FALSE000077240600007724062025-02-032025-02-03

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

______________

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(D) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of report (Date of earliest event reported): February 3, 2025

Commission File Number

| | | | | | | | |

| | CIRRUS LOGIC, INC. | |

| (Exact name of Registrant as specified in its charter) |

| | | | | | | | | | | | | | |

| Delaware | | 000-17795 | | 77-0024818 |

(State or Other Jurisdiction of

Incorporation or Organization) | | (Commission File Number) | | (IRS Employer

Identification No.) |

| | | | | | | | | | | | | | |

| 800 W. 6th Street | Austin, | TX | | 78701 |

| (Address of Principal Executive Offices) | | (Zip Code) |

| | | | |

Registrant’s telephone number, including area code: | (512) | 851-4000 |

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol | | Name of each exchange on which registered |

| Common stock, $0.001 par value | | CRUS | | The NASDAQ Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 Results of Operations and Financial Condition.

On February 4, 2025, Cirrus Logic, Inc. (“Cirrus Logic” or the “Company”) issued a press release announcing its financial results for its third quarter fiscal year 2025. The full text of the press release is furnished as Exhibit No. 99.1 to this Current Report on Form 8-K.

Item 5.02 Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

Appointment of Chief Financial Officer

On February 4, 2025, Cirrus Logic, Inc. (the “Company,” “we,” or “our”) announced the appointment of Jeff Woolard as Chief Financial Officer (“CFO”) of the Company, effective February 24, 2025.

Mr. Woolard, age 55, joins the Company having come from Velocity Global, LLC., a private company that provides a global workforce platform and related services, where he served from September 2023 as CFO. Previously, from December 2021, Mr. Woolard served as CFO for Solidigm, a private company that provides flash memory solutions. Prior to that, from May 2020, Mr. Woolard worked at Intel Corporation, a public semiconductor company, as CFO Manufacturing and Technology and from March 2012 as CFO Intel Capital, Emerging Growth Incubation. Previously, Mr. Woolard held other various leadership positions at Intel. From 2019-2022, Mr. Woolard also served as a board member for McAfee Corp., a computer security software company. Mr. Woolard holds a Bachelor of Science degree in Finance from Arizona State University and a Master of Business Administration degree from the University of Washington.

In connection with his appointment, Mr. Woolard entered into an offer-letter agreement (the “Offer Letter”) with the Company on December 20, 2024, which provides that, subject to him commencing employment, he will receive the following:

•A base salary of $475,000 per year.

•A $200,000 cash hiring bonus, subject to pro-rated repayment if Mr. Woolard voluntarily resigns, takes a personal leave exceeding three months, or is terminated (other than in a reduction in force) within 24 months of his hire date.

•Eligibility to participate in our 2007 Management and Key Individual Contributor Incentive Plan with a semiannual target bonus percentage of 37.5%.

•Eligibility to participate in our Executive Severance and Change of Control Plan.

•Eligibility to participate in our health, retirement, and other programs on the same basis as other executive officers.

•The right to receive the following equity awards, which are expected to be granted on the Company’s next regularly scheduled monthly grant date following February 24, 2025:

•A one-time, make-whole equity award valued at $2.5 million in restricted stock units (RSUs) vesting over three years, with 20% vesting at the first anniversary of grant, 40% vesting at the second anniversary, and 40% vesting at the third anniversary, intended to offset equity or compensation forfeited upon joining the Company. This award is subject to accelerated vesting if Mr. Woolard’s employment is terminated by the Company without Cause other than in connection with a Change of Control (as those terms are defined in our Executive Severance and Change of Control Plan).

•A one-time, new-hire equity award valued at $1.5 million in RSUs vesting over two years, with 50% vesting at the first anniversary of grant and 50% vesting at the second anniversary.

•A one-time, new-hire equity award valued at $1.5 million in performance-based RSUs referred to as market stock units (MSUs), which cliff vest after three years. The number of MSUs that ultimately vest after three years may range from 0 to 200% of the target number of shares, depending on the Company’s total shareholder return (“TSR”) measured relative to the TSR of the component companies of the Russell 3000 Index over that three-year period, as described in our proxy statement.

Mr. Woolard will not be required to relocate to the Company’s headquarters in Austin, Texas and plans to work remotely from Phoenix, Arizona, traveling as needed to our headquarters and other locations.

The foregoing summary of the Offer Letter does not purport to be complete and is qualified in its entirety by reference to the full text of the Offer Letter, a copy of which is attached hereto as Exhibit 10.1 and is incorporated herein by reference.

There are no other arrangements or understandings between Mr. Woolard and any other persons pursuant to which he was selected as the Company’s CFO. There are no family relationships between Mr. Woolard and the executive officers or directors of the Company, and no transactions involving the Company and Mr. Woolard that the Company would be required to report pursuant to Item 404(a) of Regulation S-K.

Resignation of Mr. Habermann as Interim Chief Financial Officer and Continued Role as Principal Accounting Officer

On May 16, 2024, the Company filed a Current Report on Form 8-K disclosing that Ulf Habermann had been appointed as the Company’s interim CFO until a successor was appointed. In connection with Mr. Woolard’s appointment, Ulf Habermann will step down from his position as interim CFO, effective February 24, 2025.

This change in Mr. Habermann’s position results only from the appointment of Mr. Woolard and is not a result of any disagreement with the Company’s independent auditors or any member of management on any matter of accounting principles or practices, financial statement disclosure, or internal controls. Mr. Habermann will remain a key member of the Company’s finance organization, serving as our Principal Accounting Officer, Treasurer, and Senior Vice President of Finance.

On February 3, 2025, the Compensation and Human Resources Committee of the Board of Directors approved updates to Mr. Habermann’s compensation in connection with his change of position. Following his tenure as interim CFO, Mr. Habermann’s annual base salary will be adjusted from $431,047 to $375,000, and his semiannual target bonus percentage will decrease from 37.5% to 25% of his annual base salary. For the purpose of calculating Mr. Habermann’s cash bonus for the second half of fiscal year 2025 (our current semiannual bonus period), his base salary and target bonus percentage prior to these adjustments (i.e., $431,047 and 37.5%, respectively) will be used.

Item 7.01 Regulation FD Disclosure

On February 4, 2025, in addition to issuing a press release, the Company posted on its website a shareholder letter to investors summarizing the financial results for its third quarter fiscal year 2025. The full text of the shareholder letter is furnished as Exhibit No. 99.2 to this Current Report on Form 8-K. A copy of the Company’s press release announcing the appointment of Mr. Woolard and the transition of Mr. Habermann is being furnished as Exhibit 99.3 to this Current Report on Form 8-K.

The information contained in Item 7.01 of this Form 8-K, including Exhibits 99.2 and 99.3, is being furnished and shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934 (the “Exchange Act”), or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference in any filing by the company under the Securities Act of 1933 or the Exchange Act, except as shall be expressly set forth by specific reference in such filing.

Use of Non-GAAP Financial Information

To supplement Cirrus Logic's financial statements presented on a GAAP basis, Cirrus has provided non-GAAP financial information, including non-GAAP net income, diluted earnings per share, operating income and profit, operating expenses, gross margin and profit, tax expense, tax expense impact on earnings per share, effective tax rate, free cash flow and free cash flow margin. A reconciliation of the adjustments to GAAP results is included in the press release below. Non-GAAP financial information is not meant as a substitute for GAAP results, but is included because management believes such information is useful to our investors for informational and comparative purposes. In addition, certain non-GAAP financial information is used internally by management to evaluate and manage the company. The non-GAAP financial information used by Cirrus Logic may differ from that used by other companies. These non-GAAP measures should be considered in addition to, and not as a substitute for, the results prepared in accordance with GAAP.

The information contained in Items 2.02, 7.01, and 9.01 in this Current Report on Form 8-K and the exhibits furnished hereto contain forward-looking statements regarding the Company and cautionary statements identifying important factors that could cause actual results to differ materially from those anticipated. In addition, this information shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section, nor shall they be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, except as expressly set forth by specific reference in such a filing.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

Exhibit Description

Exhibit 10.1 Offer Letter entered December 20, 2024 between Cirrus Logic, Inc. and Mr. Woolard Exhibit 99.1 Cirrus Logic, Inc. press release dated February 4, 2025 Exhibit 99.2 Cirrus Logic, Inc. shareholder letter dated February 4, 2025 Exhibit 99.3 Cirrus Logic, Inc. press release dated February 4, 2025 Exhibit 104 Cover Page Interactive Data File (formatted as Inline XBRL and contained in Exhibit 101)

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, Registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

| | | | | | | | | | | | | | | | | |

| | | CIRRUS LOGIC, INC. | |

| | | | | |

| | | | | |

| Date: | February 4, 2025 | By: | /s/ Ulf Habermann | |

| | | Name: | Ulf Habermann | |

| | | Title: | Interim Chief Financial Officer |

| | |

Docusign Envelope ID: 8E60E7DB-096A-481C-8743-988377C8FE51 |

CIRRUS LOGIC, Inc., 800 W. Sixth St, Austin, TX 78701

Tel: (512) 851-4000 www.cirrus.com

December 20, 2024

Jeff Woolard

8634 N. 52nd St

Paradise Valley, AZ 85253

Dear Jeff:

We are pleased to extend to you an offer of employment with Cirrus Logic, including as applicable Cirrus Logic, Inc. and its subsidiaries and Affiliates (“Cirrus Logic” or the “Company”), in the position of EVP, Chief Financial Officer reporting to John Forsyth beginning with a tentative start date of February 17, 2025. Your starting annual salary will be $475,000, which is paid bi-weekly. In all respects, this offer of employment is subject to final approval by our Board of Directors in their capacity to appoint certain officers of the Company under our bylaws.

