Sif reaches agreement on refinancing

February 26 2019 - 12:00AM

Roermond (the Netherlands), 26 February 2019 - Sif

Holding N.V. today announces that it has reached an agreement with

RABO bank, ING, ABN AMRO, Euler-Hermes and Tokio Marine

concerning the refinancing of the Company. The new

credit facility of € 350 million in total replaces the facility of

€ 250 million in total set to expire mid-2019.

The new facility expires 22 February 2022, with

two one-year extension options. The facility consists of a

revolving credit facility of € 100 million and a committed

guarantee facility of € 250 million. The previous arrangement had a

revolving credit facility of € 90 million with committed guarantee

facilities of € 160 million. The increase in facilities serves to

support SIF's future business.

Margins and commitment fees remain unchanged at

Euribor plus a surcharge that depends on the leverage and solvency

on a quarterly basis. The new leverage (net debt/EBITDA)

should be equal to or less than 2.5 (was 1.5 under the expiring

facility) and the solvency should be equal to or more than 30% in

2019 and 35% during the years beyond 2019. .

The financing arrangement has also been made

sustainable. Sif can earn discounts of max 0.05% if certain

sustainability KPI's are reached.

Leon Verweij, CFO: "This amended and broader

facility provides sufficient flexibility to pursue our strategy

going forward. This new agreement assures Sif a financing structure

that fits the characteristics of our Company."

Refinancing agreement February

2019

This

announcement is distributed by West Corporation on behalf of West

Corporation clients.

The issuer of this announcement warrants that they are solely

responsible for the content, accuracy and originality of the

information contained therein.

Source: Sif Holding NV via Globenewswire

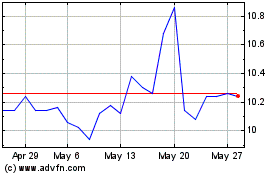

Sif Holding NV (EU:SIFG)

Historical Stock Chart

From Nov 2024 to Dec 2024

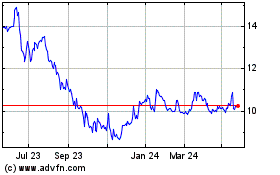

Sif Holding NV (EU:SIFG)

Historical Stock Chart

From Dec 2023 to Dec 2024

Real-Time news about Sif Holding NV (Euronext): 0 recent articles

More Sif Holding NV News Articles