false

0001648087

0001648087

2024-11-05

2024-11-05

0001648087

AREB:CommonStock0.001ParValueMember

2024-11-05

2024-11-05

0001648087

AREB:CommonStockPurchaseWarrantsMember

2024-11-05

2024-11-05

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d) of The Securities Exchange Act of 1934

Date

of Report (Date of earliest event reported) November 5, 2024

AMERICAN

REBEL HOLDINGS, INC.

(Exact

name of registrant as specified in its charter)

| Nevada |

|

001-41267 |

|

47-3892903 |

(State or other jurisdiction

of incorporation) |

|

(Commission

File Number) |

|

(IRS Employer

Identification No.) |

5115

Maryland Way, Suite 303

Brentwood,

Tennessee |

|

37027 |

| (Address

of principal executive offices) |

|

(Zip

Code) |

Registrant’s

telephone number, including area code: (833) 267-3235

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions:

| ☐ | Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| | |

| ☐ | Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| | |

| ☐ | Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| | |

| ☐ | Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of each class |

|

Trading

Symbol(s) |

|

Name

of each exchange on which registered |

| Common

Stock, $0.001 par value |

|

AREB |

|

The

Nasdaq Stock Market LLC |

| Common

Stock Purchase Warrants |

|

AREBW |

|

The

Nasdaq Stock Market LLC |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company ☐

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for

complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

☐

Item

1.01. Entry into a Material Definitive Agreement.

1800

Diagonal Note

On

November 6, 2024, the Company entered into a Securities Purchase Agreement with 1800 Diagonal Lending, LLC, an accredited investor (the

“Lender”), pursuant to which the Lender made a loan to the Company, evidenced by a promissory note in the principal amount

of $122,960 (the “Note”). An original issue discount of $16,960 and fees of $6,000 were applied on the issuance date, resulting

in net loan proceeds to the Company of $100,000. Accrued, unpaid interest and outstanding principal, subject to adjustment, is required

to be paid in nine payments of $15,574.89, with the first payment due on December 15, 2024, and remaining eight payments due on the 15th

day of each month thereafter (a total payback to the Lender of $140,174).

Upon

the occurrence and during the continuation of any Event of Default, the Note shall become immediately due and payable and the Company

will be obligated to pay to the Lender, in full satisfaction of its obligations, an amount equal to 150% times the sum of (w) the then

outstanding principal amount of the Note plus (x) accrued and unpaid interest on the unpaid principal amount of the Note to the date

of payment plus (y) default interest, if any, at the rate of 22% per annum on the amounts referred to in clauses (w) and/or (x) plus

(z) any amounts owed to the Lender pursuant to the conversion rights referenced below.

Only

upon an occurrence of an event of default under the Note, the Lender may convert the outstanding unpaid principal amount of the Note

into restricted shares of common stock of the Company at a discount of 25% of the market price. The Lender agreed to limit the amount

of stock received to less than 4.99% of the total outstanding common stock. There are no warrants or other derivatives attached to this

Note. The Company agreed to reserve a number of shares of common stock equal to four times the number of shares of common stock which

may be issuable upon conversion of the Note at all times.

The

foregoing descriptions of the Note and the Securities Purchase Agreement and of all of the parties’ rights and obligations under

the Note and the Securities Purchase Agreement are qualified in its entirety by reference to the Note and the Securities Purchase Agreement,

copies of which are filed as Exhibits 10.1 and 10.2 respectively to this Current Report on Form 8-K, and of which are incorporated herein

by reference.

Item

2.03. Creation of a Direct Financial Obligation or an Obligation Under an Off-Balance Sheet Arrangement of a Registrant.

The

information set forth above in Item 1.01 of this Current Report on Form 8-K is incorporated herein by reference.

Item

3.02 Sale of Unregistered Securities.

On

November 7, 2024, the Company authorized the issuance of 71,783 shares of common stock to an accredited investor upon the partial exercise

of a prefunded warrant on a cashless basis.

The

issuance of the shares of Common Stock will not be registered under the Securities Act of 1933, as amended, in reliance upon the exemption

from the registration requirements of that Act provided by Section 4(a)(2) thereof. The recipient is an accredited investor with the

experience and expertise to evaluate the merits and risks of an investment in securities of the Company and the financial means to bear

the risks of such an investment.

