As filed with the

Securities and Exchange Commission on November 18, 2024.

Registration Statement No. 333-

UNITED STATES

SECURITIES AND EXCHANGE

COMMISSION

Washington, D.C.

20549

FORM S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES

ACT OF 1933

Applied DNA Sciences, Inc.

(Exact name of Registrant

as specified in its charter)

| Delaware |

|

7380 |

|

59-2262718 |

(State

or other jurisdiction of

incorporation

or organization) |

|

(Primary

Standard Industrial

Classification

Code Number) |

|

(I.R.S.

Employer

Identification

Number) |

50 Health Sciences

Drive

Stony Brook, New

York 11790

631-240-8800

(Address, including

zip code, and telephone number, including area code, of Registrant’s principal executive offices)

James A. Hayward,

Ph.D., Sc.D.

Chairman, Chief Executive Officer and President

Applied DNA Sciences, Inc.

50 Health Sciences Drive

Stony Brook, New York 11790

631-240-8801

(Name, address,

including zip code, and telephone number, including area code, of agent for service)

Copies to:

Merrill M. Kraines

Todd Kornfeld

McDermott Will &

Emery LLP

One Vanderbilt Avenue

New York, New York

10017-3852

(212)

547-5616

Approximate date of commencement of

proposed sale to the public:

From time to time after this Registration

Statement becomes effective.

If

any of the securities being registered on this form are to be offered on a delayed or continuous basis pursuant to Rule 415 under

the Securities Act of 1933, check the following box. x

If

this form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please

check the following box and list the Securities Act registration statement number of the earlier effective registration statement

for the same offering. ¨

If

this form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and

list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If

this form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and

list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

Indicate by check

mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or

an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller

reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer |

|

¨ |

|

Accelerated filer |

|

¨ |

| |

|

|

|

| Non-accelerated filer |

|

x |

|

Smaller reporting company |

|

x |

| |

|

|

|

| |

|

|

|

Emerging growth company |

|

¨ |

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. ¨

The Registrant

hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrant

shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance

with Section 8(a) of the Securities Act of 1933, as amended, or until the Registration Statement shall become effective on

such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

The

information contained in this prospectus is not complete and may be changed. The selling stockholders named in this prospectus may not

sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus

is not an offer to sell these securities and we are not soliciting offers to buy these securities in any jurisdiction where such offer

or sale is not permitted.

| PRELIMINARY

PROSPECTUS |

|

SUBJECT

TO COMPLETION |

|

DATED

NOVEMBER 18, 2024 |

Up to 20,312,500

shares of Common Stock underlying the Series C Warrants

Up to 20,312,500

shares of Common Stock underlying the Series D Warrants

Up to 1,015,625

shares of Common Stock underlying the Placement Agent Warrants

Applied

DNA Sciences, Inc.

This prospectus relates

to the resale from time to time, by the selling stockholders (the “Selling Stockholders”) identified in this prospectus under

the caption “Selling Stockholders,” of up to an aggregate of 41,640,625 shares of common stock, par value $0.001 per share

(the “Common Stock”), which the selling stockholders (the “Selling Stockholders”) may acquire upon the exercise

of outstanding warrants, consisting of (i) 20,312,500 Series C Warrants (the “Series C Warrants”), (ii) 20,312,500

Series D Warrants (“Series D Warrants”, and, together with the Series C Warrants, the “Series Warrants”)

and (iii) 1,015,625 Placement Agent Warrants (“Placement Agent Warrants”, and together with the Series Warrants,

the “Private Placement Warrants”).

We issued the Series Warrants

to the Selling Stockholders in a private placement concurrent with a registered direct offering (the “Offering”) of 19,247,498

shares of Common Stock and pre-funded warrants (the “Pre-Funded Warrants”) to purchase 1,065,002 shares of Common Stock.

We issued the Placement Agent Warrants to the Selling Stockholders pursuant to that certain engagement letter dated August 23, 2024,

by and between the Company and Craig-Hallum Capital Group LLC (“Craig Hallum”).

The exercisability

of the Private Placement Warrants will be available only upon receipt of such stockholder approval (the “Warrant Stockholder Approval”)

as may be required by the applicable rules and regulations of The Nasdaq Stock Market LLC. Each Series C Warrant has an exercise

price of $0.32 per share of Common Stock, will become exercisable upon the first trading day (the “Stockholder Approval Date”)

following the Company’s notice to warrantholders of Warrant Stockholder Approval, and will expire on the five-year anniversary

of the Stockholder Approval Date. Each Series D Warrant has an exercise price of $0.32 per share of Common Stock, will become exercisable

upon the Stockholder Approval Date, and will expire on the 18-month anniversary of the Stockholder Approval Date. Each Placement Agent

warrant has an exerice price of $0.32, will become exercisable upon the Stockholder Approval date and will expire on October 30,

2029.

The closing of the

issuance and sale of the Private Placement Warrants, Common Stock and Pre-Funded Warrants was consummated on October 31, 2024.

The Selling Stockholders

of the securities and any of their pledgees, assignees and successors-in-interest may, from time to time, sell any or all of their securities

covered hereby on the principal trading market or any other stock exchange, market or trading facility on which the securities are traded

or in private transactions. These sales may be at fixed or negotiated prices. See “Plan of Distribution” in this prospectus

for more information. We will not receive any proceeds from the resale or other disposition of the Common Stock by the Selling Stockholders.

However, we will receive the proceeds of any cash exercise of the Private Placement Warrants. See “Use of Proceeds” beginning

on page 13 and “Plan of Distribution” beginning on page 17 of this prospectus for more information.

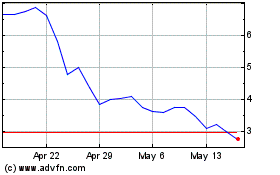

Our Common Stock is listed on Nasdaq under the symbol “APDN.”

On November 15, 2024, the last reported sale price of our Common Stock was $0.16 per share.

We are a “smaller

reporting company,” as defined under the federal securities laws and, as such, have elected to comply with certain reduced reporting

requirements for this prospectus and may elect to do so in future filings. See the section titled “Implications of Being a Smaller

Reporting Company.”

Investing

in our securities involves a high degree of risk. See “Risk Factors”

beginning on page 8 of this prospectus and under similar headings in the other documents that are incorporated by reference into

this prospectus for a discussion of information that should be considered in connection with an investment in our securities.

Neither the Securities

and Exchange Commission (“SEC”) nor any state securities commission has approved or disapproved of these securities or passed

upon the adequacy or accuracy of this prospectus. Any representation to the contrary is a criminal offense. The securities are not being

offered in any jurisdiction where the offer is not permitted.

The date of this prospectus

is , 2024.

TABLE OF CONTENTS

Prospectus

ABOUT

THIS PROSPECTUS

The

information contained in this prospectus is not complete and may be changed. You should rely only on the information provided in or incorporated

by reference in this prospectus, or in a related free writing prospectus, or documents to which we otherwise refer you. We have not authorized

anyone else to provide you with different information.

We have not authorized

any dealer, agent or other person to give any information or to make any representation other than those contained or incorporated by

reference in this prospectus or any related free writing prospectus. You must not rely upon any information or representation not contained

or incorporated by reference in this prospectus or any related free writing prospectus. This prospectus and any related free writing

prospectus, if any, do not constitute an offer to sell or the solicitation of an offer to buy any securities other than the registered

securities to which they relate, nor do this prospectus and any related free writing prospectus, if any, constitute an offer to sell

or the solicitation of an offer to buy securities in any jurisdiction to any person to whom it is unlawful to make such offer or solicitation

in such jurisdiction. You should not assume that the information contained in this prospectus and any related free writing prospectus,

if any, is accurate on any date subsequent to the date set forth on the front of such document or that any information we have incorporated

by reference is correct on any date subsequent to the date of the document incorporated by reference, even though this prospectus and

any related free writing prospectus is delivered or securities are sold on a later date.

