false

0001672909

0001672909

2024-01-31

2024-01-31

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of report (Date of earliest event reported): January 31, 2024

Canterbury Park Holding Corporation

(Exact name of registrant as specified in its charter)

Minnesota

(State or Other Jurisdiction of Incorporation)

|

001-37858

|

|

47-5349765

|

|

(Commission File Number)

|

|

(IRS Employer Identification No.)

|

| |

|

|

|

1100 Canterbury Road, Shakopee, Minnesota

|

|

55379

|

|

(Address of Principal Executive Offices)

|

|

(Zip Code)

|

(952) 445-7223

(Registrant’s telephone number, including area code)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities Registered Pursuant to Section 12(b) of the Act

|

Title of Each Class

|

Trading Symbol

|

Name of each exchange on which registered

|

|

Common Stock, par value, $.01 per share

|

CPHC

|

The Nasdaq Stock Market

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405) or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR §240.12b-2). Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 1.01 Entry Into a Material Definitive Agreement.

Effective January 31, 2024, (i) Canterbury Park Entertainment, LLC, (the “Borrower”), a Minnesota limited liability company and subsidiary of Canterbury Park Holding Corporation, a Minnesota corporation (the “Company”); (ii) the Company as Guarantor; (iii) Canterbury Park Concessions, Inc., a Minnesota corporation and subsidiary of the Company; and (iv) and Bremer Bank, National Association (“Bremer Bank”) entered into the Seventh Amendment Agreement (“Seventh Amendment”) to the General Credit and Security Agreement dated as of November 14, 2016, as amended (“Credit Agreement”).

The Seventh Amendment extended the maturity date for the line of credit facility established under the Credit Agreement to January 31, 2027 and reduced the maximum borrowing under the line of credit to $5.0 million, which was reflected in the Fourth Amended and Restated Revolving Credit Note attached to the Seventh Amendment and entered into concurrently with the Seventh Amendment. In connection with the Seventh Amendment, Bremer Bank terminated a mortgage to release certain of the Borrower’s real property as collateral and the Borrower entered into a Negative Pledge Agreement dated January 31, 2024 in favor of Bremer Bank by which the Borrower agreed not to create or suffer any liens or encumbrances on certain real property. The Seventh Amendment also changed the Credit Agreement’s debt service coverage ratio to not less than 1.20 to 1.00 as of the end of each fiscal quarter of Borrower for the trailing 12 months, measured quarterly.

The foregoing descriptions of the material terms of each of the Seventh Amendment and the Negative Pledge Agreement is not complete and is qualified in their respective entirety by reference to the full text of the Seventh Amendment and the Negative Pledge Agreement, copies of which are incorporated by reference as exhibits to this Current Report on Form 8-K and are incorporated herein by reference.

Item 9.01 Financial Statements and Exhibits

|

Exhibit No.

|

|

Description

|

| |

|

|

|

10.1

|

|

|

| |

|

|

|

10.2

|

|

|

| |

|

|

|

104

|

|

Cover Page Interactive Data File (formatted as Inline XBRL).

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

CANTERBURY PARK HOLDING CORPORATION

|

|

|

|

|

|

|

|

Dated: February 2, 2024

|

By:

|

/s/ Randall D. Sampson

|

|

|

|

|

Randall D. Sampson

|

|

|

|

|

President and Chief Executive Officer

|

|

Exhibit 10.1

SEVENTH AMENDMENT AGREEMENT

THIS SEVENTH AMENDMENT AGREEMENT (this “Amendment”) is made effective as of the 31 day of January, 2024, by and among CANTERBURY PARK ENTERTAINMENT LLC, a Minnesota limited liability company (the “Borrower”), CANTERBURY PARK HOLDING CORPORATION, a Minnesota corporation (the “Guarantor”), CANTERBURY PARK CONCESSIONS, INC., a Minnesota corporation (“Canterbury Concessions”), and BREMER BANK, NATIONAL ASSOCIATION, a national banking association (the “Lender”).

