SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

SCHEDULE 13D

(Amendment No.)

(Rule 13d-101)

Under the Securities Exchange Act of 1934

AMERICA’S

CAR-MART, INC.

(Name of Issuer)

Common

Stock,

par

value $0.01 per share

(Title of Class of Securities)

03062T105

(CUSIP NUMBER)

Taki Vasilakis

130 Main St. 2nd Floor

New Canaan, CT 06840

(203) 308-4440

(Name, Address and Telephone Number of Person

Authorized to Receive Notices and Communications)

September 19,

2024

(Date of event which requires filing of this statement)

If the filing person has previously filed a statement

on Schedule 13G to report the acquisition which is the subject of this Schedule 13D, and is filing this schedule because of Rule 13d-1(e),

13d-1(f) or 13d-1(g) check the following box ¨.

The information required in the remainder of this

cover page shall not be deemed to be “filed” for the purpose of Section 18 of the Securities Exchange Act of 1934, as amended

(the “Act”), or otherwise subject to the liabilities of that section of the Act but shall be subject to all other provisions

of the Act.

| 1 |

NAME OF REPORTING PERSONS

I.R.S. IDENTIFICATION NOS. OF ABOVE PERSONS (ENTITIES ONLY)

Nantahala Capital Management, LLC

|

| 2 |

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP*

|

(a)

¨

(b)

¨ |

| 3 |

SEC USE ONLY

|

| 4 |

SOURCE OF FUNDS*

AF

|

| 5 |

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT

TO ITEM 2(d) or 2(e)

|

¨ |

| 6 |

CITIZENSHIP OR PLACE OF ORGANIZATION

Massachusetts

|

|

NUMBER OF

SHARES

BENEFICIALLY |

7 |

SOLE VOTING POWER

0

|

|

OWNED BY

EACH

REPORTING

PERSON WITH |

8 |

SHARED VOTING POWER

544,686

|

| |

9 |

SOLE DISPOSITIVE POWER

0

|

| |

10 |

SHARED DISPOSITIVE POWER

544,686

|

| 11 |

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

544,686

|

| 12 |

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES

CERTAIN SHARES*

|

¨ |

| 13 |

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

6.7%

|

| 14 |

TYPE OF REPORTING PERSON*

IA, OO

|

| 1 |

NAME OF REPORTING PERSONS

I.R.S. IDENTIFICATION NOS. OF ABOVE PERSONS (ENTITIES ONLY)

Wilmot B. Harkey

|

| 2 |

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP*

|

(a)

¨

(b)

¨ |

| 3 |

SEC USE ONLY

|

| 4 |

SOURCE OF FUNDS*

AF

|

| 5 |

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT

TO ITEM 2(d) or 2(e)

|

¨ |

| 6 |

CITIZENSHIP OR PLACE OF ORGANIZATION

United States

|

|

NUMBER OF

SHARES

BENEFICIALLY |

7 |

SOLE VOTING POWER

0

|

|

OWNED BY

EACH

REPORTING

PERSON WITH |

8 |

SHARED VOTING POWER

544,686

|

| |

9 |

SOLE DISPOSITIVE POWER

0

|

| |

10 |

SHARED DISPOSITIVE POWER

544,686

|

| 11 |

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

544,686

|

| 12 |

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES

CERTAIN SHARES*

|

¨ |

| 13 |

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

6.7%

|

| 14 |

TYPE OF REPORTING PERSON*

HC, IN

|

| 1 |

NAME OF REPORTING PERSONS

I.R.S. IDENTIFICATION NOS. OF ABOVE PERSONS (ENTITIES ONLY)

Daniel Mack

|

| 2 |

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP*

|

(a)

¨

(b)

¨ |

| 3 |

SEC USE ONLY

|

| 4 |

SOURCE OF FUNDS*

AF

|

| 5 |

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT

TO ITEM 2(d) or 2(e)

|

¨ |

| 6 |

CITIZENSHIP OR PLACE OF ORGANIZATION

United States

|

|

NUMBER OF

SHARES

BENEFICIALLY |

7 |

SOLE VOTING POWER

0

|

|

OWNED BY

EACH

REPORTING

PERSON WITH |

8 |

SHARED VOTING POWER

544,686

|

| |

9 |

SOLE DISPOSITIVE POWER

0

|

| |

10 |

SHARED DISPOSITIVE POWER

544,686

|

| 11 |

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

544,686

|

| 12 |

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES

CERTAIN SHARES*

|

¨ |

| 13 |

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

6.7%

|

| 14 |

TYPE OF REPORTING PERSON*

HC, IN

|

SCHEDULE 13D

This Schedule 13D (this “Schedule

13D”) is being filed on behalf of Nantahala Capital Management, LLC, a Massachusetts limited liability company (“Nantahala”),

Mr. Wilmot B. Harkey and Mr. Daniel Mack, the principals of Nantahala (collectively, the “Reporting Persons”), relating to

Common Stock, par value $0.01 per share (the “Common Stock”), of America’s Car-Mart, Inc., a Texas corporation (the

“Issuer”).

