false

0001464343

0001464343

2024-01-24

2024-01-24

0001464343

atlc:CommonStockCustomMember

2024-01-24

2024-01-24

0001464343

atlc:SeriesBCumulativePerpetualPreferredStock7625CustomMember

2024-01-24

2024-01-24

0001464343

atlc:SeniorNotesDue20266125CustomMember

2024-01-24

2024-01-24

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): January 24, 2024

Atlanticus Holdings Corporation

(Exact name of registrant as specified in its charter)

| |

| |

|

|

|

|

|

Georgia

|

|

000-53717

|

|

58-2336689

|

|

(State or other jurisdiction of incorporation)

|

|

(Commission File Number)

|

|

(I.R.S. Employer Identification No.)

|

Five Concourse Parkway, Suite 300, Atlanta, Georgia 30328

(Address of principal executive offices)

Registrant’s telephone number, including area code: 770-828-2000

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

|

Title of class

|

Trading Symbol

|

Name of exchange on which registered

|

| |

|

|

|

Common stock, no par value

|

ATLC

|

Nasdaq Global Select Market

|

|

7.625% Series B Cumulative Perpetual Preferred Stock, no par value

|

ATLCP

|

Nasdaq Global Select Market

|

|

6.125% Senior Notes due 2026

|

ATLCL

|

Nasdaq Global Select Market

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02. Results of Operations and Financial Condition.

The preliminary financial information as of December 31, 2023, and for the quarter then ended, set forth under Item 8.01 below is incorporated into this Item 2.02 by reference.

Item 7.01. Regulation FD Disclosure.

On January 24, 2024, Atlanticus Holdings Corporation (the “Company”) issued a press release (the “Press Release”) announcing that it has commenced an underwritten public offering of Senior Notes due 2029 (the “Offering”). A copy of the Press Release is furnished as Exhibit 99.1 to this Current Report on Form 8-K.

On January 24, 2024, the Company released an investor presentation that will be used by the Company with respect to the Offering (the “Investor Presentation”). A copy of the Investor Presentation is furnished as Exhibit 99.2 to this Current Report on Form 8-K.

In accordance with General Instruction B.2 of Form 8-K, the information furnished pursuant to this Item 7.01, Exhibit 99.1 and Exhibit 99.2 shall not be deemed to be “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section, nor shall such information be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, except as shall be expressly set forth by specific reference in such a filing.

Item 8.01. Other Events.

On January 24, 2024, the Company filed a preliminary prospectus supplement with the Securities and Exchange Commission (the “Commission”) under its effective shelf registration statement on Form S-3 (Registration No. 333-255834) (the “Preliminary Prospectus Supplement”) in connection with the Offering. The Preliminary Prospectus Supplement contains preliminary financial information as of December 31, 2023, and for the quarter then ended, and includes the following disclosure:

| |

●

|

Unrestricted cash and cash equivalents: Approximately $339 million

|

| |

●

|

Aggregate unpaid gross balance of loans, interest and fees receivable that are reported at fair value: Approximately $2,411 million

|

| |

●

|

Notes payable outstanding, net: Approximately $1,862 million

|

| |

●

|

Total revenue: Approximately $309 million

|

| |

●

|

Net income attributable to common shareholders: In the range of $18-20 million

|

The preparation of financial statements for the Company for the year ended December 31, 2023, is not yet complete. Accordingly, the preliminary financial information presented in the Preliminary Prospectus Supplement and this Item 8.01 reflects the Company’s estimates of certain financial information as of December 31, 2023 and for the quarter then ended. Management believes the preliminary financial information is reasonable under the circumstances and reflects management’s estimates based solely upon information available as of the date of this Current Report on Form 8-K. These estimates are not meant to be a comprehensive statement of the Company’s results for this period and should not be viewed as a substitute for financial statements prepared in accordance with applicable accounting standards. Accordingly, you should not place undue reliance on these estimates.

Cautionary Statement Regarding Forward-Looking Statements

This Current Report on Form 8-K contains forward-looking statements that reflect the Company’s current views with respect to, among other things, its business, operations, financial performance and preliminary financial information as of December 31, 2023 and for the quarter then ended. You generally can identify these statements by the use of words such as “outlook,” “potential,” “continue,” “may,” “seek,” “approximately,” “predict,” “believe,” “expect,” “plan,” “intend,” “estimate” or “anticipate” and similar expressions or the negative versions of these words or comparable words, as well as future or conditional verbs such as “will,” “should,” “would,” “likely” and “could.” These statements are subject to certain risks and uncertainties that could cause actual results to differ materially from those included in the forward-looking statements. Actual results could differ materially from these estimates because of final adjustments, the completion of the Company’s financial review and closing procedures, and other developments after the date of this Current Report on Form 8-K. Important factors that could cause actual results to differ from our estimates are set forth below.

