Adagene Inc. (“Adagene”) (Nasdaq: ADAG), a platform-driven,

clinical-stage biotechnology company transforming the discovery and

development of novel antibody-based therapies, today reported

financial results for the full year 2023 and provided corporate

updates.

“The SAFEbody precision masking technology

platform remains at the core of our value proposition given its

ability to enhance next generation antibody-based therapies that

span modalities, including bispecific T-cell engagers and

antibody-drug conjugates, both areas where a wider therapeutic

index is needed to fully address solid tumors,” said Peter Luo,

Ph.D., Chairman, CEO and President of R&D at Adagene.

He continued, “Turning to our clinical pipeline,

we remain steadfast in our belief that anti-CTLA-4 therapy can be

reimagined as a cornerstone of cancer care by enabling higher, more

frequent and repeated doses in combination with anti-PD-1 and other

therapies. With our SAFEbody platform, we have a 30-fold improved

therapeutic index for ADG126 and a mechanism enabling CTLA-4

mediated intratumoral Treg depletion. We are taking anti-CTLA-4

therapy to a new level unleashing this proven immunotherapy where

safety has limited its therapeutic potential.”

“In particular, our new loading dose regimen in

late-stage MSS CRC patients enables our masked anti-CTLA-4 therapy

to reach a high initial concentration, close to the steady state of

activated species within the tumor tissue to immediately engage the

CTLA-4 pathway and stop the tumor from aggressive growth. This

loading dose strategy, together with repeated maintenance doses at

10 mg/kg showing limited treatment-related grade 3 and no higher

toxicities with minimal late-onset toxicities for ADG126, is

expected to engage the CTLA-4 target consistently, thereby

maintaining and sustaining clinical benefit, via both the initial

response rate and prolonged survival benefit. We look forward to

reporting more clinical results for the ADG126 combination dose

expansion in MSS CRC later this year.”

PIPELINE HIGHLIGHTS

- Phase 1b/2 data for ADG126, a masked anti-CTLA-4

SAFEbody targeting a unique epitope of CTLA-4 on regulatory T cells

(Tregs) in tumor tissue as driven by the fundamental biology of

CTLA-4, showed a potential best-in-class profile in combination

with Merck’s anti-PD-1 therapy, KEYTRUDA®

(pembrolizumab)*, in MSS CRC, PD-1 experienced and PD-L1

low tumors:

- Results presented at the 2024 American Society of Clinical

Oncology (ASCO) Gastrointestinal (GI) Symposium from dose

escalation and dose expansion cohorts of ADG126 in combination with

pembrolizumab (200 mg/Q3W) demonstrated a differentiated safety

profile for ADG126 at doses from 6 mg/kg to 10 mg/kg in heavily

pre-treated advanced/metastatic patients (N=46):

- Limited dose-dependent toxicities were observed.

- Grade 3 TRAEs occurred in 5/46 patients (10.8%), with no Grade

4 or 5 TRAEs and a discontinuation rate of 6.5% (3/46).

- In dose escalation across tumor types, two partial confirmed

responses (PRs) were observed among the three patients treated with

ADG126 10 mg/kg Q3W, which triggered expansion cohorts at this

dosing regimen. One of the patients had PD-1 refractory cervical

cancer and the other had endometrial cancer. Both confirmed PRs are

sustained after more than one year with repeat dosing while

maintaining robust safety profiles.

- In dose expansion of patients with MSS CRC, 12 evaluable

patients without liver metastases were treated at the active,

potent dose of 10 mg/kg Q3W:

- Two confirmed PRs were observed in nine of these patients

without peritoneal and liver metastases, resulting in an overall

response rate of 22% in this subset.

- An additional seven of these nine patients experienced stable

disease (SD) for an overall disease control rate of 100% (2 PRs and

7 SD).

- Observation of these clinical activities triggered further

expansion into the second stage of the Simon’s 2-stage design for

this dose level.

