income growth came to +7.1%.

The impact of rental reversion on these sectors is particularly

marked, contributing +2% to like-for-like growth.

- On La Défense market (7% of the

Group’s office portfolio), Gecina’s rental income is up +7.7%

like-for-like, linked mainly to the effects of indexation and

occupancy, while no impact was recorded for rental reversion.

- In secondary sectors (Péri-Défense,

Inner and Outer Rims, and Other regions), like-for-like rental

income growth (+2.7%) was supported by high indexation (+5.1%), but

significantly limited by the effects in terms of occupancy (-2.3%)

and the contraction in market rents (-1%).

Rental income growth on a current basis came to +4.8% for

offices. The robust like-for-like performance and the pipeline’s

positive contribution more than offset the full impact of the

disposals carried out in 2023.

Gecina is continuing to gradually roll out its Yourplace office solutions

Since mid-2023, Gecina has been gradually rolling out its

Yourplace range of serviced offices, with a “ready to use” approach

(furnished and featuring a wide range of services), in the Paris

City’s most central areas. This offer is a response to growing

demand for small and mid-size units (under 1,000 sq.m) in Paris’

Central Business District that are flexible and ready to be

used.

Nearly 5,000 sq.m have already been let based on this

format, enabling Gecina to capture a significantly higher

operating margin than with traditional ways of operating. This

model will be developed floor by floor, at around 40 of the Group’s

buildings – meeting the criteria needed to ensure the relevance of

this letting approach - over the coming years, along tenant’s

rotation on this part of the portfolio. From 2025, nearly 15,000

sq.m could be let in line with this model.

Residential: operational trends confirmed

Gross rental income

Jun 30, 2023

Jun 30, 2024

Change (%)

In million euros

Current basis

Like-for-like

(%)

(%)

Residential

66.3

63.8

-3.8%

+5.4%

YouFirst Residence

55.6

51.5

-7.4%

+4.0%

YouFirst Campus

10.7

12.4

+15.1%

+11.0%

The residential division’s rental income is up + 5.4%

like-for-like. This performance reflects the impact of

indexation, occupancy and the rental reversion

captured with the rotation of tenants.

YouFirst Residence: strong

operational trends Like-for-like, rental income from

residential properties is up +4.0%. This growth benefited

from a significant favorable effect resulting from the

reversion captured (+15% on average) through our tenant

rotation, which has been ramping up steadily for the past two

years.

YouFirst Campus: very strong

rental trends Rental income from the student housing

portfolio is up +11% like-for-like and +15% on a current basis,

linked primarily to the high level of positive reversion captured

thanks to the rapid rotation of tenants with this type of product,

as well as the very significant improvement in lettings processes,

particularly with the possibility offered for young workers to

become tenants, improving the occupancy rates in our residences.

Illustrating this, the number of leases signed during the first

half of 2024 was 40% higher than over the same period in 2023.

Gecina is gradually rolling out a “serviced” YouFirst

residential offering

Building on Gecina’s experience operating student residences,

the Group has been developing an offer since mid-2023 to respond to

the growing demand for furnished “turnkey” residential properties,

with dimensions adapted for new uses and an extensive range of

shared services (coworking spaces, fitness center, reception areas,

etc.).

The performance recorded on the student scope in the past few

years is therefore encouraging the Group to roll out this new

“managed” offer across its YouFirst Residence portfolio. To date,

nearly 150 apartments have already been let or are in the

process of being let under this model. By 2025, this number

could reach nearly 600 apartments.

Financial occupancy rate improving

Average financial occupancy rate -

Offices

Dec 31, 2022

Jun 30, 2023

Dec 31, 2023

Jun 30, 2024

Offices

92.8%

93.8%

93.7%

93.8%

Paris City

94.5%

93.5%

93.0%

93.5%

Core Western Crescent

89.9%

93.9%

94.3%

95.2%

La Défense

91.2%

97.9%

98.3%

99.5%

Other locations (Péri-Défense, Inner /

Outer Rims and Other regions)

90.5%

91.5%

91.9%

88.5%

Residential

94.5%

94.4%

94.7%

95.2%

- YouFirst Residence

96.7%

96.3%

96.4%

96.6%

- YouFirst Campus

86.0%

86.8%

87.7%

90.6%

Group total

93.1%

93.9%

93.9%

94.1%

The Group’s average financial occupancy rate is up +20bp over

12 months to 94.1%.

For the office scope, the average occupancy rate is

stable at 93.8%. This rate reflects the impact of the buildings

vacated during the year in Paris City, which have already been

relet, but were classed as financial vacancies during the time when

minor renovation work was carried out. If we include these

buildings that have now been let as occupied, the normative

occupancy rate reaches 95.2%.

The financial occupancy rate is up year-on-year for both central

areas (Paris, Neuilly, Boulogne) and La Défense. These sectors

represent 93% of the Group’s office portfolio. It is only down for

the secondary sectors and other French regions, which represent

less than 7% of the commercial portfolio.

For residential, the average financial occupancy rate

shows a year-on-year increase of +80bp, linked primarily to the

student portfolio benefiting from the new lettings platforms and

the ramping up of the residences delivered recently.

CSR: Further reduction in energy consumption following an

already particularly virtuous year in 2023

Energy performance plan

already particularly effective In

2022, Gecina launched an energy performance plan aiming to rapidly

reduce energy consumption, while supporting its tenants to use

their offices more efficiently.

This efficiency plan already showed very significant progress in

2023. Average energy consumption across the commercial

portfolio on which Gecina directly manages the technical equipment

consuming energy was reduced by nearly -10%, contributing to

the reduction in carbon emissions.

2023 already saw particularly strong progress with reducing

energy consumption, and Gecina continued building on this trend

through a reduction in its average consumption per square meter by

-3.4% over six months for the buildings in which technical

equipment and facilities are managed directly by Gecina. This rate

of progress is especially significant as it is already higher than

the average annual reduction rate seen before the efficiency plan

was rolled out, i.e. between 2008 and 2021 (annual average of

-2.2%).

