AquaBounty Technologies, Inc. (Nasdaq: AQB) (“AquaBounty” or the

“Company”), a land-based aquaculture company utilizing technology

to enhance productivity and sustainability, has provided financial

results for the third quarter and nine months ended September 30,

2021.

Third Quarter 2021 Highlights

- Harvested 84 tons of genetically engineered (GE) Atlantic

salmon from AquaBounty’s Indiana and Rollo Bay farm sites,

generating $402 thousand in revenue from sales to customers during

the third quarter.

- Progressed in-line with the plans for the Company’s Ohio farm

project, including design engineering, detailed construction cost

estimates and debt financing.

- Launched an Environmental, Social, and Governance (ESG)

integrated reporting initiative using the Sustainability Accounting

Standards Board (SASB) as its primary reporting standard.

- Participated in key investor conferences to improve visibility

within the investment community, including the H.C. Wainwright

Annual Global Investment Conference, Lake Street Best Ideas

Conference and Bank of America Future Fish Event.

Management Commentary

“During the quarter we continued our transition to a commercial

production enterprise with the ongoing harvest and sale of the

first cohorts of our proprietary GE salmon at our Albany, Indiana

and Prince Edward Island, Canada farms,” said Sylvia Wulf, Chief

Executive Officer of AquaBounty. “We’ve also made solid

progress on our planned expansion with our Ohio farm. After the

initial success of our first commercial harvests to U.S. and

Canadian customers in the second quarter, we harvested over 84 tons

of salmon in the third quarter. Customer interest in purchasing our

salmon remains high and continues to surpass our current ability to

supply, as we have been challenged by the labor shortages that have

affected the food service industry which currently limits the

amount of salmon we can harvest and process below the farm’s 100

tons per month capacity. We are working diligently to resolve our

capacity constraints and we look forward to onboarding more

customers over the coming months as we move to increase our weekly

harvest volumes to fulfill the strong demand – clearly proving the

market acceptance for our GE salmon.

“In addition to our focus on increasing salmon harvests from our

existing farm sites, we also are moving towards the start of

construction of our planned Ohio farm. We have made solid progress

towards finalizing site engineering designs and permitting since

our site announcement in July. With hydrology studies complete,

confirming that the quantity and quality of water available meets

our needs as well as the needs of the local community, key water

and environmental permits are currently underway. We remain on

track with our preliminary timing estimates to commence

construction by year-end, with commercial stocking of salmon

estimated to occur in 2023. We are working closely with the Village

of Pioneer, Williams County, the State of Ohio, JobsOhio and the

Regional Growth Partnership – whose ongoing support has been

invaluable in our progress.

“As we’ve progressed on the final design for our 10,000 metric

ton Ohio farm, we have been able to further refine our expected

project cost, which we estimate to be in the range of $290 million

to $320 million, including a reserve for potential contingencies of

$30 million. The increase from our previous estimates is

attributable to several factors, including the cost of building

materials and the Recirculating Aquaculture System technology,

along with the inclusion of an on-site processing plant and water

treatment facility.

“As we’ve stated before, our capitalization plan for financing

the farm project includes leveraging our equity contribution with

debt. To that point, we have begun the process for the placement of

a mix of tax-exempt and taxable bonds through the Toledo-Lucas

County Port Authority, whose board has approved the issuance of up

to $300 million in bonds to support the financing of the project.

We have also engaged Wells Fargo Corporate and Investment Banking

to underwrite and market the bond placement, which we expect to

complete in Q1 2022. Though there is still work to be done to close

this transaction, we believe that this financing will be a major

milestone for the Company.

“Our commitment to sustainability and corporate responsibility

was highlighted during the quarter with the announcement of our

Environmental, Social, Governance (ESG) reporting initiative, using

the Sustainability Accounting Standards Board (SASB) as our primary

reporting standard. We believe reporting like this is critical and

aligns well with our mission to contribute to sustainability by

relieving fishing pressure on the oceans. We plan to share our

first report with the market later this year.

