KLÉPIERRE: STRONG OPERATING PERFORMANCE DRIVING TO VALUATION

INCREASE AND GUIDANCE UPGRADE

PRESS RELEASE

STRONG OPERATING PERFORMANCE DRIVING TO

VALUATION INCREASE AND GUIDANCE UPGRADE

Paris — July 31, 2024

Klépierre delivered strong operating growth in

the first half of 2024(1), while

property valuations increased by 2%:

- Net current cash flow per share at

€1.25, up 3.3% vs. first-half 2023

-

EBITDA(2) up 5.4% year on

year

- Net rental income up 6.0%

like-for-like(3) (4.9% year on

year)

- Upward trend in operations:

- Collection rate at 97.7%, up 120

basis points year on year

- Occupancy at 96.2%, up 50 basis

points year on year

- Rental uplift +3% and occupancy

cost ratio at 12.6%, down 20 basis points year on year, reflecting

an upward trend in retailer sales with a 3.9%

increase(4)

- Further improvement in credit

metrics:

- Historic low net debt to EBITDA at

7.3x, LTV at 37.6% and ICR at 8.2x

- In May, S&P confirmed the BBB+

credit rating and increased its outlook from stable to

positive

- Fitch confirmed the ‘A-’ rating

with a stable outlook on Klépierre’s senior unsecured debt

- €775 million in long-term financing

closed year-to-date

- €625 million of existing bilateral

credit facilities renewed for five-years

- Property valuation turned positive,

being up 2.0% like-for-like over six months

- EPRA NTA per share at €31.4, up

4.3% over six months

- Active capital rotation with

investment in best-in-class destinations: highly accretive

acquisitions of O’Parinor and RomaEst and €106 million of disposals

closed or secured since January 1st

- IFRS consolidated net income:

€602.4 million (attributable to owners of the parent: €535.7

million)

- Upgraded full-year 2024 guidance:

EBITDA(2) growth of 5% and NCCF of

€2.50-€2.55 per share

HIGHLIGHTS OF THE PERIOD

Klépierre, the premier shopping malls specialist

with exclusive focus on continental Europe delivered a strong set

of results in the first half of 2024.

Operating momentum continues

Klépierre’s proactive asset management and

development initiatives designed to constantly adapt the offering

have been driving significant leasing tension for assets identified

as key destinations for expanding banners. This translated into

growth of 11% in the volume of leases signed (896) and a 3.0%

rental uplift on renewals and relettings, while the occupancy rate

was up 50 basis points compared to June 30, 2023, at 96.2%. The

occupancy cost ratio decreased to 12.6% (down 20 basis points

over 12 months), showcasing the affordable level of rents amid a

3.9%(4) year on year increase in

retailer sales and 2% growth in footfall.

Against this backdrop, net rental income

amounted to €520.1 million, up 4.9% year on year or 6.0% on a

like-for-like basis(3),

representing a spread of 320 basis points over indexation driven by

higher collection and occupancy rates and an 8% like-for-like

increase in additional revenues (turnover rents, car park revenues

and mall income).

Growing earnings and property values

Fueled by strong net rental income growth,

strict control over payroll and G&A expenses and higher

management fees, EBITDA(2) grew by

5.4% year on year. At the same time, net current cash flow

increased by 3.3% year on year to €1.25 per share.

Portfolio valuations upturned, increasing 2% on

a like-for-like basis over six

months(5), to €19,874 million

(total share)(6). The

EPRA NIY(7) for the portfolio

remained stable at 5.9%. EPRA NTA per share amounted to €31.4 as of

June 30, 2024, up 4.3% over six months.

Strong balance sheet capacities enabled to invest into

high-return opportunities

Klépierre continues to operate sector-leading

credit metrics. The net debt to EBITDA reached a historically low

level of 7.3x, the Loan-to-Value ratio was down 40 basis points

over six months at 37.6% and the interest coverage ratio stood at

8.2x. Eventually, the average debt maturity was 6.2 years and

the cost of debt 1.6%. Taken together, this has created significant

balance sheet capacity to act as a net investor in accretive

opportunities.