This performance was achieved thanks in particular to the task

forces1 set up, promoting ongoing dialogue with the Group’s tenants

to support them with rolling out efficiency measures, such as

reducing the periods and temperatures for heating and air

conditioning.

Since 2008, based on the trend for the first half of this year,

Gecina expects to reduce average energy consumption (per sq.m and

per year) by -38% and carbon emissions by -74% across its entire

portfolio by the end of 2024.

Portfolio value up in central sectors

Breakdown by segment

Appraised values

Net capitalization

rates

Like-for-like change

In million euros

Jun 30, 2024

Jun 30, 2024

Dec 31, 2023

Jun 2024 vs. Dec 2023

Offices (incl. retail units)

13,551

5.2%

5.1%

+0.4%

Central areas

11,672

4.5%

4.4%

+1.1%

- Paris City

9,695

4.2%

4.1%

+1.8%

- Core Western Crescent

1,977

6.3%

6.0%

-2.3%

La Défense

947

8.3%

8.0%

-2.0%

Other locations

932

10.0%

9.6%

-5.0%

Residential (block)

3,540

3.6%

3.4%

-0.3%

Hotels & finance leases

39

Group total

17,130

4.9%

4.8%

+0.2%

The portfolio value (block) came to €17.1bn, with

a like-for-like value revaluation of +0.2% over six

months and nearly -7% over 12 months. This change includes

contrasting trends depending on the areas, reflecting a

polarization of the markets, benefiting the most central sectors,

where values are now rising (+1.1%), while values for the

residential portfolio are stable.

Overall, this stabilization of values factors in:

- A “yield effect” that is still negative, with an adjustment in

yields having a negative impact across all sectors (around

-1.6% over six months).

- This is combined with a positive “rent effect” of around

+1.8%.

These trends reflect the observations made on the investment

market, with volumes - still very restricted - concentrated in the

most central areas.

Offices: contrasting trends

between areas – slight growth for central sectors On a

like-for-like basis, the portfolio value increased slightly over

the first half of the year (+0.4%), but is still down -8%

year-on-year.

- In central sectors: increase

in values by around +1.1% like-for-like over six months, with close

to +2% for Paris City. This increase in value reflects a yield

effect that is still marginally negative for these areas, but

offset by a rent effect showing a positive trend on these markets

where supply is scarce. - In La Défense: moderate

contraction in values (-2% over six months), reflecting the

combination of a still negative yield effect (-2.7%) and a

marginally positive rent effect (+0.8%) - In peripheral areas:

more marked decrease in values (-5% over six months), combining

negative yield and rent effects.

Residential: resilient

values The residential portfolio value is relatively stable for the

first half of the year (-0.3% over six months, -2.7% over 12

months).

NAV: Net Tangible Assets (NTA) stabilized at €142 per

share

- The EPRA Net Disposal Value (NDV) came to €149.5

per share (-0.4%), with €156.9 based on unit values for the

residential portfolio. - The EPRA Net Tangible Assets (NTA)

came to €142.1 per share (-1%), with €149.5 based on

unit values for the residential portfolio. - The EPRA Net

Reinstatement Value (NRV) came to €156.5 per share

(-1%), with €164.5 based on unit values for the residential

portfolio.

The stabilization of NAV primarily reflects the stabilization of

asset values on a like-for-like basis, with the following

breakdown:

- Dividend paid in the first half of 2024: - €2.65 - Recurrent

income: + €3.2 - Value adjustment linked to the yield effect: -

€3.8 - Value adjustment linked to the “rent” effect: + €2.9 - Other

(including IFRS 16, IAS 17): - €1.1

Balance sheet and financial structure: agile structure

making it possible to capitalize on opportunities in an uncertain

context

Ratios

Covenant

June 30, 2024

Loan to value (block, excl. duties)

< 60%

37.1%

EBITDA / net financial expenses

> 2.0x

6.7x

Outstanding secured debt / net asset value

of portfolio (block, excl. duties)

< 25%

0.0%

Net asset value of portfolio (block, excl.

duties) in billion euros

> 6.0

17.1

In the current context, Gecina has a particularly beneficial and

flexible financial structure in place, which supports its strategic

flexibility, enabling opportunistic headroom, as well as long-term

visibility over the maintenance of its current balance sheet

structure.

In an environment that shows encouraging signs (decrease in

inflation and rates during the first half of the year), as well as

various factors for national and international economic and

political uncertainty, Gecina’s balance sheet structure sets out

the Group’s agility to adapt to an uncertain context. The Group is

therefore positioned to benefit from the sustainably precautionary

structure of its balance sheet, while adopting potentially more

proactive choices to move forward, illustrated by the launch of new

development operations in Paris and Neuilly-sur-Seine.

Favorable access to financing and all indicators maintained at

excellent levels or improving Since the start of 2024, thanks to

its recently confirmed strong financial ratings (S&P A-,

Moody’s A3), Gecina has proactively anticipated the refinancing of

its undrawn credit lines, signing €1.0bn of new bank credit lines

with an average maturity of nearly seven years.

Proactive management helping maintain the core indicators at

excellent levels

- Debt maturity came to 7.1 years - LTV

(including duties) of 35.0% (vs. 34.4% end-2023) is still in

line with the best levels on Continental Europe - The ICR is

now 6.7x (vs. 5.9x end-2023) - The debt is c.100% covered

by fixed-rate hedging through to the end of 2026, and 84% on

average through to the end of 2029 - €4.1bn of available

liquidity (including undrawn credit lines) covering all the

bond maturities through to the end of 2028

The average cost of drawn debt was 1.1%, stable compared

with end-2023, reflecting the relevance of the rate hedging

strategy rolled out by Gecina in previous years.