You will be eligible to participate in Cirrus Logic’s Management and Key Individual Contributor Incentive Plan. Under this plan, you are eligible for a semi-annual target bonus payout of thirty-seven-point five percent (37.5%) of your base salary at 100% performance. For the first bonus period following your hire date with the Company, you will be eligible for a pro-rated bonus based upon the number of calendar days employed during the plan cycle. Payment of any bonus is dependent upon the Company meeting certain financial and operational goals along with other terms and conditions of the incentive plan document, which is available for your review upon request.

The Compensation Committee of our Board of Directors has approved that you be granted:

•A one-time, make-whole equity award valued at $2.5 million in restricted stock units (RSUs) vesting over 3 years, with 20% vesting at the first anniversary of grant, 40% vesting at the second anniversary, and 40% vesting at the third anniversary intended to compensate you for equity or compensation forfeited upon joining the Company;

•A one-time, new-hire equity award valued at $1.5 million in RSUs vesting over 2 years, with 50% vesting at the first anniversary of grant and 50% vesting at the second anniversary; and

•A one-time, new-hire equity award valued at $1.5 million in performance-based RSUs (PBRSUs), which will cliff vest after 3 years. The number of PBRSU shares that ultimately vest after three years may range from 0 to 200% of the target number of shares, depending on the Company’s performance over that three-year period as described in our proxy statement, a copy of which can be provided upon request.

If you begin work before February 24, 2025, we expect that these equity awards will be granted on March 5, 2025.

You will also be eligible to participate in Cirrus Logic’s Executive Severance and Change of Control Plan (“Severance Plan”), which describes eligibility for certain benefits by participants whose employment is terminated by the Company other than for Cause, or as a result of, or following, a Change of Control (as those terms are defined in the Severance Plan).

Your one-time, make-whole equity award will be subject to accelerated vesting in the event that your employment is terminated by the Company without Cause other than in connection with a Change of Control (as those terms are defined in the Severance Plan), conditioned upon your execution and delivery of an effective release of claims against the Company and related parties.

| | |

Docusign Envelope ID: 8E60E7DB-096A-481C-8743-988377C8FE51 |

You will receive a hiring bonus of $200,000, less all applicable taxes and deductions, to be paid with your first payroll check after you begin employment. Your hiring bonus will be subject to the Company’s standard practice of requiring a pro-rated repayment should you voluntarily terminate your employment; take a personal leave of absence in excess of three months; or are involuntarily terminated for reasons other than a reduction in force within twenty-four months of your date of hire, with the repayment obligation reduced by 1/24 for each completed month of service.

Note that, as an executive officer, you will be subject to all policies that apply to the Company’s executive officers including but not limited to the Company’s “Recovery of Erroneously Awarded Incentive Compensation Policy,” which requires the clawback of incentive compensation paid to current and former executive officers when that compensation is based upon achievement of financial results that later require a restatement, whether or not resulting from error or intentional misconduct by such executive officers. Descriptions of this and other applicable executive policies are disclosed in our proxy statement.

Cirrus Logic will use your industry experience for the limited purpose of determining your annual Personal Time Off (PTO) accrual rate. PTO includes time off for any reason, including vacation and sick days. Based on your prior experience, you are entitled to 27 days of PTO annually, which will accrue at the rate of 8.31 hours bi-weekly.

Cirrus Logic makes available to its employees a generous benefits package that includes competitive medical, dental, life and vision insurance programs, as well as other benefits including group term life insurance, long-term and short- term disability insurance, a 401(k) plan supplemented by Company matching contributions, and paid vacations and holidays. A summary of our benefits program is available for your review upon request. Many of our benefits become effective on your first day of employment and will be explained in detail during new employee orientation.

During your employment with the Company, you will not be required to relocate to the Company’s headquarters (currently Austin, Texas), and we understand that you intend to provide your services remotely from Phoenix, Arizona. As part of this offer of employment, you acknowledge that you will be required to travel on business (including, without limitation, to the Company’s headquarters and other Company offices) as required to perform your duties and responsibilities. Travel expenses will be reimbursed by the Company in accordance with our Travel and Expense Policy.

This offer of employment is also contingent upon your ability to provide and maintain all of the following:

1.Proper documentation showing you have the legal right to work in the United States;

2.Signed copy of this offer letter and the return of any standard, associated materials;

3.Successful completion of background, employment history, educational verifications and reference checks; and

4.If requested, proof of graduation, by submission of an official final transcript or photocopy of your diploma. If you are unable to provide proof of degree completion, contact your recruiter for discussion prior to start your date.

All verifications must be completed no less than 5 business days prior to your employment start date.

Cirrus Logic is an at-will employer. Nothing in this offer is intended to depart from the at-will employment status applicable to all Cirrus Logic employees nor should any language in this offer be misunderstood to suggest that there will be any definite duration for your anticipated employment with Cirrus Logic.

To accept this offer of employment, please sign below, note your start date in the space provided, and submit your acceptance. Upon acceptance, we will follow up with you regarding additional logistical details.

| | |

Docusign Envelope ID: 8E60E7DB-096A-481C-8743-988377C8FE51 |

This offer of employment expires: December 27, 2024.

The creative ability and dedication of our employees continues to enable us to set new standards. As a result of our recent discussions with you, we are confident you possess these same qualities and that your contribution will be significant. We look forward to your acceptance of our offer of employment and very much want you to join our team.

Sincerely,

John Forsyth

President and Chief Executive Officer

I am pleased to accept your offer of employment as outlined.

December 20, 2024

December 20, 2024Date Signed

2/24/25

Start Date (Must be a Monday)

Please contact Denise Grodé to confirm your orientation date.

FINANCIAL NEWS

Cirrus Logic Reports Fiscal Third Quarter Revenue of $555.7 Million

AUSTIN, Texas – February 4, 2025 – Cirrus Logic, Inc. (NASDAQ: CRUS) today posted on its website at investor.cirrus.com the quarterly Shareholder Letter that contains the complete financial results for the third quarter of fiscal year 2025, which ended December 28, 2024, as well as the company’s current business outlook.

“Cirrus Logic delivered revenue significantly above the top end of our guidance range in the December quarter as shipments into smartphones exceeded our expectations,” said John Forsyth, Cirrus Logic president and chief executive officer. “During the quarter, we experienced strong demand for our smartphone audio components, including our latest-generation custom boosted amplifier and first 22-nanometer smart codec. Additionally, we gained momentum in our laptop business as we were featured as part of the Intel Arrow Lake reference design, began sampling our latest amplifier and codec specifically designed for laptops, and expanded our breadth of content across a variety of devices. With a compelling roadmap of products and a proven track record of execution, we believe Cirrus Logic is well-positioned to grow long-term shareholder value.”

Reported Financial Results – Third Quarter FY25

•Revenue of $555.7 million;

•GAAP and non-GAAP gross margin of 53.6 percent;

•GAAP operating expenses of $152.0 million and non-GAAP operating expenses of $129.2 million; and

•GAAP earnings per share of $2.11 and non-GAAP earnings per share of $2.51.

A reconciliation of GAAP to non-GAAP financial information is included in the tables accompanying this press release.

Business Outlook – Fourth Quarter FY25

•Revenue is expected to range between $350 million and $410 million;

•GAAP gross margin is forecasted to be between 51 percent and 53 percent; and

•Combined GAAP R&D and SG&A expenses are anticipated to range between $141 million and $147 million, including approximately $20 million in stock-based compensation expense and $2 million in amortization of acquired intangibles, resulting in a non-GAAP operating expense range between $119 million and $125 million.

Cirrus Logic will host a live Q&A session at 5 p.m. EST today to discuss its financial results and business outlook. Participants may listen to the conference call on the investor relations website at investor.cirrus.com. A replay of the webcast can be accessed on the Cirrus Logic website approximately two hours following its completion or by calling (609) 800-9909 or toll-free at (800) 770-2030 (Access Code: 95424).

About Cirrus Logic, Inc.

Cirrus Logic is a leader in low-power, high-precision mixed-signal processing solutions that create innovative user experiences for the world’s top mobile and consumer applications. With headquarters in Austin, Texas, Cirrus Logic is recognized globally for its award-winning corporate culture.

Cirrus Logic, Cirrus and the Cirrus Logic logo are registered trademarks of Cirrus Logic, Inc. All other company or product names noted herein may be trademarks of their respective holders.

Investor Contact:

Chelsea Heffernan

Vice President, Investor Relations

Cirrus Logic, Inc.

(512) 851-4125

Investor@cirrus.com

Use of non-GAAP Financial Information

To supplement Cirrus Logic's financial statements presented on a GAAP basis, the company has provided non-GAAP financial information, including non-GAAP net income, diluted earnings per share, operating income and profit, operating expenses, gross margin and profit, tax expense, tax expense impact on earnings per share, effective tax rate, free cash flow, and free cash flow margin. A reconciliation of the adjustments to GAAP results is included in the tables below. Non-GAAP financial information is not meant as a substitute for GAAP results but is included because management believes such information is useful to our investors for informational and comparative purposes. In addition, certain non-GAAP financial information is used internally by management to evaluate and manage the company. The non-GAAP financial information used by Cirrus Logic may differ from that used by other companies. These non-GAAP measures should be considered in addition to, and not as a substitute for, the results prepared in accordance with GAAP.