Since January 1, the Group closed the acquisitions of O’Parinor and

RomaEst, two super-regional shopping malls for a total amount of

€238 million. Pursuing its active capital rotation approach, the

Group disposed non-core assets for a total amount of

€106 million (€65 million closed and €41

million(8) under promissory

agreements), above appraised values (+16.4%) for a blended EPRA Net

Initial Yield of 5.5%. In parallel, Klépierre continued to invest

in its assets and delivered the Maremagnum extension (Barcelona,

Spain) in July, while the extension work of Odysseum (Montpellier,

France) is ongoing. Yield on costs of these projects reach 13.5%

and 9%, respectively.

Capitalizing on its investment grade credit ratings – BBB+ with

positive outlook at S&P (upgraded on May 27, 2024)

and A- with stable outlook at Fitch (confirmed on May 24, 2024) –

the Group raised €775 million in long-term financing (including a

€600-million bond with a maturity of 9.6 years and a coupon of

3.875%, a 130-basis-point spread over the reference rate). Since

January 1, the Group has renewed €625 million of existing

revolving credit facilities on a five-year basis (including €125

million in July 2024).

As of June 30, 2024, consolidated net debt stood at €7,479

million.

Outlook revised upwards

Based on the first-half performance and taking

into account the positive contribution of acquisitions closed

year-to-date, Klépierre is revising its full-year guidance upwards

and now expects to generate a 5% increase in EBITDA and net current

cash flow to reach €2.50-€2.55 per share in 2024.

NET CURRENT CASH FLOW

As common practice in the real estate industry,

Klépierre sees net current cash flow as a relevant alternative

performance measure. It is obtained by deducting from aggregates of

the IFRS income statement certain non-cash and/or non-recurring

effects.

|

06/30/2023

(as published) |

06/30/2023

(H1 2024 format) |

06/30/2024 |

Change |

|

Total share, in €m |

|

|

|

|

| Gross rental

income |

566.5 |

569.7 |

597.4 |

|

| Rental and

building expenses |

(82.4) |

(73.7) |

(77.3) |

|

| Net rental

income |

484.1 |

495.9 |

520.1 |

+6.0% |

| |

|

|

|

(like-for-like) |

|

Management, administrative, related income and other income |

36.3 |

36.3 |

36.8 |

|

| Payroll

expenses and other general expenses |

(68.5) |

(79.5) |

(79.6) |

|

|

EBITDA(a) |

451.9 |

452.7 |

477.3 |

+5.4% |

|

Cost of net debt |

(59.4) |

(59.4) |

(77.8) |

|

|

Cash flow before share in equity investees and taxes |

392.5 |

393.3 |

399.5 |

|

|

Share in equity investees |

27.5 |

27.5 |

30.2 |

|

| Current tax

expenses |

(23.7) |

(23.7) |

(19.0) |

|

| Adjustments to

calculate net current cash flow |

(2.3) |

– |

– |

|

| Adjustment

from the non-cash impact of Covid-19 rent concessions

amortization |

3.2 |

– |

– |

|

|

Net current cash flow |

397.3 |

397.3 |

410.6 |

|

| Group

share, in €m |

|

|

|

|

|

NET CURRENT CASH FLOW |

348.3 |

348.3 |

359.7 |

|

|

Average number of

shares(b) |

286,363,431 |

286,363,431 |

286,757,193 |

|

|

Per share, in € |

|

|

|

|

|

NET CURRENT CASH FLOW |

1.21 |

1.21 |

1.25 |

+3.3% |

(a) EBITDA stands for “earnings before interest,

taxes, depreciation and amortization” and is a measure of the

Group’s operating performance.

(b) Excluding treasury shares.

In the first half of 2023 and 2024, these

adjustments mainly concerned the depreciation charge for

right-of-use assets, share-based compensation payments, an

exceptional profit accounted in general expenses, non-current

operating expenses/income and the annualization of property tax

under IFRIC 21.

In the first half 2023 release, the adjustments were presented

below EBITDA (“Adjustments to calculate net current cash

flow”).

As of June 30, 2024, these adjustments are reallocated to each

relevant line item (H1 2024 format), with no impact on net current

cash flow.