W I T N E S S E T H:

WHEREAS, the Borrower and the Lender are parties to that certain General Credit and Security Agreement dated as of November 14, 2016, as amended by that certain Amendment Agreement dated as of September 30, 2017, as further amended by that certain Second Amendment Agreement dated as of September 30, 2018, as further amended by that certain Third Amendment Agreement dated as of September 30, 2019, as further amended by that certain Fourth Amendment Agreement dated as of September 30, 2020, as further amended by that certain Fifth Amendment Agreement dated as of December 23, 2020, and as further amended by that certain Sixth Amendment Agreement dated as of February 28, 2021 (collectively, the “Credit Agreement”), which sets forth the terms and conditions of a revolving line of credit to the Borrower in the current maximum principal amount of Ten Million and 00/100 Dollars ($10,000,000.00) (the “Loan”); and

WHEREAS, the obligation of the Borrower to repay the Loan is evidenced by that certain Third Amended and Restated Revolving Credit Note dated as of February 28, 2021 (the “Existing Note”), executed by the Borrower and payable to the Lender in the original principal amount of $10,000,000.00; and

WHEREAS, the Existing Note is secured by, among other things, that certain Mortgage, Security Agreement, Fixture Financing Statement and Assignment of Leases and Rents dated as of February 28, 2021 (the “Mortgage”), executed by Borrower, as mortgagor, in favor of the Lender, as mortgagee, and encumbering the real property described therein; and

WHEREAS, the Existing Note is further secured by, among other things, that certain Third Party Security Agreement dated as of November 14, 2016 (the “Security Agreement”), executed by Canterbury Concessions, as debtor, in favor of the Lender, as secured party; and

WHEREAS, the Existing Note has been guaranteed by the Guarantor pursuant to that certain Corporate Guaranty dated as of November 14, 2016 (the “Guaranty”), executed by the Guarantor in favor of the Lender; and

WHEREAS, as of the date hereof, there is outstanding under the Existing Note the principal amount of $0.00; and

WHEREAS, the Borrower has requested that the Lender (i) extend the Maturity Date of the Loan from January 31, 2024, to January 31, 2027, (ii) reduce the maximum principal available under the Loan from $10,000,000 to $5,000,000, (iii) release the Mortgage as collateral for the loan, (iv) modify the Debt Service Coverage Ratio reporting; and (v) make certain other modifications to the Credit Agreement; and

WHEREAS, the Lender has agreed to the foregoing, subject to the terms and conditions of this Agreement.

NOW, THEREFORE, in consideration of the foregoing recitals and for other good and valuable consideration, the receipt and sufficiency of which are hereby acknowledged, the parties hereto hereby agree as follows:

1. Capitalized Terms. Capitalized terms not otherwise defined herein shall have the meaning assigned to such term in the Credit Agreement.

2. Recitals. All of the recitals set forth above shall bind the parties hereto and are hereby made a part of this Amendment.

3. Release of Mortgage. Contemporaneously with the execution of this Amendment, the Lender hereby agrees to release the land secured by the Mortgage from the Lender’s lien and security interest. To effectuate the release, the Lender will deliver that certain Satisfaction of Mortgage, Security Agreement, Fixture Financing Statement and Assignment of Leases and Rents (the “Mortgage Release”) to the Borrower, the form of which is attached hereto as Exhibit B. The Borrower shall coordinate the filing of the Mortgage Release with the applicable governmental office. Notwithstanding anything to the contrary contained in the Credit Agreement, from and after the date of the Mortgage Release, any and all references, covenants or conditions in the Credit Agreement related to the Mortgage or the collateral secured thereby shall be disregarded.

4. Fourth Amended and Restated Revolving Credit Note. Contemporaneously with the execution of this Amendment, the Borrower has executed and delivered to the Lender that certain Fourth Amended and Restated Revolving Credit Note of even date herewith in the original principal amount of $5,000,000.00 (the “Amended and Restated Note”), which constitutes an amendment and restatement of the Existing Note in its entirety.

