For Immediate Release

Chicago, IL – April 17, 2012 – Zacks Equity Research highlights:

Hain Celestial Group (HAIN) as the Bull of

the Day and Citi Trends, Inc. (CTRN) as the

Bear of the Day. In addition, Zacks Equity Research provides

analysis on Target Corporation (TGT),

Wal-Mart Stores Inc. (WMT) and Costco

Wholesale Corporation (COST).

Full analysis of all these stocks is available at

http://at.zacks.com/?id=2678.

Here is a synopsis of all five stocks:

Bull of the Day:

A leader in natural food and personal care products with an

array of well-known brands, Hain Celestial

Group (HAIN) offers investors one of the strongest

growth profiles in the industry. The company's strategic

investments plus continued efforts to contain costs, increase

productivity, and enhance cash flows and margins have enabled it to

deliver healthy results.

This is quite evident from Hain's second-quarter 2012 results.

The quarterly earnings of $0.52 per share beat the Zacks Consensus

Estimate of $0.49, and rose 33.3% from the prior-year quarter. The

company's top line also grew an impressive 32.1%.

The company continues to expect total revenue between $1,455

million and $1,480 million, and earnings in the range of $1.63 to

$1.73 per share for fiscal 2012. Buoyed by better-than-expected

results and an optimistic outlook, we maintain our Outperform

recommendation on the stock.

Bear of the Day:

Citi Trends, Inc.'s (CTRN) falling

comparable store sales, coupled with rising cost of goods sold and

operating expenses, battered fourth-quarter 2011 results. The

company incurred a quarterly loss of $0.18 per share, falling

drastically from the year-ago quarter earnings of $0.64 per share.

The results, however, bettered the Zacks Consensus Estimate of a

loss of $0.20 per share.

Further, due to uncertainty hovering around sales, given the

global economic unrest, the company decided not to provide any

guidelines unless it finds any near-term catalysts to drive sales.

Intense competition from other retailers, seasonal nature of

business and risks associated with sourcing merchandise from

developing countries may further undermine the company's future

growth prospects.

Currently, we are maintaining a long-term Underperform

recommendation on the stock. Our target price of $10.00 is based on

P/CF (price-to-cash flow) multiple of 8.27x.

Latest Posts on the Zacks Analyst Blog:

Zacks Consensus Rises for Target

Corp.

The Zacks Consensus Estimates for Target

Corporation (TGT) have been portraying an upward

trend as the analysts covering the stock have become more

constructive after the company posted better-than-expected March

sales results and raised its first-quarter 2012 earnings

projection.

March Sales in Brief

The Easter holiday and a favorable weather aided Target to post

strong sales results for the five-week period ended March 31, 2012.

The company registered an increase of 7.3% in comparable-store

sales for March 2012, contrary to a 5.5% decline in the prior-year

period. Net retail sales rose 7.9% to $6,427 million from $5,955

million reported in the prior-year period.

Management noted that the company’s March sales surpassed its

expected growth range, reflecting an increase in average

transaction size coupled with a rise in comparable store

transactions.

What the Company Guided

Buoyed by the better-than-expected results, Target raised its

first-quarter 2012 bottom-line forecast. The company now expects

first quarter earnings between of $1.04 and $1.10 per share versus

its earlier guidance range of 97 cents to $1.07. Going forward,

Target expects comparable-store sales to increase in low to

mid-single-digit range for April 2012.

Magnitude of Estimate Revisions

Clearly, a positive sentiment is palpable among most of the

analysts, who remain optimistic on Target’s performance. The Zacks

Consensus Estimate has risen with the majority of analysts

remaining bullish on the stock. The magnitude of estimate revisions

by the analysts is clearly reflected through changes in the Zacks

Consensus Estimates.

The Zacks Consensus Estimate for the first quarter of 2012

jumped 4 cents to $1.00 in the last 30 days. The Zacks Consensus

Estimate for the second quarter remained constant at 98 cents in

the last 30 days, as the revisions made by the analysts had a

neutral impact on it.