Item

7.01 Regulation FD Disclosure.

On

November 5, 2024, the Company issued a press release entitled “American Rebel Supports Metro Nashville Police Department’s

30th Annual Toy Parade in collaboration with Boswell’s Harley-Davidson - American Rebel Light Beer Featured at Nashville’s

Scoreboard Opry Bar & Grill Afterparty.” A copy of the press release is attached hereto as Exhibit 99.1.

The

press release contains forward-looking statements within the meaning of the federal securities laws. These forward-looking statements

are necessarily based on certain assumptions and are subject to significant risks and uncertainties. These forward-looking statements

are based on management’s expectations as of the date hereof. The Registrant does not undertake any responsibility for the adequacy,

accuracy or completeness or to update any of these statements in the future. Actual future performance and results could differ from

that contained in or suggested by these forward-looking statements.

The

information in Item 7.01 of this Current Report on Form 8-K is being furnished and shall not be deemed “filed” for purposes

of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), nor shall it be deemed incorporated

by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, whether made before or after the date hereof,

except as shall be expressly set forth by specific reference to Item 7.01 of this Current Report on Form 8-K in such a filing.

Item

9.01 Financial Statements and Exhibits.

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934 the registrant has duly caused this report to be signed on its behalf by the

undersigned hereunto duly authorized.

| |

AMERICAN REBEL HOLDINGS, INC. |

| |

|

|

| Date:

November 8, 2024 |

By: |

/s/

Charles A. Ross, Jr. |

| |

|

Charles

A. Ross, Jr.

|

| |

|

Chief

Executive Officer |

Exhibit

10.1

Exhibit

10.2

Exhibit

99.1

American

Rebel Supports Metro Nashville Police Department’s 30th Annual Toy Parade in collaboration with Boswell’s Harley-Davidson

- American Rebel Light Beer Featured at Nashville’s Scoreboard Opry Bar & Grill Afterparty

Nashville,

TN, Nov. 05, 2024 (GLOBE NEWSWIRE) — American Rebel Holdings, Inc. (NASDAQ: AREB) (“American Rebel” or the “Company”),

creator of American Rebel Light Beer ( americanrebelbeer.com ), and a designer, manufacturer, and marketer of branded safes, personal

security and self-defense products and apparel, supported the after-party at Scoreboard Opry Bar & Grill ( scoreboardopry.com

) at the conclusion of Metro Nashville Police Department’s 30 th Annual Toy Parade in collaboration with Boswell’s

Harley-Davidson. The toy parade serves as the main fundraising event for MNPD’s Christmas Basket Program, which is in its 63 rd

year.

“What

a great event for Rebel Light to Stand Tall, Stand Proud and Be Loud ,” said Andy Ross, Chief Executive Officer of American

Rebel Holdings, Inc.. “American Rebel Light Beer was the featured beer at Scoreboards for the after-party of this great annual

toy parade. Bikers love our beer and we love bikers and we couldn’t more proud to be supporting this great effort by the MNPD which

will deliver food and toys to Nashvillians on Christmas Eve morning. Last year’s toy parade raised over $67,000 and over 30 years

they have raised over $1,000,000.”

“Middle

Tennessee is loaded with great and caring motorcycle riders,” said Bubba Boswell, president of Boswell’s Harley-Davidson.

“This event shows the community our passion for an outstanding cause. We are proud that our organization and the Metro Police Department

have partnered together for three decades to make a difference for families in need.” The MNPD said that over 200 families will

receive surprise gifts this year.

Bill

Davidson, a descendant of the founding family of Harley-Davidson Motorcycles, was the grand marshal for the Saturday toy parade.

American

Rebel Beer’s Tennessee distributor, Best Brands, Inc., arranged the featured beer commitment at Scoreboard Opry as the

first of many supporting events for American Rebel Light Beer in Tennessee. “Big bars, live music, great people and a great cause,”

said Andy Ross. “A perfect event for America’s Patriotic, God-Fearing, Constitution-Loving, National Anthem-Singing, Stand

Your Ground Beer.”

Scoreboard

Opry Bar & Grill is located at 2408 Music Valley Dr. across from the Gaylord Opryland Resort & Convention Center and the Grand

Ole Opry in the Music Valley Drive entertainment district in Nashville.

American

Rebel Light Beer is produced in partnership with AlcSource, the largest integrated provider of beverage development, sourcing, and production

solutions in the U.S. American Rebel Light Beer is a Premium Domestic Light Lager.

For

an updated list of locations featuring American Rebel Light, visit americanrebelbeer.com.

To

make a donation to Metro Nashville Police Department Charities click on Donate.

About

American Rebel Holdings, Inc.

