Central Garden & Pet Company (NASDAQ: CENT)(NASDAQ: CENTA)

today announced results for its third quarter ended June 26,

2010.

The Company reported net sales of $465 million in the quarter, a

decline of three percent compared to $482 million in the comparable

fiscal 2009 period. The Company reported operating income of $52.6

million, an increase of two percent compared to $51.6 million in

the year ago period. Net interest expense was $9.8 million compared

to $5.2 million a year ago. Net income for the quarter was $25.9

million, or $0.40 per fully diluted share compared to $31.1 million

or $0.44 per fully diluted share in the year ago period. Branded

products sales decreased six percent to $382 million. Sales of

other manufacturers’ products increased ten percent to $83 million.

Depreciation and amortization was $7.2 million, the same as the

year ago period. The quarter-ending leverage ratio was 2.5x

compared to 2.7x a year ago.

“Despite a soft garden season, the quarter produced solid

results in many areas of the company,” noted William Brown,

Chairman and Chief Executive Officer of Central Garden & Pet

Company. “We are continuing to control costs, manage working

capital and drive gross profit margin. Our goal is to grow sales

and drive further margin and capital efficiency improvement across

the business while developing new programs and products that make a

difference for consumers.”

Fiscal third quarter net sales for the Garden Products segment

were $243 million, a decrease of nine percent from $267 million in

the comparable fiscal 2009 period. Operating income for Garden

Products was $30.1 million compared to $35.3 million in the year

ago period. Branded garden products sales decreased thirteen

percent to $201 million. Sales of other manufacturers’ products

increased fifteen percent to $42 million. Fiscal third quarter net

sales for the Pet Products segment were $222.7 million, an increase

of four percent from $215 million compared to the fiscal 2009

period. Operating income for the Pet Products segment was $32.6

million, compared to $29.8 million in the year ago period. Branded

pet products sales were $181.6 million, an increase of three

percent compared to last year. Sales of other manufacturers’

products were $41.1 million, an increase of six percent compared to

last year.

For the nine months ended June 26, 2010, the Company reported

net sales of $1.18 billion compared to $1.25 billion in the

comparable 2009 period, a decline of six percent. Operating income

for the period was $113.7 million compared to operating income of

$106.1 million in the year ago period. Net income for the nine

months ended June 26, 2010 was $54.6 million compared to net income

of $57.9 million in the comparable 2009 period. Earnings per

diluted share were $0.83 compared to $0.82 per diluted share in the

year ago period. Branded product sales declined eight percent to

$970 million and sales of other manufacturers’ products increased

seven percent to $206 million. Depreciation and amortization for

the nine month period was $21.7 million compared to $21.9 million

in the year ago period.

The Company will discuss its third quarter results on a

conference call today at 4:30 p.m. EDT / 1:30 p.m. PDT. Individuals

may access the call by dialing 1-888-713-4199 and passcode 4145

4989 (domestic) or 1-617-213-4861 and passcode 4145 4989

(international).

The conference call will be simultaneously broadcast over the

Internet through Central’s website, http://www.central.com/

or you may link directly to the webcast on our website at

http://phx.corporate-ir.net/phoenix.zhtml?c=93879&p=irol-calendar.

To listen to the webcast, please log on to the website prior to the

scheduled call time to register and download any necessary audio

software.

In order to simplify your registration process, you may

pre-register at the following link:

https://www.theconferencingservice.com/prereg/key.process?key=PXPR8NGUJ.

By pre-registering, you may bypass the operator and go directly to

the teleconference with a unique PIN number as soon as the call

begins. At the time of the call, after dialing the number and

passcode mentioned above, enter your PIN for immediate access to

the teleconference.

Re-play dial-in numbers for the call will be available for three

weeks: 1-888-286-8010 and passcode 4325 6896 (domestic) and

1-617-801-6888 and passcode 4325 6896 (international).

Central Garden & Pet Company is a leading innovator,

marketer and producer of quality branded products for the lawn

& garden and pet supplies markets. Committed to new product

innovation, our products are sold to specialty independent and mass

retailers. Participating categories in Lawn & Garden include:

Grass seed including the brands PENNINGTON®, SMART SEEDTM and THE

REBELS™; wild bird feed and the brands PENNINGTON® and KAYTEE®;

weed and insect control and the brands AMDRO®, SEVIN®, IRONITE® and

Over ‘N Out®; and decorative outdoor patio products and the brands

NORCAL®, NEW ENGLAND POTTERY® and MATTHEWS FOUR SEASONS™. We also

provide a host of other regional and application-specific garden

brands and supplies. Participating categories in Pet include:

Animal health and the brands ADAMS™ and ZODIAC®; aquatics and

reptile and the brands OCEANIC®, AQUEON™ and ZILLA™; bird &

small animal and the brands KAYTEE®, SUPER PET® and CRITTER TRAIL®;

dog & cat and the brands TFH™, NYLABONE®, FOUR PAWS®, PINNACLE®

and Avoderm®; and equine and the brands FARNAM®, BRONCO® and SUPER

MASK®. We also provide a host of other application-specific Pet

brands and supplies. Central Garden & Pet Company is based in

Walnut Creek, California, and has approximately 5,000 employees,

primarily in North America and Europe. For additional information

on Central Garden & Pet Company, including access to the

Company's SEC filings, please visit the Company’s website at

www.central.com.