Capital allocation: €280m of additional

investments committed to (new pipeline)

For reference, the Group sold €1.3bn of real estate assets in

2023, with an average loss of rental income of 2.5%:

- 10 office buildings, for over €1bn, with a

loss of rental income of around +2.4% and a premium versus the

latest appraisal values of around +10%

- seven office buildings in Paris City (129 Malesherbes, 142

Haussmann, 43 Friedland, 209 Université, Pyramides, 189 Vaugirard

and 101 Champs Elysées), representing 21,400 sq.m

- three office buildings located in secondary sectors,

representing around 15,000 sq.m

- three residential buildings and a number of

unit sales for a total of €258m, with a +3% premium versus the

appraisals and a loss of rental income of 3.1%

Use of proceeds from

disposals: opportunistic

acceleration of the development pipeline

€850m (with €159m paid out during the first half of the

year) are being or will be redeployed between early 2024 and

2027 through value-creating redevelopment operations, with

around €100m to €120m of additional potential rental

income

€600m of investments recently paid out or to be paid out for the

committed pipeline

- €313m for operations already launched at

end-2023 and to be delivered in 2024 or 2025, with €159m

already paid out during the first half of 20242. - Additional

total of nearly €300m by 2027, on two new redevelopment

projects in Paris and Neuilly (Carreau de Neuilly and Gamma),

representing 55,000 sq.m of offices. These projects will create

strong levels of value in terms of both capital and rental

performance.

€250m of additional investments in potential redevelopment

operations to be launched over the coming half-year periods In

terms of potential redevelopment projects that are now controlled,

Gecina could invest a further €250m over the coming years. These

projects, located in Paris City, are expected to generate a yield

on cost of around 6%.

Volume of debt reduced Since the start of 2023, the Group has

reduced its net debt by over€0.8bn, enabling its LTV to remain at

around 35%. For reference, the proceeds from these disposals were

used to replace short-term financing facilities (commercial

paper) with an average cost of around 3.5%, resulting in an

accretive impact on recurrent net income per share. These

disposals also had a positive impact on Gecina’s debt

aggregates (LTV, ICR, net debt/EBITDA), as well as the level

of available liquidity.

Project pipeline: €100m to €120m additional annualized

potential rental income by 2027

Main changes expected or recorded in 2024

Seven projects delivered or to be

delivered in 2024 (74,000 sq.m), representing c.€40m of annualized

potential rental income

- During the first half of 2024, the Porte Sud building

(Montrouge) was delivered. It offers 12,600 sq.m and is fully let

to the Edenred Group.

- Six other projects representing nearly 62,000 sq.m will

be delivered during the second half of 2024.

- Two office buildings in Paris’ Central Business

District, with Mondo (30,100 sq.m), fully let to the

Publicis Group, and 35-Capucines (6,400 sq.m), fully let to

various luxury industry companies and a law firm.

- Four residential buildings (two in Paris and two in the

Paris Region) representing 25,000 sq.m.

Two new development operations, which

have now been launched (over 55,000 sq.m), will be delivered from

2027, representing over €30m of additional rental income

In a favorable rental context in central areas, Gecina has launched

two new projects, representing over 55,000 sq.m at central

locations in Paris and Neuilly, with the Carreau de Neuilly

project (36,000 sq.m) in Neuilly and the Gamma project in

Paris (19,000 sq.m). These two projects will require €280m

of investment before their scheduled deliveries from 2027 and

could generate more than €30m of potential additional rental

income.

Major new operations to be launched

over the coming half-year periods By the end of this

year, Gecina expects to launch a major new operation in Paris. This

project represents around 40,000 sq.m and could also be delivered

from 2027. Several other projects could be launched over the coming

half-year periods, also in Paris. Before these projects can be

launched, the tenants in place will need to vacate these assets. At

the end of 2024, Gecina expects to see the departure of tenants

representing an annualized rental volume of around €20m.

Pipeline committed or to be committed representing €2.6bn to

date (2024-2027)

- €691m still to be paid out from H2 2024 to end 2027

- Nearly €100/120m of additional potential rental

income

- Yield on cost of nearly 6% on the office projects

- Office projects exclusively in Paris and Neuilly

- 220,000 sq.m of projects expected to be delivered by

2027

- 171,000 sq.m of projects launched (70% offices, 30%

residential)

- 51,000 sq.m to be launched over the coming half-year periods

(92% offices)

At end-June, €437m were still to be invested out of a total

investment of €2bn including land (existing building) on committed

projects, with €140m by end-2024, €163m in 2025, €101m in 2026 and

€32m in 2027.

2024 guidance confirmed: Recurrent net income per share

growth of +5.5% to +6.5% expected (i.e. €6.35 to €6.40)

The results published for the first half of 2024 reflect the

good level of the rental markets in Gecina's preferred sectors.

This robust operational performance is further strengthened through

indexation, which remains high, and the pipeline’s positive

contribution to the Group’s rental income growth.

With the good trends for rental income growth, the improvement

in its operating margin and the visibility over financial expenses,

Gecina is on track to achieve its objectives for 2024.

Gecina confirms that recurrent net income (Group share)

growth is expected to range from +5.5% to +6.5% in 2024, with

between €6.35 and €6.40 per share.

Photo credits: Brenac & Gonzalez This document does not

constitute an offer to sell or a solicitation of an offer to buy

Gecina securities and has not been independently verified. If you

would like to obtain further information concerning Gecina, please

refer to the public documents filed with the French Financial

Markets Authority (Autorité des marchés financiers, AMF), which are

also available on our internet site. This document may contain

certain forward-looking statements. Although the Company believes

that such statements are based on reasonable assumptions on the

date on which this document was published, they are by their very

nature subject to various risks and uncertainties which may result

in differences. However, Gecina assumes no obligation and makes no

commitment to update or revise such statements.

2024 first-half earnings

1- APPENDICES

1.1 Financial statements / Net asset value (NAV) / Pipeline

CONDENSED INCOME STATEMENT AND RECURRENT INCOME At the

Board meeting on July 23, 2024, chaired by Jérôme Brunel, Gecina’s

Directors approved the financial statements at June 30, 2024. The

audit procedures have been completed on these accounts, and the

certification reports have been issued.