We have not done anything

that would permit this offering or possession or distribution of this prospectus or any free writing prospectus in any jurisdiction where

action for that purpose is required, other than in the United States. You are required to inform yourself about and to observe any restrictions

relating as to this offering and the distribution of this prospectus and any such free writing prospectus outside the United States.

We further note that

the representations, warranties and covenants made by us in any agreement that is filed as an exhibit to any document that is incorporated

by reference in this prospectus were made solely for the benefit of the parties to such agreement, including, in some cases, for the

purpose of allocating risk among the parties to such agreements, and should not be deemed to be a representation, warranty or covenant

to you. Moreover, such representations, warranties or covenants were accurate only as of the date when made. Accordingly, such representations,

warranties and covenants should not be relied on as accurately representing the current state of our affairs.

The SEC allows us

to “incorporate by reference” into this prospectus the information in documents we file with it, which means that we can

disclose important information to you by referring you to those documents. The information incorporated by reference is considered to

be a part of this prospectus, and information that we file later with the SEC will automatically update and supersede this information.

Any statement contained in any document incorporated or deemed to be incorporated by reference herein shall be deemed to be modified

or superseded for purposes of this prospectus to the extent that a statement contained in or omitted from this prospectus or any accompanying

prospectus supplement, or in any other subsequently filed document which also is or is deemed to be incorporated by reference herein,

modifies or supersedes such statement. Any such statement so modified or superseded shall not be deemed, except as so modified or superseded,

to constitute a part of this prospectus.

PROSPECTUS

SUMMARY

This summary highlights

certain information about us, this offering and information appearing elsewhere in this prospectus and in the documents we incorporate

by reference in this prospectus. This summary is not complete and does not contain all of the information that you should consider before

investing in our securities. After you carefully read this summary, to fully understand our Company and this offering and its consequences

to you, you should read this entire prospectus and any related free writing prospectus authorized by us, including the information referred

to under the heading “Risk Factors” in this prospectus beginning on page 8, and any related free writing prospectus,

as well as the other documents that we incorporate by reference into this prospectus, including our financial statements and the notes

to those financial statements, which are incorporated herein by reference from our Annual

Report on Form 10-K for the year ended September 30, 2023, filed December 7, 2023, as amended

on January 26, 2024, and our Quarterly

Reports on Form 10-Q for the three month periods ended December 31, 2023, filed on February 8, 2024, March 31,

2024, filed on May 10,

2024 and June 30, 2024, filed on August 8,

2024, respectively. Please read “Where You Can Find More Information” on page 23 of this prospectus.

In this prospectus,

unless context requires otherwise, references to “we,” “us,” “our,” or “the Company”

refer to Applied DNA Sciences, Inc., a Delaware corporation and its consolidated subsidiaries. Our trademarks currently used in

the United States include Applied DNA Sciences®, SigNature® molecular tags, SigNature® T molecular tags, fiberTyping®,

SigNify®, Beacon®, CertainT®, LineaDNA®, Linea RNAPTM, Linea™ COVID-19 Diagnostic Assay Kit, safeCircle®

COVID-19 testing and TR8TM pharmacogenetic testing. We do not intend our use or display of other companies’

trade names or trademarks to imply a relationship with, or endorsement or sponsorship of us by, any other companies. All trademarks,

service marks and trade names included in this prospectus are the property of the respective owners.

Applied DNA Sciences, Inc.

Introduction

We are a biotechnology

company developing and commercializing technologies to produce and detect deoxyribonucleic acid (“DNA”) and ribonucleic acid

(“RNA”). Using polymerase chain reaction (“PCR”) to enable the production and detection of DNA and RNA, we currently

operate in three primary business markets: (i) the enzymatic manufacture of synthetic DNA for use in the production of nucleic acid-based

therapeutics (including biologics and drugs), as well as the development and sale of a proprietary RNA polymerase (“RNAP”)

for use in the production of messenger RNA (“mRNA”) therapeutics (“Therapeutic DNA Production Services”); (ii) the

detection of DNA and RNA in molecular diagnostics and genetic testing services (“MDx Testing Services”); and (iii) the

manufacture and detection of DNA for industrial supply chains and security services (“DNA Tagging and Security Products and Services”).

Our current growth

strategy is to primarily focus our resources on the further development, commercialization, and customer adoption of our Therapeutic

DNA Production Services, including the expansion of our contract development and manufacturing operation (“CDMO”) for the

manufacture of synthetic DNA for use in the production of nucleic acid-based therapies.

We will continue to

update our business strategy and monitor the use of our resources regarding our various business segments. The Company’s management

is currently engaged in a strategic review of the Company’s business segments that may result in the closure or divestiture of

the Company’s MDx Testing Services and/or DNA Tagging and Security Products and Services, as well as workforce reductions and potential

management changes. The terms and structure of any possible closure or divestiture have not been determined or agreed to by the Company’s

Board of Directors. Although the purpose of any closure or divestiture would be to reduce the Company’s expenses and effectuate

cost savings, it is possible that there may be restructuring costs. We expect that based on available opportunities and our beliefs regarding

future opportunities, we will continue to modify and refine our business strategy.

Therapeutic DNA

Production Services

Through our LineaRX, Inc.

subsidiary we are developing and commercializing our Linea DNA and Linea IVT platforms for the manufacture of synthetic DNA and proprietary

enzymes for use in the production of nucleic acid-based therapeutics.

Linea DNA Platform

Our Linea DNA platform

is our core enabling technology, and enables the rapid, efficient, and large-scale cell-free manufacture of high-fidelity DNA sequences

for use in the manufacturing of a broad range of nucleic acid-based therapeutics. The Linea DNA platform enzymatically produces a linear

form of DNA we call “LineaDNA” that is an alternative to plasmid-based DNA manufacturing technologies that have supplied

the DNA used in biotherapeutics for the past 40 years.

As of the third quarter

of calendar year 2024, there were 4,099 gene, cell and RNA therapies in development from preclinical through pre-registration stages,

almost all of which use DNA in their manufacturing process. (Source: ASGCT Gene, Cell & RNA Therapy Landscape: Q3 2024 Quarterly

Report ). Due to what we believe are the Linea DNA platform’s numerous advantages over legacy nucleic acid-based therapeutic

manufacturing platforms, we believe this large number of therapies under development represents a substantial market opportunity for

the Linea DNA platform to supplant legacy manufacturing methods in the manufacture of nucleic acid-based therapies although no assurance

can be given that we will be successful in exploiting this market opportunity.

We believe our Linea

DNA platform holds several important advantages over existing cell-based plasmid DNA manufacturing platforms. Plasmid-based DNA manufacturing

is based on the complex, costly and time-consuming biological process of amplifying DNA in living bacterial cells. Once amplified, the

DNA must be separated from the living cells and other process contaminants via multiple rounds of purification, adding further complexity

and costs. Unlike plasmid-based DNA manufacturing, the Linea DNA platform does not require living cells and instead amplifies DNA via

the enzymatic process of PCR. The Linea DNA platform is simple and can rapidly produce very large quantities of DNA without the need

for complex purification steps.

