Bruker BioSciences Corporation (NASDAQ: BRKR) today reported second

quarter 2005 revenue of $71.4 million, an 11.3% increase from

revenue of $64.1 million in the second quarter of 2004. For the six

months ended June 30, 2005, revenue increased 10.6% to $146.3

million, compared to $132.3 million for the same period last year.

Revenue growth during the three and six months ended June 30, 2005

included favorable foreign currency effects of 3.3% and 3.5%,

respectively. Second quarter 2005 operating income was $0.9

million, compared to an operating loss of ($5.0) million in the

second quarter of 2004. Net income in the second quarter of 2005

was $0.3 million, or $0.00 per diluted share, compared to a net

loss of ($4.4) million, or ($0.05) per diluted share, in the second

quarter of 2004. For the six months ended June 30, 2005, operating

income was $3.5 million, and net income was $0.7 million, or $0.01

per diluted share, compared to an operating loss of ($3.6) million,

and a net loss of ($3.9) million, or ($0.04) per diluted share for

the first half of 2004. During the second quarter 2005, positive

operating cash flow of $18.8 million increased our cash position to

$92.0 million, while short-term borrowings declined to $9.3 million

from $12.2 million at December 31, 2004. Commenting on the quarter,

Frank Laukien, President and CEO said: "Over the last year, we have

made steady progress in controlling our expenses, returning to

profitability, and strengthening our cash flows and balance sheet.

We will continue to focus on higher profitability through various

ongoing gross margin improvement initiatives, continued strict

expense control, reduction in our interest expenses and gradual

improvements in our effective tax rate." Dr. Laukien continued:

"Our organic revenue growth in the first half of 2005 has been

above industry average, despite weaker than expected demand in

several of our market segments. In the first half of this year, we

have introduced several important new technologies, and a

remarkable number of innovative products that are receiving strong

customer interest. We believe that our proven ability to generate

innovations and rapid organic growth will enable us to become an

even more significant driver within our markets, and will allow us

over time to leverage our continued R&D and distribution

investments to reach industry-standard profitability." William

Knight, Chief Financial Officer, commented: "Improvements in our

profitability continue to be our top priority and these efforts

have steadily improved our operating and net income. Our gross

profit margins improved both year-over-year and sequentially,

reflecting some initial success from our gross profit margin

improvement programs. In addition, the spending control and

productivity programs announced during the second half of 2004 have

contributed to our operating expenses as a percentage of revenue

being more in-line with industry averages. Overall I am pleased

with the progress we have made to date, but realize more remains to

be done. We are also very pleased with our positive operating cash

flows of almost $24 million during the first half of 2005."

OPERATING BUSINESSES Set forth below is selected financial

information for Bruker BioSciences' two operating businesses:

Bruker Daltonics (life-science mass spectrometry and NBC detection

business) and Bruker AXS (x-ray analysis business): BRUKER

DALTONICS In the second quarter of 2005, revenue for the Bruker

Daltonics business increased 7.1% to $37.4 million, from $34.9

million in the second quarter of 2004. For the six months ended

June 30, 2005, revenue for the Bruker Daltonics business increased

8.5% to $80.0 million, from $73.7 million for the same period last

year. For the six months ended June 30, 2005, Bruker Daltonics'

revenue was derived 70% from life-science mass spectrometry

systems, 11% from substance detection systems, and 19% from

after-market sales. EBITDA was $2.3 million for the second quarter

of 2005, compared to ($0.2) million for the second quarter of 2004.

EBITDA was $6.6 million for the six months ended June 30, 2005,

compared to $3.0 million for the same period last year. BRUKER AXS

In the second quarter of 2005, revenue for the Bruker AXS business

increased 16.4% to $34.1 million, from $29.3 million in the second

quarter of 2004. For the six months ended June 30, 2005, revenue

for the Bruker AXS business increased 13.6% to $66.6 million, from

$58.6 million for the same period last year. For the six months

ended June 30, 2005, Bruker AXS' revenue was derived 75% from x-ray

systems sales and 25% from after-market sales. EBITDA was $1.3

million in the second quarter of 2005, compared to ($1.7) million

in the second quarter of 2004. EBITDA was $3.0 million for the six

months ended June 30, 2005, compared to $(0.8) million for the same

period last year. USE OF NON-GAAP FINANCIAL MEASURES In addition to

the financial measures prepared in accordance with generally

accepted accounting principles (GAAP), we use the non-GAAP measure

of EBITDA. EBITDA is defined as US GAAP operating income (loss)