This Schedule 13D relates

to Common Stock of the Issuer beneficially owned by Nantahala through the accounts of certain private funds and managed accounts (collectively,

the “Nantahala Investors”). Nantahala serves as the investment adviser to the Nantahala Investors. Mr. Harkey and Mr. Mack

are the principals of Nantahala.

| Item

1. | Security

and Issuer |

America’s Car-Mart, Inc.

Address:

1805 North 2nd Street, Suite

401

Rogers, Arkansas 72756

Securities acquired:

Common Stock, par value $0.01

per share

CUSIP no. 03062T105

| Item

2. | Identity

and Background |

(a) This Schedule 13D is jointly

filed by Nantahala, Mr. Harkey and Mr. Mack. Because Nantahala is the investment adviser to the Nantahala Investors, with exclusive authority

to exercise voting and investment power on their behalf in respect of the Common Stock, and Mr. Harkey and Mr. Mack are the principals

and managing members of Nantahala, the Reporting Persons may be deemed, pursuant to Rule 13d-3 of the Securities Exchange Act of 1934,

as amended (the “Act”), to be the beneficial owners all of shares of Common Stock held by the Nantahala Investors. The Reporting

Persons are filing this Schedule 13D jointly, solely pursuant to Rule 13d-1(k)(1), and expressly disclaim that they form any “group”

under Section 13(d)(3) of the Act. In addition, Qianqian Zhong is the Chief Financial Officer and Taki Vasilakis is the Chief Compliance

Officer (each of Ms. Zhong and Mr. Vasilakis, an “Other Officer” and collectively, the “Other Officers”) of Nantahala.

(b) The principal place of business

for each of the Reporting Persons and the Other Officers is 130 Main St. 2nd Floor, New Canaan, CT 06840.

(c) The principal occupation

of Mr. Harkey is serving as a principal of Nantahala. The principal occupation of Mr. Mack is serving as a principal of Nantahala. The

principal business of Nantahala is acting as the investment adviser to the Nantahala Investors. The principal occupations of the Other

Officers are the Nantahala positions set forth above.

(d) During the last five years,

none of the Reporting Persons or Other Officers has been convicted in a criminal proceeding (excluding traffic violations or similar misdemeanors).

(e) During the last five years,

none of the Reporting Persons or Other Officers has been a party to a civil proceeding of a judicial or administrative body of competent

jurisdiction and, as a result of such proceeding, were or are subject to a judgment, decree or final order enjoining future violations

of, or prohibiting or mandating activities subject to, federal or state securities laws or finding any violation with respect to such

laws.

(f) Nantahala is organized under

the laws of the State of Massachusetts. Mr. Harkey is a citizen of the United States of America. Mr. Mack is a citizen of the United States

of America. Ms. Zhong is a citizen of China. Mr. Vasilakis is a citizen of the United States of America.

| Item

3. | Source

and Amount of Funds |

On September 19, 2024, the Nantahala

Investors bought 232,558 shares of Common Stock for $43 per share, cash, in a sale registered pursuant to the Securities Act of 1933 (the

“Sale”), for which the Nantahala Investors paid using cash on hand. During 2023 the Nantahala Investors also acquired 312,128

shares of Common Stock in open market transactions. The shares of Common Stock disclosed herein are held by the Nantahala Investors in

margin accounts together with other securities; such accounts may from time to time make use of margin.

| Item

4. | Purpose

of the Transaction |

The Reporting Persons caused

the Nantahala Investors to make the investments described above in Item 3 for ordinary investment purposes.

No Reporting Person has any

present plan or proposal which would relate to or result in any of the matters set forth in subparagraphs (a) - (j) of Item 4 of Schedule

13D except as set forth herein or such as would occur upon or in connection with completion of, or following, any of the actions discussed

herein. The Reporting Persons intend to review their investment in the Issuer on a continuing basis.

