– Cemtrex, Inc. (Nasdaq: CETX) (the “Company”), an advanced

security technology and industrial services company, today

announced the pricing of a firm commitment underwritten public

offering with gross proceeds to the Company expected to be

approximately $10 million, before deducting underwriting discounts

and other estimated expenses payable by the Company. The offering

was upsized from $9 million. The base offering consists of

11,764,705 Common Units or Pre-Funded Units, each consisting of one

share of common stock (“Common Share”) or one Pre-Funded Warrant,

one Series A Warrant to purchase one Common Share at an exercise

price of $0.85 per share or pursuant to an alternative cashless

exercise option, which warrant will expire two-and-a-half years

from the closing date of this offering (the “Series A Warrant”) and

one Series B Warrant to purchase one Common Share at an exercise

price of $0.85 per share, which warrant will expire on the

five-year anniversary of the closing date of this offering (the

“Series B Warrants” and together with the Series A Warrants, the

“Warrants”). The purchase price of each Common Unit is $0.85, and

the purchase price of each Pre-Funded Unit is $0.849 (which is

equal to the public offering price per Common Unit minus $0.001).

The Pre-Funded Warrants will be immediately exercisable and may be

exercised at any time until all the Pre-Funded Warrants are

exercised in full.

The Company intends to use the net proceeds from this

offering to conduct operations, increase marketing efforts,

investment in existing business initiatives and products, and for

the partial repayment of indebtedness. The Company may also use a

portion of the net proceeds of this offering to acquire or invest

in complementary businesses, products, or technologies, or to

obtain the right to use such complementary technologies.

In addition, the Company has granted Aegis Capital Corp. a

45-day option to purchase additional Common Shares and/or Warrants,

representing up to 15% of the number of securities sold in the

offering, solely to cover over-allotments, if any.

The closing of the offering is expected to occur on May 3, 2024,

subject to customary closing conditions.

Aegis Capital Corp. is acting as the sole book-running

manager for the Offering. The Doney Law Firm is serving as counsel

to the Company for the offering. Kaufman & Canoles, P.C. is

serving as counsel to Aegis Capital Corp. for the

offering.

The offering was made pursuant to an effective registration

statement on Form S-1 (No. 333-276556) previously filed with the

U.S. Securities and Exchange Commission (the “SEC”) and declared

effective by the SEC on April 30, 2024. A preliminary prospectus

(the “Preliminary Prospectus”) describing the terms of the proposed

offering was filed with the SEC and is available on the SEC’s

website located at www.sec.gov. A final prospectus (the “Final

Prospectus”) relating to and describing the terms of the offering

will be filed with the SEC and will be available on the SEC’s

website located at www.sec.gov. Electronic copies of the

Preliminary Prospectus and Final Prospectus, when available, may be

obtained by contacting Aegis Capital Corp., Attention: Syndicate

Department, 1345 Avenue of the Americas, 27th floor, New York, NY

10105, by email at syndicate@aegiscap.com, or by telephone at (212)

813-1010. Before investing in this offering, interested parties

should read in their entirety the registration statement and the

Preliminary Prospectus and the other documents that the Company has

filed with the SEC that are incorporated by reference in such

registration statement and the Preliminary Prospectus, which

provide more information about the Company and the offering.

This press release shall not constitute an offer to sell or the

solicitation of an offer to buy nor shall there be any sale of

these securities in any state or jurisdiction in which such offer,

solicitation or sale would be unlawful prior to registration or

qualification under the securities laws of any such state or

jurisdiction.

About Cemtrex

Cemtrex Inc. (CETX) is a company that owns two operating

subsidiaries: Vicon Industries, Inc. (“Vicon”) and Advanced

Industrial Services, Inc. (“AIS”).

Vicon is a global leader in advanced security and surveillance

technology to safeguard businesses, schools, municipalities,

hospitals and cities. Since 1967, Vicon has delivered

mission-critical security surveillance systems, specializing in

engineering complete security solutions that simplify deployment,

operation and ongoing maintenance. Vicon provides security

solutions for some of the largest municipalities and businesses in

the U.S. and around the world, offering a wide range of

cutting-edge and compliant security technologies, from AI-driven

video analytics to fully integrated access control solutions. For

more information visit www.vicon-security.com.

AIS is a premier provider of industrial contracting services

including millwrighting, rigging, piping, electrical, welding. AIS

installs high precision equipment in a wide variety of industrial

markets including automotive, printing & graphics, industrial

automation, packaging, and chemicals. AIS owns and operates a

modern fleet of custom-designed specialty equipment to assure safe

and quick installation of production equipment. AIS staff

participates in recurring instructional training, provided to

ensure that the most current industry methods are being utilized to

provide an efficient and safe working environment. For more

information visit www.ais-york.com.

For more information visit www.cemtrex.com.

Forward-Looking Statements

The information contained herein may contain “forward-looking

statements.” Forward-looking statements reflect the current view

about future events. When used in this press release, the words

“anticipate,” “believe,” “estimate,” “expect,” “future,” “intend,”

“plan,” or the negative of these terms and similar expressions, as

they relate to the Company or its management, identify

forward-looking statements. Such statements include, but are not

limited to, statements contained in this press release relating to

the closing of the offering. Forward-looking statements are based

on the Company’s current expectations and assumptions regarding its

business, the economy, and other future conditions. In this press

release, such forward-looking statements include statements

regarding the anticipated use of proceeds from the offering.

Because forward–looking statements relate to the future, they are

subject to inherent uncertainties, risks, and changes in

circumstances that are difficult to predict, many of which are

beyond the control of the Company, including those set forth in the

Risk Factors section of the Preliminary Prospectus. The Company’s

actual results may differ materially from those contemplated by the

forward-looking statements. They are neither statements of

historical fact nor guarantees of assurance of future performance.

Readers are cautioned against relying on any of these

forward-looking statements. Factors or events that could cause the

Company’s actual results to differ may emerge from time to time,

and it is not possible for the Company to predict all of them. The

Company cannot guarantee future results, levels of activity,

performance, or achievements. Except as required by applicable law,

including the securities laws of the United States, the Company

does not intend to update any of the forward-looking statements.

References and links to websites have been provided as a

convenience, and the information contained on such websites is not

incorporated by reference into this press release.

Company Contact:

Investor Relations

Chris Tyson

Executive Vice President

MZ North America

Direct: 949-491-8235

CETX@mzgroup.us

www.mzgroup.us

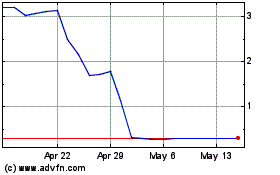

Cemtrex (NASDAQ:CETX)

Historical Stock Chart

From Nov 2024 to Dec 2024

Cemtrex (NASDAQ:CETX)

Historical Stock Chart

From Dec 2023 to Dec 2024