We believe the key

advantages of the Linea DNA platform include:

| |

· |

Speed –

Production of Linea DNA can be measured in terms of hours, not days and weeks as is the case with plasmid-based DNA manufacturing

platforms. |

| |

· |

Scalability

– Linea DNA production takes place on efficient bench-top instruments, allowing for rapid scalability in a minimal footprint. |

| |

|

|

| |

· |

Purity –

DNA produced via PCR is pure, resulting in only large quantities of only the target DNA sequence. Unwanted DNA sequences such as

the plasmid backbone and antibiotic resistance genes, inherent to plasmid DNA, are not present in Linea DNA. |

| |

|

|

| |

· |

Simplicity

– The production of Linea DNA is streamlined relative to plasmid-based DNA production. Linea DNA requires only four primary

ingredients, does not require living cells or complex fermentation systems and does not require multiple rounds of purification. |

| |

|

|

| |

· |

Flexibility

– DNA produced via the Linea DNA platform can be easily chemically modified to suit specific customer applications. In addition,

the Linea DNA platform can produce a wide range of complex DNA sequences that are difficult to produce via plasmid-based DNA production

platforms. These complex sequences include inverted terminal repeats and long homopolymers such as polyadenylation sequences (poly

(A) tail) important for gene therapy and mRNA therapies, respectively. |

Preclinical studies

conducted by the Company have shown that Linea DNA is substitutable for plasmid DNA in numerous nucleic acid-based therapies, including:

| |

· |

DNA templates

to produce RNA, including mRNA therapeutics; |

| |

· |

adoptive

cell therapy (CAR-T) manufacturing; and |

| |

· |

homology-directed

repair (HDR)-mediated gene editing. |

Further, we believe

that Linea DNA is also substitutable for plasmid DNA in the following nucleic acid-based therapies:

| |

· |

viral vector

manufacturing for in vivo and ex vivo gene editing; |

| |

· |

clustered

regularly interspaced short palindromic repeats-mediated gene therapy; and |

| |

· |

non-viral

gene therapy. |

Linea IVT Platform

The number of mRNA

therapies under development is growing at a rapid rate, thanks in part to the success of the mRNA COVID-19 vaccines. mRNA therapeutics

are produced via a process called in vitro transcription (“IVT”) that requires DNA as a starting material. As of

the third quarter of calendar 2024, there were over 450 mRNA therapies under development, with the majority of these therapies (67%)

in the preclinical stage (Source: ASGCT Gene, Cell & RNA Therapy Landscape: Q2 2024 Quarterly Report). The Company believes

that the mRNA market is in a nascent stage that represents a large growth opportunity for the Company via the production and supply of

DNA critical starting materials and RNAP to produce mRNA therapies.

In August 2022,

the Company launched DNA IVT templates manufactured via its Linea DNA platform that have resulted in evaluations of the Company’s

IVT templates by numerous therapeutic developers and CDMOs in the United States and the Asia-Pacific. In addition, the Company’s

IVT templates are under late-stage evaluations by two therapeutic developers and one CDMO for use as templates for the production of

mRNA intended for clinical use. However there can be no assurance that related contracts will be entered into. In response to this demand,

the continued growth of the mRNA therapeutic market, and the unique abilities of the Linea DNA platform, the Company acquired Spindle

in July 2023 to potentially increase its mRNA-related total addressable market (“TAM”).

Through our acquisition

of Spindle, we launched our Linea IVT platform in July 2023, which combines Spindle’s proprietary high-performance RNAP, now

marketed by the Company as Linea RNAP, with our enzymatically produced Linea DNA IVT templates. We believe the Linea IVT platform enables

our customers to make better mRNA, faster. Based on data generated by the Company, we believe the integrated Linea IVT platform offers

the following advantages over conventional mRNA production to therapy developers and manufacturers:

| |

· |

The prevention

or reduction of double stranded RNA (“dsRNA”) contamination resulting in higher target mRNA yields with the potential

to reduce downstream processing steps. dsRNA is a problematic immunogenic byproduct produced during conventional mRNA manufacture; |

| |

· |

delivery

of IVT templates in as little as 14 days for milligram scale and 30 days for gram scale; |

| |

· |

reduced mRNA

manufacturing complexities; and |

| |

· |

potentially

enabling mRNA manufactures to produce mRNA drug substance in less than 45 days. |

According to the Company’s

internal modeling, the ability to sell both Linea DNA IVT templates and Linea RNAP under the Linea IVT platform potentially increases

the Company’s mRNA-related TAM by approximately 3-5x as compared to selling Linea DNA IVT templates alone, while also providing

a more competitive offering to the mRNA manufacturing market. Currently, Linea RNAP is produced for the Company under an ISO 13485 quality

system by Alphazyme, LLC a third-party CDMO located in the United States. The Company recently completed manufacturing process development

work on its Linea RNAP to increase the production scale of the enzyme and reduce unit costs.

Manufacturing Scale-up

The Company plans

to offer several quality grades of Linea DNA, each of which will have different permitted uses.

| Quality

Grade |

Permitted

Use |

Company

Status |

| GLP |

Research

and pre-clinical discovery |

Currently

available |

| GMP

for Starting Materials |

DNA

critical starting materials for the production of mRNA therapies |

Planned

availability in Q4 of CY2024 |

| GMP |

DNA

biologic, drug substance and/or drug product |

Planned

availability second half of CY 2025 (1) |

| |

(1) |

Dependent

on the availability of future financing. |

|

| |

|

|

|

|

We are currently manufacturing

Linea DNA pursuant to Good Laboratory Practices (“GLP”) and, are in the final stages of creating a fit for purpose manufacturing

facility within our current Stony Brook, NY laboratory space capable of producing Linea DNA IVT templates under Good Manufacturing Practices

(“GMP”) suitable for use as a critical starting material for clinical and commercial mRNA therapeutics, with an anticipated

completion date in the fourth quarter of calendar year 2024 (“GMP Site 1”). We also plan to offer additional capacity for

Linea DNA IVT templates as well as capacity for Linea DNA materials manufactured under GMP suitable for use as, or incorporation into,

a biologic, drug substance and/or drug product, with availability expected during the second half of calendar year 2025, dependent upon

the availability of future funding (“GMP Site 2”). GMP is a quality standard used globally and by the U.S. Food and Drug

Administration (“FDA”) to ensure pharmaceutical quality. Drug substances are the pharmaceutically active components of drug

products.

Segment Business

Strategy

Our business strategy

for our Therapeutic DNA Production Services is to capitalize upon the rapid growth of mRNA therapies in the near term via our planned

near term future availability of Linea DNA IVT templates manufactured under GMP at our GMP Site 1, while at the same time laying the

basis for additional clinical and commercial applications of Linea DNA with our future planned availability of Linea DNA manufactured

under GMP suitable for use as, or incorporation into, a biologic, drug substance and/or drug product at planned GMP Site 2. Planned GMP

Site 2 may also be used for additional Linea DNA IVT template manufacturing if customer demand exceeds capacity of GMP Site 1. Our current

plan is: (i) through our Linea IVT platform and planned near term future GMP manufacturing capabilities for IVT templates at GMP

Site 1 to secure commercial-scale supply contracts with clinical and commercial mRNA and/or self-amplifying mRNA (“sa-RNA”)

manufacturers for Linea DNA IVT templates and/or Linea RNAP as critical starting materials; (ii) to utilize our current GLP production

capacity for non-IVT template applications to secure supply and/or development contracts with pre-clinical therapy developers that use

DNA in their therapy manufacturing, and (iii) upon our development of our planned future Linea DNA production under GMP suitable

for use as, or incorporation into, a biologic, drug substance and/or drug product at planned GMP Site 2, to convert existing and new

Linea DNA customers into large-scale supply contracts to supply Linea DNA for clinical and commercial use as, or incorporation into,

a biologic, drug substance and/or drug product in a wide range of nucleic acid therapies. Until we complete our GMP Site 1 to produce

DNA critical starting materials (DNA IVT templates) for mRNA manufacturing, we will not be able to realize significant revenues from

this business. We estimate the remaining capital expenditure (“CAPEX”) costs to creating GMP Site 1 will be less than $0.30

million. If we were to expand our facilities to enable GMP production of Linea DNA for use as, or incorporation, into a biologic, drug

substance and/or drug product as planned for GMP Site 2, the additional CAPEX may be up to approximately $10 million which would require

additional funding. We are currently building GMP Site 1 within our existing laboratory space. We anticipate that a GMP Site 2 would

require us to acquire additional space.