In million euros

Jun 30, 2023

Jun 30, 2024

Change (%)

Gross rental income

332.9

343.1

+3.1%

Net rental income

301.3

313.1

+3.9%

Operating margin for other business

1.0

0.8

-25.7%

Services and other income (net)

1.9

0.5

-71.7%

Overheads

(39.7)

(39.4)

-0.8%

EBITDA - recurrent

264.6

275.1

+4.0%

Net financial expenses

(47.5)

(39.4)

-17.1%

Recurrent gross income

217.0

235.7

+8.6%

Recurrent net income from associates

1.1

1.3

+17.3%

Recurrent minority interests

(0.9)

(1.0)

+5.9%

Recurrent tax

(0.8)

(1.0)

+29.9%

Recurrent net income (Group share)

(1)

216.5

235.1

+8.6%

Recurrent net income (Group share) per

share

2.93

3.18

+8.4%

Gains from disposals

76.5

(0.1)

na

Change in fair value of properties

(862.9)

(133.1)

-84.6%

Depreciation and amortization

(5.7)

(5.4)

-6.0%

Change in value of financial instruments

and debt

(12.0)

7.6

na

Other

(7.5)

(2.5)

-66.6%

Consolidated net income attributable to

owners of the parent (2)

(595.1)

101.5

na

(1) EBITDA excluding IFRIC 21

after deducting net financial expenses, recurrent tax, minority

interests, including income from associates and restated for

certain non-recurring items.

(2) Excluding impact of IFRIC 21

CONSOLIDATED BALANCE SHEET

ASSETS

Dec 31, 2023

Jun 30, 2024

LIABILITIES

Dec 31, 2023

Jun 30, 2024

In million euros

In million euros

Non-current assets

17,174.9

17,169.2

Shareholders’ equity

10,599.5

10,293.4

Investment properties

15,153.5

14,833.6

Share capital

575.0

575.0

Buildings under redevelopment

1,398.4

1,722.3

Additional paid-in capital

3,307.6

3,307.6

Operating properties

81.8

81.8

Consolidated reserves

8,487.3

6,305.2

Other property, plant and equipment

9.3

9.6

Consolidated net income

(1,787.2)

89.5

Goodwill

165.8

165.8

Intangible assets

12.8

11.5

Shareholders’ equity attributable to

owners of the parent

10,582.7

10,277.3

Financial receivables on finance

leases

32.8

29.5

Non-controlling interests

16.7

16.1

Financial fixed assets

51.2

38.2

Investments in associates

86.7

79.9

Non-current liabilities

6,051.0

5,585.3

Non-current financial instruments

181.9

196.1

Non-current financial debt

5,784.7

5,310.7

Deferred tax assets

0.9

0.9

Non-current lease obligations

49.6

49.6

Non-current financial instruments

123.9

131.2

Current assets

473.9

790.5

Non-current provisions

92.7

93.9

Properties for sale

184.7

231.0

Trade receivables and related

35.4

55.8

Current liabilities

998.3

2,081.0

Other receivables

82.9

91.3

Current financial debt

599.6

1,429.1

Prepaid expenses

23.6

30.5

Security deposits

86.4

87.3

Current financial instruments

3.6

4.3

Trade payables and related

185.6

170.0

Cash and cash equivalents

143.7

377.5

Current tax and employee-related

liabilities

58.0

108.5

Other current liabilities

68.7

286.1

TOTAL ASSETS

17,648.7

17,959.8

TOTAL LIABILITIES

17,648.7

17,959.8

NET ASSET VALUE

At June 30, 2024

EPRA NRV (Net Reinstatement

Value)

EPRA NTA (Net Tangible Asset

Value)

EPRA NDV (Net Disposal Value)

IFRS equity attributable to

shareholders

10,277.3

10,277.3

10,277.3

Receivable from shareholders

195.8

195.8

195.8

Includes / Excludes

Impact of exercising stock options

-

-

-

Diluted NAV

10,473.1

10,473.1

10,473.1

Includes

Revaluation of investment property

166.1

166.1

166.1

Revaluation of investment property under

construction

-

-

-

Revaluation of other non-current

investments

-

-

-

Revaluation of tenant leases held as

finance leases

0.4

0.4

0.4

Revaluation of trading properties

-

-

-

Diluted NAV at fair value

10,639.6

10,639.6

10,639.6

Excludes

Deferred tax

-

-

x

Fair value of financial instruments

(69.2)

(69.2)

x

Goodwill as a result of deferred tax

-

-

-

Goodwill as per the IFRS balance sheet

x

(165.8)

(165.8)

Intangibles as per the IFRS balance

sheet

x

(11.5)

x

Includes

Fair value of debt (1)

x

x

605.3

Revaluation of intangibles to fair

value

-

x

x

Transfer duties

1,034.4

140.6

x

NAV

11,604.7

10,533.7

11,079.2

Fully diluted number of shares

74,132,098

74,132,098

74,132,098

NAV per share

€156.5

€142.1

€149.5

Unit NAV per share (2)

€164.5

€149.5

€156.9

(1) Fixed-rate debt has been measured at

fair value based on the yield curve at June 30, 2024.

(2) Taking into account the residential

portfolio’s unit values

DEVELOPMENT PIPELINE OVERVIEW

Project

Location

Delivery date

Total space (sq.m)

Total investment (€m)

Already invested (€m)

Still to invest (€m)

Yield on cost (est.)

