AST SpaceMobile, Inc. (“AST SpaceMobile”) (NASDAQ: ASTS), the

company building the first and only space-based cellular broadband

network accessible directly by everyday smartphones, and designed

for both commercial and government applications, is providing its

business update for the third quarter ended September 30, 2024.

"We achieved many significant milestones in the quarter and

continue our momentum with several key pieces now in place," said

Abel Avellan, Founder, Chairman and CEO of AST SpaceMobile. "With

the first five BlueBird satellites successfully unfolded and

entering initial operations, our business is progressing according

to plan. We’ve advanced our strategy across multiple efforts

including progress on securing orbital launch capacity, growing our

manufacturing capability, and expanding our customer

ecosystem."

Business Update

- First five commercial BlueBird satellites achieved

successful initial operations and filed Special Temporary Authority

(STA) request with FCC to begin beta service with AT&T and

Verizon

- All five satellites successfully unfolded as of late October,

completing a key post-launch activity

- Preparing satellites for operational readiness through ongoing

integration with partner networks

- Secured orbital launch capacity to enable continuous

space-based cellular broadband service coverage in key markets,

including U.S., Europe, Japan, the U.S. Government and other

strategic markets globally

- Launch services agreements with Blue Origin and existing launch

vehicles for launches during 2025 and 2026

- The agreements enable the orbital launch of up to approximately

60 Block 2 BlueBird satellites

- Achieved initial validation of our AST5000 ASIC chip, with test

software, test equipment, procedures, and main infrastructure in

place to commission during 2025

- Combination of novel ASIC and larger Block 2 array will offer

beams designed to support a capacity of up to 40MHz, enabling peak

data transmission speeds up to 120Mbps, supporting voice, full data

and video applications

- Expanded the AST SpaceMobile customer ecosystem, adding

three new contract awards with the U.S. Government and continued to

advance discussions with multiple commercial partners

- Selection by the Space Development Agency (SDA) to compete

directly as a prime contractor under the Hybrid Application for

proliferated low Earth orbit (HALO) program

- Added three new contract awards with U.S. Government to

leverage and expand existing in-orbit technology capabilities,

directly and through prime contractors

- Growing pipeline of government opportunities for non-commercial

applications demonstrates significant advantages of AST

SpaceMobile’s dual-use technologies

- Strong balance sheet with $518.9 million in cash, cash

equivalents, and restricted cash, benefiting from warrant

redemption and ATM program

- Received $153.3 million in net proceeds from the redemption of

publicly traded warrants

- Repaid $48.5 million of Senior Secured Credit Facility in Q4,

lowering go-forward interest expense

- Filed formal application with the Export-Import Bank of the

United States (EXIM) for debt financing

- Continue to prioritize raising strategic capital through

non-dilutive approaches, including commercial prepayments and

commitments from our MNO partners

Third Quarter 2024 Financial Highlights

- As of September 30, 2024, we had cash, cash equivalents, and

restricted cash of $518.9 million

- Total operating expenses for the third quarter of 2024 were

$66.6 million, including $21.4 million of depreciation and

amortization and stock-based compensation expense. This represents

an increase of $2.7 million as compared to $63.9 million in the

second quarter of 2024, due to a $10.3 million increase in research

and development costs and a $0.6 million increase in engineering

services costs, partially offset by a $2.3 million decrease in

general and administrative costs, and a $5.9 million decrease in

depreciation and amortization expense

- Adjusted operating expenses(1) for the third quarter of 2024

were $45.3 million, an increase of $10.7 million as compared to

$34.6 million in the second quarter of 2024, due to a $1.2 million

increase in Adjusted general and administrative costs(1), and a

$10.3 million increase in research and development costs, partially

offset by a $0.8 million decrease in Adjusted engineering services

costs(1)

- As of September 30, 2024, we have incurred approximately $374.0

million of gross capitalized property and equipment costs and

accumulated depreciation and amortization of $113.9 million. The

capitalized costs include costs of satellite materials for BlueBird

satellites, advance launch payments, Block 1 and BlueWalker 3

satellites, assembly and integration facilities including assembly

and test equipment, and ground antennas

(1) See reconciliation of Adjusted

operating expenses to Total operating expenses, Adjusted

engineering services costs to Engineering services costs and

Adjusted general and administrative costs to General and

administrative costs in the tables accompanying this press

release.