American

Rebel Holdings, Inc. (NASDAQ: AREB) operates primarily as a designer, manufacturer and marketer of branded safes, personal security and

self-defense products, and American Rebel Beer ( americanrebelbeer.com ). The Company also designs and produces branded apparel

and accessories. To learn more, visit americanrebel.com. For investor information, visit americanrebel.com/investor-relations.

About

Best Brands, Inc.

Best

Brands, Inc. is a leading distributor of wines, spirits and beer, with four primary coverage areas of western Tennessee, middle Tennessee,

southeastern Tennessee and northeastern Tennessee. Best Brands is a major force in the Tennessee market with an experienced management

team and a sales staff second to none. Best Brands’ people’s devotion to promoting and growing their brands, both on-premise

and off-premise, separates them from their competition.

Forward-Looking

Statements

This

press release contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. American

Rebel Holdings, Inc., (NASDAQ: AREB; AREBW) (the “Company,” “American Rebel,” “we,” “our”

or “us”) desires to take advantage of the safe harbor provisions of the Private Securities Litigation Reform Act of 1995

and is including this cautionary statement in connection with this safe harbor legislation. The words “forecasts” “believe,”

“may,” “estimate,” “continue,” “anticipate,” “intend,” “should,”

“plan,” “could,” “target,” “potential,” “is likely,” “expect”

and similar expressions, as they relate to us, are intended to identify forward-looking statements. We have based these forward-looking

statements primarily on our current expectations and projections about future events and financial trends that we believe may affect

our financial condition, results of operations, business strategy, and financial needs. Important factors that could cause actual results

to differ from those in the forward-looking statements include continued increase in revenues, actual size of Best Brands, Inc., actual

sales to be derived from Best Brands, Inc., implied or perceived benefits resulting from the Best Brands, Inc. agreement, actual launch

timing and availability of American Rebel Beer in additional markets, our ability to effectively execute our business plan, and the Risk

Factors contained within our filings with the SEC, including our Annual Report on Form 10-K for the year ended December 31, 2022. Any

forward-looking statement made by us herein speaks only as of the date on which it is made. Factors or events that could cause our actual

results to differ may emerge from time to time, and it is not possible for us to predict all of them. We undertake no obligation to publicly

update any forward-looking statements, whether as a result of new information, future developments or otherwise, except as may be required

by law.

Company

Contact:

info@americanrebel.com

James

“Todd” Porter

American Rebel Beverages, LLC

tporter@americanrebelbeer.com

Investor

Relations:

Brian M. Prenoveau, CFA

MZ

Group – MZ North America

areb@mzgroup.us

561-489-5315

v3.24.3

Cover

|

Nov. 05, 2024 |

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Nov. 05, 2024

|

| Entity File Number |

001-41267

|

| Entity Registrant Name |

AMERICAN

REBEL HOLDINGS, INC.

|

| Entity Central Index Key |

0001648087

|

| Entity Tax Identification Number |

47-3892903

|

| Entity Incorporation, State or Country Code |

NV

|

| Entity Address, Address Line One |

5115

Maryland Way

|

| Entity Address, Address Line Two |

Suite 303

|

| Entity Address, City or Town |

Brentwood

|

| Entity Address, State or Province |

TN

|

| Entity Address, Postal Zip Code |

37027

|

| City Area Code |

(833)

|

| Local Phone Number |

267-3235

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity Emerging Growth Company |

false

|

| Common Stock, $0.001 par value |

|

| Title of 12(b) Security |

Common

Stock, $0.001 par value

|

| Trading Symbol |

AREB

|

| Security Exchange Name |

NASDAQ

|

| Common Stock Purchase Warrants |

|

| Title of 12(b) Security |

Common

Stock Purchase Warrants

|

| Trading Symbol |

AREBW

|

| Security Exchange Name |

NASDAQ

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=AREB_CommonStock0.001ParValueMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=AREB_CommonStockPurchaseWarrantsMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

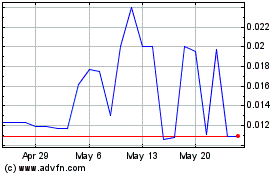

American Rebel (NASDAQ:AREBW)

Historical Stock Chart

From Oct 2024 to Nov 2024

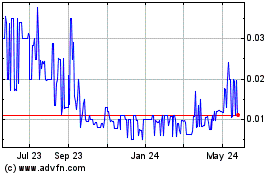

American Rebel (NASDAQ:AREBW)

Historical Stock Chart

From Nov 2023 to Nov 2024