false

0000007623

0000007623

2023-07-11

2023-07-11

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 8-K

Current Report Pursuant to Section 13 OR 15(d)

of The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): July 11, 2023

ART’S-WAY MANUFACTURING CO., INC.

(Exact name of registrant as specified in its charter)

|

Delaware

|

|

(State or other jurisdiction of incorporation)

|

| |

|

|

|

000-05131

|

|

42-0920725

|

|

(Commission File Number)

|

|

(IRS Employer

|

| |

|

Identification No.)

|

|

5556 Highway 9

Armstrong, Iowa 50514

|

|

(Address of principal executive offices) (Zip Code)

|

| |

|

(712) 208-8467

|

|

(Registrant’s telephone number, including area code)

|

| |

|

Not Applicable

|

|

(Former name or former address, if changed since last report.)

|

| |

|

|

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class

|

Trading Symbol(s)

|

Name of each exchange on which registered

|

|

Common stock $0.01 par value

|

ARTW

|

The Nasdaq Stock Market LLC

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 Results of Operations and Financial Condition.

On July 11, 2023, Art’s-Way Manufacturing Co., Inc. (the “Company”) issued a press release announcing its financial results for the second quarter and first six months of fiscal 2023. The full text of the press release is set forth in Exhibit 99.1 attached hereto and is incorporated by reference in this Current Report on Form 8-K as if fully set forth herein.

The information contained in this Current Report on Form 8-K, including Exhibit 99.1 attached hereto and incorporated herein, shall not be deemed “filed” for the purposes of Section 18 of the Securities Exchange Act of 1934, as amended, or otherwise subject to the liabilities of that Section, and shall not be incorporated by reference into any registration statement pursuant to the Securities Act of 1933, as amended, except as shall be expressly set forth by specific reference in such filing.

Item 9.01 Financial Statements and Exhibits.

(a) Financial statements: None

(b) Pro forma financial information: None

(c) Shell Company Transactions: None

(d) Exhibits:

104 Cover Page Interactive Data File (embedded within the Inline XBRL document)

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

Dated: July 12, 2023

|

|

|

|

|

|

|

ART’S-WAY MANUFACTURING CO., INC.

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

/s/ Michael W. Woods

|

|

|

|

|

Michael W. Woods

|

|

|

|

|

Chief Financial Officer

|

|

Exhibit 99.1

FOR IMMEDIATE RELEASE

July 11, 2023

ART’S WAY ANNOUNCES EARNINGS GROWTH FOR Q2 AND FIRST SIX MONTHS OF FISCAL 2023 LED BY AGRICULTURAL PRODUCTS SEGMENT

ARMSTRONG, IOWA, July 11, 2023 – Art’s Way Manufacturing Co., Inc. (Nasdaq: ARTW) (the “Company”), a diversified, international manufacturer and distributor of equipment serving agricultural, research and steel cutting needs, announces its financial results for the second quarter and year to date of fiscal 2023.

| |

|

For the Three Months Ended

|

|

| |

|

(Consolidated)

|

|

| |

|

May 31, 2023

|

|

|

May 31, 2022

|

|

|

Sales

|

|

$ |

9,008,000 |

|

|

$ |

7,275,000 |

|

|

Operating Income

|

|

$ |

434,000 |

|

|

$ |

321,000 |

|

|

Net Income

|

|

$ |

307,000 |

|

|

$ |

175,000 |

|

|

EPS (Basic)

|

|

$ |

0.06 |

|

|

$ |

0.04 |

|

|

EPS (Diluted)

|

|

$ |

0.06 |

|

|

$ |

0.04 |

|

| |

|

|

|

|

|

|

|

|

|

Weighted Average Shares Outstanding:

|

|

|

|

|

|

|

|

|

|

Basic

|

|

|

5,014,050 |

|

|

|

4,629,331 |

|

|

Diluted

|

|

|

5,014,050 |

|

|

|

4,629,331 |

|

| |

|

For the Six Months Ended

|

|

| |

|

(Consolidated)

|

|

| |

|

May 31, 2023

|

|

|

May 31, 2022

|

|

|

Sales

|

|

$ |

16,903,000 |

|

|

$ |

12,888,000 |

|

|

Operating Income (Loss)

|

|

$ |

982,000 |

|

|

$ |

(115,000 |

) |

|

Net Income (Loss)

|

|

$ |

649,000 |

|

|

$ |

(231,000 |

) |

|

EPS (Basic)

|

|

$ |

0.13 |

|

|

$ |

(0.05 |

) |

|

EPS (Diluted)

|

|

$ |

0.13 |

|

|

$ |

(0.05 |

) |

| |

|

|

|

|

|

|

|

|

|

Weighted Average Shares Outstanding:

|

|

|

|

|

|

|

|

|

|

Basic

|

|

|

4,995,708 |

|

|

|

4,599,743 |

|

|

Diluted

|

|

|

4,995,708 |

|

|

|

4,599,743 |

|

Sales: The Company’s consolidated corporate sales for the three- and six-month periods ended May 31, 2023 were $9,008,000 and $16,903,000, respectively, compared to $7,275,000 and $12,888,000 during the same respective periods in fiscal 2022, a $1,733,000, or 23.8%, increase for the three months and a $4,015,000, or 31.1%, increase for the six months. The Company increased revenue and saw increased demand in all three business segments for the three and six months ended May 31, 2023.

The Company’s second quarter sales in the Agricultural Products segment were $6,368,000 compared to $5,316,000 during the same period of fiscal 2022, an increase of $1,052,000, or 19.8%. Year-to-date agricultural product sales were $11,813,000 compared to $9,477,000 during the same period in fiscal 2022, an increase of $2,336,000, or 24.6%. Successful execution of the Company’s production plan in fiscal 2023 has led to strong increases in the revenue for beet equipment, grinders, manure spreaders and bale processing equipment year on year. While some supply chain challenges still exist, proper planning has allowed the Company to overcome most of these issues. The Company continued to see improved throughput in the production facility due to automation advances including the utilization of robotic weld cells and from the alleviation of bottleneck constraints with the addition of a high-definition plasma cutter. Demand has remained steady for the first six months of fiscal 2023 as commodity prices continue to be strong and the Company has not yet seen an indication of a pullback in fiscal 2023.

The Company’s second quarter sales in its Modular Buildings segment were $1,856,000 compared to $1,209,000 for the same period in fiscal 2022, an increase of $647,000, or 53.5%. Year-to-date sales in the Modular Buildings segment were $3,498,000 compared to $2,077,000 for the same period in fiscal 2022, an increase of $1,421,000, or 68.4%. While fiscal 2023 sales are up significantly, the first six months to fiscal 2022 were unusually slow for this business segment. The Company’s sales team capitalized on the strong commodity prices in the agriculture sector over the past two fiscal years. Agricultural building sales made up over 50% of gross revenues in the Modular Buildings segment in fiscal years 2023 and 2022 compared to less than 10% in fiscal 2021. Coupling the strong agricultural market with a few large research modular contracts has made for a successful first six months of fiscal 2023.

As announced in a press release on June 7, 2023, the Company is discontinuing the Tools segment with the last day of normal operations on July 14, 2023. The company is working through remaining orders that can be fulfilled without additional inventory purchases and will begin an orderly liquidation process in the weeks following production shutdown. The liquidation process will include sale of remaining inventory, auctioning off machinery and equipment and the sale of real estate. The Company estimates cash generation of approximately $950,000 from the liquidation of receivables, inventory and other assets (excluding real estate) to fund estimated liquidation costs of $200,000. These numbers assume the majority of open sales orders at June 7, 2023 are fulfilled before production ceases on July 14, 2023. The Tools segment had sales of $783,000 and $1,591,000 during the three- and six-month periods ended May 31, 2023, respectively, compared to $750,000 and $1,334,000 for the same respective periods in fiscal 2022, a 4.4% increase and a 19.3% increase, respectively.

Net Income: Consolidated net income was $307,000 for the three-month period ended May 31, 2023, compared to $175,000 for the same period in fiscal 2022. Consolidated net income for the six months ended May 31, 2023, was $649,000 compared to a net loss of $(231,000) in the same period in fiscal 2022. The Agricultural Products and Modular Buildings segments recorded profitability for the three- and six-months ending May 31, 2023. The Company attributes the positive results in fiscal 2023 to strong demand for its products paired with successful production execution.

Income (Loss) per Share: Income per basic and diluted share for the second quarter of fiscal 2023 was $0.06, compared to income per basic and diluted share of $0.04 for the same period in fiscal 2022. Income per basic and diluted share for the first six months of fiscal 2023 was $0.13, compared to loss per basic and diluted share of ($0.05) for the same period in fiscal 2022.

“Art’s Way continues to thrive in strong market conditions, driven by sound execution of our growth strategy and from the operational excellence of our employees, dealers and suppliers,” said David King, Chief Executive Officer. “While supply chain constraints have eased over the last two quarters, our planning around these constraints has improved our ability to deliver product and meet customer demand.”