Non-GAAP Financial Measures

We refer to certain non-GAAP financial measures in this press

release, including Adjusted operating expenses, Adjusted

engineering services costs and Adjusted general and administrative

costs. We believe these non-GAAP financial measures are useful

measures across time in evaluating our operating performance as we

use these measures to manage the business, including in preparing

our annual operating budget and financial projections. These

non-GAAP financial measures that have no standardized meaning

prescribed by U.S. GAAP, and therefore have limits in their

usefulness to investors. Because of the non-standardized

definitions, these measures may not be comparable to the

calculation of similar measures of other companies and are

presented solely to provide investors with useful information to

more fully understand how management assesses performance. These

measures are not, and should not be viewed as, a substitute for

their most directly comparable GAAP measures. Reconciliation of

non-GAAP financial measures and the most directly comparable GAAP

financial measures are included in the tables accompanying this

press release.

Conference Call Information

AST SpaceMobile will hold a quarterly business update conference

call at 5:00 p.m. (Eastern Time) on Thursday, November 14, 2024.

The call will be accessible via a live webcast on the Events page

of AST SpaceMobile’s Investor Relations website at

https://ast-science.com/investors/. An archive of the webcast will

be available shortly after the call.

About AST SpaceMobile

AST SpaceMobile is building the first and only global cellular

broadband network in space to operate directly with standard,

unmodified mobile devices based on our extensive IP and patent

portfolio, and designed for both commercial and government

applications. Our engineers and space scientists are on a mission

to eliminate the connectivity gaps faced by today’s five billion

mobile subscribers and finally bring broadband to the billions who

remain unconnected. For more information, follow AST SpaceMobile on

YouTube, X (Formerly Twitter), LinkedIn and Facebook. Watch this

video for an overview of the SpaceMobile mission.

Forward-Looking Statements

This communication contains “forward-looking statements” that

are not historical facts, and involve risks and uncertainties that

could cause actual results of AST SpaceMobile to differ materially

from those expected and projected. These forward-looking statements

can be identified by the use of forward-looking terminology,

including the words “believes,” “estimates,” “anticipates,”

“expects,” “intends,” “plans,” “may,” “will,” “would,” “potential,”

“projects,” “predicts,” “continue,” or “should,” or, in each case,

their negative or other variations or comparable terminology. These

forward-looking statements involve significant risks and

uncertainties that could cause the actual results to differ

materially from the expected results. Most of these factors are

outside AST SpaceMobile’s control and are difficult to predict.

Factors that could cause such differences include, but are not

limited to: (i) expectations regarding AST SpaceMobile’s strategies

and future financial performance, including AST’s future business

plans or objectives, expected functionality of the SpaceMobile

Service, anticipated timing of the launch of the Block 2 BlueBird

satellites, anticipated demand and acceptance of mobile satellite

services, prospective performance and commercial opportunities and

competitors, the timing of obtaining regulatory approvals, ability

to finance its research and development activities, commercial

partnership acquisition and retention, products and services,

pricing, marketing plans, operating expenses, market trends,

revenues, liquidity, cash flows and uses of cash, capital

expenditures, and AST SpaceMobile’s ability to invest in growth

initiatives; (ii) the negotiation of definitive agreements with

mobile network operators relating to the SpaceMobile Service that

would supersede preliminary agreements and memoranda of

understanding and the ability to enter into commercial agreements

with other parties or government entities; (iii) the ability of AST

SpaceMobile to grow and manage growth profitably and retain its key

employees and AST SpaceMobile’s responses to actions of its

competitors and its ability to effectively compete; (iv) changes in

applicable laws or regulations; (v) the possibility that AST

SpaceMobile may be adversely affected by other economic, business,

and/or competitive factors; (vi) the outcome of any legal

proceedings that may be instituted against AST SpaceMobile; and

(vii) other risks and uncertainties indicated in the Company’s

filings with the Securities and Exchange Commission (SEC),

including those in the Risk Factors section of AST SpaceMobile’s

Form 10-K filed with the SEC on April 1, 2024.

