LACROIX : First-quarter 2024 revenue of €186.3 million (-4.4%),

marked by a high comparative base for Electronics and continued

strong momentum for City and Environment divisions.

13/05/2024

First-quarter 2024 revenue of €186.3

million (-4.4%), marked by a high comparative base

for Electronics and continued strong momentum for

City and Environment divisions

Sales and profitability targets for 2024

confirmed

|

Revenue in millions of euros |

Q1 2024 |

Q1 2023 |

Change |

|

Electronics activity |

138,4 |

152,5 |

-9,2% |

| City

activity |

26,0 |

23,3 |

+11,5% |

|

Environment activity |

21,8 |

18,9 |

+15,4% |

|

Total |

186,3 |

194,8 |

-4,4% |

|

Excl. Road Signs Segment (sold April 30, 2024) |

174,2 |

182,7 |

-4,7% |

First quarter in line with

expectations

As of March 31, 2024, LACROIX posted a revenue

of €186.3 million, compared with €194.8 million a year earlier. As

a reminder, revenue had risen by 17.9% in the first quarter of

2023, driven by a strong recovery for the Electronics division

following a period of disruption to component supplies. On this

highly challenging basis of comparison, sales for Q1 2024 were down

4.4%. It should be noted that the Group sales in Q1 2024 were up by

12.8% on Q1 2022.

Taking into account a positive currency effect

of +3.6 M€, mainly due to the appreciation of the Polish zloty,

revenue at constant exchange rates(1), was down by 6.2%.

Excluding the Road Signs, a segment in the

process of being sold during the period, LACROIX sales were down

4.7% in the first quarter of 2024, at €174.2 million.

____________________

(1) At constant exchange rates

: the currency effect is calculated by applying the exchange rates

of the previous period to the revenue of the current period.

Continued strong momentum for City and

Environment divisions

Electronics

The Electronics division reported a revenue of

€138.4m, down 9.2% on the first quarter of 2023. This period had

been marked by an exceptional performance for Electronics (+24.9%),

particularly in the Automotive sector, due to improved supply

conditions for electronic components after several quarters of

tension.

In EMEA, where this base effect is particularly

significant (+32.7% growth in Q1 2023), business in the Automotive

and HBAS (Home & Building Automation Systems) sectors declined

in Q1 2024. The Industry sector is at break-even, buoyed by the

ramp-up of several new programs (notably in the Symbiose plant),

while the Avionics sector continues to enjoy very strong

growth.

Across the Atlantic, sales at LACROIX

Electronics North America were virtually stable over the period

(-1.3% cc), in line with the Group's expectations for the

subsidiary in the process of recovery.

City

With a revenue of €26.0m in the first quarter of

2024, the City activity is once again posting strong growth

(+11.5%). It continues to be driven by the remarkable performance

of the Street Lighting segment (>20%), in line with the trend

for fiscal 2022 and 2023 (+27.1% and +15.1% respectively).

It should be noted that the sale of the Road

Signs segment to AIAC (American Industrial Acquisition Corporation)

takes effect on April 30, 2024, at which time it will be removed

from the Group's scope of consolidation.

Environment

The division continued its very positive

momentum in the first quarter of 2024. Following annual growth of

9.1% and 8.1% over the last two years, the business posted a 15.4%

increase in the first quarter, with a total revenue of €21.8

million. The performance of the Environment activity, which is

benefiting from favorable structural trends across all segments,

was driven over the period by the Water segment in France and

internationally, as well as by the Smart Grids segment.

Annual targets confirmed: growth and

improved operating profitability

After a start to the year in line with Group

expectations, the second quarter of 2024 should once again be

marked by contrasting trends. On the one hand, momentum looks set

to be very positive in the City and Environment activities; on the

other, the Electronics activity will continue to be impacted by an

unfavorable base effect, albeit less pronounced than in the first

quarter, as well as ongoing slow trends in the automotive and HBAS

sectors. Thereafter, in the second half of 2024, LACROIX expects a

more favorable business trend.

For the year as a whole, the Group reiterates

the targets announced at the time of publication of its annual

results. Excluding the Road Signs segment, LACROIX expects its

revenue to exceed €710 million in 2024, up slightly on the 2023

level excluding the Road Signs segment (i.e. €702 million). The

current EBITDA margin is expected to exceed its 2023 level, within

a range of 5.5% to 6.5%.

Upcoming reportsRevenue for the

second quarter and first half of 2024: 23 july 2024 after market

closes

Visit our investor relations page to

find financial

informationhttps://www.lacroix-group.com/investors

About LACROIX

Convinced that technology must contribute to simple,

sustainable, and safer environments, LACROIX supports its customers

in developing more sustainable living ecosystems, thanks to useful,

robust, and secure electronic equipment and connected

technologies. As a listed, family-owned midcap with a €761

million euros revenue in 2023, LACROIX combines agile innovation,

industrialization capacity, cutting-edge technological know-how and

a long-term vision to meet environmental and societal challenges

through its three activities: Electronics, City and

Environment. Ranked among the TOP 50 EMS worldwide, the

Electronics activity of LACROIX, the Group's industrial backbone,

designs and manufactures electronic functions and industrial IoT

(hardware, software, and cloud) and AI solutions, for the

automotive, industrial, connected homes and buildings (HBAS),

avionics and defense, and healthcare sectors. Through its City

and Environment activities, LACROIX also supplies secure and

connected electronic equipment and IoT solutions to optimize the

management of critical infrastructures such as smart road

infrastructures (public lighting, traffic management and C-ITS,

passenger transport systems) and the remote control of water and

energy infrastructures (Smart Grids and HVAC). Drawing on its

experience and technological and business expertise, LACROIX works

with its customers and partners to bridge the gap between today's

world and tomorrow's. The Group supports them in building the

industry of the future and benefiting from the innovation

opportunities that surround them, by bringing them the electronic

equipment and IoT solutions for a more sustainable world.

|

Contacts

LACROIX COO & Executive

VP FinanceNicolas Bedouin investors@lacroix.group

Tel.: +33 (0)2 72 25 68 80 |

ACTIFIN

Press relationsJennifer Jullia jjullia@actifin.fr

Tel. : +33 (0)1 56 88 11 19 |

ACTIFIN

Financial communicationMarianne Pympy@actifin.fr

Tel.: +33 (0)6 88 78 59 99 |

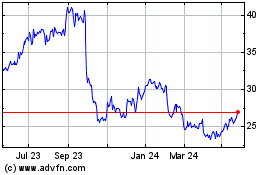

Lacroix (EU:LACR)

Historical Stock Chart

From Oct 2024 to Nov 2024

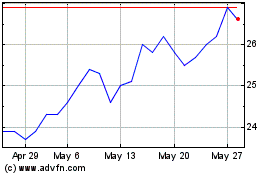

Lacroix (EU:LACR)

Historical Stock Chart

From Nov 2023 to Nov 2024