Increase of 4.1 % of the dividend per share in 2023 compared to 2022

March 14 2024 - 11:45AM

Increase of 4.1 % of the dividend per share in 2023 compared to

2022

Press ReleaseInside/regulated

information

March 14, 2024, after 5.40 PM

- The 2023 dividend of € 5.81 per share is increasing by 4.1 %

compared to 2022.

- The cash revenue1, powered by the inflow of dividends from its

participation in Solvay, came to € 132.1 million higher than the

2022 revenue (€ 125.6 million) and is increasing compared to last

year thanks to the rise of the Solvay dividend per share, as shown

in the table below:

|

|

2022 |

2023 |

|

Solvay dividend per share – January (in EUR) |

1.50 |

1.54 |

|

Number of Solvay shares held by Solvac (in million) |

32.6 |

32.6 |

| Solvay

dividend received in January (in million EUR) (a) |

48.9 |

50.2 |

|

Solvay dividend per share – May (in EUR) |

2.35 |

2.51 |

|

Number of Solvay shares held by Solvac (in million) |

32.6 |

32.6 |

| Solvay

dividend received in May (in million EUR) (b) |

76.7 |

81.9 |

|

Cash revenue (a) + (b)1 (in million EUR) |

125.6 |

132.1 |

|

Administrative costs |

-2,0 |

-2.5 |

| Other

Operational Costs |

0,0 |

-2.2 |

| Cost

of borrowing |

-2.9 |

-3.1 |

|

Cash income1 (in million EUR) |

120.7 |

124.3 |

Insofar as the company statutory accounts

authorise, it is on the basis of cash income1, that the Board of

Directors determines the dividend amounts proposed for distribution

by Solvac.

- Modification of the financial reporting

framework.

Solvac holds a stake in Solvay and Syensqo and

exercises significant influence over their direction.The Board of

Directors has decided to publish Solvac's financial statements as

of December 31, 2023 exclusively according to the framework of

Belgian accounting law while enriching it with additional notes

useful for the good understanding of its activity by all

stakeholders.Until now, Solvac presented its financial statements

according to both the IFRS framework and the Belgian accounting law

framework. The presentation according to the IFRS framework was

published on a voluntary basis and did not result from any legal or

regulatory obligation.Based on discussions with different

stakeholders, it appears that the equity accounting of investments

in companies over which Solvac exercises significant influence does

not constitute relevant information for the reader of the financial

statements. He is in fact interested in the fair value of our (now

our two) participation(s), and in the impact that this (these) has

(have) on Solvac's assets.

- The Board of Directors reports the figures of the

statutory accounts of Solvac SA in 2023 :

|

EUR thousand |

|

2021 |

2022 |

|

|

Financial result |

|

123,966 |

132,085 |

|

|

Operating result |

|

-1,946 |

-4,742 |

|

| Profit

before tax |

|

122,020 |

127,343 |

|

| Profit

after tax |

|

122,020 |

127,343 |

|

| Gross

payment to shareholders |

|

119,273 |

124,189 |

|

|

Retained earnings |

|

2,747 |

3,154 |

|

The 2023 net income is € 127.3 million (versus €

122.0 million in 2022). The increase of € 5.3 million mainly comes

from the increase of the total dividend per share obtained from

Solvay (€ 4.05 per share in 2023 compared to € 3.85 per share in

2022).

- Two interim dividend payments were made, respectively

on August 24, 2023 and on December 29, 2023, the second

representing in principle the balance due, which the General

Shareholders Meeting will be asked to approve. In total, each share

received in 2023 a gross compensation increasing by 4.1 % compared

to 2022 :

|

EUR |

2022 |

2022 |

|

| A

first deposit |

3.26 |

3.35 |

|

| A

second deposit |

2.32 |

2.46 |

|

| Gross

dividend per share |

5.58 |

5.81 |

|

- Distribution of dividends for the 2023 financial year

by Solvay and Syensqo

The Board of Directors of Syensqo decided on March 11, 2024 to

pay on May 31st, 2024, a dividend for the financial year 2023

coming to € 1.62 gross per share.

The Board of Directors of Solvay decided on

March 12, 2024 to pay on June 05, 2024 the balance due on the

dividend for the financial year 2023, which comes to € 0.81 gross

per share. Taking into account the interim dividend of € 1.62 paid

on January 17 2024, the gross dividend of Solvay sets at € 2.43 for

the fiscal year 2023.

The Board of Directors of Solvac notes that during 2024, the sum

of dividends paid by Solvay and Syensqo will amount to €4.05 per

share, equal to the dividend paid in 2023.

NOTES

1. Statement from the statutory

auditor

EY confirms that its audit work on the financial statements of

Solvac SA, established according to the legal and regulatory

framework applicable in Belgium, has been substantially completed.

EY confirms that the financial information contained in this press

release does not require any comment on its end and is consistent

with the financial statements of Solvac SA. The complete audit

report of the financial statements as well as the complete report

of the Auditor relating to the audit of the annual financial

information will appear in the 2023 annual report which will be

published on the internet (www.solvac.be) on April 2, 2024.

2. Content

The risk management analysis is included in the

annual report, which will be available on the Internet

(www.solvac.be).

3. Solvac shares

|

|

2022 |

2023 |

|

| Number

of shares issued at the end of the period |

21,375,033 |

21,375,033 |

|

4. Statement by the responsible persons

M. Jean-Marie Solvay, Chairman of the Board of

Directors and M. Melchior de Vogüé, President of the Audit

Committee, confirm that to the best of their knowledge: a) the

financial statements, prepared in accordance with the applicable

accounting standards, give a true and fair view of the assets,

financial situation and results of the issuer;(b) the management

report contains a fair presentation of the development of the

issuer's business, results and situation, as well as a description

of the main risks and uncertainties they face.

Key dates for financial communications

• April 2, 2024:

Publication of the 2023 annual report on www.solvac.be • May 28,

2024:

Ordinary General Meeting and Extraordinary Meeting of the

Shareholders (2:30 pm) • August 2, 2024:

Results from the first half of 2024 and announcement of the first

interim dividend for financial year 2024• August 27, 2023:

Payment of

the first interim dividend for financial year 2024• December 18,

2024: Announcement of the second interim

dividend for financial year 2024• December 31, 2024:

Payment of the second interim dividend for

financial year 2024

For more information, please contact:

SOLVAC S.A.Investor RelationsChamps

Elyséesstreet, 43 B - 1050 BrusselsTel.: 32/2/639 66 30 Email:

Investor.relations@solvac.be

Dit persbericht is ook in het Nederlands

beschikbaar - Ce communiqué de presse est également disponible en

français

- Press Release Earnings 2023

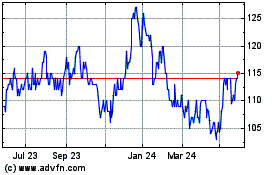

Solvac (EU:SOLV)

Historical Stock Chart

From Feb 2025 to Mar 2025

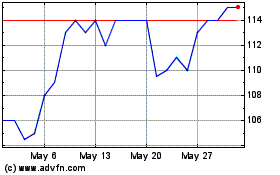

Solvac (EU:SOLV)

Historical Stock Chart

From Mar 2024 to Mar 2025