Safe Harbor Statement

Except for historical information contained herein, the matters set forth in this news release contain forward-looking statements including our statement about our belief that we are well-positioned to grow long-term shareholder value; and our estimates for the fourth quarter fiscal year 2025 revenue, gross margin, combined research and development and selling, general and administrative expense levels, stock-based compensation expense, and amortization of acquired intangibles. In some cases, forward-looking statements are identified by words such as “expect,” “anticipate,” “target,” “project,” “believe,” “goals,” “opportunity,” “estimates,” “intend,” and variations of these types of words and similar expressions. In addition, any statements that refer to our plans, expectations, strategies, or other characterizations of future events or circumstances are forward-looking statements. These forward-looking statements are based on our current expectations, estimates, and assumptions and are subject to certain risks and uncertainties that could cause actual results to differ materially, and readers should not place undue reliance on such statements. These risks and uncertainties include, but are not limited to, the following: the level and timing of orders and shipments during the fourth quarter of fiscal year 2025, customer cancellations of orders, or the failure to place orders consistent with forecasts, along with the risk factors listed in our Form 10-K for the year ended March 30, 2024 and in our other filings with the Securities and Exchange Commission, which are available at www.sec.gov. The foregoing information concerning our business outlook represents our outlook as of the date of this news release, and we expressly disclaim any obligation to update or revise any forward-looking statements, whether as a result of new developments or otherwise.

Summary Financial Data Follows:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| CONSOLIDATED CONDENSED STATEMENT OF OPERATIONS |

| (in thousands, except per share data; unaudited) |

| | | | | | | | | |

| Three Months Ended | | Nine Months Ended |

| Dec. 28, | | Sep. 28, | | Dec. 30, | | Dec. 28, | | Dec. 30, |

| 2024 | | 2024 | | 2023 | | 2024 | | 2023 |

| Q3'25 | | Q2'25 | | Q3'24 | | Q3'25 | | Q3'24 |

| Audio | $ | 346,272 | | | $ | 316,588 | | | $ | 378,597 | | | $ | 881,830 | | | $ | 857,258 | |

| High-Performance Mixed-Signal | 209,466 | | | 225,269 | | | 240,387 | | | 589,791 | | | 559,805 | |

| Net sales | 555,738 | | | 541,857 | | | 618,984 | | | 1,471,621 | | | 1,417,063 | |

| Cost of sales | 257,951 | | | 259,267 | | | 301,520 | | | 702,319 | | | 693,616 | |

| Gross profit | 297,787 | | | 282,590 | | | 317,464 | | | 769,302 | | | 723,447 | |

| Gross margin | 53.6 | % | | 52.2 | % | | 51.3 | % | | 52.3 | % | | 51.1 | % |

| | | | | | | | | |

| Research and development | 112,976 | | | 112,925 | | | 112,672 | | | 331,264 | | | 323,092 | |

| Selling, general and administrative | 39,042 | | | 37,813 | | | 37,604 | | | 113,625 | | | 107,306 | |

| Restructuring costs | — | | | — | | | (360) | | | — | | | 1,959 | |

| | | | | | | | | |

| Total operating expenses | 152,018 | | | 150,738 | | | 149,916 | | | 444,889 | | | 432,357 | |

| | | | | | | | | |

| Income from operations | 145,769 | | | 131,852 | | | 167,548 | | | 324,413 | | | 291,090 | |

| | | | | | | | | |

| | | | | | | | | |

| Interest income | 8,146 | | | 8,134 | | | 4,889 | | | 24,482 | | | 13,218 | |

| Other income (expense) | (214) | | | 19 | | | (337) | | | 1,414 | | | (30) | |

| Income before income taxes | 153,701 | | | 140,005 | | | 172,100 | | | 350,309 | | | 304,278 | |

| Provision for income taxes | 37,696 | | | 37,865 | | | 33,377 | | | 90,069 | | | 74,548 | |

| Net income | $ | 116,005 | | | $ | 102,140 | | | $ | 138,723 | | | $ | 260,240 | | | $ | 229,730 | |

| | | | | | | | | |

| Basic earnings per share | $ | 2.19 | | | $ | 1.92 | | | $ | 2.57 | | | $ | 4.89 | | | $ | 4.22 | |

| Diluted earnings per share: | $ | 2.11 | | | $ | 1.83 | | | $ | 2.50 | | | $ | 4.69 | | | $ | 4.09 | |

| | | | | | | | | |

| Weighted average number of shares: | | | | | | | | | |

| Basic | 53,081 | | | 53,275 | | | 54,016 | | | 53,263 | | | 54,449 | |

| Diluted | 55,076 | | | 55,800 | | | 55,592 | | | 55,529 | | | 56,160 | |

| | | | | | | | | |

| Prepared in accordance with Generally Accepted Accounting Principles |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| RECONCILIATION BETWEEN GAAP AND NON-GAAP FINANCIAL INFORMATION | | |

| (in thousands, except per share data; unaudited) | | |

| (not prepared in accordance with GAAP) | | |

| | | | | | | | | | | |

| Non-GAAP financial information is not meant as a substitute for GAAP results, but is included because management believes such information is useful to our investors for informational and comparative purposes. In addition, certain non-GAAP financial information is used internally by management to evaluate and manage the company. As a note, the non-GAAP financial information used by Cirrus Logic may differ from that used by other companies. These non-GAAP measures should be considered in addition to, and not as a substitute for, the results prepared in accordance with GAAP. | | |

| | | | | | | | | | | |

| Three Months Ended | | Nine Months Ended | | |

| Dec. 28, | | Sep. 28, | | Dec. 30, | | Dec. 28, | | Dec. 30, | | |

| 2024 | | 2024 | | 2023 | | 2024 | | 2023 | | |

| Net Income Reconciliation | Q3'25 | | Q2'25 | | Q3'24 | | Q3'25 | | Q3'24 | | |

| GAAP Net Income | $ | 116,005 | | | $ | 102,140 | | | $ | 138,723 | | | $ | 260,240 | | | $ | 229,730 | | | |

| Amortization of acquisition intangibles | 1,647 | | | 1,864 | | | 1,972 | | | 5,483 | | | 6,312 | | | |

| Stock-based compensation expense | 20,823 | | | 22,447 | | | 23,067 | | | 64,655 | | | 67,113 | | | |

| Lease impairment | 661 | | | — | | | — | | | 1,680 | | | — | | | |

| Restructuring costs | — | | | — | | | (360) | | | — | | | 1,959 | | | |

| | | | | | | | | | | |

| Acquisition-related costs | — | | | — | | | — | | | — | | | 4,105 | | | |

| | | | | | | | | | | |

| Adjustment to income taxes | (827) | | | (1,162) | | | (2,769) | | | (6,094) | | | (9,001) | | | |

| Non-GAAP Net Income | $ | 138,309 | | | $ | 125,289 | | | $ | 160,633 | | | $ | 325,964 | | | $ | 300,218 | | | |

| | | | | | | | | | | |

| Earnings Per Share Reconciliation | | | | | | | | | | | |

| GAAP Diluted earnings per share | $ | 2.11 | | | $ | 1.83 | | | $ | 2.50 | | | $ | 4.69 | | | $ | 4.09 | | | |

| Effect of Amortization of acquisition intangibles | 0.03 | | | 0.04 | | | 0.04 | | | 0.10 | | | 0.11 | | | |

| Effect of Stock-based compensation expense | 0.38 | | | 0.40 | | | 0.41 | | | 1.16 | | | 1.20 | | | |

| Effect of Lease impairment | 0.01 | | | — | | | — | | | 0.03 | | | — | | | |

| Effect of Restructuring costs | — | | | — | | | (0.01) | | | — | | | 0.04 | | | |

| | | | | | | | | | | |

| Effect of Acquisition-related costs | — | | | — | | | — | | | — | | | 0.07 | | | |

| | | | | | | | | | | |

| Effect of Adjustment to income taxes | (0.02) | | | (0.02) | | | (0.05) | | | (0.11) | | | (0.16) | | | |

| Non-GAAP Diluted earnings per share | $ | 2.51 | | | $ | 2.25 | | | $ | 2.89 | | | $ | 5.87 | | | $ | 5.35 | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| Operating Income Reconciliation | | | | | | | | | | | |

| GAAP Operating Income | $ | 145,769 | | | $ | 131,852 | | | $ | 167,548 | | | $ | 324,413 | | | $ | 291,090 | | | |

| GAAP Operating Profit | 26.2 | % | | 24.3 | % | | 27.1 | % | | 22.0 | % | | 20.5 | % | | |

| Amortization of acquisition intangibles | 1,647 | | | 1,864 | | | 1,972 | | | 5,483 | | | 6,312 | | | |

| Stock-based compensation expense - COGS | 351 | | | 355 | | | 395 | | | 972 | | | 1,041 | | | |

| Stock-based compensation expense - R&D | 14,498 | | | 15,844 | | | 16,771 | | | 46,105 | | | 48,195 | | | |

