Citi Trends, Inc. (CTRN) - Bear of the Day

April 23 2012 - 7:00PM

Zacks

Citi Trends, Inc.'s (CTRN) falling comparable store sales,

coupled with rising cost of goods sold and operating expenses,

battered fourth-quarter 2011 results. The company incurred a

quarterly loss of $0.18 per share, falling drastically from the

year-ago quarter earnings of $0.64 per share. The results, however,

bettered the Zacks Consensus Estimate of a loss of $0.20 per share.

Further, due to uncertainty hovering around sales, given the

global economic unrest, the company decided not to provide any

guidelines unless it finds any near-term catalysts to drive sales.

Intense competition from other retailers, seasonal nature of

business and risks associated with sourcing merchandise from

developing countries may further undermine the company's future

growth prospects.

Currently, we are maintaining a long-term Underperform

recommendation on the stock. Our target price of $10.00 is based on

P/CF (price-to-cash flow) multiple of 8.27x.

CITI TRENDS INC (CTRN): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

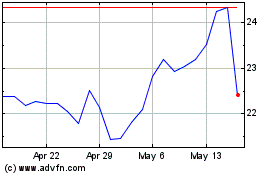

Citi Trends (NASDAQ:CTRN)

Historical Stock Chart

From Jun 2024 to Jul 2024

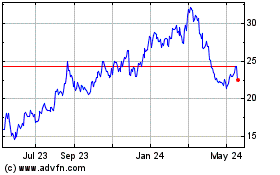

Citi Trends (NASDAQ:CTRN)

Historical Stock Chart

From Jul 2023 to Jul 2024