excluding depreciation and amortization expense. We believe that

the inclusion of this non-GAAP measure helps investors to gain a

better understanding of our core operating results and future

prospects, consistent with how management measures and forecasts

the Company's performance, especially when comparing such results

to previous periods or forecasts. However, the non-GAAP financial

measure included in this press release is not meant to be a better

presentation or a substitute for results of operations prepared in

accordance with GAAP. Reconciliations of this non-GAAP financial

measure to the most directly comparable GAAP financial measures are

set forth in the accompanying tables. EARNINGS CONFERENCE CALL

Bruker BioSciences will host an operator-assisted earnings

conference call at 10 a.m. Eastern Daylight Time on Wednesday,

August 3, 2005. To listen to the webcast, investors can go to

www.bruker-biosciences.com and click on the live web broadcast

symbol. The webcast will be available through the Company web site

for 30 days. Investors can also listen and participate on the

telephone in the US and Canada by calling 888-339-2688, or

617-847-3007 outside the US and Canada. Investors should refer to

the Bruker BioSciences Quarterly Earnings Call. A telephone replay

of the conference call will be available one hour after the

conference call by dialing 888-286-8010 in the US and Canada, or

617-801-6888 outside the US and Canada, and then entering replay

pass code 27000303. ABOUT BRUKER BIOSCIENCES Bruker BioSciences

Corporation, headquartered in Billerica, Massachusetts, is the

publicly traded parent company of Bruker Daltonics Inc. and Bruker

AXS Inc. Bruker AXS is a leading developer and provider of life

science and advanced materials research tools based on x-ray

technology. Bruker Daltonics is a leading developer and provider of

innovative life science tools based on mass spectrometry. Bruker

Daltonics also offers a broad line of nuclear, biological and

chemical (NBC) detection products for defense and homeland

security. For more information, please visit

www.bruker-biosciences.com CAUTIONARY STATEMENT Any statements

contained in this press release that do not describe historical

facts may constitute forward-looking statements as that term is

defined in the Private Securities Litigation Reform Act of 1995.

Any forward-looking statements contained herein are based on

current expectations, but are subject to a number of risks and

uncertainties. The factors that could cause actual future results

to differ materially from current expectations include, but are not

limited to, risks and uncertainties relating to the Company's

reorganization strategies, integration risks, failure of

conditions, technological approaches, product development, market

acceptance, cost and pricing of the Company's products, exposure to

currency fluctuations, changes in governmental regulations, capital

spending and government funding policies, FDA and other regulatory

approvals to the extent applicable, competition, the intellectual

property of others, patent protection and litigation. These and

other factors are identified and described in more detail in our

filings with the SEC, including, without limitation, our respective

annual reports on Form 10-K for the year ended December 31, 2004,

our most recent quarterly reports on Form 10-Q, and our current

reports on Form 8-K. We disclaim any intent or obligation to update

these forward-looking statements. Condensed consolidated statements

of operations, operating business information, and balance sheets

follow for Bruker BioSciences Corporation. -0- *T Bruker

BioSciences Corporation CONDENSED CONSOLIDATED STATEMENTS OF

OPERATIONS (in thousands, except per share data) Three Months Ended

Six Months Ended June 30, June 30,

------------------------------------- 2005 2004 2005 2004 -------

------- -------- -------- Product revenue $60,723 $56,182 $127,547

$115,219 Service revenue 9,977 7,635 17,732 16,500 Other revenue

668 330 1,000 582 ------- ------- -------- -------- Total revenue

71,368 64,147 146,279 132,301 Cost of product revenue 34,275 35,116

72,540 69,055 Cost of service revenue 6,548 5,383 11,815 11,435

------- ------- -------- -------- Total cost of revenue 40,823

40,499 84,355 80,490 ------- ------- -------- -------- Gross profit

margin 30,545 23,648 61,924 51,811 Operating Expenses: Sales and

marketing 13,385 13,192 25,537 25,864 General and administrative

5,287 5,115 10,955 9,258 Research and development 10,962 10,327

21,982 20,267 ------- ------- -------- -------- Total operating

expenses 29,634 28,634 58,474 55,389 ------- ------- --------

-------- Operating income (loss) 911 (4,986) 3,450 (3,578) Interest

and other income (expense), net 554 (965) 424 (866) ------- -------

-------- -------- Income (loss) before income tax provision

(benefit) and minority interest in consolidated subsidiaries 1,465

(5,951) 3,874 (4,444) Provision (benefit) for income taxes 1,145

(1,580) 3,070 (560) ------- ------- -------- -------- Income (loss)