5. Amendments to the Credit Agreement.

A. Any and all references in the Credit Agreement to the “Agreement” or “this Agreement” shall mean and refer to the Credit Agreement, as amended by this Amendment.

B. The definition of “Loan Documents” and all references thereto in the Credit Agreement are hereby modified to mean and include the Loan Documents, defined in the Credit Agreement, as such documents may be amended by this Amendment, and shall no longer include reference to the Mortgage.

C. The definition of “Maturity Date” in Section 2 of the Credit Agreement is hereby amended by deleting the date “January 31, 2024” and replacing it with the date “January 31, 2027”, thereby extending the Maturity Date to such later date.

D. Paragraph A of the recitals in the Credit Agreement is hereby amended by deleting the reference to the original principal amount of “Ten Million and 00/100 Dollars ($10,000,000.00)” and replacing it with “Five Million and 00/100 Dollars ($5,000,000.00)”, thus reflecting the reduction in the maximum principal amount available under the Loan.

E. The definition of “Revolving Credit Commitment” located in Section 2 of the Credit Agreement is hereby amended by deleting the reference to “$10,000,000.00” and replacing it with “$5,000,000.00”, thus reflecting the reduction in the maximum principal amount available under the Loan.

F. Section 17(k) of the Credit Agreement is hereby deleted in its entirety and replaced with the following:

(k) Achieve and maintain a Debt Service Coverage Ratio of not less than 1.20 to 1.00 as of the end of each fiscal quarter of Borrower for the trailing twelve (12) months ending on the last day of such fiscal quarter then ended, measured quarterly.

G. The Revolving Credit Note attached as Exhibit A to the Credit Agreement is hereby deleted in its entirety and replaced with the Fourth Amended and Restated Revolving Credit Note attached hereto as Exhibit A.

6. Consent of and Reaffirmation of Guaranty. The Guarantor hereby consents to the terms of this Amendment, repeats and reaffirms each and all of its obligations under the Guaranty and agrees that the Guaranty guaranties repayment of, among other things, the Amended and Restated Note and performance of all other obligations of the Borrower to the Lender.

7. Priority and Validity of the Security Agreement. Canterbury Concessions represents and warrants to the Lender that the Security Agreement grants to the Lender a valid and first priority security interest in the collateral described therein (subject to liens permitted therein), and such security interest secures, among other things, all of the Borrower’s obligations under the Existing Note, as amended by the Amended and Restated Note, and will continue in full force and effect until the Amended and Restated Note is satisfied in full.

8. Legal Representation. The Borrower, the Guarantor and Canterbury Concessions (collectively, the “Loan Parties”) hereby represent, warrant and agree that they have fully considered the terms of this Amendment and the documents related hereto and have had the opportunity to discuss this Amendment and the documents related hereto with their legal counsel, and that they are executing the same without any coercion or duress on the part of the Lender.

9. Authority. The Loan Parties hereby represent and warrant to the Lender that they have full power and authority to execute and deliver this Amendment and to incur and perform their obligations hereunder; the execution, delivery and performance by the Loan Parties of this Amendment will not violate any provision of the organizational documents of any of the Loan Parties, or any law, rule, regulation or court order or, except as would not reasonably be expected to result in a Material Adverse Occurrence, result in the breach of, constitute a default under, or create or give rise to any lien under, any indenture or other agreement or instrument to which the Loan Parties are a party or by which the Loan Parties or their properties may be bound or affected.

10. Original Terms. Except as expressly amended herein, the Credit Agreement, and the Loan Documents associated therewith, as modified by this Amendment, shall be and remain in full force and effect in accordance with their original terms.

11. No Waiver. The Loan Parties hereby acknowledge and agree that, by executing and delivering this Amendment, the Lender is not waiving any existing Event of Default, whether known or unknown, or any event, condition or circumstance, whether known or unknown, which with the giving of notice or the passage of time or both would constitute an Event of Default, nor is the Lender waiving any of its rights or remedies under the Loan Documents.

