Cit Trends' Net Loss Widens - Analyst Blog

August 18 2011 - 8:24AM

Zacks

Citi Trends Inc. (CTRN) recently reported

disappointing second-quarter 2011 results. The company's net loss

widens 16 folds to $10.0 million compared with $0.6 million in the

year-ago quarter.

Net loss per share came in at 69 cents versus 4 cents in the

year-ago quarter, primarily due to negative comparable store sales.

Moreover, net loss was higher than the Zacks Consensus Estimate of

64 cents per share.

During the quarter, Citi Trends recorded a 0.9% year-over-year

growth in net sales to $130.2 million, missing the Zacks Consensus

Estimate of $131.0 million. Comparable store sales dropped 11.9% in

the second quarter of fiscal 2011.

Citi Trends' gross profit plunged 10.0% from the prior-year

period to $43.5 million, mainly due to higher cost of sales. Gross

margin came in at 33.4% compared with 37.4% in prior-year

quarter.

Selling, general and administrative expenses increased 14.1%

year over year to $50.7 million. Accordingly, the company's

operating loss increased almost 16 folds to $15.2 million compared

with $0.9 million in the year-ago period.

Citi Trends ended the quarter with a debt-free balance sheet and

cash and cash equivalents of $49.5 million compared with $84.6

million in the prior-year period. Shareholders' equity at the end

of the quarter was $208.7 million compared with $195.6 million in

the year-ago period.

Citi Trends is a value-priced retailer of urban fashion apparel

and accessories including nationally recognized brands,

private-label products and has a limited assortment of home décor

items. The company currently operates 482 stores across 27 states

in the Southeast, Mid-Atlantic and Midwest regions as well as in

the states of Texas and California.

The company operates in a highly fragmented specialty retail

sector and faces intense competition from larger off-price rivals,

such as The TJX Companies Inc. (TJX) and

Ross Stores Inc. (ROST), and mass merchants

including Wal-Mart Stores Inc. (WMT) and

Kmart.

Currently, Citi Trends retains a short-term Zacks #4 Rank (Sell

rating). However, we hold a long-term Neutral recommendation on the

stock.

CITI TRENDS INC (CTRN): Free Stock Analysis Report

ROSS STORES (ROST): Free Stock Analysis Report

TJX COS INC NEW (TJX): Free Stock Analysis Report

WAL-MART STORES (WMT): Free Stock Analysis Report

Zacks Investment Research

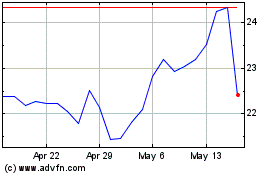

Citi Trends (NASDAQ:CTRN)

Historical Stock Chart

From Jun 2024 to Jul 2024

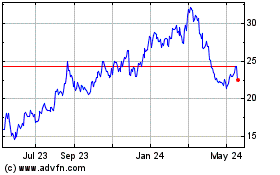

Citi Trends (NASDAQ:CTRN)

Historical Stock Chart

From Jul 2023 to Jul 2024