MDx Testing

Services

Through Applied DNA

Clinical Labs, LLC (“ADCL”), we leverage our expertise in DNA and RNA detection via PCR to provide and develop clinical molecular

diagnostics and genetic (collectively “MDx”) Testing Services. ADCL is a New York State Department of Health (“NYSDOH”)

clinical laboratory improvement amendments (CLIA)-certified laboratory which is currently permitted for virology and genetics (molecular).

In providing MDx Testing Services, ADCL employs its own or third-party molecular diagnostic tests.

We have successfully

internally validated our pharmacogenomics testing services (the “PGx Testing Services”). Our PGx Testing Services utilizes

a 120-target PGx panel test to evaluate the unique genotype of a specific patient to help guide the patient’s healthcare provider

in making individual drug therapy decisions. Our PGx Testing Services are designed to interrogate DNA targets on over 33 genes and provide

genotyping information relevant to certain cardiac, mental health, oncology, and pain management drug therapies.

On June 12, 2024

we received full approval from NYSDOH for our PGx Testing Services. Recently published studies show that population-scale PGx enabled

medication management can significantly reduce overall population healthcare costs, reduce adverse drug events, and increase overall

population wellbeing. These benefits can result in significant cost savings to large entities and self-insured employers, the latter

accounting for approximately 65% of all U.S. employers in 2022.We plan to leverage our PGx Testing Services to provide PGx testing services

to large entities, self-insured employers and healthcare providers, as well as concierge healthcare providers.

On September 11,

2024, we announced that ADCL has launched an expansion of its clinical testing services for the detection of Mpox (formerly monkeypox)

to include testing for both Mpox Clade I and Clade II. The launch of the expanded Mpox testing service comes after ADCL’s interaction

with relevant regulatory bodies, including the New York State Department of Health (NYSDOH) and the U.S. Food and Drug Administration

(FDA).The Company believes that ADCL will be able to support New York and other states’ response to the threat of Mpox. ADCL’s

Linea Mpox Virus 1.0 Assay was previously approved as a laboratory-developed test for the detection of Mpox Clade II by NYSDOH in September 2022.

In August 2024, ADCL conducted additional validation testing showing the Assay can also detect the genetic sequence of Mpox Clade

I, which is the subject of the World Health Organization’s (WHO) August 14, 2024 declaration of a public health emergency

of international concern. ADCL will provide the testing service from its CLEP/CLIA molecular diagnostics laboratory in Stony Brook, N.Y.

There can be no assurance that we will be able to generate revenue and and profits from Mpox testing.

Historically, the

majority of our revenue attributable to our MDx Testing Services has been derived from our safeCircle® COVID-19 testing solutions,

for which testing demand has significantly declined commencing in our fiscal third quarter of 2023, resulting in substantially reduced

revenues. We expect future demand for COVID-19 testing to continue to be reduced and we may terminate COVID-19 testing services in the

future.

DNA Tagging and

Security Products and Services

By leveraging our

expertise in both the manufacture and detection of DNA via PCR, our DNA Tagging and Security Products and Services allow our customers

to use non-biologic DNA tags manufactured on our Linea DNA platform to mark objects in a unique manner and then identify these objects

by detecting the absence or presence of the DNA tag. The Company’s core DNA Tagging and Security Products and Services, which are

marketed collectively as a platform under the trademark CertainT®, include:

| |

· |

SigNature®

Molecular Tags, which are short non-biologic DNA taggants produced by the Company’s Linea DNA platform, provide a methodology

to authenticate goods within large and complex supply chains with a focus on cotton, nutraceuticals and other products. |

| |

· |

SigNify®

portable DNA readers and SigNify consumable reagent test kits provide definitive real-time authentication of the Company’s

DNA tags in the field. |

| |

· |

fiberTyping®

and other product genotyping services use PCR-based DNA detection to determine a cotton species or cultivar, via a product’s

naturally occurring DNA sequence for the purposes of product provenance authentication. |

| |

· |

Isotopic

analysis testing services, provided in partnership with third-party labs, use cotton’s carbon, hydrogen and oxygen elements

to indicate origin of its fiber through finished goods. |

To date, our largest

commercial application for our DNA Tagging and Security Products and Services is in the tracking and provenance authentication of cotton.

The Uyghur Forced

Labor Prevention Act (“UFLPA”) signed into law on December 23, 2021 establishes that any goods mined, produced, or manufactured

wholly or in part in the Xinjiang Uyghur Autonomous Region (“XUAR”) of the People’s Republic of China are not entitled

to entry to the United States. On June 17, 2022, the UFLPA additionally listed DNA tagging and isotopic analysis as evidence that

importers may use to potentially prove that a good did not originate in XUAR. Recently, in July of 2024, the Company announced a

multi-year commercialization agreement for its CertainT platform with Indus Group, a multinational apparel/textile manufacturing and

sourcing company.

Our business plan

is to leverage consumer and governmental awareness for product traceability to expand our existing partnerships and seek new partnerships

for our DNA Tagging and Security Products and Services with a focus on cotton.

Recent Developments

Nasdaq Minimum Bid Price Requirement

Deficiency Notification

On November 12,

2024, the Company received written notice (the “Notification Letter”) from the Listing Qualifications Department of The Nasdaq

Stock Market LLC (“Nasdaq”) notifying the Company that it is not in compliance with the minimum bid price requirements set

forth in Nasdaq Listing Rule 5550(a)(2) for continued listing on The Nasdaq Capital Market. Nasdaq Listing Rule 5550(a)(2) requires

listed securities to maintain a minimum bid price of $1.00 per share, and Nasdaq Listing Rule 5810(c)(3)(A) provides that a

failure to meet the minimum bid price requirement exists if the deficiency continues for a period of thirty (30) consecutive business

days (collectively, the “Bid Price Rule”). Based on the closing bid price of the Company’s Common Stock for the thirty-one

(31) consecutive business days from September 27, 2024 to November 11, 2024, the Company no longer meets the requirements of

the Bid Price Rule.

The Notification Letter

does not impact the Company’s listing on The Nasdaq Capital Market at this time. The Notification Letter states that the Company

has 180 calendar days, or until May 12, 2025, to regain compliance with the Bid Price Rule. To regain compliance, the bid price

of the Company’s Common Stock must have a closing bid price of at least $1.00 per share for a minimum of ten (10) consecutive

business days, with a longer period potentially required by the staff of Nasdaq (the “Staff”). If the Company does not regain

compliance with the Bid Price Rule by May 12, 2025, the Company may be eligible for an additional 180 calendar day compliance

period. To qualify, the Company would be required to meet the continued listing requirement for market value of publicly held shares

and all other initial listing standards for The Nasdaq Capital Market, with the exception of the Bid Price Rule, and would need to provide

written notice of its intention to cure the deficiency during the second compliance period, by effecting a reverse stock split, if necessary,

no later than ten (10) business days prior to May 12, 2025.