| Stock-based compensation expense - SG&A | 5,974 | | | 6,248 | | | 5,901 | | | 17,578 | | | 17,877 | | | |

| Lease impairment | 661 | | | — | | | — | | | 1,680 | | | — | | | |

| Restructuring costs | — | | | — | | | (360) | | | — | | | 1,959 | | | |

| | | | | | | | | | | |

| Acquisition-related costs | — | | | — | | | — | | | — | | | 4,105 | | | |

| Non-GAAP Operating Income | $ | 168,900 | | | $ | 156,163 | | | $ | 192,227 | | | $ | 396,231 | | | $ | 370,579 | | | |

| Non-GAAP Operating Profit | 30.4 | % | | 28.8 | % | | 31.1 | % | | 26.9 | % | | 26.2 | % | | |

| | | | | | | | | | | |

| Operating Expense Reconciliation | | | | | | | | | | | |

| GAAP Operating Expenses | $ | 152,018 | | | $ | 150,738 | | | $ | 149,916 | | | $ | 444,889 | | | $ | 432,357 | | | |

| Amortization of acquisition intangibles | (1,647) | | | (1,864) | | | (1,972) | | | (5,483) | | | (6,312) | | | |

| Stock-based compensation expense - R&D | (14,498) | | | (15,844) | | | (16,771) | | | (46,105) | | | (48,195) | | | |

| Stock-based compensation expense - SG&A | (5,974) | | | (6,248) | | | (5,901) | | | (17,578) | | | (17,877) | | | |

| Lease impairment | 661 | | | — | | | — | | | 1,680 | | | — | | | |

| Restructuring costs | — | | | — | | | 360 | | | — | | | (1,959) | | | |

| | | | | | | | | | | |

| Acquisition-related costs | — | | | — | | | — | | | — | | | (4,105) | | | |

| Non-GAAP Operating Expenses | $ | 129,238 | | | $ | 126,782 | | | $ | 125,632 | | | $ | 374,043 | | | $ | 353,909 | | | |

| | | | | | | | | | | |

| Gross Margin/Profit Reconciliation | | | | | | | | | | | |

| GAAP Gross Profit | $ | 297,787 | | | $ | 282,590 | | | $ | 317,464 | | | $ | 769,302 | | | $ | 723,447 | | | |

| GAAP Gross Margin | 53.6 | % | | 52.2 | % | | 51.3 | % | | 52.3 | % | | 51.1 | % | | |

| | | | | | | | | | | |

| Stock-based compensation expense - COGS | 351 | | | 355 | | | 395 | | | 972 | | | 1,041 | | | |

| Non-GAAP Gross Profit | $ | 298,138 | | | $ | 282,945 | | | $ | 317,859 | | | $ | 770,274 | | | $ | 724,488 | | | |

| Non-GAAP Gross Margin | 53.6 | % | | 52.2 | % | | 51.4 | % | | 52.3 | % | | 51.1 | % | | |

| | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| RECONCILIATION BETWEEN GAAP AND NON-GAAP FINANCIAL INFORMATION | | |

| (in thousands, except per share data; unaudited) | | |

| (not prepared in accordance with GAAP) | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| Three Months Ended | | Nine Months Ended | | |

| Dec. 28, | | Sep. 28, | | Dec. 30, | | Dec. 28, | | Dec. 30, | | |

| 2024 | | 2024 | | 2023 | | 2024 | | 2023 | | |

| Effective Tax Rate Reconciliation | Q3'25 | | Q2'25 | | Q3'24 | | Q3'25 | | Q3'24 | | |

| GAAP Tax Expense | $ | 37,696 | | | $ | 37,865 | | | $ | 33,377 | | | $ | 90,069 | | | $ | 74,548 | | | |

| GAAP Effective Tax Rate | 24.5 | % | | 27.0 | % | | 19.4 | % | | 25.7 | % | | 24.5 | % | | |

| Adjustments to income taxes | 827 | | | 1,162 | | | 2,769 | | | 6,094 | | | 9,001 | | | |

| Non-GAAP Tax Expense | $ | 38,523 | | | $ | 39,027 | | | $ | 36,146 | | | $ | 96,163 | | | $ | 83,549 | | | |

| Non-GAAP Effective Tax Rate | 21.8 | % | | 23.8 | % | | 18.4 | % | | 22.8 | % | | 21.8 | % | | |

| | | | | | | | | | | |

| Tax Impact to EPS Reconciliation | | | | | | | | | | | |

| GAAP Tax Expense | $ | 0.68 | | | $ | 0.68 | | | $ | 0.60 | | | $ | 1.62 | | | $ | 1.33 | | | |

| Adjustments to income taxes | 0.02 | | | 0.02 | | | 0.05 | | | 0.11 | | | 0.16 | | | |

| Non-GAAP Tax Expense | $ | 0.70 | | | $ | 0.70 | | | $ | 0.65 | | | $ | 1.73 | | | $ | 1.49 | | | |

| | | | | | | | | | | | | | | | | | | | |

| CONSOLIDATED CONDENSED BALANCE SHEET |

| (in thousands; unaudited) |

| | | | | | |

| | Dec. 28, | | Mar. 30, | | Dec. 30, |

| | 2024 | | 2024 | | 2023 |

| ASSETS | | | | | | |

| Current assets | | | | | | |

| Cash and cash equivalents | | $ | 526,444 | | | $ | 502,764 | | | $ | 483,931 | |

| Marketable securities | | 37,535 | | | 23,778 | | | 32,842 | |

| Accounts receivable, net | | 261,943 | | | 162,478 | | | 217,269 | |

| Inventories | | 275,558 | | | 227,248 | | | 256,675 | |

| Prepaid wafers | | 66,113 | | | 86,679 | | | 84,854 | |

| Other current assets | | 82,857 | | | 103,245 | | | 109,814 | |

| Total current Assets | | 1,250,450 | | | 1,106,192 | | | 1,185,385 | |

| | | | | | |

| Long-term marketable securities | | 252,594 | | | 173,374 | | | 70,260 | |

| Right-of-use lease assets | | 129,597 | | | 138,288 | | | 140,993 | |

| Property and equipment, net | | 163,837 | | | 170,175 | | | 167,579 | |

| Intangibles, net | | 23,957 | | | 29,578 | | | 31,677 | |

| Goodwill | | 435,936 | | | 435,936 | | | 435,936 | |

| Deferred tax asset | | 40,895 | | | 48,649 | | | 34,116 | |

| Long-term prepaid wafers | | 23,020 | | | 60,750 | | | 73,492 | |

| Other assets | | 42,954 | | | 68,634 | | | 77,675 | |

| Total assets | | $ | 2,363,240 | | | $ | 2,231,576 | | | $ | 2,217,113 | |

| | | | | | |

| LIABILITIES AND STOCKHOLDERS' EQUITY | | | | | | |

| Current liabilities | | | | | | |

| Accounts payable | | $ | 77,907 | | | $ | 55,545 | | | $ | 56,231 | |

| Accrued salaries and benefits | | 48,029 | | | 47,612 | | | 44,352 | |

| Lease liability | | 21,858 | | | 20,640 | | | 19,906 | |

| | | | | | |

| Other accrued liabilities | | 63,119 | | | 62,596 | | | 58,105 | |

| Total current liabilities | | 210,913 | | | 186,393 | | | 178,594 | |

| | | | | | |

| Non-current lease liability | | 124,622 | | | 134,576 | | | 138,415 | |

| Non-current income taxes | | 43,401 | | | 52,013 | | | 52,247 | |

| | | | | | |

| Other long-term liabilities | | 21,506 | | | 41,580 | | | 47,097 | |

| Total long-term liabilities | | 189,529 | | | 228,169 | | | 237,759 | |

| | | | | | |

| Stockholders' equity: | | | | | | |

| Capital stock | | 1,840,791 | | | 1,760,701 | | | 1,735,824 | |

Accumulated earnings | | 124,101 | | | 58,916 | | | 66,633 | |

Accumulated other comprehensive loss | | (2,094) | | | (2,603) | | | (1,697) | |

| Total stockholders' equity | | 1,962,798 | | | 1,817,014 | | | 1,800,760 | |

| Total liabilities and stockholders' equity | | $ | 2,363,240 | | | $ | 2,231,576 | | | $ | 2,217,113 | |

| | | | | | |

| Prepared in accordance with Generally Accepted Accounting Principles |

| | | | | | | | | | | | | | |

| CONSOLIDATED CONDENSED STATEMENT OF CASH FLOWS |

| (in thousands; unaudited) |

| | | | |

| | Three Months Ended |

| | | | |

| | Dec. 28, | | Dec. 30, |

| | 2024 | | 2023 |

| | Q3'25 | | Q3'24 |

| Cash flows from operating activities: | | | | |

| Net income | | $ | 116,005 | | | $ | 138,723 | |

Adjustments to reconcile net income to net cash provided by operating activities: | | | | |

