Third quarter net loss of $513,000 compared with net income of $2.8

million last year SAVANNAH, Ga., Nov. 26 /PRNewswire-FirstCall/ --

Citi Trends, Inc. (NASDAQ:CTRN) today reported results for the

third quarter ended November 3, 2007. Financial Highlights - 13

weeks ended November 3, 2007 Total net sales increased 14.2% to

$99.5 million compared with $87.1 million in the 13-week period

ended October 28, 2006. Comparable store sales increased 1.9% on a

comparable store, comparable weeks basis. Each quarter of fiscal

2007 starts one week later than the same quarter of 2006, due to

the Company's 2006 fiscal year having 53 weeks versus the normal 52

weeks. This timing shift can have a significant impact on quarterly

sales comparisons. The measurement of sales in comparable stores

for comparable weeks above is based on sales during the 13 weeks

ended November 3, 2007 in relation to the 13 weeks ended November

4, 2006. On a fiscal quarter basis, comparing the 13 weeks ended

November 3, 2007 with the 13 weeks ended October 28, 2006,

comparable store sales decreased 2.7%. As a result of the negative

comparable store sales on a fiscal basis and a related increase in

clearance markdowns, the Company had a net loss of $513,000 in the

third quarter of 2007, compared with net income of $2,809,000 in

the prior-year quarter. Net loss per diluted share was $0.04,

compared with net income per diluted share of $0.20 in last year's

third quarter. The Company opened six stores in the third quarter

of 2007, reaching a total store count of 306 at the end of the

quarter. For the remainder of the fiscal year, the Company plans to

open an additional 13 stores bringing the end of year store count

to 319. Financial Highlights - 39 weeks ended November 3, 2007

Total net sales increased 18.7% to $302.9 million compared with

$255.1 million in the 39-week period ended October 28, 2006.

Comparable store sales increased 1.9% on a comparable store,

comparable weeks basis and 0.7% on a fiscal basis. Net income

decreased to $5,836,000 compared with $10,979,000 in the first 39

weeks of 2006. Net income per diluted share decreased to $0.41,

including $0.04 of expenses related to a secondary stock offering,

compared with $0.78 in the prior year period. Fiscal 2007 Outlook

The Company is lowering its estimate of 2007 earnings to a range of

$0.91 to $0.96 per diluted share. This guidance, which includes the

secondary stock offering expenses of $0.04, is based upon an

anticipated 2007 comparable store sales increase of approximately

1% to 2% on a comparable weeks basis and a comparable store sales

decrease of approximately 1% to 2% on a fiscal basis. For the year,

the Company expects to increase selling square footage by at least

20%, consistent with the Company's previously issued guidance. The

Company reminds investors of the complexity of accurately assessing

future results given the difficulty in predicting fashion trends,

consumer preferences and general economic conditions and the impact

of other business variables. See "Forward-Looking Statements" below

for more information regarding these uncertainties. Investor

Conference Call and Webcast Citi Trends will host a conference call

on November 26, 2007 at 5:00 p.m. ET. The number to call for the

live interactive teleconference is (913) 981-4911. A replay of the

conference call will be available until December 4, 2007, by

dialing (719) 457-0820 and entering the passcode, 2886491. The live

broadcast of Citi Trends' quarterly conference call will be

available online at the Company's website,

http://www.cititrends.com/, as well as

http://ir.cititrends.com/medialist.cfm on November 26, 2007,

beginning at 5:00 p.m. ET. The online replay will follow shortly

after the call and continue through December 4, 2007. During the

conference call, the Company may discuss and answer questions

concerning business and financial developments and trends. The

Company's responses to questions, as well as other matters

discussed during the conference call, may contain or constitute

information that has not been disclosed previously. About Citi

Trends Citi Trends, Inc. is a value-priced retailer of urban

fashion apparel and accessories for the entire family. The Company

currently operates 311 stores located in 19 states in the

Southeast, Mid-Atlantic and Midwest regions and the state of Texas.

Citi Trends' website address is http://www.cititrends.com/. CTRN-E

Forward-Looking Statements All statements other than historical

facts contained in this news release, including statements

regarding our future financial results and position, business

policy and plans and objectives of management for future

operations, are forward-looking statements that are subject to

material risks and uncertainties. The words "believe," "may,"

"could," "plans," "estimate," "continue," "anticipate," "intend,"

"expect" and similar expressions, as they relate to Citi Trends,

are intended to identify forward-looking statements. Statements

with respect to earnings guidance are forward-looking statements.

