Comcast to Offer Data Services to Big Firms Nationwide

September 16 2015 - 3:40AM

Dow Jones News

Comcast Corp. said it would start selling Internet and phone

services to large businesses nationwide, even those located outside

its service area, as it seeks to steal away more customers from

telecom providers like AT&T Inc. and Verizon Communications

Inc.

The cable giant unveiled plans Wednesday to create a new unit to

offer data services to Fortune 1000 businesses across the country,

including those located in other cable companies' territories.

Comcast said it has struck wholesale agreements with cable

operators including Cox Communications Inc., Time Warner Cable

Inc., Charter Communications Inc., Cablevision Systems Corp. and

Mediacom Communications Corp., to offer services using their

pipes.

Comcast says it is seeking to bring together the cable industry

to provide a meaningful alternative to AT&T and Verizon, the

longtime incumbents in the market for selling network services to

businesses. Because cable companies are regional by nature, they

haven't been able to offer one-stop-shop, nationwide offerings for

big enterprises. "Sometimes, [big businesses] would just eliminate

us" when choosing a provider, said Bill Stemper, president of

Comcast Business.

Through these new wholesale arrangements, Comcast hopes that a

bank with locations outside of Comcast's service area, for

instance, can still sign up with Comcast and receive service at all

its locations. Comcast would pay wholesale fees to other operators

to service business locations outside of Comcast's footprint. To

help manage national accounts, Comcast said it acquired a company

called Contingent Network Services two weeks ago.

The move sets up Comcast to potentially compete with other cable

operators for business customers, threatening the longtime status

quo in the cable industry, where operators historically haven't

competed with each other for customers in the same geographic

areas. But Mr. Stemper believes there will only be "edge cases"

where Comcast ends up competing for the same customer as another

cable operator. He said that businesses naturally will align with

the operator that makes the most sense with where their branches

are located.

"We don't view it as new competition," said Todd Smith, a

spokesman for Atlanta-based Cox Communications Inc. If a business

picked Comcast's solution but had branches in Cox territory, "it's

still revenue for us," he noted, whereas if the business went with

a nationwide phone company like AT&T, it could cut out Cox

completely.

Cable executives said Comcast's plan is an extension of what's

gone on at a local level for years—where operators have sold

wholesale network capacity to other operators so they can serve a

business client's far-flung branches. "I'd look at it as a

positive, that we might be getting more customers that…haven't

chosen us before," said Tom Larsen, senior vice president of

government and public relations at cable operator Mediacom

Communications Corp.

Comcast is expanding its business-services division as it

contends with pressure in its core pay-television business.

Business services have become one of cable operators'

fastest-growing divisions as video subscriber losses have mounted.

Last year, Comcast's business-services division generated about $4

billion in revenue, up 22% compared with the year earlier. Mr.

Stemper said the total market opportunity nationwide for Comcast to

sell data services to businesses could be about $40 billion.

Write to Shalini Ramachandran at

shalini.ramachandran@wsj.com

Subscribe to WSJ: http://online.wsj.com?mod=djnwires

(END) Dow Jones Newswires

September 16, 2015 04:25 ET (08:25 GMT)

Copyright (c) 2015 Dow Jones & Company, Inc.

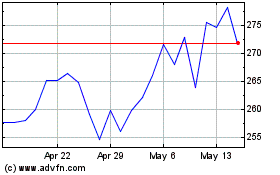

Charter Communications (NASDAQ:CHTR)

Historical Stock Chart

From Jun 2024 to Jul 2024

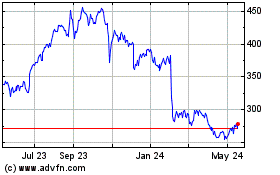

Charter Communications (NASDAQ:CHTR)

Historical Stock Chart

From Jul 2023 to Jul 2024