Pre-let (%)

Paris - 35 Capucines

Paris CBD

Q3-24

6,400

182

100%

Paris - Mondo

Paris CBD

Q3-24

30,100

387

100%

Paris - Icône

Paris CBD

Q1-25

13,500

210

12%

Paris - 27 Canal

Paris

Q2-25

15,300

124

-

Paris - Tour Gamma

Paris

Q1-27

19,200

214

-

Carreau de Neuilly

Western Crescent

Q2-27

36,300

465

-

Total offices

120,800

1,582

1,207

375

5.6%

32%

Paris - Wood'up

Paris

Q3-24

8,000

94

na

Paris - Dareau

Paris

Q3-24

5,500

52

na

Rueil - Arsenal

Rueil

Q3-24

6,000

47

na

Rueil - Doumer

Rueil

Q3-24

5,500

45

na

Bordeaux - Belvédère

Bordeaux

Q1-25

8,000

38

na

Garenne Colombes - Madera

La Garenne Colombes

Q1-25

4,900

42

na

Bordeaux - Brienne

Bordeaux

Q3-25

5,500

26

na

Paris - Glacière

Paris

Q3-25

800

10

na

Paris - Porte Brancion

Paris

Q1-25

2,100

16

na

Paris - Vouillé

Paris

Q1-25

2,400

24

na

Paris - Lourmel

Paris

Q2-25

1,600

17

na

Total residential

50,300

411

350

61

3.8%

Total committed pipeline

171,100

1,993

1,556

437

5.2%

Controlled and certain: Offices

46,900

540

317

223

6.0%

Controlled and certain:

Residential

4,200

31

0

31

4.5%

Total controlled and certain

51,100

571

317

254

5.9%

Total committed + controlled

222,200

2,564

1,873

691

5.4%

Total controlled and likely

48,500

141

57

84

5.7%

TOTAL PIPELINE

270,700

2,705

1,930

775

5.4%

1.2 EPRA reporting at June 30, 2024

Gecina applies the EPRA(1) best practices recommendations

regarding the indicators listed hereafter. Gecina has been a member

of EPRA, the European Public Real Estate Association, since its

creation in 1999. The EPRA best practice recommendations include,

in particular, key performance indicators to make the financial

statements of real estate companies listed in Europe more

transparent and more comparable across Europe.

Gecina reports on all the EPRA indicators defined by the “Best

Practices Recommendations” available on the EPRA website.

Moreover, EPRA defined recommendations related to corporate

social responsibility (CSR), called “Sustainable Best Practices

Recommendations.”

(1) European Public Real Estate Association.

06/30/2024

06/30/2023

See Note

EPRA Earnings (in million euros)

229.7

211.3

2.2.1.

EPRA Earnings per share

€3.11

€2.86

2.2.1.

EPRA Net Tangible Asset Value (in million

euros)

10,533.7

10,638.1(1)

2.2.2.

EPRA Net Tangible Asset Value per share

(in euros)

142.1

143.6(1)

2.2.2.

EPRA Net Initial Yield

4.0%

3.9%(1)

2.2.3.

EPRA “Topped-up” Net Initial Yield

4.4%

4.2%(1)

2.2.3.

EPRA Vacancy Rate

6.1%

7.0%

2.2.4.

EPRA Cost Ratio (including direct vacancy

costs)

20.9%

22.3%

2.2.5.

EPRA Cost Ratio (excluding direct vacancy

costs)

18.5%

20.2%

2.2.5.

EPRA Property related Capex (in million

euros)

211

160

2.2.6.

EPRA Loan-to-Value (including duties)

35.7%

34.5%

2.2.7.

EPRA Loan-to-Value (excluding duties)

37.8%

36.6%

2.2.7.

(1) At December 31, 2023.

1.2.1 EPRA recurrent net income

The table below indicates the transition between the recurrent

net income disclosed by Gecina and the EPRA recurrent net

income:

In thousand euros

06/30/2024

06/30/2023

Recurrent net income (Group

share)(1)

235,080

216,532

Depreciation and amortization, net

impairments and provisions

(5,351)

(5,199)

EPRA recurrent net income (A)

229,730

211,333

Weighted average number of shares before

dilution (B)

73,914,585

73,832,958

EPRA recurrent net income per share

(A/B)

€3.11

€2.86

(1) EBITDA excluding IFRIC 21 after

deducting net financial expenses, recurring tax, minority

interests, including income from associates and restated for

certain non-recurring items.

1.2.2 Net Asset Value

The calculation for the net asset value is explained in section

“Net asset value.”

In euros/share

06/30/2024

12/31/2023

EPRA NAV NRV

€156.5

€158.1

EPRA NAV NTA

€142.1

€143.6

EPRA NAV NDV

€149.5

€150.1

1.2.3 EPRA net initial yield and EPRA “Topped-up” net initial

yield

The table below indicates the transition between the yield

disclosed by Gecina and the yields defined by EPRA:

In %

06/30/2024

12/31/2023

Gecina net capitalization

rate(1)

4.9%

4.8%

Impact of estimated costs and duties

-0.3%

–0.3%

Impact of changes in scope

0.1%

0.0%

Impact of rent adjustments

-0.7%

–0.6%

EPRA net initial yield(2)

4.0%

3.9%

Exclusion of lease incentives

0.4%

0.3%

EPRA “Topped-up” net initial

yield(3)

4.4%

4.2%

(1) Like-for-like June 2024.

(2) The EPRA net initial yield is defined

as the annualized contractual rent, net of property operating

expenses, excluding lease incentives, divided by the portfolio

value including duties.

(3) The EPRA “Topped-up” net initial yield

is defined as the annualized contractual rent, net of property

operating expenses, excluding lease incentives, divided by the

portfolio value including duties.

EPRA net initial yield and EPRA

“Topped-up” net initial yield

(in million euros)

Offices

Residential

Total H1 2024

Investment properties

13,551

3,540

17,091 (3)

Adjustment of assets under development and

land reserves

-2,108

-324

-2,432

Value of the property portfolio in

operation excluding duties

11,443

3,216

14,659

Transfer duties

734

213

947

Value of the property portfolio in

operation including duties

B

12,177

3,429

15,606

Gross annualized rents

533

128

661

Non recoverable property charges

16

23

39

Net annualized rents

A

517

105

622

Rents at the expiration of the lease

incentives or other rent discounts

57

0

57

“Topped-up” net annualized

rents

C

575

105

680

EPRA net initial yield(1)

A/B

4.2%

3.1%

4.0%

EPRA “Topped-up” net initial

yield(2)

C/B

4.7%

3.1%

4.4%

(1) The EPRA net initial yield is defined

as the annualized contractual rent, net of property operating

expenses, excluding lease incentives, divided by the portfolio

value including duties.