King added, “The outlook for the remainder of the year looks positive as projected farm income levels for 2023 remain above historical levels, which should continue to drive agricultural equipment sales. Market conditions for our modular buildings also remain strong. We anticipate additional building contracts to be signed for 2023 and into 2024 to add to our already robust backlog. Demand remains high for our Agricultural Products and Modular Buildings segments, which is reflected by higher backlog than we have traditionally seen in years past. With a strong 2nd half of fiscal 2023 backlog, and anticipated revenues and profits, along with the sale of the Tools assets, we expect significant cash flow to be available to fund strategic initiatives to further improve our agriculture business as well as reduce our outstanding debt.”

Art’s-Way Manufacturing Co., Inc.

Art’s Way Manufacturing is a small, publicly traded company that specializes in equipment manufacturing. For over 65 years, it has been committed to designing and building high-quality machinery for all operations. It has approximately 150 employees across three branch locations: Art’s Way Manufacturing in Armstrong, Iowa, Art’s Way Scientific in Monona, Iowa, and American Carbide Tool in Canton, Ohio. Art’s Way manure spreaders, forage boxes, high dump carts, bale processors, graders, land planes, sugar beet harvesters and grinder mixers are designed to optimize production, increase efficiency and meet the growing demands of customers. Art’s Way Manufacturing has three reporting segments: Agricultural Products; Modular Buildings; and Tools.

For more information, contact: David King, Chief Executive Officer

712-208-8467

davidk@artsway.com

Or visit the Company’s website at www.artsway.com/

Cautionary Statements

This release includes "forward-looking statements" within the meaning of the federal securities laws. Statements made in this release that are not strictly statements of historical facts, including the Company’s expectations regarding: (i) the Company’s business position; (ii) demand and potential growth within the Company’s business segments; (iii) future results, including but not limited to, revenue and margin expectations, expectations with respect to the impact of price increases, and expectations with respect to backlog and product mix; (iv) the Company’s ability to increase production with capital investments and other activities, (v) future agricultural sales and plans to enter into building contracts; (vi) cash flows and plans to fund strategic initiatives and pay down debt; and (vii) the benefits of the Company’s business model and strategy, are forward-looking statements. Statements of anticipated future results are based on current expectations and are subject to a number of risks and uncertainties, including, but not limited to: customer demand for the Company’s products; credit-worthiness of the Company’s customers; the Company’s ability to operate at lower expense levels; the Company’s ability to complete projects in a timely and efficient manner in accordance with customer specifications; the Company’s ability to renew or obtain financing on reasonable terms; the Company’s ability to repay current debt, continue to meet debt obligations and comply with financial covenants; inflation and its effect on the Company’s supply chain and demand for its products, domestic and international economic conditions; the Company’s ability to attract and maintain an adequate workforce in a competitive labor market; any future COVID-19 setbacks; factors affecting the strength of the agricultural sector; the cost of raw materials; unexpected changes to performance by any of the Company’s operating segments; obstacles related to liquidation of product lines and segments; and other factors detailed from time to time in the Company’s Securities and Exchange Commission filings. Actual results may differ markedly from management's expectations. Readers are cautioned not to place undue reliance upon any such forward-looking statements. The Company does not intend to update forward-looking statements other than as required by law.

v3.23.2

Document And Entity Information

|

Jul. 11, 2023 |

| Document Information [Line Items] |

|

| Entity, Registrant Name |

ART’S-WAY MANUFACTURING CO., INC.

|

| Document, Type |

8-K

|

| Document, Period End Date |

Jul. 11, 2023

|

| Entity, Incorporation, State or Country Code |

DE

|

| Entity, File Number |

000-05131

|

| Entity, Tax Identification Number |

42-0920725

|

| Entity, Address, Address Line One |

5556 Highway 9

|

| Entity, Address, City or Town |

Armstrong

|

| Entity, Address, State or Province |

IA

|

| Entity, Address, Postal Zip Code |

50514

|

| City Area Code |

712

|

| Local Phone Number |

208-8467

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common stock

|

| Trading Symbol |

ARTW

|

| Security Exchange Name |

NASDAQ

|

| Entity, Emerging Growth Company |

false

|

| Amendment Flag |

false

|

| Entity, Central Index Key |

0000007623

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

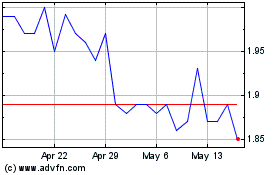

Arts Way Manufacturing (NASDAQ:ARTW)

Historical Stock Chart

From Apr 2024 to May 2024

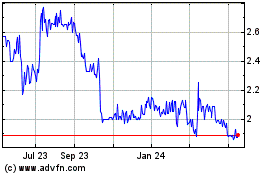

Arts Way Manufacturing (NASDAQ:ARTW)

Historical Stock Chart

From May 2023 to May 2024