AST SpaceMobile cautions that the foregoing list of factors is

not exclusive. AST SpaceMobile cautions readers not to place undue

reliance upon any forward-looking statements, which speak only as

of the date made. For information identifying important factors

that could cause actual results to differ materially from those

anticipated in the forward-looking statements, please refer to the

Risk Factors in AST SpaceMobile’s Form 10-K filed with the SEC on

April 1, 2024. AST SpaceMobile’s securities filings can be accessed

on the EDGAR section of the SEC’s website at www.sec.gov. Except as

expressly required by applicable securities law, AST SpaceMobile

disclaims any intention or obligation to update or revise any

forward-looking statements whether as a result of new information,

future events or otherwise.

Third Quarter Financial Results

AST SPACEMOBILE, INC.

CONDENSED CONSOLIDATED BALANCE

SHEETS (UNAUDITED)

(Dollars in thousands, except

share data)

As of

September 30, 2024

December 31, 2023

ASSETS

Current

assets:

Cash and cash equivalents

$

516,389

$

85,622

Restricted cash

2,497

2,475

Prepaid expenses

7,073

4,591

Other current assets

19,662

14,194

Total current assets

545,621

106,882

Non-current

assets:

Property and equipment, net

260,068

238,478

Operating lease right-of-use assets,

net

12,088

13,221

Other non-current assets

3,872

2,311

TOTAL ASSETS

$

821,649

$

360,892

LIABILITIES AND

STOCKHOLDERS' EQUITY

Current

liabilities:

Accounts payable

$

8,962

$

20,575

Accrued expenses and other current

liabilities

16,480

23,926

Contract liabilities

22,468

-

Current operating lease liabilities

1,534

1,468

Current portion of long-term debt

44,635

252

Total current liabilities

94,079

46,221

Non-current

liabilities:

Warrant liabilities

57,460

29,960

Non-current operating lease

liabilities

11,057

11,900

Long-term debt, net

156,252

59,252

Total liabilities

318,848

147,333

Commitments and contingencies

Stockholders'

Equity:

Class A Common Stock, $.0001 par value;

800,000,000 shares authorized; 170,039,305 and 90,161,309 shares

issued and outstanding as of September 30, 2024 and December 31,

2023, respectively.

17

9

Class B Common Stock, $.0001 par value;

200,000,000 shares authorized; 39,747,447 and 50,041,757 shares

issued and outstanding as of September 30, 2024 and December 31,

2023, respectively.

4

5

Class C Common Stock, $.0001 par value;

125,000,000 shares authorized; 78,163,078 shares issued and

outstanding as of September 30, 2024 and December 31, 2023,

respectively.

8

8

Additional paid-in capital

762,426

288,404

Accumulated other comprehensive income

353

227

Accumulated deficit

(453,888

)

(189,662

)

Noncontrolling interest

193,881

114,568

Total stockholders' equity

502,801

213,559

TOTAL LIABILITIES AND STOCKHOLDERS'

EQUITY

$

821,649

$

360,892

AST SPACEMOBILE, INC.

CONDENSED CONSOLIDATED

STATEMENTS OF OPERATIONS (UNAUDITED)

(Dollars in thousands, except

share and per share data)

For the Three Months Ended

September 30,

For the Nine Months Ended

September 30,

2024

2023

2024

2023

Revenues

$

1,100

$

-

$

2,500

$

-

Operating

expenses:

Engineering services costs

21,828

19,523

62,546

58,818

General and administrative costs

15,551

10,995

45,677

31,073

Research and development costs

14,724

9,418

23,435

36,721

Depreciation and amortization

14,543

19,029

54,880

34,877

Total operating expenses

66,646

58,965

186,538

161,489

Other income

(expense):