- In a preliminary progression-free survival (PFS) analysis of

those MSS CRC patients free of liver and peritoneal metastasis, a

median PFS of seven months was observed in those treated with

ADG126 10 mg/kg at two dosing frequencies pooled together [every

three weeks (n=9) and every six weeks (n=6)]. The durable clinical

activity of ADG126 in combination with pembrolizumab will continue

to be evaluated as a larger cohort of subjects becomes evaluable at

the 10 mg/kg Q3W dose level.

- Following the ASCO GI Symposium, Adagene announced progress and

expansion of the ADG126 clinical program, which increases the

ongoing phase 2 dose expansion in MSS CRC to over 50 patients.

Updates included:

- Enrollment of 12 additional patients in the second stage of the

Simon’s 2-stage design was completed in the fourth quarter of 2023

for the ongoing phase 2 dose expansion cohort evaluating ADG126 10

mg/kg Q3W in combination with pembrolizumab in MSS CRC. These

Part 2 results will supplement data from Part 1 of the dose

expansion in MSS CRC as recently presented at the 2024 ASCO GI

Symposium.

- Given the ADG126 safety profile, evaluation of the 20 mg/kg

loading dose regimen has been initiated in combination with

pembrolizumab in patients with advanced/metastatic cancer. Pending

outcome of the ongoing safety evaluation, the company plans to

evaluate the efficacy profile of the loading dose regimen in

expansion cohorts, followed by maintenance with ADG126 10 mg/kg Q3W

in combination with pembrolizumab at sites in the US and Asia

Pacific.

- Clearance received from China’s Center for Drug Evaluation to

initiate clinical evaluation of ADG126 in combination with

pembrolizumab. This enables the company to broaden its dose

expansion cohorts for MSS CRC at selected dosing regimens, and

potentially in other tumor types, in its clinical trial

collaboration and supply agreement with Merck.

- Additionally, the company recently

initiated dosing of a small number of patients with

advanced/metastatic cancers at 30 mg/kg ADG126 monotherapy Q3W in

China to define the potential maximum tolerated dose of ADG126

monotherapy.

- Phase 1b/2 data for ADG116, an unmasked anti-CTLA-4

NEObody™ targeting a unique epitope, showed a favorable safety

profile and clinical responses, both in monotherapy and in

combination with anti-PD-1:

- ADG116 monotherapy has demonstrated a favorable safety profile

at doses up to 15 mg/kg (N=59) and an overall response rate (ORR)

of 13% (3/23 evaluable), including confirmed and durable PRs in

multiple tumor types.

- In combination with anti-PD-1 therapy, ADG116 (3 mg/kg Q6W)

(N=22) showed a manageable safety profile and an encouraging

efficacy profile in dose escalation. Clinical responses from the

combination cohorts include a complete response (CR) sustained for

nearly two years in a head and neck squamous cell carcinoma (HNSCC)

patient dosed with repeat cycles of ADG116 3 mg/kg (initially every

three weeks, then every six weeks) plus toripalimab (ORR = 20%; 1/5

evaluable). An initial PR was also observed in a patient with MSS

CRC dosed with repeat cycles of ADG116 3 mg/kg every six weeks plus

toripalimab, further demonstrating the potential clinical benefit

associated with targeting a unique epitope of CTLA-4 and the

essential effects of Treg depletion.

- ADG116 is clinically active and

ready to advance into further clinical development as resources

allow.

- Phase 1 evaluation is ongoing for ADG206,

a masked, IgG1 FC-enhanced

anti-CD137 POWERbody™ in patients with advanced/metastatic

tumors:

- Adagene has enrolled 10 patients in an ongoing phase 1 trial of

ADG206 to evaluate safety, efficacy and tolerability profiles for

this next generation anti-CD137 candidate. Dose escalation

continues with a cohort ongoing at 3 mg/kg Q3W. No maximum

tolerated dose (MTD) has yet been reached.

