Swiss Franc Higher Amid Cautious Mood

August 28 2024 - 8:28AM

RTTF2

The Swiss franc rose against its major counterparts in the New

York session on Wednesday, as risk sentiment dampened ahead of the

release of quarterly results from AI darling Nvidia (NVDA) after

the close of today's trading.

Shares of Nvidia are currently tumbling by 3.2 percent, more

than offsetting the 1.5 percent jump seen during Tuesday's

session.

Traders also look ahead to the release of Commerce Department's

report on personal income and spending for July on Friday, which

includes readings on inflation said to be preferred by the Federal

Reserve.

Economists currently expect the report to show the annual rate

of consumer price growth was unchanged at 2.5 percent.

With inflation nearly defeated and the job market cooling, the

inflation reading could impact expectations for how quickly the Fed

cuts rates.

The franc advanced to a 5-day high of 171.72 against the yen,

near 2-week high of 1.1099 against the pound and near a 3-week high

of 0.9360 against the euro, off its early lows of 170.78, 1.1173

and 0.9420, respectively. The currency is seen finding resistance

around 174.5 against the yen, 1.09 against the pound and 0.925

against the euro.

The franc recovered to 0.8411 against the greenback, from an

early low of 0.8452. The currency is likely to locate resistance

around the 0.83 level.

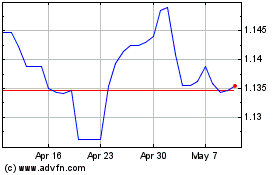

Sterling vs CHF (FX:GBPCHF)

Forex Chart

From Oct 2024 to Nov 2024

Sterling vs CHF (FX:GBPCHF)

Forex Chart

From Nov 2023 to Nov 2024