For fiscal 2012, the Zacks Consensus Estimate rose 4 cents to

$4.25 in the last 30 days. For fiscal 2013, the Consensus Estimate

increased by a couple of cents to $4.82.

Closing Comment

Target is consistently trying every means to keep afloat in this

sluggish economic environment. The company’s P-fresh remodel

program, 5% REDcard Rewards program, City Target stores, The Shops

at Target initiatives and its foray into the foreign market are its

arsenal to safeguard against any unprecedented event.

However, the greater concentration of Target’s revenue

generating capability in a few regions of the United States, poses

a competitive threat, compared to Wal-Mart Stores

Inc. (WMT) and Costco Wholesale

Corporation (COST), which are geographically more

diversified and more resourceful.

Consequently, we have a long-term ‘Neutral’ recommendation on

the stock. Moreover, Target holds a Zacks #3 Rank that translates

into a short-term ‘Hold’ rating.

Get the full analysis of all these stocks by going to

http://at.zacks.com/?id=2649.

About the Bull and Bear of the Day

Every day, the analysts at Zacks Equity Research select two

stocks that are likely to outperform (Bull) or underperform (Bear)

the markets over the next 3-6 months.

About the Analyst Blog

Updated throughout every trading day, the Analyst Blog provides

analysis from Zacks Equity Research about the latest news and

events impacting stocks and the financial markets.

About Zacks Equity Research

Zacks Equity Research provides the best of quantitative and

qualitative analysis to help investors know what stocks to buy and

which to sell for the long-term.

Continuous analyst coverage is provided for a universe of 1,150

publicly traded stocks. Our analysts are organized by industry

which gives them keen insights to developments that affect company

profits and stock performance. Recommendations and target prices

are six-month time horizons.

Zacks "Profit from the Pros" e-mail newsletter provides

highlights of the latest analysis from Zacks Equity Research.

Subscribe to this free newsletter today by visiting

http://at.zacks.com/?id=7158.

About Zacks

Zacks.com is a property of Zacks Investment Research, Inc.,

which was formed in 1978 by Leonard Zacks. As a PhD from MIT Len

knew he could find patterns in stock market data that would lead to

superior investment results. Amongst his many accomplishments was

the formation of his proprietary stock picking system; the Zacks

Rank, which continues to outperform the market by nearly a 3 to 1

margin. The best way to unlock the profitable stock recommendations

and market insights of Zacks Investment

Research is through our free daily email newsletter; Profit from

the Pros. In short, it's your steady flow of Profitable ideas

GUARANTEED to be worth your time! Register for your free

subscription to Profit from the Pros at

http://at.zacks.com/?id=4582.

Visit http://www.zacks.com/performance for information about the

performance numbers displayed in this press release.

Follow us on Twitter: http://twitter.com/zacksresearch

Join us on Facebook:

http://www.facebook.com/home.php#/pages/Zacks-Investment-Research/57553657748?ref=ts

Disclaimer: Past performance does not guarantee future results.

Investors should always research companies and securities before

making any investments. Nothing herein should be construed as an

offer or solicitation to buy or sell any security.

Media Contact

Zacks Investment Research

800-767-3771 ext. 9339

support@zacks.com

http://www.zacks.com

COSTCO WHOLE CP (COST): Free Stock Analysis Report

CITI TRENDS INC (CTRN): Free Stock Analysis Report

HAIN CELESTIAL (HAIN): Free Stock Analysis Report

TARGET CORP (TGT): Free Stock Analysis Report

WAL-MART STORES (WMT): Free Stock Analysis Report

To read this article on Zacks.com click here.

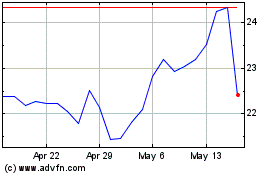

Citi Trends (NASDAQ:CTRN)

Historical Stock Chart

From Jun 2024 to Jul 2024

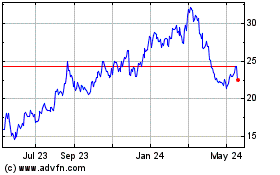

Citi Trends (NASDAQ:CTRN)

Historical Stock Chart

From Jul 2023 to Jul 2024