- Preclinical data demonstrated that ADG206 was well

tolerated and had robust anti-tumor activity as a single agent in

multiple tumor models, with 4-fold stronger anti-CD137 agonistic

activity of its activated form than a benchmark antibody (urelumab

analog) that displayed dose-dependent liver toxicity with an MTD of

0.1 mg/kg Q3W.

- ADG206 is the company’s first SAFEbody with Fc enhancement,

called a POWERbody, to advance into clinic. ADG206 combines

SAFEbody precision masking, Fc enhancement and targeting of a

unique epitope to solve the safety and efficacy challenges of

anti-CD137 therapies, reflecting versatility of Adagene’s dynamic

antibody discovery and masking platform.

COLLABORATIONS

- Exelixis: In June 2023, Adagene received

a US$3.0 million milestone payment from Exelixis for the successful

nomination of lead SAFEbody candidates for the second collaboration

program under a technology licensing agreement to develop novel

masked antibody-drug conjugate candidates.

- Sanofi: Adagene and Sanofi are collaborating

to develop both bispecific and monoclonal SAFEbody antibody

candidates, preparing preclinical candidates using Adagene’s

SAFEbody precision masking technology for future development and

commercialization by Sanofi. The collaboration announced in March

2022 included an upfront payment of US$17.5 million for the initial

two programs, an option fee for two additional programs, potential

milestone payments of up to US$2.5 billion, and tiered

royalties.

- Roche: Roche is sponsoring and conducting a

phase 1b/2 multi-national trial to evaluate ADG126 in a triple

combination with atezolizumab and bevacizumab in first-line

hepatocellular carcinoma (HCC). Adagene retains global

development and commercialization rights to ADG126.

CHANGE OF BOARD OF DIRECTORS

The following changes to Adagene’s Board of Directors will be

effective upon the filing of its 2023 annual report on Form 20-F

(“2023 Annual Report”), unless otherwise noted:

- Dr. Ulf Grawunder will join the Board of Directors (the

“Board”) as an independent director and serves as a member of Audit

Committee and Strategy Committee of the Board. Dr. Grawunder is an

experienced Swiss/German life-science entrepreneur with over 20

years of experience in the therapeutic antibody development

industry.

- Dr. Zhu Li, currently an independent director, will serve as a

member of Compensation Committee of the Board.

- Term of Mr. Andy (Yiu Leung) Cheung, Dr. Mervyn Turner and Mr.

Man Kin (Raymond) Tam will be extended.

- Dr. Min Li, currently an independent director and a member of

Audit Committee, Compensation Committee and Nominating and

Corporate Governance Committee, and Ms. Yan Li, Senior Vice

President of Bioinformatics and Information Technology and

currently a member of the Board, will resign as directors of the

Board and membership of the various committees, as applicable, due

to person reasons. Ms. Yan Li's resignation from the board will be

effective on June 15, 2024, after which she will continue to serve

as an observer to the Board. Each of Dr. Min Li and Ms. Yan Li

confirmed that he or she has no disagreement with the Board, and

there is no other matter relating to his or her resignation that

needs to be brought to the attention of the shareholders of the

company.

The Board would like to take this opportunity to express their

sincere gratitude to Dr. Min Li and Ms. Yan Li for their valuable

contributions to the Board during their tenure. Background of the

newly appointed directors and their terms are detailed in the 2023

Annual Report.

2024 MILESTONES & CASH RUNWAY INTO 2026

Consistent with ongoing initiatives to prudently manage its cash

balance, Adagene expects its current cash balance to fund

activities into 2026, with the following milestones:

- Data from the ongoing phase 1b/2 clinical trial of ADG126 in

combination with pembrolizumab, including dose expansion cohorts in

MSS CRC, are anticipated throughout 2024:

- Follow up of Part 1 evaluable patients at 10 mg/kg Q3W (n=12)

and 10 mg/kg Q6W (n=10)

- Data from Part 2 patients at 10 mg/kg Q3W (n=12)

- Evaluation of 20 mg/kg loading doses for Project Optimus

requirements:

- Safety data with repeat doses

- Dose expansion in MSS CRC (n~10)

- Additional patients in China (n≥10)

- Additional

technology licensing agreement(s) and/or milestone(s).