Jonathan Z. Buba, a Partner

at Nantahala, has served on the Issuer’s board of directors (the “Board”) since November 2023. Depending on various

factors including, without limitation, the Issuer’s financial position and investment strategy, the price levels of the Common Stock,

conditions in the securities markets and general economic and industry conditions, the Reporting Persons may in the future take such actions

with respect to their investment in the Issuer as they deem appropriate including, without limitation, engaging in communications with

management and the Board, whether including or through Mr. Buba, engaging in discussions with other Issuer investors and others about

the Issuer and the Nantahala Investors’ investment, making proposals to the Issuer concerning changes to the capitalization, ownership

structure, Board structure (including Board composition) or operations of the Issuer, purchasing additional shares of Common Stock, or

changing their intention with respect to any and all matters referred to in Item 4.

| Item

5. | Interest

in Securities of the Issuer |

(a) The

aggregate percentage of Common Stock beneficially owned by the Reporting Persons is based upon 8,096,757 shares of Common Stock outstanding,

which is the total of 6,396,757 shares of Common Stock reported outstanding as of September 12, 2024, as reported in the Issuer’s

10-Q filed with the Securities and Exchange Commission (the “SEC”) on September 16, 2024, plus the 1,700,000 shares of Common

Stock issued to the Nantahala Investors and others in the Sale.

Nantahala, as the investment

adviser of the Nantahala Investors, may be deemed to beneficially own the 544,686 shares of Common Stock held by the Nantahala Investors,

or 6.7% of the shares of Common Stock outstanding. Each of Mr. Harkey and Mr. Mack, as principals of Nantahala, may also be deemed to

beneficially own the same shares of Common Stock.

Mr. Buba holds options to acquire

12,732 shares of Common Stock acquired from the Issuer in his capacity as an Issuer director and as disclosed by Mr. Buba in a Form 4

filed with the SEC on May 13, 2024. Such options become exercisable, subject to customary conditions, on May 9, 2025 and expire on May

9, 2034. The Reporting Persons disclaim any interest in or beneficial ownership of Mr. Buba’s stock options or any underlying shares

of Common Stock.

(b) Nantahala,

Mr. Harkey and Mr. Mack have the shared power to vote and dispose of the Common Stock reported in this Schedule 13D.

(c) Except

as disclosed in Item 3, there have been no transactions in the shares of Common Stock during the past sixty (60) days by the Reporting

Persons or the Other Officers.

(d) The

Nantahala Investors hold the shares of Common Stock reported herein. No person other than the Nantahala Investors is known to have the

right to receive, or the power to direct the receipt of dividends from, or proceeds from the sale of, the Common Stock reported herein.

(e) Not

applicable.

| Item

6. | Contracts,

Arrangements, Understandings or Relationships with Respect to Securities of the Issuer |

Except as disclosed above and

in Item 3 and Item 4, there are no contracts, arrangements, understandings, or relationships among the Reporting Persons or Other Officers,

or between any of the Reporting Persons or Other Officers and any other person, with respect to the securities of the Issuer.

| Item

7. | Material

to be Filed as Exhibits |

| Exhibit 99.1 | |

Joint Filing Agreement, dated September 24, 2024 |

Signatures

After reasonable inquiry and

to the best of their knowledge and belief, each of the undersigned certifies that the information set forth in this statement is true,

complete and correct.

Dated: September 24,

2024

| NANTAHALA CAPITAL MANAGEMENT, LLC |

|

| |

|

|

| By: |

/s/ Taki Vasilakis |

|

| |

Taki Vasilakis |

|

| |

Chief Compliance Officer |

|

| |

|

|

| /s/ Wilmot B. Harkey |

|

| Wilmot B. Harkey |

|

| |

|

|

| /s/ Daniel Mack |

|

| Daniel Mack |

|

Exhibit 99.1

JOINT FILING AGREEMENT

In accordance with Rule 13d-1(k)(1) promulgated under the Securities

Exchange Act of 1934, the undersigned agree to the joint filing of a Statement on Schedule 13D (including any and all amendments thereto)

with respect to the Common Stock, par value $0.01 per share, of America’s Car-Mart, Inc. and further agree to the filing of this

agreement as an Exhibit thereto. In addition, each party to this Agreement expressly authorizes each other party to this Agreement to

file on its behalf any and all amendments to such Statement on Schedule 13D.

Date: September 24,

2024

| NANTAHALA CAPITAL MANAGEMENT, LLC |

|

| |

|

|

| By: |

/s/ Taki Vasilakis |

|

| |

Taki Vasilakis |

|

| |

Chief Compliance Officer |

|

| |

|

|

| /s/ Wilmot B. Harkey |

|

| Wilmot B. Harkey |

|

| |

|

|

| /s/ Daniel Mack |

|

| Daniel Mack |

|

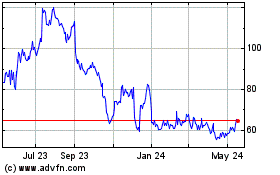

Americas Car Mart (NASDAQ:CRMT)

Historical Stock Chart

From Dec 2024 to Jan 2025

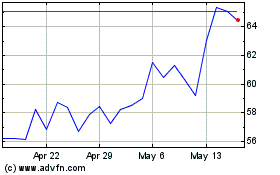

Americas Car Mart (NASDAQ:CRMT)

Historical Stock Chart

From Jan 2024 to Jan 2025