| Depreciation and amortization | | 12,824 | | | 12,732 | |

| Stock-based compensation expense | | 20,823 | | | 23,067 | |

| Deferred income taxes | | 8,379 | | | 9,723 | |

| Loss on retirement or write-off of long-lived assets | | 369 | | | 10 | |

| Other non-cash charges | | (379) | | | 668 | |

| Restructuring costs | | — | | | (360) | |

| | | | |

| Net change in operating assets and liabilities: | | | | |

| Accounts receivable, net | | 62,155 | | | 54,048 | |

| Inventories | | (3,793) | | | 72,257 | |

| Prepaid wafers | | 20,411 | | | 15,596 | |

| Other assets | | 1,720 | | | 17,973 | |

| Accounts payable and other accrued liabilities | | (21,556) | | | (32,123) | |

| Income taxes payable | | 1,630 | | | 1,378 | |

| | | | |

Net cash provided by operating activities | | 218,588 | | | 313,692 | |

| Cash flows from investing activities: | | | | |

| Maturities and sales of available-for-sale marketable securities | | 12,423 | | | 5,176 | |

| Purchases of available-for-sale marketable securities | | (44,868) | | | (32,334) | |

| Purchases of property, equipment and software | | (6,687) | | | (9,813) | |

| | | | |

| | | | |

| Net cash used in investing activities | | (39,132) | | | (36,971) | |

| Cash flows from financing activities: | | | | |

| | | | |

| | | | |

Net proceeds from the issuance of common stock | | 378 | | | 50 | |

| Repurchase of stock to satisfy employee tax withholding obligations | | (29,112) | | | (13,722) | |

| Repurchase and retirement of common stock | | (70,037) | | | (56,923) | |

| Net cash used in financing activities | | (98,771) | | | (70,595) | |

Net increase in cash and cash equivalents | | 80,685 | | | 206,126 | |

| Cash and cash equivalents at beginning of period | | 445,759 | | | 277,805 | |

| Cash and cash equivalents at end of period | | $ | 526,444 | | | $ | 483,931 | |

| | | | |

| Prepared in accordance with Generally Accepted Accounting Principles |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| RECONCILIATION BETWEEN GAAP AND NON-GAAP FINANCIAL INFORMATION |

| (in thousands; unaudited) |

| | | | | | | | | | |

| Free cash flow, a non-GAAP financial measure, is GAAP cash flow from operations (or cash provided by operating activities) less capital expenditures. Capital expenditures include purchases of property, equipment and software as well as investments in technology, as presented within our GAAP Consolidated Condensed Statement of Cash Flows. Free cash flow margin represents free cash flow divided by revenue. |

| | | | | | | | | | |

| | Twelve Months Ended | | Three Months Ended |

| | | | | | | | | | |

| | Dec. 28, | | Dec. 28, | | Sep. 28, | | Jun. 29, | | Mar. 30, |

| | 2024 | | 2024 | | 2024 | | 2024 | | 2024 |

| | Q3'25 | | Q3'25 | | Q2'25 | | Q1'25 | | Q4'24 |

| | | | | | | | | | |

Net cash provided by operating activities (GAAP) | | $ | 484,506 | | | $ | 218,588 | | | $ | 8,231 | | | $ | 87,161 | | | $ | 170,526 | |

| Capital expenditures | | (27,267) | | | (6,687) | | | (2,740) | | | (10,145) | | | (7,695) | |

| Free Cash Flow (Non-GAAP) | | $ | 457,239 | | | $ | 211,901 | | | $ | 5,491 | | | $ | 77,016 | | | $ | 162,831 | |

| | | | | | | | | | |

| Cash Flow from Operations as a Percentage of Revenue (GAAP) | | 26 | % | | 39 | % | | 2 | % | | 23 | % | | 46 | % |

| Capital Expenditures as a Percentage of Revenue (GAAP) | | 1 | % | | 1 | % | | 1 | % | | 3 | % | | 2 | % |

| Free Cash Flow Margin (Non-GAAP) | | 25 | % | | 38 | % | | 1 | % | | 21 | % | | 44 | % |

| | | | | | | | |

| RECONCILIATION BETWEEN GAAP AND NON-GAAP FINANCIAL INFORMATION |

| (in millions; unaudited) |

| (not prepared in accordance with GAAP) |

| | |

| | Q4 FY25 |

| | Guidance |

| Operating Expense Reconciliation | | |

| GAAP Operating Expenses | | $141 - 147 |

| Stock-based compensation expense | | (20) | |

| Amortization of acquisition intangibles | | (2) | |

| | |

| Non-GAAP Operating Expenses | | $119 - 125 |

Q3 FY25

Letter to Shareholders

February 4, 2025

February 4, 2025

Dear Shareholders,

In Q3 FY25, Cirrus Logic delivered revenue of $555.7 million, significantly above the top end of our guidance range. GAAP and non-GAAP earnings per share were $2.11 and $2.51, respectively. During the quarter, we saw strong demand for products shipping into smartphones, including our latest-generation custom boosted amplifier and first 22-nanometer smart codec. We gained momentum in laptops, where we continue to grow in line with our previously-communicated expectations. Recent highlights in our PC-focused business include being featured as part of the Intel Arrow Lake reference design, sampling our latest amplifier and codec specifically designed for laptops, and expanding our breadth of content across a variety of new devices. Finally, we began sampling a series of timing products designed for automotive and professional audio applications. Looking forward, we are excited about the opportunities we see to leverage our products, expertise, and intellectual property to grow our business in the future.

Figure A: Cirrus Logic Q3 FY25

| | | | | | | | | | | |

| Q3 FY25 | GAAP | Adj. | Non-GAAP* |

| Revenue | $555.7 | | $555.7 |

| Gross Profit | $297.8 | $0.3 | $298.1 |

| Gross Margin | 53.6% | | 53.6% |

| Operating Expense | $152.0 | ($22.8) | $129.2 |

| Operating Income | $145.8 | $23.1 | $168.9 |

| Operating Profit | 26.2% | | 30.4% |

| Interest Income | $8.1 | | $8.1 |

| Other Expense | $(0.2) | | $(0.2) |

| Income Tax Expense | $37.7 | $0.8 | $38.5 |

| Net Income | $116.0 | $22.3 | $138.3 |

| Diluted EPS | $2.11 | $0.40 | $2.51 |

*Complete GAAP to Non-GAAP reconciliations available on page 11

Numbers may not sum due to rounding

$ millions, except EPS

Revenue and Gross Margin

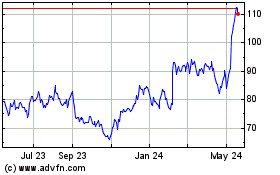

Revenue for the December quarter was $555.7 million, up three percent quarter over quarter and down 10 percent year over year. Q3 FY25 revenue was significantly above the top end of our guidance range due to stronger-than-expected demand during the quarter for products shipping into smartphones. The increase in revenue on a sequential basis reflects higher smartphone unit volumes. The year-over-year decrease in sales was primarily driven by lower smartphone unit volumes, in part due to the timing of our fiscal quarters. This was partially offset by increased revenue associated with our latest-generation products. As we indicated in our Q2 FY25 shareholder letter, when comparing our December quarter to the equivalent quarter last year, we would note that in FY25 our December quarter began one week later. Thus, it encompassed one week less of the higher-volume production associated with typical seasonal product ramps. Additionally, in FY25, our December quarter included one less week of revenue when compared to the equivalent quarter the prior year, as FY24 was a 53-week fiscal year.

In the March quarter, we expect revenue to range from $350 million to $410 million, down 32 percent sequentially and up two percent year over year at the midpoint.

| | | | | |

Q3 FY25 Letter to Shareholders | 2 |

In Q3 FY25, revenue derived from our audio and high performance mixed-signal (HPMS) product lines represented 62 percent and 38 percent of total revenue, respectively. One customer contributed approximately 91 percent of total revenue in Q3 FY25. Our relationship with our largest customer remains outstanding, with continued strong design activity across a wide range of products. While we understand there is intense interest in this customer, in accordance with our policy, we do not discuss specifics about this business.

Figure B: Cirrus Logic Revenue ($M) Q4 FY23 to Q4 FY25

*Midpoint of guidance as of February 4, 2025

GAAP gross margin in the December quarter was 53.6 percent, compared to 52.2 percent in Q2 FY25 and 51.3 percent in Q3 FY24. Non-GAAP gross margin in the December quarter was 53.6 percent, compared to 52.2 percent in Q2 FY25 and 51.4 percent in Q3 FY24. On a sequential basis, the 140-basis point increase was mostly driven by a shift in mix toward higher margin products and, to a lesser extent, lower supply chain costs. On a year-over-year basis, the 230-basis point increase was largely due to a shift in mix toward higher margin products. This was partially offset by higher inventory reserves and supply chain costs. In the March quarter, we expect gross margin to range from 51 percent to 53 percent.

| | | | | |

Q3 FY25 Letter to Shareholders | 3 |

Operating Profit, Tax, and EPS

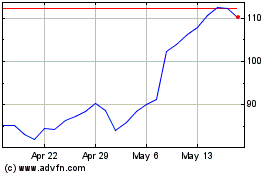

Operating profit for Q3 FY25 was 26.2 percent on a GAAP basis and 30.4 percent on a non-GAAP basis. GAAP operating expense was $152.0 million and included $20.5 million in stock-based compensation and $1.6 million in amortization of acquisition intangibles. On a sequential basis, GAAP operating expense increased by $1.3 million primarily due to higher employee-related expenses. This was offset by a reduction in stock-based compensation and product development costs. On a year-over-year basis, GAAP operating expense increased by $2.1 million largely due to higher employee-related expenses. This was offset by lower stock-based compensation and an increase in R&D incentives. Non-GAAP operating expense for the quarter was $129.2 million, up $2.5 million sequentially and $3.6 million year over year. The company’s total headcount exiting Q3 was 1,667.