12. No Setoff. The Loan Parties acknowledge and agree with the Lender that no events, conditions or circumstances have arisen or exist as of the date hereof which would give any of the Loan Parties the right to assert a defense, counterclaim and/or setoff any claim by the Lender for payment of amounts owing under the Existing Note, as amended by the Amended and Restated Note. Any defense, right of setoff or counterclaim which might otherwise be available to the Loan Parties is hereby fully and finally waived and released in all respects.

13. Merger. All prior oral and written communications, commitments, alleged commitments, promises, alleged promises, agreements, and alleged agreements by or among the Lender and the Loan Parties in connection with the Loan are hereby merged into the Loan Documents, as amended by this Amendment; shall be of no further force or effect; and shall not be enforceable unless expressly set forth in the Loan Documents, as amended by this Amendment. All commitments, promises, and agreements of the parties hereto are set forth in this Amendment and the Loan Documents and no other commitments, promises, or agreements, oral or written, of any of the parties hereto shall be enforceable against any such party.

14. Release. The Loan Parties hereby release and forever discharge the Lender and its past, present and future officers, directors, attorneys, insurers, servants, representatives, employees, shareholders, subsidiaries, affiliates, participants, partners, predecessors, principals, agents, successors and assigns of and from any and all existing or future claims, demands, obligations, interests, suits, actions or causes of action, at law or in equity, whether arising by contract, statute, common law or otherwise, both direct and indirect, of whatsoever kind or nature, arising out of or by reason of or in connection with the Loan, the Loan Documents, this Amendment, any prior amendments or agreements or the documents related hereto or thereto or any acts, omissions, or conduct occurring on or before the date hereof.

15. Costs and Expenses. The Borrower shall pay all reasonable and documented out-of-pocket costs and expenses, including attorneys’ fees paid or incurred by the Lender in connection with the preparation of this Amendment and the documents related hereto and the closing and consummation of the transaction contemplated hereby.

16. Further Assurances. The Loan Parties hereby agree to execute and deliver such other further agreements, documents and instruments as reasonably requested by the Lender in order to effectuate the purposes of this Amendment and the documents related hereto.

17. No Default. The Loan Parties hereby represent and warrant to the Lender that no Event of Default, or event which with the giving of notice or the passage of time or both would constitute an Event of Default, has occurred and is continuing.

18. Counterparts. This Amendment may be executed in any number of counterparts, all of which taken together shall constitute one agreement, and any of the parties hereto may execute this Amendment by signing any such counterpart. Delivery of an executed signature page of this Amendment by facsimile or by other electronic transmission shall be effective as delivery of a manually executed counterpart hereof.

19. Governing Law. This Amendment shall be governed by and construed in accordance with the laws of the State of Minnesota without giving effect to the choice of law provisions thereof.

20. Headings. The descriptive headings for the several sections of this Amendment are inserted for convenience only and not to define or limit any of the terms or provisions hereof.

21. Successors and Assigns. This Amendment shall be binding upon and inure to the benefit of the parties hereto and their respective heirs, successors and assigns.

IN WITNESS WHEREOF, the parties hereto have made and entered into this Amendment as of the day and year first above written.

[SIGNATURE PAGES FOLLOW]

[SIGNATURE PAGE TO SEVENTH AMENDMENT AGREEMENT]

|

|

BORROWER:

|

|

| |

|

|

| |

CANTERBURY PARK ENTERTAINMENT LLC, a Minnesota limited liability company |

|

|

|

|

|

|

|

|

|

|

|

|

|

By:

|

/s/ Randall D. Sampson

|

|

|

|

|

Randall D. Sampson

|

|

|

|

|

Its: President and CEO

|

|

| |

|

|

|

| |

|

|

|

| |

GUARANTOR: |

|

| |

|

|

| |

CANTERBURY PARK HOLDING CORPORATION, a Minnesota corporation |

|

| |

|

|

|

| |

|

|

|

| |

By: |

/s/ Randall D. Sampson |

|

| |

|

Randall D. Sampson |

|

| |

|

Its: President and CEO |

|

| |

|

|

|

| |

|

|

|

| |

CANTERBURY CONCESSIONS: |

|

| |

|

|

| |

CANTERBURY PARK CONCESSIONS INC., a Minnesota corporation |

|

| |

|

|

|

| |

|

|

|

| |

By: |

/s/ Randall D. Sampson |

|

| |

|

Randall D. Sampson |

|

| |

|

Its: President and CEO |

|

[SIGNATURE PAGE TO SEVENTH AMENDMENT AGREEMENT]