FINANCIAL HIGHLIGHTS

Cash and Cash EquivalentsCash

and cash equivalents were US$109.9 million as of December 31, 2023,

compared to US$143.8 million as of December 31, 2022. Total

borrowings from commercial banks in China (denominated in RMB)

decreased to US$21.9 million as of December 31, 2023 from US$27.8

million as of December 31, 2022. The associated loan proceeds were

primarily used to pay for the company’s R&D activities

in China.

Net Revenue:Net revenue was

US$18.1 million for the year ended December 31, 2023, compared to

US$9.3 million in 2022. The increase of approximately 95% reflects

net revenue recognized upon fulfillment of certain performance

obligations associated with the collaboration and technology

licensing agreements with Exelixis and Sanofi, respectively. Net

revenue also included a milestone payment of US$3.0 million from

Exelixis received in June 2023.

Research and Development (R&D)

Expenses: R&D expenses were US$36.6 million for the

year ended December 31, 2023, compared to US$81.3 million in 2022.

The decrease of approximately 55% in R&D expenses reflects

clinical focus on and prioritization of the company’s masked,

anti-CTLA-4 SAFEbody ADG126.

Administrative

Expenses:Administrative expenses were US$8.7 million for

the year ended December 31, 2023, compared to US$11.9 million in

2022. The decrease was due to both a reduction in personnel and in

office-related expenses as a result of cost-control measures.

Other Operating Income,

Net:Other operating income, net was US$3.5 million for the

year ended December 31, 2023. Other operating income, net included

a one-time compensation payment from a contract manufacturer for a

preclinical-related outsourcing arrangement.

Net Loss:Net loss attributable

to Adagene Inc.’s shareholders was US$18.9 million for the year

ended December 31, 2023, compared to US$80.0 million in 2022.

Ordinary Shares Outstanding:As

of December 31, 2023, there were 55,145,839 ordinary shares issued

and outstanding. Each American depository share, or ADS, represents

one and one quarter (1.25) ordinary shares of the company.

Non-GAAP Net Loss:Non-GAAP net

loss, which is defined as net loss attributable to ordinary

shareholders for the period after excluding share-based

compensation expenses, was US$11.7 million for the year ended

December 31, 2023, compared to US$69.5 million in 2022. Please

refer to the section in this press release titled “Reconciliation

of GAAP and Non-GAAP Results” for details.

Non-GAAP Financial MeasuresThe

company uses non-GAAP net loss and non-GAAP net loss per ordinary

shares for the year, which are non-GAAP financial measures, in

evaluating its operating results and for financial and operational

decision-making purposes. The company believes that non-GAAP net

loss and non-GAAP net loss per ordinary shares for the year help

identify underlying trends in the company’s business that could

otherwise be distorted by the effect of certain expenses that the

company includes in its loss for the year. The company believes

that non-GAAP net loss and non-GAAP net loss per ordinary shares

for the year provide useful information about its results of

operations, enhances the overall understanding of its past

performance and future prospects and allows for greater visibility

with respect to key metrics used by its management in its financial

and operational decision-making.

Non-GAAP net loss and non-GAAP net loss per ordinary shares for

the year should not be considered in isolation or construed as an

alternative to operating profit, loss for the year or any other

measure of performance or as an indicator of its operating

performance. Investors are encouraged to review non-GAAP net loss

and non-GAAP net loss per ordinary shares for the year and the

reconciliation to their most directly comparable GAAP measures.