However, if it appears

to the Staff that the Company will not be able to cure the deficiency, or if the Company is otherwise not eligible, Nasdaq would notify

the Company that its securities would be subject to delisting. In the event of such a notification, the Company may appeal the Staff’s

determination to delist its securities, but there can be no assurance the Staff would grant the Company’s request for continued

listing.

Pursuant to the securities

purchase agreement entered into in connection with the Offering (the “Purchase Agreement”), the Company is required to effect

a reverse stock split of its outstanding shares of Common Stock if, at any time after the Stockholder Approval Date, it is not in compliance

with Nasdaq’s Bid Price Rule and has received a deficiency letter from the Listing Qualifications Department of The Nasdaq

Stock Market LLC (the “Reverse Stock Split”). The Company must effect the Reverse Stock Split within 30 days of the Stockholder

Approval Date; provided that if within such 30 day period the Company regains compliance with the Bid Price Rule, the Company shall have

no obligation to effect the Reverse Stock Split. The Company intends to implement a reverse stock split of its outstanding securities

to regain compliance with the Bid Price Rule and to comply with the provisions of the Purchase Agreement.

Amendment to Series A Warrant

As previously disclosed

on our current report on Form 8-K filed on May 29, 2024 we closed on such date a public offering (the “May 2024

Offering”) of common stock and warrants, including 9,230,769 series A common stock purchase warrants (“May 2024 Series A

Warrants”) and 9,230,769 series B common stock purchase warrants (“May 2024 Series B Warrants”, and, with

the May 2024 Series A Warrants, the “May 2024 Series Warrants”), with Craig-Hallum and Laidlaw &

Company (UK) Ltd. (“Laidlaw”) as placement agents. As part of the May 2024 Offering, the Company entered into a

Placement Agency Agreement, dated May 28, 2024, with Craig-Hallum and Laidlaw (the “May 2024 Placement Agency Agreement”).

Subject to certain

exceptions, the Series A Warrants provide for an adjustment to the exercise price and number of shares underlying the Series A

Warrants upon the Company’s issuance of Common Stock or Common Stock equivalents at a price per share that is less than the exercise

price of the Series A Warrants (the “Price Reset Mechanism”).

On October 30,

2024, the Company and certain holders of the May 2024 Series A Warrants entered into an amendment to such holders’ May 2024

Series A Warrants (the “Warrant Amendment”), pursuant to which the Price Reset Mechanism became subject to a floor equal

to $0.20.

In connection with

the Offering, the Price Reset Mechanism in the May 2024 Series A Warrants was triggered, which resulted in the number of shares

of Common Stock issuable upon exercise of the May 2024 Series A Warrants increasing from 9,230,769 to 91,890,698. The exercise

price of the May 2024 Series A Warrants was adjusted from $1.99 per share to $0.20 per share with respect to the May 2024

Series A Warrants amended by the Warrant Amendment, and to $0.19 with respect to the May 2024 Series A Warrants not amended

by the Warrant Amendment.

Company Information

We are a Delaware

corporation, which was initially formed in 1983 under the laws of the State of Florida as Datalink Systems, Inc. In 1998, we reincorporated

in the State of Nevada, and in 2002, we changed our name to our current name, Applied DNA Sciences, Inc. On December 17, 2008,

we reincorporated from the State of Nevada to the State of Delaware.

Our corporate headquarters

are located at the Long Island High Technology Incubator at Stony Brook University in Stony Brook, New York, where we have established

laboratories for the manufacture and detection of nucleic acids (DNA and mRNA) to support our various business units. In addition, this

location also houses our NYSDOH CLEP-permitted, Clinical Laboratory Improvement Amendments (“CLIA”)-certified clinical laboratory

where we perform MDx Testing Services. The mailing address of our corporate headquarters is 50 Health Sciences Drive, Stony Brook, New

York 11790, and our telephone number is (631) 240-8800.

Implications of Being a Smaller Reporting

Company

We are a “smaller

reporting company” as defined in the Securities Exchange Act of 1934, as amended, or the Exchange Act, and have elected to take

advantage of certain of the scaled disclosures available to smaller reporting companies. We will continue to be a “smaller reporting

company” until we have $250 million or more in public float (based on our Common Stock) measured as of the last business day

of our most recently completed second fiscal quarter or, in the event we have no public float (based on our Common Stock) or a public

float (based on our Common Stock) that is less than $700 million, annual revenues of $100 million or more during the most recently

completed fiscal year.

We may choose to take

advantage of some, but not all, of these exemptions. We have taken advantage of reduced reporting requirements in this prospectus. Accordingly,

the information contained herein may be different from the information you receive from other public companies in which you hold stock.

THE

OFFERING

| Common

Stock offered by us |

41,640,625

shares of Common Stock issuable upon exercise of the Private Placement Warrants (subject to Warrant

Stockholder Approval). |

| Use

of proceeds |

We

will not receive any proceeds from the Common Stock offered by the Selling Stockholders under this prospectus. However, we will receive

the proceeds of any cash exercise of the Private Placement Warrants. We intend to use the net proceeds from any cash exercise of

the Private Placement Warrants for further development of our Therapeutic DNA Production Services, as well as for working capital

and general corporate purposes. See “Use of Proceeds.” |

| Market

for Common Stock |

Our Common Stock is listed on The Nasdaq Capital Market under the symbol

“APDN.” On November 15, 2024, the last reported sale price of our Common Stock was $0.16 per share. |

| Risk

Factors |

See

“Risk Factors” beginning on page 8 and the other information included in this prospectus

for a discussion of factors you should carefully consider before investing in our securities. |

The

number of shares of our Common Stock to be outstanding after this offering is based on the 50,896,710

shares of our Common Stock outstanding as of November 15, 2024, and excludes the following:

| · |

108,176 shares

of Common Stock issuable upon exercise of options outstanding as of November 15, 2024, with a weighted average exercise price

of $185.48 per share; |

| · |

96,083,181

shares of Common Stock issuable upon exercise of warrants outstanding as of November 15, 2024, with a weighted average exercise

price of $0.43 per share (which includes an aggregate of 94,147,750 May 2024 Series A Warrants (reflecting the the Price

Reset Mechanism being triggered by the Offering) and May 2024 Series B Warrants, of which 2,257,052 have an alternative

cashless exercise mechanism representing the right to receive 3 shares of Common Stock for each warrant, which, if exercised, would

result in 6,771,156 shares of Common Stock being issued); |

| · |

41,640,625

shares of Common Stock issuable upon exercise of the Private Placement Warrants, whose exercise

is subject to Warrant Stockholder Approval, of which 20,312,500 have an alternative cashless exercise mechanism representing the

right to receive 1 share of Common Stock for each warrant; and |

| · |

269,069

shares of Common Stock reserved for future grant or issuance as of November 15, 2024, under our equity incentive plan. |

Unless otherwise indicated,

this prospectus reflects and assumes no exercise of outstanding options and warrants.

RISK

FACTORS

Investing in our

securities involves a high degree of risk. In addition to the other information included or incorporated by reference in this prospectus,

you should carefully consider the risks described below and in the section titled “Risk Factors” in our Annual Report on

Form 10-K for our most recent fiscal year filed with the SEC, subsequent Quarterly Reports on Form 10-Q, any amendment or updates

thereto reflected in subsequent filings with the SEC, and in other reports we file with the SEC that are incorporated by reference herein,

before making an investment decision. The following risks are presented as of the date of this prospectus and we expect that these will

be updated from time to time in our periodic and current reports filed with the SEC, which will be incorporated herein by reference.