before minority interest 320 (4,371) 804 (3,884) Minority interest

in consolidated subsidiaries 36 19 103 30 ------- ------- --------

-------- Net income (loss) $ 284 $(4,390) $ 701 $ (3,914) =======

======= ======== ======== Net income (loss) per share: Basic $ 0.00

$ (0.05) $ 0.01 $ (0.04) ======= ======= ======== ======== Diluted

$ 0.00 $ (0.05) $ 0.01 $ (0.04) ======= ======= ======== ========

Weighted average shares outstanding: Basic 89,472 88,558 89,471

87,505 ======= ======= ======== ======== Diluted 89,599 88,558

89,591 87,505 ======= ======= ======== ======== Bruker BioSciences

Corporation BRUKER DALTONICS SELECTED OPERATING BUSINESS

INFORMATION (in thousands) Three Months Ended Six Months Ended June

30, June 30, -------------------------------------- 2005 2004 2005

2004 --------- -------- -------- -------- Total revenue $ 37,361 $

34,882 $ 80,005 $ 73,709 ========= ======== ======== ========

Operating income (loss) $ 973 $ (1,526)$ 3,948 $ 252 Depreciation

and amortization 1,314 1,322 2,661 2,708

-------------------------------------- EBITDA $ 2,287 $ (204)$

6,609 $ 2,960 ========= ======== ======== ======== Bruker

BioSciences Corporation BRUKER AXS SELECTED OPERATING BUSINESS

INFORMATION (in thousands) Three Months Ended Six Months Ended June

30, June 30, -------------------------------------- 2005 2004 2005

2004 -------- -------- -------- -------- Total revenue $ 34,068 $

29,265 $ 66,582 $ 58,592 ======== ======== ======== ========

Operating income (loss) $ 419 $ (2,597) $ 1,241 $ (2,767)

Depreciation and amortization 870 935 1,792 1,957

-------------------------------------- EBITDA $ 1,289 $ (1,662) $

3,033 $ (810) ======== ======== ======== ======== Bruker

BioSciences Corporation CONDENSED CONSOLIDATED BALANCE SHEETS (in

thousands) June 30, December 31, 2005 2004 ---------- ----------

(unaudited) ASSETS Current assets: Cash and short-term investments

$ 92,038 $ 77,691 Accounts receivable, net 47,222 57,792 Due from

affiliated companies 10,306 9,530 Inventories 98,355 107,748 Other

current assets 12,473 18,530 ---------- ---------- Total current

assets 260,394 271,291 Property and equipment, net 74,654 84,990

Intangible and other assets 14,993 15,266 ---------- ----------

Total assets $ 350,041 $ 371,547 ========== ========== LIABILITIES

AND SHAREHOLDERS' EQUITY Current liabilities: Short-term borrowings

$ 9,274 $ 12,205 Accounts payable 15,698 22,652 Due to affiliated

companies 6,473 3,026 Other current liabilities 72,412 73,277

---------- ---------- Total current liabilities 103,857 111,160

Long-term debt 23,910 27,763 Other long-term liabilities 15,625

15,156 Minority interest in subsidiaries 372 193 Total

shareholders' equity 206,277 217,275 ---------- ---------- Total

liabilities and shareholders' equity $ 350,041 $ 371,547 ==========

========== *T

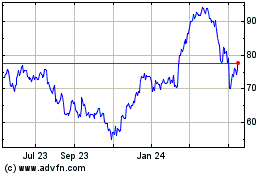

Bruker (NASDAQ:BRKR)

Historical Stock Chart

From Jun 2024 to Jul 2024

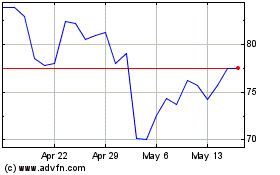

Bruker (NASDAQ:BRKR)

Historical Stock Chart

From Jul 2023 to Jul 2024