Combined GAAP R&D and SG&A expenses for Q4 FY25 are expected to range from $141 million to $147 million, including approximately $20 million in stock-based compensation expense and $2 million in amortization of acquisition intangibles, resulting in a non-GAAP operating expense range between $119 million and $125 million.

Figure C: GAAP R&D and SG&A Expenses ($M)/Headcount Q4 FY23 to Q4 FY25

*Reflects midpoint of combined R&D and SG&A guidance as of February 4, 2025

For the December quarter, GAAP tax expense was $37.7 million on GAAP pre-tax income of $153.7 million, resulting in an effective tax rate of 24.5 percent. Non-GAAP tax expense for the quarter was $38.5 million on non-GAAP pre-tax income of $176.8 million, resulting in a non-GAAP effective tax rate of 21.8 percent. The GAAP and non-GAAP effective tax rates for the December quarter were unfavorably impacted by a provision of the Tax Cuts and Jobs Act of 2017 that requires companies to capitalize and

| | | | | |

Q3 FY25 Letter to Shareholders | 4 |

amortize R&D expenses rather than deduct them in the current year. We continue to anticipate that the impact of capitalized R&D will become less pronounced as additional years of R&D expenses are amortized. We estimate that our FY25 non-GAAP effective tax rate will range from approximately 22 percent to 24 percent

GAAP earnings per share for the December quarter was $2.11, compared to earnings per share of $1.83 the prior quarter and $2.50 in Q3 FY24. Non-GAAP earnings per share for the December quarter was $2.51, versus $2.25 in Q2 FY25 and $2.89 in Q3 FY24.

Balance Sheet

Our cash and investment balance at the end of Q3 FY25 was $816.6 million, up from $706.6 million the prior quarter and $587.0 million in Q3 FY24. Cash flow from operations for the December quarter was $218.6 million. During the quarter, we repurchased 678,768 shares at an average price of $103.18, returning $70.0 million of cash to shareholders in the form of buybacks. At the end of Q3 FY25, the company had $154.1 million remaining in its share repurchase authorization. Over the long term, we expect strong cash flow generation, and we will continue to evaluate potential uses of this cash, including investing in the business to pursue organic growth opportunities, M&A, and returning capital to shareholders through share repurchases.

Q3 FY25 inventory was $275.6 million, up from $271.8 million in Q2 FY25. In Q4 FY25, we expect an increase in inventory dollars from the prior quarter. We anticipate inventory will peak during the first half of FY26 as we continue to fulfill demand and manage our wafer purchase commitments per our long-term capacity agreement with GlobalFoundries.

Company Strategy

We remain committed to our three-pronged strategy for growing our business: first, maintaining our leadership position in smartphone audio; second, increasing HPMS content in smartphones; and third, leveraging our strength in audio and HPMS to expand into additional applications and markets with both existing and new components.

Smartphones

We are delighted with the success of our latest-generation custom boosted amplifier and our first 22-nanometer smart codec, both of which began shipping in recent smartphones. These components deliver significant power and efficiency improvements while also enabling system design flexibility. We anticipate that these audio components will be used in multiple generations of smartphones over a number of years. This provides the company with longer-term visibility and an opportunity for sustained revenue contribution while also enabling us to deploy our R&D resources to focus on new projects that can drive further innovation and growth. In our general market smartphone audio business, we continue to engage with customers on next-generation flagship smartphones. During the past quarter, a leading Android OEM introduced their latest flagship smartphone featuring two Cirrus Logic boosted amplifiers and a haptic driver, and reviews have been positive.

In addition to maintaining our strong position in audio, we are enthusiastic about our opportunities to expand our presence in smartphones through HPMS solutions, which offer substantial growth potential and revenue diversification. A consistent lever of growth in our HPMS business has been in cameras. In

| | | | | |

Q3 FY25 Letter to Shareholders | 5 |

the latest generation of devices, we are benefiting from a more favorable overall mix of smartphones on the market that include our camera controllers. Over the last few years, the total value of our camera content has increased, and we anticipate that this trend will continue in the future. We are actively engaged with our customer to further build out this product line to add system-level benefits and value with each new component. We have also seen strong interest in our capabilities around battery and power, and we have a number of R&D programs underway related to high-efficiency charging, battery management, and system-side power delivery. To capitalize on these growth opportunities, we are actively pursuing sockets where our signal processing expertise can deliver more efficient, flexible solutions compared to competing solutions. Looking forward, we anticipate that the investments we are making in this space today will contribute to product diversification and expand our footprint in this product category in the future.

New Applications and Markets

Outside of smartphones, we remain focused on leveraging our intellectual property in other applications and markets. The most immediate opportunity is in laptops where we are currently shipping content to each of the top five laptop OEMs. Market trends that are fueling demand for our laptop products include devices becoming thinner, lighter and more power-efficient; the adoption of the MIPI SoundWire® interface; and the emergence of AI-enabled devices. We are still in the early stages of participation in this market and continue to see opportunities to grow our revenue. We are pleased to have a combination of our amplifiers, codec, and/or power conversion ICs included in Intel’s processor reference designs, including Lunar Lake and, most recently, Arrow Lake. At CES® 2025, a leading laptop OEM introduced a high-volume commercial mainstream laptop that utilizes the SoundWire® interface and features our latest PC codec and power conversion IC. Additionally, we started sampling our next-generation PC amplifier and codec, which are expected to broaden our portfolio and address a wider range of the laptop market as customers seek to optimize performance across tiers and retail price points. We are excited to have expanded our breadth of content in a variety of laptops that we expect to come to market in the next 12 months.

In the longer term, we intend to selectively target markets beyond laptops where we believe there is opportunity for our high-performance audio and mixed-signal solutions. We have multiple new products being introduced in the coming quarters that target the professional audio, automotive, and industrial end markets. In the December quarter, we began sampling a series of timing products that are designed to enable superior audio experiences in automotive and professional audio applications. These components enhance functionality and elevate the overall user experience by introducing advanced features that generate stable low-jitter clocks while also simplifying customer designs. In addition, customer engagement with our high-performance audio data converters is robust, and we expect the first end products featuring these components to come to market in the coming quarters. We are excited about our design momentum and the strategic opportunities ahead of us in these markets.

| | | | | |

Q3 FY25 Letter to Shareholders | 6 |

Summary and Guidance

For the March quarter we expect the following results:

•Revenue to range between $350 million and $410 million;

•GAAP gross margin to be between 51 percent and 53 percent; and

•Combined GAAP R&D and SG&A expenses to range between $141 million and $147 million, including approximately $20 million in stock-based compensation expense and $2 million in amortization of acquisition intangibles, resulting in a non-GAAP operating expense range between $119 million and $125 million.

In conclusion, we are pleased with our Q3 FY25 financial results as revenue significantly exceeded our guidance range. During the quarter, we gained momentum with our laptop business while also maintaining our leadership position in smartphone audio. With a consistent track record of execution and continued design innovation, we believe we are well-positioned to drive growth and product diversification in the future.

Sincerely,

| | | | | | | | | | | |

| John Forsyth President & Chief Executive Officer | | Ulf Habermann Interim Chief Financial Officer |

Conference Call Q&A Session

Cirrus Logic will host a live Q&A session at 5 p.m. EST today to answer questions related to its financial results and business outlook. Participants may listen to the conference call on the Cirrus Logic website.

A replay of the webcast can be accessed on the Cirrus Logic website approximately two hours following its completion or by calling (609) 800-9909 or toll-free at (800) 770-2030 (Access Code: 95424).

| | | | | |

Q3 FY25 Letter to Shareholders | 7 |

Use of Non-GAAP Financial Information

To supplement Cirrus Logic's financial statements presented on a GAAP basis, Cirrus has provided non-GAAP financial information, including non-GAAP net income, diluted earnings per share, operating income and profit, operating expenses, gross margin and profit, tax expense, tax expense impact on earnings per share, effective tax rate, free cash flow, and free cash flow margin. A reconciliation of the adjustments to GAAP results is included in the tables below. We are also providing guidance on our expected non-GAAP expected effective tax rate. We are not able to provide guidance on our GAAP effective tax rate or a related reconciliation without unreasonable efforts since our future GAAP effective tax rate depends on our future stock price and related stock-based compensation information that is not currently available.

Non-GAAP financial information is not meant as a substitute for GAAP results but is included because management believes such information is useful to our investors for informational and comparative purposes. In addition, certain non-GAAP financial information is used internally by management to evaluate and manage the company. The non-GAAP financial information used by Cirrus Logic may differ from that used by other companies. These non-GAAP measures should be considered in addition to, and not as a substitute for, the results prepared in accordance with GAAP.