These risks and uncertainties include those risks described in the Company’s filings with the Commission and include, but are not limited to, risks related to the economy, inflation, loan demand, the capital markets, labor availability and supply chains; the Company’s ability to retain existing, and attract new, merchant partners and funding sources; changes in market interest rates; increases in loan delinquencies; the Company’s ability to operate successfully in a highly regulated industry; the outcome of litigation and regulatory matters; the effect of management changes; cyberattacks and security vulnerabilities in its products and services; and the Company’s ability to compete successfully in highly competitive markets.

The preliminary financial information included in this Current Report on Form 8-K has been prepared by, and is the responsibility of, the Company’s management. BDO USA, P.C. has not audited, reviewed, examined, compiled, nor applied agreed-upon procedures with respect to the preliminary financial information. Accordingly, BDO USA, P.C. does not express an opinion or any other form of assurance with respect thereto. The forward-looking statements speak only as of the date on which they are made, and, except to the extent required by federal securities laws, the Company disclaims any obligation to update any forward-looking statement to reflect events or circumstances after the date on which the statement is made or to reflect the occurrence of unanticipated events. In light of these risks and uncertainties, there is no assurance that the events or results suggested by the forward-looking statements will in fact occur, and you should not place undue reliance on these forward-looking statements.

Disclaimer

This communication does not constitute an offer to sell or buy, nor the solicitation of an offer to sell or buy, any securities.

Item 9.01. Financial Statements and Exhibits.

|

Exhibit

No.

|

|

Description

|

| |

|

|

|

99.1

|

|

|

| |

|

|

|

99.2

|

|

|

| |

|

|

|

104

|

|

Cover Page Interactive Data File (embedded within the Inline XBRL document).

|

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

Atlanticus Holdings Corporation

|

| |

|

|

| |

|

|

|

Date: January 24, 2024

|

By:

|

/s/ William R. McCamey

|

| |

|

Name: William R. McCamey

|

| |

|

Title: Chief Financial Officer

|

Exhibit 99.1

Atlanticus Announces Offering of Senior Notes

ATLANTA, January 24, 2024 (GLOBE NEWSWIRE) -- Atlanticus Holdings Corporation (NASDAQ: ATLC) (“Atlanticus,” “the Company”, “we,” “our” or “us”), a financial technology company that enables its bank, retail and healthcare partners to offer more inclusive financial services to millions of everyday Americans, today announced it has commenced an underwritten registered public offering (the “Offering”) of Senior Notes due 2029 (the “Notes”). The Company expects to grant the underwriters a 30-day option to purchase additional Notes in connection with the Offering.

The Company expects to use the net proceeds of this Offering to redeem a portion of the Class B preferred units issued by one of the Company’s subsidiaries and/or for general corporate purposes.

In connection with the Offering, the Company will apply to list the Notes on the Nasdaq Global Select Market (“Nasdaq”) under the symbol “ATLCZ.” If approved for listing, trading on Nasdaq is expected to commence within 30 business days after the Notes are first issued.

The Company and this issuance of Notes received an “A” rating from Egan-Jones Ratings Company, an independent, unaffiliated rating agency. Ratings are not a recommendation to purchase, hold or sell Notes, inasmuch as the ratings do not comment as to market price or suitability for a particular investor. The ratings are based upon current information furnished to the rating agency by the Company and information obtained by the rating agency from other sources. The ratings are only accurate as of the date thereof and may be changed, superseded or withdrawn as a result of changes in, or unavailability of, such information, and therefore a prospective purchaser should check the current ratings before purchasing the Notes. Each rating should be evaluated independently of any other rating.

B. Riley Securities, Inc., Janney Montgomery Scott LLC, Ladenburg Thalmann & Co. Inc., William Blair & Co., L.L.C., and BTIG, LLC are acting as book-running managers for this Offering. Brownstone Investment Group, LLC is acting as co-manager for this Offering.

The Offering of these Notes is being made pursuant to an effective shelf registration statement on Form S-3, which was initially filed with the Securities and Exchange Commission (the “SEC”) on May 6, 2021 and declared effective by the SEC on May 13, 2021. The Offering will be made only by means of a prospectus and prospectus supplement. A copy of the prospectus and prospectus supplement relating to these securities may be obtained, when available, from the website of the SEC at http://www.sec.gov or by contacting: B. Riley Securities, Inc., 1300 17th Street North, Suite 1300, Arlington, Virginia 22209, Attn: Prospectus Department, Email: prospectuses@brileyfin.com, Telephone: (703) 312-9580.

This press release shall not constitute an offer to sell or the solicitation of an offer to buy, nor shall there be any sale of these securities in any state or jurisdiction in which such offer, solicitation, or sale would be unlawful prior to registration or qualification under the securities laws of any such state or jurisdiction.