(2) The EPRA “Topped-up” net initial yield

is defined as the annualized contractual rent, net of property

operating expenses, excluding lease incentives, divided by the

portfolio value including duties.

(3) Except finance leases and hotel.

1.2.4 EPRA vacancy rate

In %

06/30/2024

06/30/2023

Offices

6.0%

6.9%

Residential

6.5%

7.2%

5.8%

5.8%

9.4%

13.2%

EPRA vacancy rate

6.1%

7.0%

EPRA vacancy rate corresponds to the vacancy rate “spot” at the

end of the period, excepted for YouFirst Campus, for which an

average financial occupancy rate is used to neutralize the business

seasonality. Spot EPRA vacancy rate at the end of the period for

YouFirst Campus was 23.8% at June 30, 2024 and 32.0% at June 30,

2023.

EPRA vacancy rate is calculated as the ratio between the

estimated market rental value of vacant spaces and potential rents

for the operating property portfolio.

EPRA vacancy rate does not include leases signed with a future

effect date

The financial occupancy rate reported in other parts of this

document corresponds to the average financial occupancy rate of the

operating property portfolio.

Market rental value of vacant

spaces (in million euros)

Potential rents (in million

euros)

EPRA vacancy rate at the end of

June 2024 (in %)

Offices

36

593

6.0%

Residential

9

135

6.5%

6

107

5.8%

3

28

9.4%

EPRA vacancy rate

44

728

6.1%

1.2.5 EPRA cost ratios

In thousand euros/In %

06/30/2024

06/30/2023

Property expenses(1)(2)

(129,521)

(135,153)

Overheads(1)(2)

(42,521)

(44,888)

Recharges to tenants

99,561

103,527

Rental expenses charged to tenants in

gross rent

0

0

Other income/income covering overheads

549

1,940

Share in costs of associates

(85)

(147)

Ground rent

0

0

EPRA costs (including vacancy costs)

(A)

(72,016)

(74,720)

Vacancy costs

8,255

7,086

EPRA costs (excluding vacancy costs)

(B)

(63,762)

(67,634)

Gross rental income less ground rent

343,106

332,932

Rental expenses charged to tenants in

gross rent

0

0

Share in rental income from associates

1,675

1,469

Gross rental income (C)

344,781

334,401

EPRA cost ratio (including vacancy

costs) (A/C)

20.9%

22.3%

EPRA cost ratio (excluding vacancy

costs) (B/C)

18.5%

20.2%

(1) Marketing costs, eviction allowances,

and time spent by the operational teams directly attributable to

marketing, development or disposals are capitalized or reclassified

as gains or losses on disposals of €5.7 million in 2024 and €7.2

million in 2023.

(2) Without IFRIC 21.

1.2.6 Capital expenditure

06/30/2024

06/30/2023

In million euros

Group

Joint ventures

Total

Group

Joint ventures

Total

Acquisitions

0

n.a.

0

0

n.a.

0

Pipeline

159

n.a.

159

115

n.a.

115

of which capitalized interest

8

n.a.

8

4

n.a.

4

Maintenance Capex(1)

52

n.a.

52

45

n.a.

45

Incremental lettable space

0

n.a.

0

0

n.a.

0

No incremental lettable space

47

n.a.

47

41

n.a.

41

Tenant incentives

5

n.a.

5

3

n.a.

3

Other expenses

0

n.a.

0

0

n.a.

0

Capitalized interest

0

n.a.

0

0

n.a.

0

Total Capex

211

n.a.

211

160

n.a.

160

Conversion from accrual to cash basis

–13

n.a.

–13

7

n.a.

7

Total Capex on cash basis

197

n.a.

197

166

n.a.

166

(1) Capex corresponding to: (i) renovation

work on apartments or private areas to capture rental reversion,

(ii) work on communal areas, (iii) lessees’ work.

1.2.7 EPRA Loan-to-Value

In million euros

Group

Share of joint ventures

Share of material associates

Non-controlling Interests

Total

Include

Borrowings from financial institutions

165

13

-

178

Commercial papers

911

-

-

911

Hybrids

-

-

-

-

Bond loans

5,645

-

-

5,645

Foreign currency derivatives

-

-

-

-

Net payables

135

1

(2)

134

Owner-occupied property (debt)

-

-

-

-

Current accounts (equity

characteristic)

15

-

(15)

0

Exclude

-

-

Cash and cash equivalents

(378)

(3)

2

(378)

Net debt (A)

6,494

12

(15)

6,490

Include

Owner-occupied property

235

-

-

235

Investment properties at fair value

14,862

89

(30)

14,921

Properties held for sale

231

-

-

231

Properties under development

1,722

-

-

1,722

Intangibles

12

-

-

12

Financial assets

34

0

(0)

35

Total property value (excluding RETTs)

(B)

17,096

90

(31)

17,155

Transfer duties

1,034

7

(2)

1,039

Total property value (including RETTs)

(C)

18,131

96

(33)

18,194

EPRA LTV (excluding RETTs)

(A/B)

38.0%

37.8%

EPRA LTV (including RETTs)

(A/C)

35.8%

35.7%

1.3 Additional information on rental income

1.3.1 Rental situation

Gecina’s tenants come from a wide range of sectors of activity,

reflecting various macro-economic factors.