|

|

LENDER:

|

|

| |

|

|

| |

BREMER BANK, NATIONAL ASSOCIATION, a national banking association |

|

|

|

|

|

|

|

|

|

|

|

|

|

By:

|

/s/ Laura Helmueller

|

|

|

|

|

Laura Helmueller

|

|

|

|

|

Its: Senior Vice President

|

|

EXHIBIT A

FOURTH AMENDED AND RESTATED REVOLVING CREDIT NOTE

| $5,000,000.00 |

Eagan, Minnesota |

Effective Date: January 31, 2024

FOR VALUE RECEIVED, the undersigned, CANTERBURY PARK ENTERTAINMENT LLC, a Minnesota limited liability company (the “Borrower”), promises to pay to the order of BREMER BANK, NATIONAL ASSOCIATION, a national banking association (the “Lender”), on the Revolving Credit Termination Date, the principal sum of Five Million and No/100ths Dollars ($5,000,000.00) or, if less, the then aggregate unpaid principal amount of the Advances as may be borrowed by the Borrower under the Credit Agreement (as defined herein) and are outstanding on the Revolving Credit Termination Date. All Advances and all payments of principal shall be recorded by the Lender in its records which records shall be conclusive evidence of the subject matter thereof, absent manifest error.

The Borrower further promises to pay to the order of the Lender interest on each Advance from time to time outstanding from the date hereof until paid in full at a fluctuating annual rate equal to the greater of: (a) the Prime Rate, or (b) 3.0%; provided, however, that, notwithstanding anything to the contrary contained herein, upon the occurrence and during the continuance of any Event of Default, the rate of interest hereunder shall be 2.0% per annum above the current rate of interest. Interest shall be due and payable on the first day of each calendar month, commencing on March 1, 2024, and at maturity. Interest payment after maturity shall be payable on demand. Each change in the fluctuating interest rate shall take effect simultaneously with the corresponding change in the Prime Rate.

All payments of principal and interest under this Note shall be made in lawful money of the United States of America in immediately available funds to the Lender at the Lender’s office at 1995 Rahncliff Court, Eagan, Minnesota 55122, or at such other place as may be designated by the Lender to the Borrower in writing.

This Note is the Revolving Credit Note referred to in, and evidences indebtedness incurred under that certain General Credit and Security Agreement dated as of November 14, 2016 (herein, as it may be amended, modified or supplemented from time to time, called the “Credit Agreement”; capitalized terms not otherwise defined herein being used herein as therein defined) between the Borrower and the Lender, to which Credit Agreement reference is made for a statement of the terms and provisions thereof, including those under which the Borrower is permitted and required to make prepayments and repayments of principal of such indebtedness and under which such indebtedness may be declared to be immediately due and payable.

All parties hereof, whether as makers, endorsers or otherwise, severally waive presentment, demand, protest and notice of dishonor in connection with this Note.

This Note is made under and governed by the internal laws of the State of Minnesota.

This Note constitutes an amendment and restatement of that certain Third Amended and Restated Revolving Credit Note dated February 28, 2021 (the “Existing Note”), executed by the Borrower and payable to the Lender in the original principal amount of $10,000,000.00 and is given in replacement of, but not in payment for, the Existing Note. This Note is not a novation of any indebtedness of the Borrower to the Lender.

|

|

CANTERBURY PARK ENTERTAINMENT LLC, a Minnesota limited liability company

|

|

|

|

|

|

|

|

|

|

|

|

|

|

By:

|

/s/ Randall D. Sampson

|

|

|

|

|

Randall D. Sampson

|

|

|

|

|

Its: President and CEO

|

|

Exhibit 10.2

NEGATIVE PLEDGE AGREEMENT

THIS NEGATIVE PLEDGE AGREEMENT (this “Agreement”), is made effective as of January 31, 2024, by CANTERBURY PARK ENTERTAINMENT LLC, a Minnesota limited liability company (the “Owner”), in favor of BREMER BANK, NATIONAL ASSOCIATION, a national banking association, its successors and/or assigns (the “Lender”).