Safe Harbor Statement

Except for historical information contained herein, the matters set forth in this shareholder letter contain forward-looking statements, including statements about our expectation that we can leverage our products, expertise, and intellectual property to grow our business in the future; our expectation for strong cash flow generation over the long term; our expectation that inventory will peak in the first half of FY26 as we continue to fulfill demand and manage our wafer purchase commitments per our long-term capacity agreement with GlobalFoundries; our ability to maintain our leadership position in smartphone audio; our ability to increase HPMS content in smartphones; our ability to leverage our strength in audio and HPMS to expand into additional applications and markets with both new and existing components; our expectation that our new custom boosted amplifier and our first 22-nanometer smart codec will be used in multiple generations of smartphones over a number of years and provide sustained revenue contribution over a number of years; our ability to expand content in smartphones with HPMS solutions, which are expected to provide growth opportunities and revenue diversification; our expectation that the total value of our camera content will continue to increase in the future; our belief that the investments we are making in the power and battery space will contribute to product diversification and revenue growth in the future; our ability to leverage our intellectual property and advanced engineering capabilities to expand into new applications and markets; our expectation that a variety of laptops featuring our components will come to market in the next 12 months; our expectation that devices featuring our high-performance audio data converters will come to market in the coming quarters; our expectation that multiple new products will be introduced in the coming quarters targeting professional audio, consumer, and industrial end markets; our ability to drive growth and product diversification in the future; our non-GAAP effective tax rate for the full fiscal year 2025; our expectation that the impact of capitalized R&D will become less pronounced as additional years of R&D expenses are amortized for tax purposes; and our forecasts for the fourth quarter of fiscal year 2025 revenue, gross margin, combined research and development and selling, general and administrative expense levels, stock-based compensation expense, and amortization of acquisition intangibles. In some cases, forward-looking statements are identified by words such as “emerge,” “expect,” “anticipate,” “foresee,” “target,” “project,” “believe,” “goals,” “opportunity,” “estimates,” “intend,” “will,” and variations of these types of words and similar expressions. In addition, any statements that refer to our plans, expectations, strategies, or other characterizations of future events or circumstances are forward-looking statements.

| | | | | |

Q3 FY25 Letter to Shareholders | 8 |

These forward-looking statements are based on our current expectations, estimates, and assumptions and are subject to certain risks and uncertainties that could cause actual results to differ materially, and readers should not place undue reliance on such statements. These risks and uncertainties include, but are not limited to, the following: the level and timing of orders and shipments during the fourth quarter of fiscal year 2025, customer cancellations of orders, or the failure to place orders consistent with forecasts; changes with respect to our current expectations of future smartphone unit volumes; and the risk factors listed in our Form 10-K for the year ended March 30, 2024 and in our other filings with the Securities and Exchange Commission, which are available at www.sec.gov. The foregoing information concerning our business outlook represents our outlook as of the date of this news release, and we expressly disclaim any obligation to update or revise any forward-looking statements, whether as a result of new developments or otherwise.

Cirrus Logic, Cirrus and the Cirrus Logic logo are registered trademarks of Cirrus Logic, Inc. All other company or product names noted herein may be trademarks of their respective holders.

| | | | | |

Q3 FY25 Letter to Shareholders | 9 |

Summary of Financial Data Below:

CONSOLIDATED CONDENSED STATEMENT OF OPERATIONS

(in thousands, except per share data; unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended | | Nine Months Ended |

| Dec. 28,

2024 | | Sep. 28,

2024 | | Dec. 30,

2023 | | Dec. 28,

2024 | | Dec. 30,

2023 |

| Q3'25 | | Q2'25 | | Q3'24 | | Q3'25 | | Q3'24 |

| Audio | $ | 346,272 | | | $ | 316,588 | | | $ | 378,597 | | | $ | 881,830 | | | $ | 857,258 | |

| High-Performance Mixed-Signal | 209,466 | | | 225,269 | | | 240,387 | | | 589,791 | | | 559,805 | |

| Net sales | 555,738 | | | 541,857 | | | 618,984 | | | 1,471,621 | | | 1,417,063 | |

| Cost of sales | 257,951 | | | 259,267 | | | 301,520 | | | 702,319 | | | 693,616 | |

| Gross profit | 297,787 | | | 282,590 | | | 317,464 | | | 769,302 | | | 723,447 | |

| Gross margin | 53.6 | % | | 52.2 | % | | 51.3 | % | | 52.3 | % | | 51.1 | % |

| | | | | | | | | |

| Research and development | 112,976 | | | 112,925 | | | 112,672 | | | 331,264 | | | 323,092 | |

| Selling, general and administrative | 39,042 | | | 37,813 | | | 37,604 | | | 113,625 | | | 107,306 | |

| Restructuring costs | — | | | — | | | (360) | | | — | | | 1,959 | |

| | | | | | | | | |

| Total operating expenses | 152,018 | | | 150,738 | | | 149,916 | | | 444,889 | | | 432,357 | |

| | | | | | | | | |

| Income from operations | 145,769 | | | 131,852 | | | 167,548 | | | 324,413 | | | 291,090 | |

| | | | | | | | | |

| Interest income | 8,146 | | | 8,134 | | | 4,889 | | | 24,482 | | | 13,218 | |

| Other income (expense) | (214) | | | 19 | | | (337) | | | 1,414 | | | (30) | |

| Income before income taxes | 153,701 | | | 140,005 | | | 172,100 | | | 350,309 | | | 304,278 | |

| Provision for income taxes | 37,696 | | | 37,865 | | | 33,377 | | | 90,069 | | | 74,548 | |

| Net income | $ | 116,005 | | | $ | 102,140 | | | $ | 138,723 | | | $ | 260,240 | | | $ | 229,730 | |

| | | | | | | | | |

| Basic earnings per share | $ | 2.19 | | | $ | 1.92 | | | $ | 2.57 | | | $ | 4.89 | | | $ | 4.22 | |

| Diluted earnings per share: | $ | 2.11 | | | $ | 1.83 | | | $ | 2.50 | | | $ | 4.69 | | | $ | 4.09 | |

| | | | | | | | | |

| Weighted average number of shares: | | | | | | | | | |

| Basic | 53,081 | | | 53,275 | | | 54,016 | | | 53,263 | | | 54,449 | |

| Diluted | 55,076 | | | 55,800 | | | 55,592 | | | 55,529 | | | 56,160 | |

| | | | | | | | | |

Prepared in accordance with Generally Accepted Accounting Principles

| | | | | |

Q3 FY25 Letter to Shareholders | 10 |

RECONCILIATION BETWEEN GAAP AND NON-GAAP FINANCIAL INFORMATION CONTINUED

(in thousands, except per share data; unaudited)

(not prepared in accordance with GAAP)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Non-GAAP financial information is not meant as financial information is not meant as a substitute for GAAP results, but is included because management believes such information is useful to our investors for informational and comparative purposes. In addition, certain non-GAAP financial information is used internally by management to evaluate and manage the company. As a note, the non-GAAP financial information used by Cirrus Logic may differ from that used by other companies. These non-GAAP measures should be considered in addition to, and not as a substitute for, the results prepared in accordance with GAAP. | |

| | | | | | | | | | |

| Three Months Ended | | Nine Months Ended | |

| Dec. 28,

2024 | | Sep. 28,

2024 | | Dec. 30,

2023 | | Dec. 28,

2024 | | Dec. 30,

2023 | |

| Net Income Reconciliation | Q3'25 | | Q2'25 | | Q3'24 | | Q3'25 | | Q3'24 | |

| GAAP Net Income | $ | 116,005 | | | $ | 102,140 | | | $ | 138,723 | | | $ | 260,240 | | | $ | 229,730 | | |

| Amortization of acquisition intangibles | 1,647 | | | 1,864 | | | 1,972 | | | 5,483 | | | 6,312 | | |

| Stock-based compensation expense | 20,823 | | | 22,447 | | | 23,067 | | | 64,655 | | | 67,113 | | |

| Lease impairment | 661 | | | — | | | — | | | 1,680 | | | — | | |

| Restructuring costs | — | | | — | | | (360) | | | — | | | 1,959 | | |

| | | | | | | | | | |

| Acquisition-related costs | — | | | — | | | — | | | — | | | 4,105 | | |

| | | | | | | | | | |

| Adjustment to income taxes | (827) | | | (1,162) | | | (2,769) | | | (6,094) | | | (9,001) | | |

| Non-GAAP Net Income | $ | 138,309 | | | $ | 125,289 | | | $ | 160,633 | | | $ | 325,964 | | | $ | 300,218 | | |

| | | | | | | | | | |

| Earnings Per Share Reconciliation | | | | | | | | | | |

| GAAP Diluted earnings per share | $ | 2.11 | | | $ | 1.83 | | | $ | 2.50 | | | $ | 4.69 | | | $ | 4.09 | | |

| Effect of Amortization of acquisition intangibles | 0.03 | | | 0.04 | | | 0.04 | | | 0.10 | | | 0.11 | | |

| Effect of Stock-based compensation expense | 0.38 | | | 0.40 | | | 0.41 | | | 1.16 | | | 1.20 | | |

| Effect of Lease impairment | 0.01 | | | — | | | — | | | 0.03 | | | — | | |

| Effect of Restructuring costs | — | | | — | | | (0.01) | | | — | | | 0.04 | | |

| | | | | | | | | | |

| Effect of Acquisition-related costs | — | | | — | | | — | | | — | | | 0.07 | | |

| | | | | | | | | | |

| Effect of Adjustment to income taxes | (0.02) | | | (0.02) | | | (0.05) | | | (0.11) | | | (0.16) | | |