About Atlanticus Holdings Corporation

Empowering Better Financial Outcomes for Everyday Americans

Atlanticus’ technology allows bank, retail, and healthcare partners to offer more inclusive financial services to everyday Americans through the use of proprietary analytics. We apply the experience gained and infrastructure built from servicing over 18 million customers and $38 billion in consumer loans over our more than 25 year operating history to support lenders that originate a range of consumer loan products. These products include retail and healthcare private label credit and general purpose credit cards marketed through our omnichannel platform, including retail point-of-sale, healthcare-point of-care, direct mail solicitation, internet-based marketing, and partnerships with third parties. Additionally, through our CAR subsidiary, Atlanticus serves the individual needs of automotive dealers and automotive non-prime financial organizations with multiple financing and service programs.

Forward-Looking Statements

This press release contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. You generally can identify these statements by the use of words such as “outlook,” “potential,” “continue,” “may,” “seek,” “approximately,” “predict,” “believe,” “expect,” “plan,” “intend,” “estimate” or “anticipate” and similar expressions or the negative versions of these words or comparable words, as well as future or conditional verbs such as “will,” “should,” “would,” “likely” and “could.” These statements are subject to certain risks and uncertainties that could cause actual results to differ materially from those included in the forward-looking statements. These risks and uncertainties include those risks described in the Company’s filings with the Securities and Exchange Commission and include, but are not limited to, risks related to the uncertain economic environment, particularly the impact of inflation, interest rates, labor availability and supply chains; the Company’s ability to retain existing, and attract new, merchant partners and funding sources; increases in loan delinquencies; its ability to operate successfully in a highly regulated industry; the outcome of litigation and regulatory matters; the effect of management changes; cyberattacks and security vulnerabilities in its products and services; and the Company’s ability to compete successfully in highly competitive markets. The forward-looking statements speak only as of the date on which they are made, and, except to the extent required by federal securities laws, the Company disclaims any obligation to update any forward-looking statement to reflect events or circumstances after the date on which the statement is made or to reflect the occurrence of unanticipated events. In light of these risks and uncertainties, there is no assurance that the events or results suggested by the forward-looking statements will in fact occur, and you should not place undue reliance on these forward-looking statements.

Contact:

Investor Relations

(770) 828-2000

investors@atlanticus.com

Exhibit 99.2

v3.23.4

Document And Entity Information

|

Jan. 24, 2024 |

| Document Information [Line Items] |

|

| Entity, Registrant Name |

Atlanticus Holdings Corporation

|

| Document, Type |

8-K

|

| Document, Period End Date |

Jan. 24, 2024

|

| Entity, Incorporation, State or Country Code |

GA

|

| Entity, File Number |

000-53717

|

| Entity, Tax Identification Number |

58-2336689

|

| Entity, Address, Address Line One |

Five Concourse Parkway, Suite 300

|

| Entity, Address, City or Town |

Atlanta,

|

| Entity, Address, State or Province |

GA

|

| Entity, Address, Postal Zip Code |

30328

|

| City Area Code |

770

|

| Local Phone Number |

828-2000

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity, Emerging Growth Company |

false

|

| Amendment Flag |

false

|

| Entity, Central Index Key |

0001464343

|

| CommonStock Custom [Member] |

|

| Document Information [Line Items] |

|

| Title of 12(b) Security |

Common stock

|

| Trading Symbol |

ATLC

|

| Security Exchange Name |

NASDAQ

|

| SeriesBCumulativePerpetualPreferredStock7625 Custom [Member] |

|

| Document Information [Line Items] |

|

| Title of 12(b) Security |

7.625% Series B Cumulative Perpetual Preferred Stock

|

| Trading Symbol |

ATLCP

|

| Security Exchange Name |

NASDAQ

|

| SeniorNotesDue20266125 Custom [Member] |

|

| Document Information [Line Items] |

|

| Title of 12(b) Security |

6.125% Senior Notes due 2026

|

| Trading Symbol |

ATLCL

|

| Security Exchange Name |

NASDAQ

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=atlc_CommonStockCustomMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=atlc_SeriesBCumulativePerpetualPreferredStock7625CustomMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=atlc_SeniorNotesDue20266125CustomMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

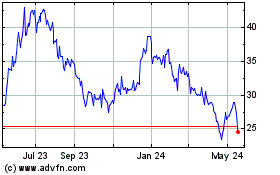

Atlanticus (NASDAQ:ATLC)

Historical Stock Chart

From Oct 2024 to Nov 2024

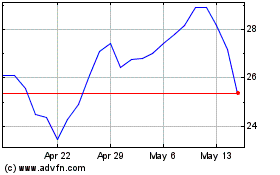

Atlanticus (NASDAQ:ATLC)

Historical Stock Chart

From Nov 2023 to Nov 2024