“As we move into the final quarter of 2021 and the year ahead,

we believe we are well positioned to scale production and provide a

safe, secure and sustainable domestic source of farm-raised salmon.

With ongoing commercial harvests of our GE salmon and the planned

construction of our Ohio farm, we look forward to future updates

and building long-term value for our shareholders,” concluded

Wulf.

Financial Summary through September 30,

2021

- Revenue for the first nine months of 2021 was $757 thousand,

compared to $77 thousand in the same period of the prior year.

Harvests at both our Indiana and PEI farms commenced in June and

weekly output is ramping steadily.

- Operating expenses for the first nine months of 2021 were $16.8

million, compared to $10.3 million in the same period of the prior

year. The increase reflects the growth in biomass, headcount and

production expenses at the farms, as well as increases in corporate

and marketing expenses.

- Net loss for the first nine months of 2021 was $16.3 million,

compared to $10.3 million in the same period of the prior

year.

- Cash, cash equivalents and marketable securities were

$197.8 million as of September 30, 2021, compared with

$95.8 million as of December 31, 2020.

About AquaBounty

AquaBounty Technologies, Inc. (NASDAQ: AQB) is a leader in

aquaculture leveraging decades of technology expertise to deliver

game changing solutions that solve global problems, while improving

efficiency, sustainability and profitability. AquaBounty provides

fresh Atlantic salmon to nearby markets by raising its fish in

carefully monitored land-based fish farms through a safe, secure

and sustainable process. The Company’s land-based Recirculating

Aquaculture System (“RAS”) farms, located in Indiana, United States

and Prince Edward Island, Canada, are close to key consumption

markets and are designed to prevent disease and to include multiple

levels of fish containment to protect wild fish populations.

AquaBounty is raising nutritious salmon that is free of antibiotics

and other contaminants and provides a solution resulting in a

reduced carbon footprint and no risk of pollution to marine

ecosystems as compared to traditional sea-cage farming. For more

information on AquaBounty, please visit www.aquabounty.com or

follow us on Facebook, Twitter, LinkedIn and Instagram.

Forward-Looking Statements

This press release contains “forward-looking statements” as

defined in the Private Securities Litigation Reform Act of 1995, as

amended, including regarding the Company’s commencement,

completion, timing, terms, size, and use of proceeds of the

proposed bond financing with the Toledo-Lucas County Port

Authority, job creation plans, anticipated size of its facility in

Ohio, production capacity, timing of construction, permits or

commercial stocking, cost of construction and startup costs, amount

to be invested in the project, availability and mix of debt and

equity financing, ability and approvals to convert operations on

PEI to broodstock, and ability to produce eggs, fry, and

broodstock, the ability to address capacity constraints and

increase harvests, future revenue streams, pricing and

profitability and the timing and content of ESG reporting. There is

no guarantee that AquaBounty will be successful in raising the

capital required for this project through the issuance of the bonds

discussed herein. The forward-looking statements in this press

release are neither promises nor guarantees, and you should not

place undue reliance on these statements because they involve

significant risks and uncertainties about AquaBounty. AquaBounty

may use words such as “expect,” “anticipate,” “project,” “intend,”

“slated to,” “plan,” “aim,” “believe,” “seek,” “estimate,” “can,”

“focus,” “will,” and “may” and similar expressions to identify such

forward-looking statements. Among the important factors that could

cause actual results to differ materially from those indicated by

such forward-looking statements are risks relating to, among other

things, whether AquaBounty and its partners will commence or

consummate the proposed bond financing, the final terms of the

proposed bond financing, market and other conditions for such

offering, the satisfaction of related closing conditions, the

impact of the bond offering on AquaBounty’s financial condition,

credit rating and stock price, whether or not AquaBounty will need

to and be able to raise additional equity capital, whether

AquaBounty will be able to service the bond commitments,

AquaBounty’s business and financial condition, AquaBounty’s ability

to secure required regulatory approvals and permits, AquaBounty’s

ability to profitably construct and operate the farm, and the

impact of general economic, public health, industry or political

conditions in the United States or internationally. For additional

disclosure regarding these and other risks faced by AquaBounty, see

disclosures contained in AquaBounty’s public filings with the SEC,

including the “Risk Factors” in the company’s Annual Report on Form

10-K and Quarterly Reports on Form 10-Q. You should consider these

factors in evaluating the forward-looking statements included in

this press release and not place undue reliance on such statements.