| Non-GAAP Diluted earnings per share | $ | 2.51 | | | $ | 2.25 | | | $ | 2.89 | | | $ | 5.87 | | | $ | 5.35 | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| Operating Income Reconciliation | | | | | | | | | | |

| GAAP Operating Income | $ | 145,769 | | | $ | 131,852 | | | $ | 167,548 | | | $ | 324,413 | | | $ | 291,090 | | |

| GAAP Operating Profit | 26.2 | % | | 24.3 | % | | 27.1 | % | | 22.0 | % | | 20.5 | % | |

| Amortization of acquisition intangibles | 1,647 | | | 1,864 | | | 1,972 | | | 5,483 | | | 6,312 | | |

| Stock-based compensation expense - COGS | 351 | | | 355 | | | 395 | | | 972 | | | 1,041 | | |

| Stock-based compensation expense - R&D | 14,498 | | | 15,844 | | | 16,771 | | | 46,105 | | | 48,195 | | |

| Stock-based compensation expense - SG&A | 5,974 | | | 6,248 | | | 5,901 | | | 17,578 | | | 17,877 | | |

| Lease impairment | 661 | | | — | | | — | | | 1,680 | | | — | | |

| Restructuring costs | — | | | — | | | (360) | | | — | | | 1,959 | | |

| | | | | | | | | | |

| Acquisition-related costs | — | | | — | | | — | | | — | | | 4,105 | | |

| Non-GAAP Operating Income | $ | 168,900 | | | $ | 156,163 | | | $ | 192,227 | | | $ | 396,231 | | | $ | 370,579 | | |

| Non-GAAP Operating Profit | 30.4 | % | | 28.8 | % | | 31.1 | % | | 26.9 | % | | 26.2 | % | |

| | | | | | | | | | |

| Operating Expense Reconciliation | | | | | | | | | | |

| GAAP Operating Expenses | $ | 152,018 | | | $ | 150,738 | | | $ | 149,916 | | | $ | 444,889 | | | $ | 432,357 | | |

| Amortization of acquisition intangibles | (1,647) | | | (1,864) | | | (1,972) | | | (5,483) | | | (6,312) | | |

| Stock-based compensation expense - R&D | (14,498) | | | (15,844) | | | (16,771) | | | (46,105) | | | (48,195) | | |

| Stock-based compensation expense - SG&A | (5,974) | | | (6,248) | | | (5,901) | | | (17,578) | | | (17,877) | | |

| Lease impairment | (661) | | | — | | | — | | | (1,680) | | | — | | |

| Restructuring costs | — | | | — | | | 360 | | | — | | | (1,959) | | |

| | | | | | | | | | |

| Acquisition-related costs | — | | | — | | | — | | | — | | | (4,105) | | |

| Non-GAAP Operating Expenses | $ | 129,238 | | | $ | 126,782 | | | $ | 125,632 | | | $ | 374,043 | | | $ | 353,909 | | |

| | | | | | | | | | |

| Gross Margin/Profit Reconciliation | | | | | | | | | | |

| GAAP Gross Profit | $ | 297,787 | | | $ | 282,590 | | | $ | 317,464 | | | $ | 769,302 | | | $ | 723,447 | | |

| GAAP Gross Margin | 53.6 | % | | 52.2 | % | | 51.3 | % | | 52.3 | % | | 51.1 | % | |

| | | | | | | | | | |

| Stock-based compensation expense - COGS | 351 | | | 355 | | | 395 | | | 972 | | | 1,041 | | |

| Non-GAAP Gross Profit | $ | 298,138 | | | $ | 282,945 | | | $ | 317,859 | | | $ | 770,274 | | | $ | 724,488 | | |

| Non-GAAP Gross Margin | 53.6 | % | | 52.2 | % | | 51.4 | % | | 52.3 | % | | 51.1 | % | |

| | | | | | | | | | |

| | | | | |

Q3 FY25 Letter to Shareholders | 11 |

RECONCILIATION BETWEEN GAAP AND NON-GAAP FINANCIAL INFORMATION

(in thousands, except per share data; unaudited)

(not prepared in accordance with GAAP)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended | | Nine Months Ended | |

| Dec. 28,

2024 | | Sep. 28,

2024 | | Dec. 30,

2023 | | Dec. 28,

2024 | | Dec. 30,

2023 | |

| Effective Tax Rate Reconciliation | Q3'25 | | Q2'25 | | Q3'24 | | Q3'25 | | Q3'24 | |

| GAAP Tax Expense | $ | 37,696 | | | $ | 37,865 | | | $ | 33,377 | | | $ | 90,069 | | | $ | 74,548 | | |

| GAAP Effective Tax Rate | 24.5 | % | | 27.0 | % | | 19.4 | % | | 25.7 | % | | 24.5 | % | |

| Adjustments to income taxes | 827 | | | 1,162 | | | 2,769 | | | 6,094 | | | 9,001 | | |

| Non-GAAP Tax Expense | $ | 38,523 | | | $ | 39,027 | | | $ | 36,146 | | | $ | 96,163 | | | $ | 83,549 | | |

| Non-GAAP Effective Tax Rate | 21.8 | % | | 23.8 | % | | 18.4 | % | | 22.8 | % | | 21.8 | % | |

| | | | | | | | | | |

| Tax Impact to EPS Reconciliation | | | | | | | | | | |

| GAAP Tax Expense | $ | 0.68 | | | $ | 0.68 | | | $ | 0.60 | | | $ | 1.62 | | | $ | 1.33 | | |

| Adjustments to income taxes | 0.02 | | | 0.02 | | | 0.05 | | | 0.11 | | | 0.16 | | |

| Non-GAAP Tax Expense | $ | 0.70 | | | $ | 0.70 | | | $ | 0.65 | | | $ | 1.73 | | | $ | 1.49 | | |

| | | | | |

Q3 FY25 Letter to Shareholders | 12 |

CONSOLIDATED CONDENSED BALANCE SHEET

(in thousands; unaudited)

| | | | | | | | | | | | | | | | | |

| Dec. 28,

2024 | | Mar. 30,

2024 | | Dec. 30,

2023 |

| ASSETS | | | | | |

| Current assets | | | | | |

| Cash and cash equivalents | $ | 526,444 | | | $ | 502,764 | | | $ | 483,931 | |

| Marketable securities | 37,535 | | | 23,778 | | | 32,842 | |

| Accounts receivable, net | 261,943 | | | 162,478 | | | 217,269 | |

| Inventories | 275,558 | | | 227,248 | | | 256,675 | |

| Prepaid wafers | 66,113 | | | 86,679 | | | 84,854 | |

| Other current assets | 82,857 | | | 103,245 | | | 109,814 | |

| Total current Assets | 1,250,450 | | | 1,106,192 | | | 1,185,385 | |

| | | | | |

| Long-term marketable securities | 252,594 | | | 173,374 | | | 70,260 | |

| Right-of-use lease assets | 129,597 | | | 138,288 | | | 140,993 | |

| Property and equipment, net | 163,837 | | | 170,175 | | | 167,579 | |

| Intangibles, net | 23,957 | | | 29,578 | | | 31,677 | |

| Goodwill | 435,936 | | | 435,936 | | | 435,936 | |

| Deferred tax asset | 40,895 | | | 48,649 | | | 34,116 | |

| Long-term prepaid wafers | 23,020 | | | 60,750 | | | 73,492 | |

| Other assets | 42,954 | | | 68,634 | | | 77,675 | |

| Total assets | $ | 2,363,240 | | | $ | 2,231,576 | | | $ | 2,217,113 | |

| | | | | |

| LIABILITIES AND STOCKHOLDERS' EQUITY | | | | | |

| Current liabilities | | | | | |

| Accounts payable | $ | 77,907 | | | $ | 55,545 | | | $ | 56,231 | |

| Accrued salaries and benefits | 48,029 | | | 47,612 | | | 44,352 | |

| Lease liability | 21,858 | | | 20,640 | | | 19,906 | |

| | | | | |

| Other accrued liabilities | 63,119 | | | 62,596 | | | 58,105 | |

| Total current liabilities | 210,913 | | | 186,393 | | | 178,594 | |

| | | | | |

| Non-current lease liability | 124,622 | | | 134,576 | | | 138,415 | |

| Non-current income taxes | 43,401 | | | 52,013 | | | 52,247 | |

| | | | | |

| Other long-term liabilities | 21,506 | | | 41,580 | | | 47,097 | |

| Total long-term liabilities | 189,529 | | | 228,169 | | | 237,759 | |

| | | | | |

| Stockholders' equity: | | | | | |

| Capital stock | 1,840,791 | | | 1,760,701 | | | 1,735,824 | |

| Accumulated earnings | 124,101 | | | 58,916 | | | 66,633 | |

| Accumulated other comprehensive loss | (2,094) | | | (2,603) | | | (1,697) | |

| Total stockholders' equity | 1,962,798 | | | 1,817,014 | | | 1,800,760 | |

| Total liabilities and stockholders' equity | $ | 2,363,240 | | | $ | 2,231,576 | | | $ | 2,217,113 | |

Prepared in accordance with Generally Accepted Accounting Principles

| | | | | |

Q3 FY25 Letter to Shareholders | 13 |

CONSOLIDATED CONDENSED STATEMENT OF CASH FLOWS

(in thousands; unaudited)

| | | | | | | | | | | |

| Three Months Ended |

| Dec. 28, | | Dec. 30, |