“Safe Harbor” Statement under the Private Securities Litigation

Reform Act of 1995: The statements contained in this release which

are not historical facts are forward-looking statements that are

subject to risks and uncertainties that could cause actual results

to differ materially from those set forth in or implied by

forward-looking statements. These risks are described in the

Central’s Annual Report on Form 10-K, filed November 20, 2009, and

Quarterly Report on Form 10-Q, filed May 5, 2010, and other

Securities and Exchange Commission filings. Central undertakes no

obligation to publicly update these forward-looking statements to

reflect new information, subsequent events or otherwise.

Central Garden & Pet

Company

Condensed Consolidated Statements

of Operations

(Unaudited)

(In thousands, except per share

amounts)

Three Months Ended Nine Months Ended June 26,

June 27, June 26, June 27, 2010

2009 2010 2009 Net Sales

$ 465,486 $ 482,162 $ 1,176,658 $ 1,251,129 Cost of Goods Sold and

Occupancy 302,712 317,108

764,926 840,041 Gross Profit 162,774

165,054 411,732 411,088 Selling, General and Administrative

Expenses 110,134 113,484 298,049

305,028 Income from Operations 52,640

51,570 113,683 106,060 Interest Expense (9,797 ) (5,211 )

(24,555 ) (17,846 ) Interest Income 1 12 12 614 Other Income

42 1,161 428 80

Income Before Income Taxes and

Noncontrolling Interest

42,886 47,532 89,568 88,908 Income Taxes 15,860

15,371 33,026 29,498

Income Including Noncontrolling Interest 27,026 32,161

56,542 59,410 Net Income Attributable to Noncontrolling

Interest 1,153 1,085 1,943

1,498

Net Income Attributable to Central

Garden & Pet Company

$

25,873

$

31,076

$

54,599

$

57,912

Net Income Per Share Attributable

to Central Garden & Pet Company:

Basic $ 0.41 $ 0.45 $ 0.84 $ 0.83 Diluted $ 0.40 $ 0.44 $

0.83 $ 0.82 Weighted Average Shares Outstanding Basic

63,810 69,345 64,879 69,885 Diluted 64,606 70,449 65,716 70,798

Central Garden & Pet

Company

Condensed Consolidated Balance

Sheets

(Unaudited)

(In thousands)

June 26,

2010

June 27,

2009

September 26,

2009

Assets Current Assets: Cash and Cash Equivalents $ 91,623 $

25,390 $ 85,668 Accounts Receivable 223,845 262,735 206,565

Inventories 306,118 313,820 284,834 Prepaid Expenses and

Other Current Assets

30,643 43,117 44,425 Total Current Assets 652,229 645,062

621,492 Property and Equipment - Net 162,352 165,519 164,734

Goodwill 208,630 206,873 207,749 Other Intangible Assets –

Net 99,828 104,318 103,366 Deferred Income Taxes and Other Assets

60,668 80,539 53,584 Total $ 1,183,707 $ 1,202,311 $

1,150,925 Liabilities and Shareholders’ Equity

Current Liabilities: Accounts Payable $ 119,869 $ 117,083 $ 108,836

Accrued Expenses 101,312 114,432 82,143 Current Portion of

Long-Term Debt 201 3,311 3,270 Total Current Liabilities

221,382 234,826 194,249 Long-Term Debt 400,138 405,676

404,815 Other Long-Term Obligations 4,223 4,685 4,526 Shareholders’

Equity 557,964 557,124 547,335 Total $ 1,183,707 $ 1,202,311

$ 1,150,925

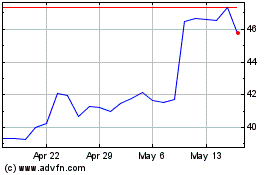

Central Garden and Pet (NASDAQ:CENT)

Historical Stock Chart

From Jun 2024 to Jul 2024

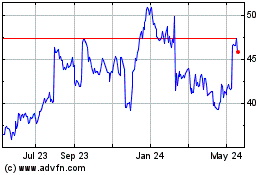

Central Garden and Pet (NASDAQ:CENT)

Historical Stock Chart

From Jul 2023 to Jul 2024