The forward-looking statements reflect AquaBounty’s current views

about its plans, intentions, expectations, strategies and

prospects, which are based on the information currently available

to AquaBounty and on assumptions AquaBounty has made as of the date

hereof. AquaBounty undertakes no obligation to update such

statements as a result of new information, future events or

otherwise, except as required by law.

This press release does not constitute an offer to sell or a

solicitation of an offer to buy the bonds described herein, nor

shall there be any sale of these bonds in any state or jurisdiction

in which such offer, solicitation or sale would be unlawful.

Company Contact:AquaBounty TechnologiesDave

ConleyCorporate Communications(613) 294-3078

Investor Relations:Greg Falesnik or Luke

ZimmermanMZ Group - MZ North America(949)

259-4987AQB@mzgroup.us

AquaBounty Technologies,

Inc.Condensed Consolidated Balance

Sheets(Unaudited)

| |

|

|

|

|

|

| |

As of |

| |

September 30, |

|

December 31, |

|

|

2021 |

|

2020 |

|

Assets |

|

|

|

|

|

| Current assets: |

|

|

|

|

|

|

Cash and cash equivalents |

$ |

118,179,653 |

|

|

$ |

95,751,160 |

|

|

Marketable securities |

|

79,632,028 |

|

|

|

— |

|

|

Inventory |

|

1,222,223 |

|

|

|

1,525,377 |

|

|

Prepaid expenses and other current assets |

|

1,197,830 |

|

|

|

405,370 |

|

|

Total current assets |

|

200,231,734 |

|

|

|

97,681,907 |

|

| |

|

|

|

|

|

| Property, plant and equipment,

net |

|

30,008,937 |

|

|

|

26,930,338 |

|

| Right of use assets, net |

|

298,966 |

|

|

|

341,997 |

|

| Intangible assets, net |

|

235,268 |

|

|

|

245,546 |

|

| Restricted cash |

|

500,000 |

|

|

|

500,000 |

|

| Other

assets |

|

78,204 |

|

|

|

76,715 |

|

|

Total assets |

$ |

231,353,109 |

|

|

$ |

125,776,503 |

|

|

|

|

|

|

|

|

| Liabilities and

stockholders' equity |

|

|

|

|

|

| Current liabilities: |

|

|

|

|

|

|

Accounts payable and accrued liabilities |

$ |

1,953,716 |

|

|

$ |

1,760,103 |

|

|

Other current liabilities |

|

65,072 |

|

|

|

62,483 |

|

|

Current debt |

|

619,552 |

|

|

|

259,939 |

|

|

Total current liabilities |

|

2,638,340 |

|

|

|

2,082,525 |

|

| |

|

|

|

|

|

| Long-term lease

obligations |

|

241,102 |

|

|

|

290,327 |

|

|

Long-term debt, net |

|

8,678,642 |

|

|

|

8,528,490 |

|

|

Total liabilities |

|

11,558,084 |

|

|

|

10,901,342 |

|

| |

|

|

|

|

|

| Commitments and

contingencies |

|

|

|

|

|

| |

|

|

|

|

|

| Stockholders' equity: |

|

|

|

|

|

|

Common stock, $0.001 par value, 80,000,000 shares authorized; |

|

|

|

|

|

|

71,025,738 (2020: 55,497,133) shares outstanding |

|

71,026 |

|

|

|

55,497 |

|

|

Additional paid-in capital |

|

384,763,523 |

|

|

|

263,629,116 |

|

|

Accumulated other comprehensive loss |

|

(242,863 |

) |

|

|

(267,258 |

) |

|

Accumulated deficit |

|

(164,796,661 |

) |

|

|

(148,542,194 |

) |

|

Total stockholders' equity |

|

219,795,025 |

|

|

|

114,875,161 |

|

|

|

|

|

|

|

|

| Total

liabilities and stockholders' equity |

$ |

231,353,109 |

|

|

$ |

125,776,503 |

|

AquaBounty Technologies,

Inc.Condensed Consolidated Statements of

Operations and Comprehensive

Loss(Unaudited)