Breakdown of tenants by sector (offices – based on annualized

headline rents)

Group

Industry

37%

Consulting/services

20%

Technology

11%

Public sector

8%

Retail

7%

Media – television

6%

Finance

5%

Hospitality

5%

Total

100%

Weighting of the top 20 tenants (% of annualized total headline

rents)

Breakdown for office only (not significant for the Residential

portfolio):

Tenant

Group

Engie

7%

Boston Consulting Group

3%

Lagardère

3%

WeWork

3%

Solocal Group

2%

Yves Saint Laurent

2%

EDF

2%

Eight Advisory

1%

Ipsen

1%

Renault

1%

LVMH

1%

Lacoste

1%

Arkema

1%

Edenred

1%

Salesforce

1%

Jacquemus

1%

Orange

1%

CGI France

1%

MSD

1%

Sanofi

1%

Top 10

25%

Top 20

35%

1.3.2 Annualized rental income

Annualized rental income increased by +€9 million compared with

December 31, 2023, primarily reflecting higher like-for-like rents

(+€8 million) and the delivery of buildings in the first half of

the year (+€5 million), offset by disposals (–€1 million) and the

release of assets for redevelopment (–€3 million).

Note that this annualized rental income includes €22 million

from assets intended to be vacated for redevelopment.

In addition, the annualized rental income figures below do not

yet include the rental income that will be generated by committed

or controlled projects, which may represent nearly €137 million of

potential headline rents, including almost €35 million pertaining

to assets that are yet to be committed.

In million euros

06/30/2024

12/31/2023

Offices

546

534

Residential

129

132

104

106

26

26

Total

675

666

1.3.3 Like-for-like rent change factors for the first half of

2024 vs. the first half of 2023

Group

Like-for-like change

Indexation

Reversion

Vacancy & other

+6.3%

+5.4%

+1.2%

-0,3%

Offices

Like-for-like change

Indexation

Reversion

Vacancy & other

+6.5%

+6.0%

+1.1%

-0,5%

Residential

Like-for-like change

Indexation

Reversion

Vacancy & other

+5.4%

+2.7%

+1.9%

+0.7%

1.3.4 Volume of rental income by three-year break and end of

leases

Commercial lease schedule

(in million euros)

2024

2025

2026

2027

2028

2029

2030

>2030

Total

Break-up options

38

95

76

137

43

43

31

130

594

End of leases

38

47

41

98

40

49

70

211

594

1.4 Financial resources

The first half of 2024 was marked by an initial 25-bp cut in key

interest rates following 10 successive increases since July 2022,

bringing the deposit rate down to 3.75%, the refinancing rate to

4.25% and the marginal rate to 4.50%. As this reduction was broadly

anticipated by the market, long-term rates had already started to

fall at the end of 2023, with rates stable on average in the first

half of 2024.

In what remained an uncertain and volatile environment during

the first half of the year, Gecina was able to rely on its

strengths – a robust and flexible balance sheet, low debt,

considerable cash, excellent access to different sources of

financing, and a strong credit rating – to continue with the early

refinancing of its undrawn credit lines, taking out €1.0 billion of

new responsible bank loans with an average maturity of nearly seven

years.

At June 30, 2024, Gecina therefore had immediate liquidity of

€5.0 billion, or €4.1 billion excluding NEU CP, which is

considerably higher than the long-term target of a minimum of €2.0

billion. This excess liquidity notably covers all bond maturities

until 2028 (and in particular the 2025, 2027 and 2028

maturities).

This proactive and dynamic management of the Group’s financial

structure further increases its strength, resilience and visibility

for the coming years. It also ensures that the Group’s main credit

indicators remain at an excellent level. The maturity of the debt

is 7.1 years, the interest rate risk hedging is close to 100% until

the end of 2026 and 84% on average until the end of 2029, and the

average maturity of this hedging is 5.8 years. The loan-to-Value

(LTV) ratio (including duties) was 35.0%, and the interest coverage

ratio (ICR) stood at 6.7x. Gecina therefore has a significant

margin with respect to all of its banking covenants. The average

cost of the drawn debt was stable compared with 2023 at 1.1%.

1.4.1 Debt structure at June 30, 2024

Net financial debt amounted to €6,359 million at the end of June

2024.

The main characteristics of the debt are:

06/30/2024

12/31/2023

Gross financial debt (in million

euros)(1)

6,736

6,380

Net financial debt (in million

euros)(2)

6,359

6,236

Gross nominal debt (in million euros)

6,835

6,445

Unused credit lines (in million euros)

4,615

4,535

Average maturity of debt (years, restated

from available credit lines)

7.1

7.4

LTV (including RETTs)

35.0%

34.4%

LTV (excluding RETTs)

37.1%

36.5%

ICR

6.7x

5.9x

Secured debt/Properties

–

–

(1) Gross financial debt (excluding fair

value related to Eurosic’s debt) = Gross nominal debt + impact of

the recognition of bonds at amortized cost + accrued interest not

yet due + miscellaneous.

(2) Excluding fair value related to

Eurosic’s debt, €6,362 million including these items.

Debt by type

Breakdown of gross nominal debt (€6.8 billion)

Graphic omitted

Breakdown of authorized financing (€10.5 billion, including

€4.6 billion of unused credit lines at June 30, 2024)

Graphic omitted

Gecina uses diversified sources of financing. Long-term bonds

represent 84% of the Group’s nominal debt and 55% of the Group’s

authorized financing.

At June 30, 2024, Gecina’s gross nominal debt was €6,835 million

and comprised:

- €5,750 million in long-term Green Bonds issued under the Euro

Medium-Term Notes (EMTN) program;

- €165 million in responsible bank loans;

- €920 million in NEU CP covered by confirmed medium and

long-term credit lines.

1.4.2 Liquidity

The main objectives of the liquidity are to provide sufficient

flexibility to adapt the volume of debt to the pace of acquisitions

and disposals, cover the refinancing of short-term maturities,

allow refinancing under optimal conditions, meet the criteria of

the credit rating agencies, and finance the Group’s investment

projects.

Financing and refinancing transactions carried out since the

start of 2024 amounted to €1.0 billion and related in particular

to:

- the setting up of eight responsible credit lines for a

cumulative amount of €993 million (including €328 million in July

2024) with an average maturity of nearly seven years, through the

early renewal of lines maturing in 2026. These new financing

programs all have a margin dependent on the achievement of CSR

objectives, and allowed the Group to renew a large part of the 2026

maturities early with longer maturities, mainly in 2031;

- taking out €20 million in responsible bank loans, with an

average term of six years.