2024 FIRST-HALF EARNINGS WEBCAST — PRESENTATION

AND CONFERENCE CALL

Klépierre’s Executive

Board will present the Company’s first-half 2024 earnings on

Wednesday July 31, 2024 at

10:00 a.m. CET (9:00 a.m. London

time). Please visit Klépierre’s website

www.klepierre.com to listen to the webcast, or

click here.

A replay will also be available after the event.

|

AGENDA |

|

|

October 23, 2024 |

Trading update for the first nine months of 2024 (before market

opening) |

|

INVESTOR RELATIONS CONTACTS |

MEDIA CONTACTS |

|

Paul Logerot, Group Head of IR and Financial

Communication

+33 (0)7 50 66 05 63 — paul.logerot@klepierre.com

Hugo Martins, IR Manager

+33 (0)7 72 11 63 24 — hugo.martins@klepierre.com

Tanguy Phelippeau, IR Manager

+33 (0)7 72 09 29 57 —tanguy.phelippeau@klepierre.com |

Hélène Salmon, Group Head of Communication

+33 (0)6 43 41 97 18 – helene.salmon@klepierre.com

Wandrille Clermontel, Taddeo

+33 (0)6 33 05 48 50 – teamklepierre@taddeo.fr |

|

ABOUT KLÉPIERRE

Klépierre is the premier shopping malls

specialist with an exclusive focus on continental Europe, combining

property development and asset management skills. The Company’s

portfolio is valued at €19.9 billion at June 30, 2024, and

comprises large shopping centers in more than 10 countries in

Continental Europe which together host hundreds of millions of

visitors per year. Klépierre holds a controlling stake in Steen

& Strøm (56.1%), one of the leading operators of shopping

centers in Scandinavia. Klépierre is a French REIT (SIIC) listed on

Euronext Paris and is included in the CAC Next 20 and EPRA Euro

Zone Indexes. It is also included in ethical indexes, such as CAC

SBT 1.5, MSCI Europe ESG Leaders, FTSE4Good, Euronext Vigeo Europe

120, and features in CDP’s “A-list”. These distinctions underscore

the Group’s commitment to a proactive sustainable development

policy and its global leadership in the fight against climate

change.

For more information, please visit the newsroom on our website:

www.klepierre.com

This press release and its appendices together

with the earnings presentation slideshow

are available in the “Publications section” of Klépierre’s Finance

page:

www.klepierre.com/en/finance/publications

(1) The Supervisory Board met on July 29, 2024, to examine the

interim financial statements, as approved by the Executive Board on

July 26, 2024. Limited review procedures on the interim condensed

consolidated financial statements have been completed. The

Statutory Auditors are in the process of issuing their report.

(2) EBITDA stands for “earnings before interest, taxes,

depreciation and amortization” and is a measure of the Group’s

operating

performance.

(3) Like-for-like data exclude the contribution of new spaces

(acquisitions, greenfield projects and extensions), spaces being

restructured, and disposals completed since January 2023.

(4) Excluding the impact of asset sales and acquisitions and

excluding Turkey.

(5) Change is on a constant currency basis.

(6) As of June 30, 2024, the appraisers assumed on average a

discount rate of 7.9% and exit rate of 6.1% while the compound

annual growth rate stood at 2.8% over the next 10 years.

(7) EPRA Net Initial Yield is calculated as annualized rental

income based on passing cash rents, less non-recoverable property

operating expenses, divided by the market value of the property

(including transfer taxes).

(8) Total asset value excluding transfer taxes and including the

portion attributable to joint owners.

- PR_KLEPIERRE_2024_HY_EARNINGS

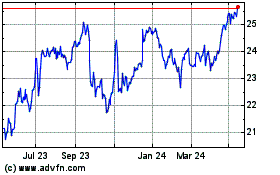

Klepierre (EU:LI)

Historical Stock Chart

From Dec 2024 to Jan 2025

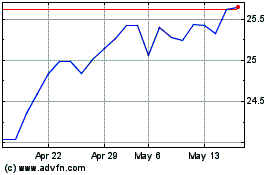

Klepierre (EU:LI)

Historical Stock Chart

From Jan 2024 to Jan 2025