Non-GAAP net loss and non-GAAP net loss per ordinary shares for the

year here may not be comparable to similarly titled measures

presented by other companies. Other companies may calculate

similarly titled measures differently, limiting their usefulness as

comparative measures to the company’s data. The company encourages

investors and others to review its financial information in its

entirety and not rely on a single financial measure.

Non-GAAP net loss and non-GAAP net loss per ordinary shares for

the year represent net loss attributable to ordinary shareholders

for the year excluding share-based compensation expenses.

Share-based compensation expense is a non-cash expense arising from

the grant of stock-based awards to employees. The company believes

that the exclusion of share-based compensation expenses from the

net loss in the Reconciliation of GAAP and Non-GAAP Results assists

management and investors in making meaningful period-to-period

comparisons in the company's operating performance or peer group

comparisons because (i) the amount of share-based compensation

expenses in any specific period may not directly correlate to the

company’s underlying performance, (ii) such expenses can vary

significantly between periods as a result of the timing of grants

of new stock-based awards, and (iii) other companies may use

different forms of employee compensation or different valuation

methodologies for their share-based compensation.

Please see the “Reconciliation of GAAP and Non-GAAP Results”

included in this press release for a full reconciliation of

non-GAAP net loss and non-GAAP net loss per ordinary shares for the

year to net loss attributable to ordinary shareholders for the

year/period.

About AdageneAdagene Inc. (Nasdaq:

ADAG) is a platform-driven, clinical-stage biotechnology company

committed to transforming the discovery and development of novel

antibody-based cancer immunotherapies. Adagene combines

computational biology and artificial intelligence to design novel

antibodies that address globally unmet patient needs. The

company has forged strategic collaborations with reputable

global partners that leverage its SAFEbody® precision masking

technology in multiple approaches at the vanguard of science.

Powered by its proprietary Dynamic Precision

Library (DPL) platform, composed of NEObody™, SAFEbody, and

POWERbody™ technologies, Adagene’s highly differentiated pipeline

features novel immunotherapy programs. The company’s SAFEbody

technology is designed to address safety and tolerability

challenges associated with many antibody therapeutics by using

precision masking technology to shield the binding domain of the

biologic therapy. Through activation in the tumor microenvironment,

this allows for tumor-specific targeting of antibodies in tumor

microenvironment, while minimizing on-target off-tumor toxicity in

healthy tissues.

Adagene’s lead clinical program, ADG126 (muzastotug), is a

masked, anti-CTLA-4 SAFEbody that targets a unique epitope of

CTLA-4 in regulatory T cells (Tregs) in the tumor microenvironment.

ADG126 is currently in phase 1b/2 clinical studies in combination

with anti-PD-1 therapy, particularly focused on Metastatic

Microsatellite-stable (MSS) Colorectal Cancer (CRC). Validated

by ongoing clinical research, the SAFEbody platform can be applied

to a wide variety of antibody-based therapeutic modalities,

including Fc enhanced antibodies, antibody-drug conjugates,

and bi/multispecific T-cell engagers.

For more information, please

visit: https://investor.adagene.com.

Follow Adagene on WeChat, LinkedIn and Twitter.

SAFEbody® is a registered trademark in the United

States, China, Australia, Japan, Singapore, and

the European Union.

*KEYTRUDA® is a registered trademark of Merck Sharp & Dohme

LLC, a subsidiary of Merck & Co., Inc., Rahway, NJ, USA.

Safe Harbor Statement

This press release contains forward-looking

statements, including statements regarding the potential

implications of clinical data for patients, and Adagene’s

advancement of, and anticipated preclinical activities, clinical

development, regulatory milestones, and commercialization of its

product candidates. Actual results may differ materially from those

indicated in the forward-looking statements as a result of various

important factors, including but not limited to Adagene’s ability

to demonstrate the safety and efficacy of its drug candidates; the

clinical results for its drug candidates, which may not support

further development or regulatory approval; the content and timing

of decisions made by the relevant regulatory authorities regarding

regulatory approval of Adagene’s drug candidates; Adagene’s ability

to achieve commercial success for its drug candidates, if approved;