| |

|

|

|

|

|

|

|

|

|

|

|

| |

Three Months Ended September 30, |

|

Nine Months EndedSeptember

30, |

|

|

2021 |

|

2020 |

|

2021 |

|

2020 |

|

Revenues |

|

|

|

|

|

|

|

|

|

|

|

|

Product revenues |

$ |

455,397 |

|

|

$ |

67,763 |

|

|

$ |

757,162 |

|

|

$ |

77,466 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

| Costs and

expenses |

|

|

|

|

|

|

|

|

|

|

|

|

Product costs |

|

4,311,003 |

|

|

|

1,355,939 |

|

|

|

7,713,254 |

|

|

|

3,238,689 |

|

|

Sales and marketing |

|

201,838 |

|

|

|

143,646 |

|

|

|

1,069,354 |

|

|

|

331,868 |

|

|

Research and development |

|

580,346 |

|

|

|

458,462 |

|

|

|

1,512,339 |

|

|

|

1,662,879 |

|

|

General and administrative |

|

2,177,153 |

|

|

|

1,722,874 |

|

|

|

6,541,621 |

|

|

|

5,053,608 |

|

|

Total costs and expenses |

|

7,270,340 |

|

|

|

3,680,921 |

|

|

|

16,836,568 |

|

|

|

10,287,044 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Operating

loss |

|

(6,814,943 |

) |

|

|

(3,613,158 |

) |

|

|

(16,079,406 |

) |

|

|

(10,209,578 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

| Other income

(expense) |

|

|

|

|

|

|

|

|

|

|

|

|

Interest expense |

|

(79,489 |

) |

|

|

(38,335 |

) |

|

|

(238,503 |

) |

|

|

(73,527 |

) |

|

Other income (expense), net |

|

29,593 |

|

|

|

1,705 |

|

|

|

63,442 |

|

|

|

15 |

|

|

Total other income (expense) |

|

(49,896 |

) |

|

|

(36,630 |

) |

|

|

(175,061 |

) |

|

|

(73,512 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net loss |

$ |

(6,864,839 |

) |

|

$ |

(3,649,788 |

) |

|

$ |

(16,254,467 |

) |

|

$ |

(10,283,090 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Other comprehensive

income (loss): |

|

|

|

|

|

|

|

|

|

|

|

|

Foreign currency |

|

(136,670 |

) |

|

|

86,491 |

|

|

|

9,293 |

|

|

|

(129,993 |

) |

|

Unrealized gains |

|

6,132 |

|

|

|

— |

|

|

|

15,102 |

|

|

|

— |

|

|

Total other comprehensive income (loss) |

|

(130,538 |

) |

|

|

86,491 |

|

|

|

24,395 |

|

|

|

(129,993 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Comprehensive loss |

$ |

(6,995,377 |

) |

|

$ |

(3,563,297 |

) |

|

$ |

(16,230,072 |

) |

|

$ |

(10,413,083 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

| Basic and diluted net loss per

share |

$ |

(0.10 |

) |

|

$ |

(0.09 |

) |

|

$ |

(0.24 |

) |

|

$ |

(0.31 |

) |

| Weighted average number of

common shares - |

|

|

|

|

|

|

|

|

|

|

|

|

basic and diluted |

|

71,025,738 |

|

|

|

38,911,054 |

|

|

|

68,889,650 |

|

|

|

32,756,074 |

|

AquaBounty Technologies,

Inc.Condensed Consolidated Statements of Cash

Flows(Unaudited)