W I T N E S S E T H:

In consideration of financial accommodations extended to Owner by the Lender on the date hereof, the Owner hereby covenants and agrees with the Lender that so long as any indebtedness under that certain General Credit and Security Agreement dated as of November 14, 2016, by and between the Owner and the Lender, or any letter(s) of credit or note(s) executed and delivered in connection therewith, and any extensions, renewals or modifications thereof, has not been satisfied, the Owner will not, without the prior written consent of the Lender, convey or otherwise transfer all or any part of the tract of land legally described on Exhibit A attached hereto and hereby made a part hereof, together with all tenements, easements, hereditaments, privileges, minerals and mineral rights, water and water rights, buildings, fixtures and improvements now or hereafter erected or located on the above‑described land (the “Property”), nor create, assume, incur or suffer to exist any pledge, mortgage, assignment or other lien or encumbrance of any kind, of or upon the Property or upon the income or profits therefrom except for:

A. liens for taxes, assessments and other governmental charges which are not delinquent or which are being contested in good faith by appropriate proceedings diligently conducted, against which adequate reserves have been established;

B. liens imposed by law in connection with transactions in the ordinary course of business, such as liens of mechanics and materialmen for sums not yet due or being contested in good faith and by appropriate proceedings diligently conducted, against which adequate reserves have been established;

C. zoning restrictions, licenses and minor encumbrances and irregularities in title, all of which in the aggregate do not materially detract from the value of the properties involved or materially impair their use in the operation of its business;

D. leases entered into in the ordinary course of business;

E. purchase money financing transactions entered into in the ordinary course of business; or

F. liens and encumbrances of record as of the date hereof.

Without limiting the generality of the foregoing, if and to the extent that any unauthorized lien or encumbrance is recorded or docketed against, or attached to, the Property, whether voluntarily or involuntarily, the Owner shall immediately cause the same to be released or satisfied in full.

IN WITNESS WHEREOF, the Owner has executed and delivered this Agreement as of the day and year first above written.

THIS INSTRUMENT WAS DRAFTED BY:

Winthrop & Weinstine, P.A. (KDL)

225 South Sixth Street, Suite 3500

Minneapolis, Minnesota 55402

(612) 604‑6400

[REMAINDER OF PAGE INTENTIONALLY LEFT BLANK]

[SIGNATURE PAGE TO NEGATIVE PLEDGE AGREEMENT]

|

|

CANTERBURY PARK ENTERTAINMENT LLC, a Minnesota limited liability company

|

|

|

|

|

|

|

|

|

|

|

|

|

|

By:

|

/s/ Randall D. Sampson

|

|

|

|

|

Randall D. Sampson

|

|

|

|

|

Its: President and CEO

|

|

STATE OF MINNESOTA )

) ss.

COUNTY OF SCOTT )

The foregoing instrument was acknowledged before me this 31 day of January, 2024, by

Randall D. Sampson, the President and CEO of Canterbury Park Entertainment LLC, a Minnesota limited liability company, for and on behalf of said limited liability company.

|

|

/s/ Randy J. Dehmer

|

|

| |

Notary Public |

|

|

|

|

|

|

EXHIBIT A

(Legal Description of Property)

Parcel 1:

That part of Lot 2, Block 1, Canterbury Amp Addition, according to the recorded plat thereof on file in the office of the Registrar of Titles, Scott County, Minnesota, lying within Outlot B, Canterbury Park Sixth Addition, according to the recorded plat thereof on file in the office of the Registrar of Titles, Scott County, Minnesota.