Adagene’s ability to obtain and maintain protection of intellectual

property for its technology and drugs; Adagene’s reliance on third

parties to conduct drug development, manufacturing and other

services; Adagene’s limited operating history and Adagene’s ability

to obtain additional funding for operations and to complete the

development and commercialization of its drug candidates; Adagene’s

ability to enter into additional collaboration agreements beyond

its existing strategic partnerships or collaborations, and the

impact of the outbreak of a widespread health epidemic on Adagene’s

clinical development, commercial and other operations, as well as

those risks more fully discussed in the “Risk Factors” section in

Adagene’s annual report for the year of 2023 on Form 20-F filed

with the U.S. Securities and Exchange Commission. All

forward-looking statements are based on information currently

available to Adagene, and Adagene undertakes no obligation to

publicly update or revise any forward-looking statements, whether

as a result of new information, future events or otherwise, except

as may be required by law.

Investor & Media Contact:Ami

Knoefler650-739-9952ir@adagene.com

FINANCIAL TABLES FOLLOW

Unaudited Consolidated Balance

Sheets

|

|

December 31,2022 |

December 31, 2023 |

|

|

US$ |

US$ |

|

ASSETS |

|

|

|

Current assets: |

|

|

|

Cash and cash equivalents |

143,758,678 |

|

109,934,257 |

|

|

Amounts due from related parties |

619,432 |

|

222,027 |

|

|

Prepayments and other current assets |

4,937,323 |

|

3,287,445 |

|

|

Total current assets |

149,315,433 |

|

113,443,729 |

|

|

Property, equipment and software, net |

2,782,963 |

|

1,835,121 |

|

|

Operating lease right-of-use assets |

191,877 |

|

365,103 |

|

|

Other non-current assets |

109,572 |

|

84,885 |

|

|

TOTAL ASSETS |

152,399,845 |

|

115,728,838 |

|

|

LIABILITIES AND SHAREHOLDERS’ EQUITY |

|

|

|

Current liabilities: |

|

|

|

Accounts payable |

3,666,124 |

|

3,093,752 |

|

|

Contract liabilities |

15,107,276 |

|

— |

|

|

Amounts due to related parties |

19,323,337 |

|

16,714,326 |

|

|

Accruals and other current liabilities |

3,212,809 |

|

3,001,508 |

|

|

Income tax payable |

— |

|

52,884 |

|

|

Short-term borrowings |

10,768,745 |

|

4,235,673 |

|

|

Current portion of long-term borrowings |

2,850,128 |

|

4,161,549 |

|

|

Current portion of operating lease liabilities |

151,983 |

|

195,955 |

|

|

Total current liabilities |

55,080,402 |

|

31,455,647 |

|

|

Long-term borrowings |

14,146,541 |

|

13,540,034 |

|

|

Operating lease liabilities |

53,834 |

|

173,660 |

|

|

Other non-current liabilities |

28,718 |

|

— |

|

|

TOTAL LIABILITIES |

69,309,495 |

|

45,169,341 |

|

|

Commitments and contingencies |

|

|

|

Shareholders’ equity: |

|

|

|

Ordinary shares (par value of US$0.0001 per share; 640,000,000

shares authorized, and 54,065,709 shares issued and outstanding as

of December 31, 2022; and 640,000,000 shares authorized, and

55,145,839 shares issued and outstanding as of December 31,

2023) |

5,497 |

|

5,547 |

|

|

Treasury shares, at cost (1 share as of December 31, 2022 and