Please refer to these subsequent reports for additional information relating to the risks associated with investing in our securities.

The risks and uncertainties

described therein and below could materially adversely affect our business, operating results and financial condition, as well as cause

the value of our securities to decline. You may lose all or part of your investment as a result. You should also refer to the other information

contained in this prospectus, or incorporated by reference, including our financial statements and the notes to those statements, and

the information set forth under the caption “Special Note Regarding Forward-Looking Statements.” Our actual results could

differ materially from those anticipated in these forward-looking statements as a result of certain factors, including the risks mentioned

below. Forward-looking statements included in this prospectus are based on information available to us on the date hereof, and all forward-looking

statements in documents incorporated by reference are based on information available to us as of the date of such documents. We disclaim

any intent to update any forward-looking statements. The risks described below and contained in our Annual Report on Form 10-K,

Quarterly Reports on Form 10-Q and in our other periodic reports are not the only ones that we face. Additional risks not presently

known to us or that we currently deem immaterial may also adversely affect our business operations.

Risks Related to our Business:

We may not successfully implement

our business strategies, including achieving our growth objectives.

We may not be able

to fully implement our business strategies or realize, in whole or in part within the expected time frames, the anticipated benefits

of our various growth or other initiatives. Our various business strategies and initiatives, including our growth, operational and management

initiatives and the development in particular of our Therapeutic DNA Production Services, are subject to business, economic and competitive

uncertainties and contingencies, many of which are beyond our control. The execution of our business strategy and our financial performance

will continue to depend in significant part our ability to obtain sufficient financing and on our executive management team and other

key management personnel, our ability to identify and complete suitable acquisitions, our executive management team’s ability to

execute new operational initiatives, and certain matters outside of our control. In addition, we may incur certain costs as we pursue

our growth, operational and management initiatives, and we may not meet anticipated implementation timetables or stay within budgeted

costs. As these initiatives are undertaken, we may not fully achieve our expected efficiency improvements or growth rates, or these initiatives

could adversely impact our customer retention, supplier relationships or operations. Also, our business strategies may change from time

to time in light of our ability to implement our business initiatives, competitive pressures, economic uncertainties or developments,

or other factors.

We may modify and refine our business

strategy, including possible divestures or closings.

Our management is

currently engaged in a strategic review of the Company’s business segments that may result in the divestiture or closure of the

Company’s MDx Testing Services and/or DNA Tagging and Security Products and Services, as well as workforce reductions and potential

management changes. The terms and structure of any possible divestiture or closure, including financial terms, have not been determined

or approved by our Board of Directors. Although the purpose of any divestiture or closure would be to reduce our expenses and effectuate

cost savings, it is possible that there may be related restructuring costs and the benefits of any divesture or closing may be less than

anticipated. The initial cash received from any divestiture, if any, may be limited, although the terms of a divesture may include

future royalties, earn-outs or similar terms, any of which could fail to be earned or received.

Stockholders may suffer substantial

dilution if certain provisions in the May 2024 Series Warrants are utilized.

On May 29, 2024,

we closed on such date the May 2024 Offering, which included the May 2024 Series A Warrants and May 2024 Series B

Warrants, pursuant to the May 2024 Placement Agency Agreement.

If the May 2024

Series B Warrants are exercised by way of an alternative cashless exercise, such exercising holder will receive three times the

number of shares of Common Stock they would receive in a cash exercise for each May 2024 Series B Warrant they exercise, without

any cash payment to us. In addition, the Series A Warrants and Series B Warrants each include a provision that

resets their exercise price in the event of a reverse split of our Common Stock, to a price equal to the lesser of (i) the then

exercise price and (ii) lowest volume weighted average price (VWAP) during the period commencing five trading days immediately preceding

and the five trading days commencing on the date we effect a reverse stock split in the future with a proportionate adjustment to the

number of shares underlying the applicable warrant,

In addition, and subject

to certain exemptions, if we sell, enter into an agreement to sell, or grant any option to purchase, or sell, enter into an agreement

to sell, or grant any right to reprice (excluding Exempt Issuances, as defined in the May 2024 Placement Agency Agreement), or otherwise

dispose of or issue (or announce any offer, sale, grant or any option to purchase or other disposition) any shares of common stock, at

an effective price per share less than the exercise price of the May 2024 Series A Warrants then in effect, the exercise price

of the May 2024 Series A Warrants will be reduced to the lower of such price or (i) $0.20 with respect to the May 2024

Series A Warrants as amended by the Warrant Amendment or (ii) the lowest volume weighted average price (VWAP) during the five

consecutive trading days immediately following such dilutive issuance or announcement thereof with respect to the the remaining May 2024

Series A Warrants not amended by the Warrant Amendment. The number of shares issuable upon exercise after the aforementioned mechanism

has been triggered will be proportionately adjusted such that the aggregate exercise price will remain unchanged.

In connection with

the Offering, the Price Reset Mechanism in the May 2024 Series A Warrants was triggered, which resulted in the number of shares

of Common Stock issuable upon exercise of the May 2024 Series A Warrants increasing from 9,230,769 to 91,890,698. The exercise

price of the May 2024 Series A Warrants was adjusted from $1.99 per share to $0.20 per share with respect to the May 2024

Series A Warrants amended by the Warrant Amendment, and to $0.19 with respect to the May 2024 Series A Warrants not amended

by the Warrant Amendment.

If any of the above provisions in the May 2024

Series Warrants are further utilized, our stockholders may suffer substantial dilution.

Stockholders may suffer substantial

dilution if certain provisions in the Series D Warrants are utilized.

If the Series D

Warrants are exercised by way of an alternative cashless exercise, assuming receipt of Warrant Stockholder Approval, such exercising

holder will receive one share of Common Stock for each share of Common Stock they would receive in a cash exercise for each May 2024

Series D Warrant they exercise, without any cash payment to us.

In addition, the Series D

Warrants include a provision that resets their exercise price in the event of a reverse split of our Common Stock, to a price equal to

the lesser of (i) the then exercise price and (ii) lowest volume weighted average price (VWAP) during the period commencing

five trading days immediately preceding and the five trading days commencing on the date we effect a reverse stock split in the future

with a proportionate adjustment to the number of shares underlying the Series D Warrants, subject to a floor of $0.0634.

If any of the above provisions in the Series Warrants

are utilized, our stockholders may suffer substantial dilution.

The exercisability

of the Private Placement Warrants is contingent upon us obtaining Warrant Stockholder Approval. If we do not obtain such Warrant Stockholder

Approval, the Series Warrants may never become exercisable.

The Private Placement

Warrants are not immediately exercisable, as their exercisability is contingent upon us obtaining Warrant Stockholder Approval. The Series Warrants

will become exercisable upon the Stockholder Approval Date and will expire on the five-year anniversary of such date with respect to

the Series C Warrants, and on the eighteen-month anniversary of such date with respect to the Series D Warrants. The Placement

Agent Warrants will become exercisable upon the Stockholder Approval Date and will expire on October 30, 2029. While we intend to

promptly seek Warrant Stockholder Approval for these mechanisms, there is no guarantee that it will ever be obtained. In the event that

we cannot obtain Warrant Stockholder Approval, the Series Warrants may never become exercisable. If we are unable to obtain

the Warrant Stockholder Approval, the Series Warrants will have no value.