| |

|

|

|

|

|

| |

Nine Months EndedSeptember

30, |

|

|

2021 |

|

2020 |

|

Operating activities |

|

|

|

|

|

|

Net loss |

$ |

(16,254,467 |

) |

|

$ |

(10,283,090 |

) |

| Adjustment to reconcile net

loss to net cash used in operating activities: |

|

|

|

|

|

|

Depreciation and amortization |

|

1,308,062 |

|

|

|

1,082,261 |

|

|

Share-based compensation |

|

305,653 |

|

|

|

383,964 |

|

|

Other non-cash charge |

|

12,993 |

|

|

|

40,151 |

|

| Changes in operating assets

and liabilities: |

|

|

|

|

|

|

Inventory |

|

303,767 |

|

|

|

(1,638,981 |

) |

|

Prepaid expenses and other assets |

|

(794,573 |

) |

|

|

(536,165 |

) |

|

Accounts payable and accrued liabilities |

|

7,273 |

|

|

|

366,403 |

|

|

Net cash used in operating activities |

|

(15,111,292 |

) |

|

|

(10,585,457 |

) |

|

|

|

|

|

|

|

| Investing

activities |

|

|

|

|

|

| Purchase of property, plant

and equipment |

|

(4,160,370 |

) |

|

|

(2,640,039 |

) |

| Proceeds from sale of asset

held for sale |

|

— |

|

|

|

99,816 |

|

| Purchases of marketable

securities, net |

|

(79,647,130 |

) |

|

|

— |

|

| Proceeds from legal

settlement, net |

|

— |

|

|

|

1,014,008 |

|

| Other

investing activities |

|

(11,010 |

) |

|

|

(18,900 |

) |

|

Net cash used in investing activities |

|

(83,818,510 |

) |

|

|

(1,545,115 |

) |

|

|

|

|

|

|

|

| Financing

activities |

|

|

|

|

|

| Proceeds from issuance of

debt |

|

606,453 |

|

|

|

4,129,510 |

|

| Repayment of term debt |

|

(119,527 |

) |

|

|

(49,862 |

) |

| Proceeds from the issuance of

common stock, net |

|

119,120,437 |

|

|

|

44,236,301 |

|

|

Proceeds from the exercise of stock options and warrants |

|

1,723,846 |

|

|

|

524,037 |

|

|

Net cash provided by financing activities |

|

121,331,209 |

|

|

|

48,839,986 |

|

|

|

|

|

|

|

|

| Effect

of exchange rate changes on cash, cash equivalents and restricted

cash |

|

27,086 |

|

|

|

(18,792 |

) |

|

Net change in cash, cash equivalents and restricted cash |

|

22,428,493 |

|

|

|

36,690,622 |

|

| Cash,

cash equivalents and restricted cash at beginning of period |

|

96,251,160 |

|

|

|

2,798,744 |

|

|

Cash, cash equivalents and restricted cash at end of

period |

$ |

118,679,653 |

|

|

$ |

39,489,366 |

|

|

|

|

|

|

|

|

| Reconciliation of

cash, cash equivalents and restricted cash reported in the

consolidated balance sheet: |

|

|

|

|

|

| Cash and cash equivalents |

$ |

118,179,653 |

|

|

$ |

39,489,366 |

|

|

Restricted cash |

|

500,000 |

|

|

|

— |

|

|

Total cash, cash equivalents and restricted cash |

$ |

118,679,653 |

|

|

$ |

39,489,366 |

|

|

|

|

|

|

|

|

| Supplemental

disclosure of cash flow information and non-cash

transactions: |

|

|

|

|

|

| Interest paid in cash |

$ |

224,595 |

|

|

$ |

47,275 |

|

| Property and equipment

included in accounts payable and accrued liabilities |

$ |

206,423 |

|

|

$ |

517,344 |

|

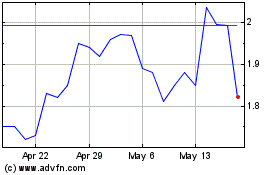

AquaBounty Technologies (NASDAQ:AQB)

Historical Stock Chart

From Jan 2025 to Feb 2025

AquaBounty Technologies (NASDAQ:AQB)

Historical Stock Chart

From Feb 2024 to Feb 2025