Investors are cautioned that any such forward-looking statements

are subject to the finalization of the Company's quarterly

financial and accounting procedures, are not guarantees of future

performance or results and are inherently subject to risks and

uncertainties, some of which cannot be predicted or quantified.

Actual results or developments may differ materially from those

included in the forward-looking statements, as a result of various

factors which are discussed in Citi Trends, Inc. filings with the

Securities and Exchange Commission. These risks and uncertainties

include, but are not limited to, uncertainties relating to economic

conditions, growth risks, consumer spending patterns, competition

within the industry, competition in our markets and the ability to

anticipate and respond to fashion trends. Except as required by

applicable law, including the securities laws of the United States

and the rules and regulations of the Securities and Exchange

Commission, Citi Trends does not undertake to publicly update any

forward- looking statements in this news release or with respect to

matters described herein, whether as a result of any new

information, future events or otherwise. CITI TRENDS, INC.

CONDENSED STATEMENTS OF INCOME (unaudited) (in $000's, except per

share data) Thirteen Weeks Ended November 3, 2007 October 28, 2006

(unaudited) (unaudited) Net sales $99,542 $87,118 Cost of sales

65,026 54,155 Gross profit 34,516 32,963 Selling, general and

administrative expenses 32,455 27,139 Depreciation and amortization

3,265 2,063 Income (loss) from operations (1,204) 3,761 Interest

income 522 475 Interest expense (107) (90) Income (loss) before

provision (benefit) for income taxes (789) 4,146 Provision

(benefit) for income taxes (276) 1,337 Net income (loss) $(513)

$2,809 Net income (loss) per share, basic $(0.04) $0.21 Net income

(loss) per share, diluted $(0.04) $0.20 Weighted average shares

used to compute net income (loss) per share, basic 14,023 13,583

Weighted average shares used to compute net income (loss) per

share, diluted 14,023 14,083 CITI TRENDS, INC. CONDENSED STATEMENTS

OF INCOME (unaudited) (in $000's, except per share data)

Thirty-Nine Weeks Ended November 3, 2007 October 28, 2006

(unaudited) (unaudited) Net sales $302,944 $255,130 Cost of sales

191,638 157,640 Gross profit 111,306 97,490 Selling, general and

administrative expenses 94,578 76,161 Depreciation and amortization

9,095 5,963 Income from operations 7,633 15,366 Interest income

1,703 1,429 Interest expense (372) (169) Income before provision

for income taxes 8,964 16,626 Provision for income taxes 3,128

5,647 Net income $5,836 $10,979 Net income per share, basic $0.42

$0.81 Net income per share, diluted $0.41 $0.78 Weighted average

shares used to compute net income per share, basic 13,917 13,516

Weighted average shares used to compute net income per share,

diluted 14,235 14,032 CITI TRENDS, INC. CONDENSED BALANCE SHEETS

(unaudited) (in $000's) November 3, 2007 October 28, 2006

(unaudited) (unaudited) Assets: Cash and cash equivalents $8,679

$5,667 Marketable securities 43,721 49,904 Inventory 93,886 74,499

Other current assets 9,288 8,629 Property and equipment, net 43,895

30,335 Other noncurrent assets 5,176 1,641 Total assets $204,645

$170,675 Liabilities and Stockholders' Equity: Accounts payable

$49,208 $43,444 Accrued liabilities 14,289 12,524 Other current

liabilities 3,921 2,956 Noncurrent liabilities 8,239 7,156 Total

liabilities 75,657 66,080 Total stockholders' equity 128,988

104,595 Total liabilities and stockholders' equity $204,645

$170,675 DATASOURCE: Citi Trends, Inc. CONTACT: Bruce Smith, Chief

Financial Officer, +1-912-443-2075, or Ed Anderson, Chairman and

Chief Executive Officer, +1-912-443-3705, both of Citi Trends, Inc.

Web Site: http://www.cititrends.com/

http://ir.cititrends.com/medialist.cfm

Copyright

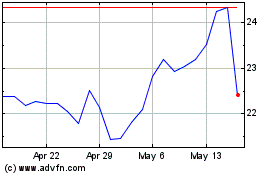

Citi Trends (NASDAQ:CTRN)

Historical Stock Chart

From Jun 2024 to Jul 2024

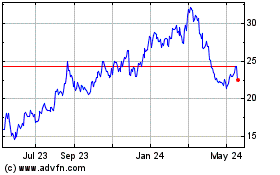

Citi Trends (NASDAQ:CTRN)

Historical Stock Chart

From Jul 2023 to Jul 2024