We have agreed to

hold a special meeting of shareholders (which may also be at the annual meeting of shareholders) at the earliest practicable date after

the date hereof, but in no event later than ninety days after the closing of the offering, in order to obtain Warrant Stockholder Approval.

There is no guarantee we will be able to hold a special meeting within this timeframe, or at all. If we do not obtain Warrant Stockholder

Approval at the first meeting, we are obligated to call a meeting every ninety days thereafter to seek Warrant Stockholder Approval until

the earlier of the date on which Stockholder Approval is obtained or the Series Warrants are no longer outstanding.

There are a

large number of shares of Common Stock underlying our outstanding options and warrants and the sale of these shares may depress the market

price of our Common Stock and cause immediate and substantial dilution to our existing stockholders.

As

of November 15, 2024, we had 50,896,710 shares of Common Stock issued and outstanding, outstanding

options to purchase 108,176 shares of Common Stock, outstanding warrants to purchase 96,083,181 shares of Common Stock, and 269,069 shares

available for grant under our equity incentive plan. The issuance of shares upon exercise of our outstanding options and warrants will

cause immediate and substantial dilution to our stockholders and any sale thereof may depress the market price of our Common Stock.

There is substantial doubt relating

to our ability to continue as a going concern.

We have recurring

net losses, which have resulted in an accumulated deficit of $306,376,012 as of June 30, 2024. We have incurred a net loss of $3,774,563

for the nine months ended June 30, 2024. At June 30, 2024, we had cash and cash equivalents of $10,442,131. We have concluded

that these factors raise substantial doubt about our ability to continue as a going concern for one year from the issuance of the June 30,

2024 financial statements. We will continue to seek to raise additional working capital through public equity, private equity or debt

financings. If we fail to raise additional working capital, or do so on commercially unfavorable terms, it would materially and adversely

affect our business, prospects, financial condition and results of operations, and we may be unable to continue as a going concern. If

we seek additional financing to fund our business activities in the future and there remains substantial doubt about our ability to continue

as a going concern, investors or other financing sources may be unwilling to provide additional funding to us on commercially reasonable

terms, if at all.

There can be no assurance that that

a commercial demand for our Linea™ Mpox Virus Assay and/or mpox testing services will develop.

On September 11,

2024 the Company announced that after interactions with relevant regulatory bodies, including NYSDOH and U.S. FDA, it was launching clinical

testing services for both mpox clade I and clade II utilizing the Linea mpox Virus Assay (the “Assay”) in New York State

and in states that recognize New York’s CLEP/CLIA certification. To date, the Company has not performed clinical testing for mpox

clade I or clade II. Future commercial demand for the Assay and/or associated mpox testing services is based upon the unknown and unpredictable

future path of the mpox public health emergency. Currently, mpox disease prevalence (both clade I and clade II) is extremely low the

United States, resulting in minimal demand for clinical mpox testing. It is unknown whether a future commercial demand for the Assay

will develop.

We have received

written notice from Nasdaq that we are not in compliance with Nasdaq’s minimum bid price requirements and if we are unable to regain

compliance with Nasdaq continued listing standards, which may require effecting a reverse stock split of our Common Stock, we could be

delisted from Nasdaq, which would negatively impact our business, our ability to raise capital, and the market price and liquidity of

our Common Stock.

On November 12,

2024, the Company received the Notification Letter from the Listing Qualifications Department of Nasdaq notifying the Company that, because

the closing bid price for its Common Stock has been below $1.00 per share for 30 consecutive business days, it no longer complies with

the Bid Price Rule for continued listing on The Nasdaq Stock Market LLC. There is no assurance that we will be able to regain compliance

with the Bid Price Rule. The Notification Letter had no immediate effect on the listing of the Company’s Common Stock on The Nasdaq

Stock Market LLC. The Company has been provided an initial compliance period of 180 calendar days, or until May 12, 2025, to

regain compliance with the Bid Price Rule. During the compliance period, the Company’s shares of Common Stock will continue to

be listed and traded on The Nasdaq Stock Market LLC. To regain compliance, the closing bid price of the Company’s Common Stock

must meet or exceed $1.00 per share for a minimum of ten consecutive business days during the 180-day compliance period, with a longer

period potentially required by the Staff.

If our Common Stock

is delisted by Nasdaq, our Common Stock may be eligible for quotation on an over-the-counter quotation system or on the pink sheets but

will lack the market efficiencies associated with Nasdaq. Upon any such delisting, our Common Stock would become subject to the regulations

of the SEC relating to the market for penny stocks. A penny stock is any equity security not traded on a national securities exchange

that has a market price of less than $5.00 per share. The regulations applicable to penny stocks may severely affect the market liquidity

for our Common Stock and could limit the ability of stockholders to sell securities in the secondary market. In such a case, an investor

may find it more difficult to dispose of or obtain accurate quotations as to the market value of our Common Stock, and there can be no

assurance that our Common Stock will be eligible for trading or quotation on any alternative exchanges or markets.

Delisting from Nasdaq

could adversely affect our ability to raise additional financing through public or private sales of equity securities, would significantly

affect the ability of investors to trade our securities and would negatively affect the value and liquidity of our Common Stock. Delisting

could also have other negative results, including the potential loss of confidence by employees and customers, the loss of institutional

investor interest and fewer business development opportunities.

Pursuant to the Purchase

Agreement, the Company is required to effect a reverse stock split of its outstanding shares of Common Stock if, at any time after the

Stockholder Approval Date, it is not incompliance with Nasdaq’s Bid Price Rule and has received a deficiency letter from the

Listing Qualifications Department of The Nasdaq Stock Market LLC (the “Reverse Stock Split”). The Company must effect the

Reverse Stock Split within 30 days of the Stockholder Approval Date; provided that if within such 30 day period the Company regains compliance

with the Bid Price Rule, the Company shall have no obligation to effect the Reverse Stock Split. The Company intends to implement a reverse

stock split of its outstanding securities to regain compliance with the Bid Price Rule and to comply with the provisions of the

Purchase Agreement.

SPECIAL

NOTE REGARDING FORWARD-LOOKING STATEMENTS

This prospectus and

the documents that we incorporate herein by reference contain forward-looking statements concerning our business, operations and

financial performance and condition, as well as our plans, objectives and expectations for our business operations and financial performance

and condition. Any statements contained herein that are not statements of historical facts may be deemed to be forward-looking statements.

In some cases, you can identify forward-looking statements by terminology such as “can”, “may”, “could”,

“should”, “assume”, “forecasts”, “believe”, “designed to”, “will”,

“expect”, “plan”, “anticipate”, “estimate”, “potential”, “position”,

“predicts”, “strategy”, “guidance”, “intend”, “budget”, “seek”,

“project” or “continue”, or the negative thereof or other comparable terminology regarding beliefs, plans, expectations

or intentions regarding the future. You should read statements that contain these words carefully because they:

| |

· |

discuss our

future expectations; |

| |

· |

contain projections

of our future results of operations or of our financial condition; and |

| |

· |

state other

“forward-looking” information. |

We believe it is important

to communicate our expectations. However, forward-looking statements are based on our current expectations, assumptions, estimates and

projections about our business and our industry and are subject to known and unknown risks, uncertainties and other factors. Accordingly,

our actual results and the timing of certain events may differ materially from those expressed or implied in such forward-looking statements

due to a variety of factors and risks, including, but not limited to, those set forth under “Risk Factors” in this prospectus,

and the following factors and risks:

| |

· |

our expectations

of future revenues, expenditures, capital or other funding requirements; |

| |

· |

the adequacy

of our cash and working capital to fund present and planned operations and growth; |

| |

· |

the substantial

doubt relating to our ability to continue as a going concern; |

| |

· |

our need

for additional financing which may in turn require the issuance of additional shares of Common Stock, preferred stock or other debt

or equity securities (including convertible securities) which would dilute the ownership held by stockholders; |

| |

· |

our business

strategy and the timing of our expansion plans, including the development of new production facilities for our Therapeutic DNA Production