Gecina updated its EMTN program with the AMF in June 2024 and

its Negotiable European Commercial Paper (NEU CP) program with the

Banque de France in May 2024, with caps of €8 billion and €2

billion, respectively.

In the first half of 2024, Gecina continued to use short-term

resources via the issue of NEU CPs. At June 30, 2024, the Group’s

short-term resources totaled €920 million.

1.4.3 Debt maturity breakdown

At June 30, 2024, the average maturity of Gecina’s debt, after

allocation of unused credit lines and cash, was 7.1 years.

The following chart shows the debt maturity breakdown after

allocation of unused credit lines at June 30, 2024, pro forma of

the loans taken out in July 2024:

Debt maturity breakdown after taking into account undrawn

credit lines (in billion euros)

Graphic omitted

All of the credit maturities up to 2028, including the 2025,

2027 and 2028 bond maturities in particular, were covered by unused

credit lines as at June 30, 2024 (pro forma of the loans taken out

in July 2024) and by free cash.

1.4.4 Average cost of debt

The average cost of the drawn debt amounted to 1.1% at the end

of June 2024 (and 1.5% for total debt), stable compared with 2023.

This stability in the average cost of debt, despite the very marked

increase in interest rates on the financial markets, is due to the

Group’s financial structure and in particular its hedging

policy.

Average cost of drawn debt

Graphic omitted

Capitalized interest on development projects amounted to €8.6

million at the end of June 2024 (compared with €4.0 million in June

2023).

1.4.5 Credit rating

The Gecina group is rated by both Standard & Poor’s and

Moody’s, which respectively maintained the following ratings in

2023 and 2024:

- A– (stable outlook) for Standard & Poor’s;

- A3 (stable outlook) for Moody’s.

1.4.6 Management of interest rate risk hedge

Gecina’s interest rate risk management policy is aimed at

hedging the Company’s exposure to interest rate risk. To do so,

Gecina uses fixed-rate debt and derivative products (mainly caps

and swaps) in order to limit the impact of interest rate changes on

the Group’s results and to keep the cost of debt under control.

In the first half of 2024, Gecina continued to adjust and

optimize its hedging policy with the aim of:

- maintaining an optimal hedging ratio;

- maintaining a high average maturity of hedges (fixed-rate debt

and derivative instruments), and;

- securing favorable long-term interest rates.

At June 30, 2024, the average duration of the portfolio of firm

hedges stood at 5.8 years.

Based on the current level of debt, the hedging ratio will

average close to 100% until the end of 2026 and 84% until

end-2029.

The chart below shows the profile of the hedge portfolio:

Graphic omitted

Gecina’s interest rate hedging policy is implemented mainly at

Group level and on the long-term; it is not specifically assigned

to certain loans.

Measuring interest rate risk

Gecina’s anticipated nominal net debt in 2024 is fully hedged

against interest rate increase (depending on observed Euribor rate

levels, due to caps).

Based on the existing hedge portfolio, contractual conditions as

at June 30, 2024, and anticipated debt in the second half of 2024,

a 50 basis point increase or decrease in the interest rate,

compared to the forward rate curve of June 30, 2024, would have no

material impact on financial expenses in 2024.

1.4.7 Financial structure and banking covenants

Gecina’s financial position as at June 30, 2024, meets all

requirements that could affect the compensation conditions or early

repayment clauses provided for in the various loan agreements.

The table below shows the status of the main financial ratios

outlined in the loan agreements:

Benchmark standard

Balance at 06/30/2024

LTV – Net financial debt/revalued block

value of property holding (excluding duties)

Maximum 60%

37.1%

ICR – EBITDA/net financial expenses

Minimum 2.0x

6.7x

Outstanding secured debt/revalued block

value of property holding (excluding duties)

Maximum 25%

–

Revalued block value of property holding

(excluding duties), (in billion euros)

Minimum €6 bn

€17.1 bn

The financial ratios shown above are the same as those used in

the covenants included in all the Group’s loan agreements. LTV

excluding duties was 37.1% at June 30, 2024, (36.5% at the end of

2023). The ICR stood at 6.7x (5.9x in 2023).

1.4.8 Guarantees given

At the end of June 2024, the Group did not hold any debt

guaranteed by real sureties (i.e. mortgages, lender’s liens,

unregistered mortgages).

Thus, at June 30, 2024, there was no financing guaranteed by

mortgage-backed assets for an authorized maximum limit of 25% of

the total block value of the property portfolio in the various loan

agreements.

L1ve, 75 avenue de la Grande Armée, Paris 16

1 Dedicated on-site team to reconfigure energy-consuming

equipment to optimize its consumption based on each building’s

specific features and occupancy 2 Nearly €270m was also paid out

for the pipeline in 2023

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240723798950/en/

GECINA

Financial communications

Samuel Henry-Diesbach Tel: +33 (0)1 40 40 52 22

samuelhenry-diesbach@gecina.fr

Attalia Nzouzi Tel: +33 (0)1 40 40 18 44

attalianzouzi@gecina.fr

Press relations

Glenn Domingues Tel: +33 (0)1 40 40 63 86

glenndomingues@gecina.fr

Armelle Miclo Tel: +33 (0)1 40 40 51 98

armellemiclo@gecina.fr

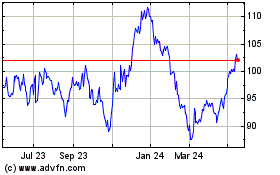

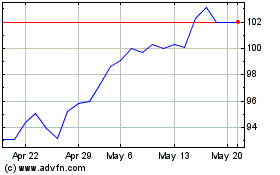

Gecina Nom (EU:GFC)

Historical Stock Chart

From Oct 2024 to Nov 2024

Gecina Nom (EU:GFC)

Historical Stock Chart

From Nov 2023 to Nov 2024