Earnings Preview: Central Garden - Analyst Blog

August 01 2011 - 12:00PM

Zacks

Central Garden & Pet Company (CENT), one of

the leading producers and marketers of premium and value-oriented

products, is slated to report its third-quarter 2011 financial

results on August 3, 2011. The current Zacks Consensus Estimate for

the quarter is 47 cents a share. For the quarter to be reported,

the Zacks Consensus Estimate for revenue is $489 million.

Second-Quarter 2011, a Synopsis

Central Garden & Pet Company delivered a quarterly income of

54 cents a share, beating the Zacks Consensus Estimate and

prior-year quarter’s income of 49 cents.

Central Garden & Pet witnessed total revenue increase of

10.0% to $485.7 million, reflecting significant sales growth in

garden products segment. The company’s total branded product sales

climbed 13.0% to $417.3 million, whereas sales of other

manufacturers’ products went down 7.6% to $68.4 million.

The reported net sales also surpassed the Zacks Consensus

Revenue Estimate of $457.0 million.

Third-Quarter 2011 Zacks Consensus

Analysts considered by Zacks expect Central Garden to post

third-quarter 2011 earnings of 47 cents a share. The current Zacks

Consensus Estimate is 17.5%, up from the prior-year quarter

earnings. The current Zacks Consensus Estimates for the quarter

ranges between 45 cents and 48 cents.

Zacks Agreement & Magnitude

None of the analysts revised the estimates in the last 7 and 30

days keeping the Zacks Consensus Estimate stable for the third

quarter of 2011.

Mixed Earnings Surprise History

With respect to earnings surprises, Central Garden has missed as

well as topped the Zacks Consensus Estimate over the last four

quarters in the range of negative 114.3% to positive 10.2%. The

average remained at negative 43.3%.

Our View

Central Garden’s diversified portfolio of brands has helped it

to develop a healthy commercial relationship with giant retailers,

such as Wal-Mart Stores Inc. (WMT) and The

Home Depot Inc. (HD). This provides a significant upside

potential to the company.

The company’s effective inventory management is helping it to

optimize merchandise levels in accordance with the sales trends.

Further, Central Garden & Pet is implementing an

enterprise-wide information technology platform, which is expected

to improve working capital management.

The company has been focusing on improving its gross and

operating margins. To achieve its goal, Central Garden & Pet

has tried every means to improve its sales, consolidate

manufacturing facilities and logistics centers. Further, the

company has made prudent capital investments while focusing on

improving manufacturing efficiencies.

However, the discretionary spending environment continues to

remain sluggish amid high unemployment levels and tight credit

markets. This is especially a matter of concern for the company as

a significant portion of its product portfolio consists of premium

offerings.

Currently, we maintain a long-term Outperform recommendation on

the stock. Moreover, Central Garden & Pet holds a Zacks #3

Rank, which translates into a short-term Hold rating.

CENTRAL GARDEN (CENT): Free Stock Analysis Report

HOME DEPOT (HD): Free Stock Analysis Report

WAL-MART STORES (WMT): Free Stock Analysis Report

Zacks Investment Research

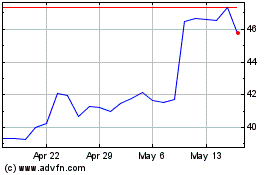

Central Garden and Pet (NASDAQ:CENT)

Historical Stock Chart

From Jun 2024 to Jul 2024

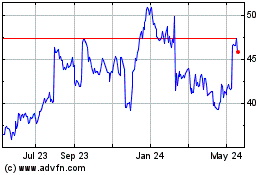

Central Garden and Pet (NASDAQ:CENT)

Historical Stock Chart

From Jul 2023 to Jul 2024