Services; |

| |

· |

demand for

Therapeutic DNA Production Services; |

| |

· |

demand for

DNA Tagging Services; |

| |

· |

demand for

MDx Testing Services; |

| |

· |

our expectations

concerning existing or potential development and license agreements for third-party collaborations or joint ventures; |

| |

· |

regulatory

approval and compliance for our Therapeutic DNA Production Services, upon which our business strategy is substantially dependent; |

| |

· |

whether we

are able to achieve the benefits expected from the acquisition of Spindle; |

| |

· |

the effect

of governmental regulations generally; |

| |

· |

our expectations

of when regulatory submissions may be filed or when regulatory approvals may be received; |

| |

· |

our expectations

concerning product candidates for our technologies; |

| |

· |

our expectations

concerning potential restructuring of our business model; |

| |

· |

our expectations

of when or if we will become profitable; |

| |

· |

our current

non-compliance with Nasdaq's Bid Price Rule, which in the absence of a reverse split, may lead to delisting, potentially negatively

impacting our business, our ability to raise capital, and the market price and liquidity of our Common Stock; |

| |

· |

the risk

that our LDTs may become subject to additional regulatory requirements due to FDA rulemaking activity, and that compliance with such

requirements may be expensive and time-consuming, resulting in significant or unanticipated delay; and |

| |

· |

unknown future

market demand for the Linea Mpox Virus 1.0 Assay and associated mpox testing services. |

Any or all of our

forward-looking statements may turn out to be wrong. They may be affected by inaccurate assumptions that we might make or by known or

unknown risks and uncertainties. Actual outcomes and results may differ materially from what is expressed or implied in our forward-looking

statements. Among the factors that could affect future results are:

| |

· |

the inherent

uncertainties of product development based on our new and as yet not fully proven technologies; |

| |

· |

the risks

and uncertainties regarding the actual effect on humans of seemingly safe and efficacious formulations and treatments when tested

clinically; |

| |

· |

formulations

and treatments that utilize our Therapeutic DNA Production Services; |

| |

· |

the inherent

uncertainties associated with clinical trials of product candidates, including product candidates that utilize our Therapeutic DNA

Production Services; |

| |

· |

the inherent

uncertainties associated with the process of obtaining regulatory clearance or approval to market product candidates, including product

candidates that utilize our Therapeutic DNA Production Services; |

| |

· |

the inherent

uncertainties associated with commercialization of products that have received regulatory clearance or approval, including products

that utilize our Therapeutic DNA Production Services; |

| |

· |

the inherent

uncertainties associated with commercialization of our PGx Testing Services; |

| |

· |

economic

and industry conditions generally and in our specific markets; |

| |

· |

the volatility

of, and decline in, our stock price; and |

| |

· |

our ability

to obtain the necessary financing to fund our operations and effect our strategic development plan. |

All forward-looking

statements and risk factors included in this prospectus are made as of the date hereof, and all forward-looking statements and risk factors

included in documents incorporated herein by reference are made as of their original date, in each case based on information available

to us as of the date hereof, or in the case of documents incorporated by reference, the original date of any such document, and we assume

no obligations to update any forward-looking statement or risk factor, unless we are required to do so by law. If we do update one or

more forward-looking statements, no inference should be drawn that we will make updates with respect to other forward-looking statements

or that we will make any further updates to those forward-looking statements at any future time.

Forward-looking statements

may include our plans and objectives for future operations, including plans and objectives relating to our products and our future economic

performance, projections, business strategy and timing and likelihood of success. Assumptions relating to the foregoing involve judgments

with respect to, among other things, future economic, competitive and market conditions, future business decisions, demand for our products

and services, and the time and money required to successfully complete development and commercialization of our technologies, all of

which are difficult or impossible to predict accurately and many of which are beyond our control.

Any of the assumptions

underlying the forward-looking statements contained in this prospectus could prove inaccurate and, therefore, we cannot assure you that

any of the results or events contemplated in any of such forward-looking statements will be realized. Based on the significant uncertainties

inherent in these forward-looking statements, the inclusion of any such statement should not be regarded as a representation or as a

guarantee by us that our objectives or plans will be achieved, and we caution you against relying on any of the forward looking-statements

contained herein.

MARKET, INDUSTRY

AND OTHER DATA

Market

data and certain industry data and forecasts used throughout this prospectus were obtained from sources we believe to be reliable, including

market research databases, publicly available information, reports of governmental agencies and industry publications and surveys. We

have relied on certain data from third-party sources, including internal surveys, industry forecasts and market research, which we believe

to be reliable based on our management’s knowledge of the industry. Forecasts are particularly likely to be inaccurate, especially

over long periods of time. In addition, we do not necessarily know what assumptions regarding general economic growth were used in preparing

the third-party forecasts we cite. Statements as to our market position are based on the most currently available data. While we are

not aware of any misstatements regarding the industry data presented in this prospectus and the documents incorporated by reference into

this prospectus, our estimates involve risks and uncertainties and are subject to change based on various factors, including those discussed

under the heading “Risk Factors” in this prospectus and the documents incorporated by reference into this prospectus.

USE

OF PROCEEDS

We will not receive

any proceeds from the sale of the shares of Common Stock by the Selling Stockholders. However, we will receive proceeds from the exercise

of the Private Placement Warrants by the Selling Stockholders to the extent they are exercised for cash. We estimate that the maximum

proceeds that we may receive from the exercise of the Private Placement Warrants, assuming all the Private Placement Warrants are exercised

at their exercise price of $0.32, will be $13,325,000. We do not know, however, whether any of the Private Placement Warrants will be

exercised for cash or, if any of the Private Placement Warrants are exercised for cash, when they will be exercised. It is possible that

the Private Placement Warrants will expire and never be exercised.

There are circumstances

under which the Private Placement Warrants may be exercised on a cashless basis, including pursuant to the alternative cashless exercise

mechanism of the Series D Warrants. In these circumstances, even if the Private Placement Warrants are exercised, we may not receive

any proceeds, or the proceeds that we do receive may be significantly less than what we might expect. We intend to use the aggregate

net proceeds from the exercise of the Private Placement Warrants for the further development of our Therapeutic DNA Production Services,

as well as for general corporate purposes, including working capital. The actual allocation of proceeds realized from the exercise of

these Private Placement Warrants will depend upon the amount and timing of such exercises, our operating revenues and cash position at

such time and our working capital requirements. The Selling Stockholders will pay any expenses incurred by the Selling Stockholders for

brokerage, accounting, tax or legal services or any other expenses incurred by the Selling Stockholders in disposing of their shares

of Common Stock. We will bear all other costs, fees and expenses incurred in effecting the registration of the shares covered by this

prospectus, including, without limitation, all registration fees and fees and expenses of our counsel and our accountants.

MARKET

PRICE OF OUR COMMON STOCK AND RELATED STOCKHOLDER MATTERS

Market Information

Our Common Stock is

listed on The Nasdaq Capital Market under the symbol “APDN.” A description of our Common Stock is set forth under the heading

“Description of Capital Stock” beginning on page 19 of this prospectus.