December 31, 2023) |

(4 |

) |

(4 |

) |

|

Additional paid-in capital |

342,739,268 |

|

350,105,518 |

|

|

Accumulated other comprehensive loss |

(849,305 |

) |

(1,800,088 |

) |

|

Accumulated deficit |

(258,805,106 |

) |

(277,751,476 |

) |

|

Total shareholders’ equity |

83,090,350 |

|

70,559,497 |

|

|

TOTAL LIABILITIES AND SHAREHOLDERS’ EQUITY |

152,399,845 |

|

115,728,838 |

|

Unaudited Consolidated Statements of

Comprehensive Loss

| |

For the Year Ended December 31, 2022 |

For the Year Ended December 31, 2023 |

|

|

US$ |

US$ |

|

Revenues |

|

|

|

Licensing and collaboration revenue |

9,292,724 |

|

18,111,491 |

|

|

Operating expenses and income |

|

|

|

Research and development expenses |

(81,339,540 |

) |

(36,639,146 |

) |

|

Third parties |

(46,212,077 |

) |

(33,978,642 |

) |

|

Related parties |

(35,127,463 |

) |

(2,660,504 |

) |

|

Administrative expenses |

(11,873,867 |

) |

(8,672,843 |

) |

|

Other operating income, net |

— |

|

3,480,632 |

|

|

Loss from operations |

(83,920,683 |

) |

(23,719,866 |

) |

|

Interest income |

377,501 |

|

4,283,085 |

|

|

Interest expense |

(693,323 |

) |

(1,107,820 |

) |

|

Other income, net |

2,168,388 |

|

1,843,437 |

|

|

Foreign exchange gain, net |

2,555,325 |

|

1,446,202 |

|

|

Loss before income tax |

(79,512,792 |

) |

(17,254,962 |

) |

|

Income tax expense |

(459,055 |

) |

(1,691,408 |

) |

|

Net loss attributable to Adagene Inc.’s

shareholders |

(79,971,847 |

) |

(18,946,370 |

) |

|

Other comprehensive loss |

|

|

|

Foreign currency translation adjustments, net of nil tax |

(755,324 |

) |

(950,783 |

) |

|

Total comprehensive loss attributable to

Adagene Inc.’s shareholders |

(80,727,171 |

) |

(19,897,153 |

) |

|

Net loss attributable to Adagene Inc.’s

shareholders |

(79,971,847 |

) |

(18,946,370 |

) |

|

Net loss attributable to ordinary

shareholders |

(79,971,847 |

) |

(18,946,370 |

) |

|

Weighted average number of ordinary shares used in per

share calculation: |

|

|

|

—Basic |

54,135,084 |

|

54,737,530 |

|

|

—Diluted |

54,135,084 |

|

54,737,530 |

|

|

Net loss per ordinary share |

|

|

|

—Basic |

(1.48 |

) |

(0.35 |

) |

|

—Diluted |

(1.48 |

) |

(0.35 |

) |

Reconciliation of GAAP and Non-GAAP

Results

|

|

For the Year Ended December 31, 2022 |

For the Year Ended December 31, 2023 |

|

|

US$ |

US$ |

|

GAAP net loss attributable to ordinary

shareholders |

(79,971,847 |

) |

(18,946,370 |

) |

|

Add back: |

|

|

|

Share-based compensation expenses |

10,520,282 |

|

7,271,700 |

|

|

Non-GAAP net loss |

(69,451,565 |

) |

(11,674,670 |

) |

|

Weighted average number of ordinary shares used in per share

calculation: |

|

|

|

—Basic |

54,135,084 |

|

54,737,530 |

|

|

—Diluted |

54,135,084 |

|

54,737,530 |

|

|

Non-GAAP net loss per ordinary share |

|

|

|

—Basic |

(1.28 |

) |

(0.21 |

) |

|

—Diluted |

(1.28 |

) |

(0.21 |

) |

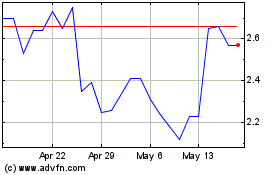

Adagene (NASDAQ:ADAG)

Historical Stock Chart

From Nov 2024 to Dec 2024

Adagene (NASDAQ:ADAG)

Historical Stock Chart

From Dec 2023 to Dec 2024