AND

That part of Lot 2, Block 1, Canterbury Amp Addition, according to the recorded plat thereof on file in the office of the Registrar of Titles, Scott County, Minnesota, lying within Lot 1, Block 1, Canterbury Park Fifth Addition, according to the recorded plat thereof on file in the office of the Registrar of Titles, Scott County, Minnesota.

AND

That part of Lot 2, Block 1, Canterbury Amp Addition, according to the recorded plat thereof on file in the office of the Registrar of Titles, Scott County, Minnesota, lying within the South Half of the Southeast Quarter of Section 5, Township 115 North, Range 22 West, Scott County, Minnesota.

AND

That part of Lot 2, Block 1, Canterbury Amp Addition, according to the recorded plat thereof on file in the office of the Registrar of Titles, Scott County, Minnesota, lying within Outlot B, Canterbury Park Seventh Addition, according to the recorded plat thereof on file in the office of the Register of Titles, Scott County, Minnesota.

AND

That part of Lot 2, Block 1, Canterbury Amp Addition, according to the recorded plat thereof on file in the office of the Registrar of Titles, Scott County, Minnesota, lying within the Southwest Quarter of the Southwest Quarter of Section 4, Township 115 North, Range 22 West, Scott County, Minnesota.

AND

That part of Lot 2, Block 1, Canterbury Amp Addition, according to the recorded plat thereof on file in the office of the Registrar of Titles, Scott County, Minnesota, lying within the Northwest Quarter of Section 9, Township 115 North, Range 22 West, Scott County, Minnesota.

Torrens Property

Parcel 2:

That part of Lot 2, Block 1, Canterbury Amp Addition, lying within the East Half of the Northeast Quarter of Section 8, Township 115, Range 22, Scott County, Minnesota.

Abstract Property

Parcel 3:

That part of Lot 2, Block 1, Canterbury Amp Addition, lying within Outlot A, Canterbury Park Sixth Addition, Scott County, Minnesota.

Abstract Property

Parcel 4:

Nonexclusive easement for underground sanitary sewer, as set forth in Sanitary Sewer Easement Agreement, dated September 23, 2019, filed October 4, 2019, as Document Nos. A1075977 (Abstract) and T257682 (Torrens).

Parcel 5:

Nonexclusive easement for drainage improvements, as set forth in Storm Water Sewer Easement Agreement, dated September 23, 2019, filed October 4, 2019, as Document Nos. A1075978 (Abstract) and T257683 (Torrens).

v3.24.0.1

Document And Entity Information

|

Jan. 31, 2024 |

| Document Information [Line Items] |

|

| Entity, Registrant Name |

Canterbury Park Holding Corporation

|

| Document, Type |

8-K

|

| Document, Period End Date |

Jan. 31, 2024

|

| Entity, Incorporation, State or Country Code |

MN

|

| Entity, File Number |

001-37858

|

| Entity, Tax Identification Number |

47-5349765

|

| Entity, Address, Address Line One |

1100 Canterbury Road

|

| Entity, Address, City or Town |

Shakopee

|

| Entity, Address, State or Province |

MN

|

| Entity, Address, Postal Zip Code |

55379

|

| City Area Code |

952

|

| Local Phone Number |

445-7223

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock

|

| Trading Symbol |

CPHC

|

| Security Exchange Name |

NASDAQ

|

| Entity, Emerging Growth Company |

false

|

| Amendment Flag |

false

|

| Entity, Central Index Key |

0001672909

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

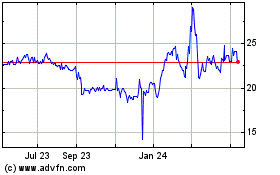

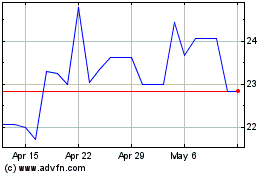

Canterbury Park (NASDAQ:CPHC)

Historical Stock Chart

From Mar 2024 to Apr 2024

Canterbury Park (NASDAQ:CPHC)

Historical Stock Chart

From Apr 2023 to Apr 2024