(Loss) gain on remeasurement of warrant

liabilities

(236,912

)

7,481

(284,839

)

21,454

Interest (expense) income, net

(1,386

)

495

(5,846

)

4,311

Other income (expense), net

1,410

507

1,661

(10,237

)

Total other income (expense),

net

(236,888

)

8,483

(289,024

)

15,528

Loss before income tax (expense)

benefit

(302,434

)

(50,482

)

(473,062

)

(145,961

)

Income tax (expense) benefit

(646

)

(266

)

(1,172

)

408

Net loss before allocation to

noncontrolling interest

(303,080

)

(50,748

)

(474,234

)

(145,553

)

Net loss attributable to noncontrolling

interest

(131,134

)

(29,839

)

(210,008

)

(89,918

)

Net loss attributable to common

stockholders

$

(171,946

)

$

(20,909

)

$

(264,226

)

$

(55,635

)

Net loss per share attributable to holders

of Class A Common Stock

Basic and diluted

$

(1.10

)

$

(0.23

)

$

(1.89

)

$

(0.70

)

Weighted-average shares of Class A Common

Stock outstanding

Basic and diluted

155,644,888

89,514,621

139,485,036

79,065,471

AST SPACEMOBILE, INC.

CONDENSED CONSOLIDATED

STATEMENTS OF COMPREHENSIVE LOSS (UNAUDITED)

(Dollars in thousands)

For the Three Months Ended

September 30,

For the Nine Months Ended

September 30,

2024

2023

2024

2023

Net loss before allocation to

noncontrolling interest

$

(303,080

)

$

(50,748

)

$

(474,234

)

$

(145,553

)

Other comprehensive loss

Foreign currency translation

adjustments

529

(358

)

190

(526

)

Total other comprehensive loss

529

(358

)

190

(526

)

Total comprehensive loss before allocation

to noncontrolling interest

(302,551

)

(51,106

)

(474,044

)

(146,079

)

Comprehensive loss attributable to

noncontrolling interest

(130,906

)

(30,050

)

(209,944

)

(90,226

)

Comprehensive loss attributable to common

stockholders

$

(171,645

)

$

(21,056

)

$

(264,100

)

$

(55,853

)

AST SPACEMOBILE, INC.

CONDENSED CONSOLIDATED

STATEMENTS OF CASH FLOWS (UNAUDITED)

(Dollars in thousands)

For the Nine Months Ended

September 30,

2024

2023

Cash flows from operating activities:

Net loss before allocation to

noncontrolling interest

$

(474,234

)

$

(145,553

)

Adjustments to reconcile net loss before

noncontrolling interest to cash used in operating activities:

Depreciation and amortization

54,880

34,877

Amortization of debt issuance costs

3,047

374

Loss on disposal of property and

equipment

2,221

-

Loss (gain) on remeasurement of warrant

liabilities

284,839

(21,454

)

Stock-based compensation

20,617

10,595

Paid-in-kind ("PIK") interest expense

2,959

-

Changes in operating assets and

liabilities:

Prepaid expenses and other current

assets

(7,940

)

1,601

Accounts payable and accrued expenses

(7,998

)

(6,215

)

Operating lease right-of-use assets and

operating lease liabilities

357

54

Contract liabilities

22,468

-

Other assets and liabilities

1,081

1,680

Net cash used in operating activities

(97,703

)

(124,041

)

Cash flows from investing activities:

Purchase of property and equipment

(92,095

)

(96,462

)

Net cash used in investing activities

(92,095

)

(96,462

)

Cash flows from financing activities:

Proceeds from debt

145,000

63,500

Repayments of debt

(187

)

(180

)

Payments for debt issuance costs

(9,435

)

(9,653

)

Proceeds from issuance of common stock

338,911

65,003

Payments for equity issuance costs

(6,903

)

(1,527

)

Proceeds from warrants exercises

153,307

-

Issuance of equity under employee stock

plan

3,058

225

Employee taxes paid for stock-based

compensation awards

(3,325

)

