AquaBounty Technologies, Inc. Announces Proposed Public Offering of Common Stock by Selling Stockholders

November 18 2021 - 3:01PM

AquaBounty Technologies, Inc. (Nasdaq: AQB) (“AquaBounty” or the

“Company”), a land-based aquaculture company utilizing technology

to enhance productivity and sustainability, today announced that it

has commenced a proposed underwritten public offering of 11,200,000

shares of common stock of the Company by certain selling

stockholders affiliated with Third Security (the “Selling

Stockholders”) of AquaBounty. In addition, the Selling Stockholders

have granted the underwriters of the offering a 30-day option to

purchase up to 1,680,000 additional shares of common stock at the

public offering price, less underwriting discounts and commissions.

AquaBounty will not receive any of the proceeds from the sale of

the shares being offered by the Selling Stockholders. The Selling

Stockholders will bear the costs associated with the sale of such

shares, including underwriting discounts and commissions.

Oppenheimer & Co. Inc. and Lake Street

Capital Markets, LLC are acting as joint book-running managers for

this offering. The offering is subject to market and other

conditions, and there can be no assurance as to whether or when the

offering may be completed, or as to the actual size or terms of the

offering.

A registration statement on Form S-3 relating to

the public offering of the shares of common stock described above

was filed with the Securities and Exchange Commission (“SEC”) and

was declared effective on August 19, 2021. The proposed offering

will be made only by means of a prospectus and a prospectus

supplement. A copy of the preliminary prospectus supplement

describing the terms of the offering will be filed with the SEC and

will form a part of the effective registration statement. Copies of

the preliminary prospectus supplement and the accompanying

prospectus relating to the offering may be obtained, when

available, from Oppenheimer & Co. Inc. Attention:

Syndicate Prospectus Department, 85 Broad Street, 26th Floor, New

York, NY 10004, or by calling (212) 667-8563, or by emailing

EquityProspectus@opco.com; or Lake Street Capital Markets, LLC,

Attention: Syndicate Department, 920 Second Avenue South, Suite

700, Minneapolis, Minnesota 55402, or by calling (612) 326-1305, or

by emailing syndicate@lakestreetcm.com; or at the SEC’s website at

http://www.sec.gov.

This press release shall not constitute an offer

to sell, or a solicitation of an offer to buy, nor shall there be

any sale of these securities in any state or jurisdiction in which

such an offer, solicitation, or sale would be unlawful prior to

registration or qualification under the securities laws of any such

state or jurisdiction.

About AquaBounty

AquaBounty Technologies, Inc. (NASDAQ: AQB) is a

leader in aquaculture leveraging decades of technology expertise to

deliver game changing solutions that solve global problems, while

improving efficiency, sustainability and profitability. AquaBounty

provides fresh Atlantic salmon to nearby markets by raising its

fish in carefully monitored land-based fish farms through a safe,

secure and sustainable process. The Company’s land-based

Recirculating Aquaculture System (“RAS”) farms, located in Indiana,

United States and Prince Edward Island, Canada, are close to key

consumption markets and are designed to prevent disease and to

include multiple levels of fish containment to protect wild fish

populations. AquaBounty is raising nutritious salmon that is free

of antibiotics and other contaminants and provides a solution

resulting in a reduced carbon footprint and no risk of pollution to

marine ecosystems as compared to traditional sea-cage farming. For

more information on AquaBounty, please visit www.aquabounty.com or

follow us on Facebook, Twitter, LinkedIn and Instagram.

Forward-Looking Statements

This press release contains “forward-looking

statements” as defined in the Private Securities Litigation Reform

Act of 1995, as amended, that involve significant risks and

uncertainties about AquaBounty, including but not limited to

statements with respect to the completion, timing, and size of the

proposed underwritten offering of common stock. AquaBounty may use

words such as “expect,” “anticipate,” “project,” “intend,” “plan,”

“aim,” “believe,” “seek,” “estimate,” “can,” “focus,” “will,” and

“may” and similar expressions to identify such forward-looking

statements. Among the important factors that could cause actual

results to differ materially from those indicated by such

forward-looking statements are risks relating to, among other

things, whether or not AquaBounty will be able to raise capital,

the final terms of the underwritten offering of common stock,

market and other conditions, the satisfaction of customary closing

conditions related to the underwritten offering of common stock,

AquaBounty’s business and financial condition, and the impact of

general economic, public health, industry or political conditions

in the United States or internationally. For additional disclosure

regarding these and other risks faced by AquaBounty, see

disclosures contained in AquaBounty’s public filings with the SEC,

including the “Risk Factors” in the company’s Annual Report on Form

10-K, Quarterly Reports on Form 10-Q, and prospectus supplement for

this offering. You should consider these factors in evaluating the

forward-looking statements included in this press release and not

place undue reliance on such statements. The forward-looking

statements are made as of the date hereof, and AquaBounty

undertakes no obligation to update such statements as a result of

new information, except as required by law.

Contact

AquaBounty Technologies, Inc. Dave Conley,

Director of Communications +1 613 294 3078

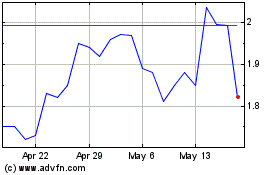

AquaBounty Technologies (NASDAQ:AQB)

Historical Stock Chart

From Jan 2025 to Feb 2025

AquaBounty Technologies (NASDAQ:AQB)

Historical Stock Chart

From Feb 2024 to Feb 2025