Williams, BWP Form Joint Venture - Analyst Blog

March 07 2013 - 10:40AM

Zacks

North American energy firm

Williams Companies Inc. (WMB) inked a deal with a

master limited partnership Boardwalk Pipeline Partners

LP (BWP) to form a joint venture for developing a pipeline

project. The pipeline will carry natural gas liquids (NGL) to the

growing petrochemical complex on the Gulf Coast from Utica and

Marcellus shale plays situated in Ohio, West Virginia and

Pennsylvania.

The planned Bluegrass Pipeline system will carry the NGL at a rate

of 200,000 barrels a day from the producing regions of Ohio, West

Virginia and Pennsylvania to the Texas Gas Transmission system of

Boardwalk, based in Hardinsburg, Kentucky. From Kentucky the liquid

will be transported to the coast of Texas and Louisiana, where it

will be used as feedstock for the petrochemical plants, for

fractionation purposes and the export market. In addition, the

companies are looking to construct a processing plant in

Louisiana.

Included in the deal, the companies are also planning to build a

new liquefied petroleum gas terminal on the Gulf Coast to better

access international customers.

The proposed pipeline is expected to be in operation in the second

half of 2015, subject to the fulfillment of all the required

conditions. In order to support the growing market demand, the

capacity of the pipeline is also expected to be increased to

400,000 barrels a day from 200,000 barrels a day by adding an extra

pumping system.

However, the cost of the project is not yet disclosed by any of the

companies.

Tulsa, Oklahoma-based Williams is a premier energy infrastructure

provider in North America. The company’s core operations include

finding, producing, gathering, processing, and transportation of

natural gas. Boasting of a widespread pipeline system, Williams is

one of the largest domestic transporters of natural gas by volume.

Its facilities – gas wells, pipelines, and midstream services – are

concentrated in the Northwest, Rocky Mountains, Gulf Coast, and

Eastern Seaboard. Williams divides its business into four segments:

Williams Partners, Williams NGL & Petchem Services, Access

Midstream Partners, and Other.

We remain concerned about Williams’ high debt levels, which leave

it vulnerable to an extended drop in commodity prices. As of Dec

31, 2012, Williams had long-term debt of more than $10.7 billion,

representing a debt-to-capitalization ratio of 69.3%.

Williams currently retains a Zacks Rank #5 (Strong Sell), implying

that it is expected to underperform the broader U.S. equity market

over the next 1 to 3 months.

However, there are other stocks in the oil and gas sector –

Calumet Specialty Products Partners LP (CLMT) and

Compressco Partners LP (GSJK) – which hold a Zacks

Rank #1 and are expected to perform better.

BOARDWALK PIPLN (BWP): Free Stock Analysis Report

CALUMET SPECLTY (CLMT): Free Stock Analysis Report

COMPRESSCO PTNR (GSJK): Free Stock Analysis Report

WILLIAMS COS (WMB): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

CSI Compressco (NASDAQ:CCLP)

Historical Stock Chart

From Jun 2024 to Jul 2024

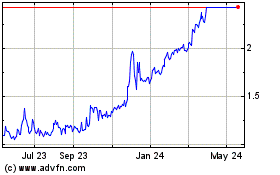

CSI Compressco (NASDAQ:CCLP)

Historical Stock Chart

From Jul 2023 to Jul 2024