-

Net cash provided by financing

activities

620,426

117,368

Effect of exchange rate changes on cash,

cash equivalents and restricted cash

161

(395

)

Net increase (decrease) in cash, cash

equivalents and restricted cash

430,789

(103,530

)

Cash, cash equivalents and restricted

cash, beginning of period

88,097

239,256

Cash, cash equivalents and restricted

cash, end of period

$

518,886

$

135,726

Supplemental disclosure of cash flow

information:

Non-cash activities:

Right-of-use assets obtained in exchange

for operating lease liabilities

$

-

$

6,709

Non-cash investing and financing

activities:

Purchases of property and equipment in

accounts payable and accrued expenses

$

5,086

$

7,120

PIK interest paid through issuance of PIK

notes

2,959

-

Settlement of warrant liabilities by

issuing shares

257,337

-

Cash paid for:

Interest

$

6,694

$

1,071

Income taxes, net

1,135

510

AST SPACEMOBILE, INC.

RECONCILIATION OF GAAP

REPORTED TO NON-GAAP ADJUSTED MEASURES (UNAUDITED)

(Dollars in thousands)

For the Three Months Ended

September 30, 2024

GAAP Reported

Stock-Based Compensation

Expense

Adjusted

Engineering services costs

$

21,828

$

(3,431

)

$

18,397

General and administrative costs

15,551

(3,379

)

12,172

Research and development costs

14,724

-

14,724

Depreciation and amortization

14,543

-

14,543

Total operating expenses

$

66,646

$

(6,810

)

$

59,836

Less: Depreciation and amortization

(14,543

)

Adjusted operating expenses

$

45,293

For the Three Months Ended

June 30, 2024

GAAP Reported

Stock-Based Compensation

Expense

Adjusted

Engineering services costs

$

21,202

$

(2,032

)

$

19,170

General and administrative costs

17,839

(6,842

)

10,997

Research and development costs

4,460

-

4,460

Depreciation and amortization

20,392

-

20,392

Total operating expenses

$

63,893

$

(8,874

)

$

55,019

Less: Depreciation and amortization

(20,392

)

Adjusted operating expenses

$

34,627

Adjusted operating expenses, Adjusted engineering services costs

and Adjusted general and administrative costs are alternative

financial measures used by management to evaluate our operating

performance as a supplement to our most directly comparable U.S.

GAAP financial measure. We define Adjusted operating expense as

Total operating expenses adjusted to exclude amounts of stock-based

compensation expense and depreciation and amortization expense. We

define Adjusted engineering services costs and Adjusted general and

administrative costs as engineering services costs and general and

administrative costs adjusted to exclude stock-based compensation

expenses.

We believe Adjusted operating expenses, Adjusted engineering

services costs and Adjusted general and administrative costs are

useful measures across time in evaluating our operating performance

as we use these measures to manage the business, including in

preparing our annual operating budget and financial projections.

Adjusted operating expenses, Adjusted engineering services costs,

and Adjusted general and administrative costs are non-GAAP

financial measures that have no standardized meaning prescribed by

U.S. GAAP, and therefore have limits in their usefulness to

investors. Because of the non-standardized definitions, these

measures may not be comparable to the calculation of similar

measures of other companies and are presented solely to provide

investors with useful information to more fully understand how

management assesses performance. These measures are not, and should

not be viewed as, a substitute for their most directly comparable

GAAP measure of Total operating expenses, Engineering services

costs and General and administrative costs.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241114769845/en/

Investor Contact: Scott Wisniewski

investors@ast-science.com

Media Contact: Allison PR Eva Murphy Ryan 917-547-7289

ASTSpaceMobile@allisonpr.com

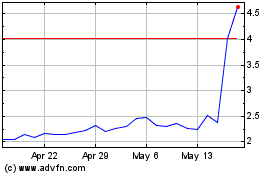

AST SpaceMobile (NASDAQ:ASTS)

Historical Stock Chart

From Dec 2024 to Jan 2025

AST SpaceMobile (NASDAQ:ASTS)

Historical Stock Chart

From Jan 2024 to Jan 2025