Nordstrom Beats Estimates in 4Q - Analyst Blog

February 22 2013 - 4:30AM

Zacks

Upscale department store operator, Nordstrom

Inc. (JWN) reported fourth quarter fiscal 2012 earnings of

$1.40 per share, above the Zacks Consensus Estimate of $1.34.

Quarterly earnings gained 26.1% from the prior-year period earnings

of $1.11 per share.

For fiscal 2012, the company’s earnings per share soared 13.4% year

over year to $3.56, while it beat the Zacks Consensus Estimate of

$3.50.

Total revenue

Nordstrom's same-store sales and top-line trends also remained

encouraging driven by robust performance at the company's stores as

well as the inclusion of an additional week in fiscal 2012. Total

revenue rose 13.3% during the quarter to $3,702 million and

surpassed the Zacks Consensus Estimate of $3,686 million.

Total revenue for the quarter reflected a 13.5% increase in Net

Retail sales to $3,596 million and 9.3% increase in Credit Card

revenues to $106 million.

Total revenue grew 11.7% to $12,148 million in fiscal 2012,

comprising $11,762 million (up 12.1% year over year) from Net

Retail Sales and $386 million (up 1.6%) from Credit Card revenues.

It also surpassed the Zacks Consensus Estimate of $12,079

million.

Comps for the fourth quarter gained 6.3% on top of the year-ago

quarter, comprising a 2.2% increase in Nordstrom full-line store

comps, 31% increase in Direct Sales comps and 7.1% increase in

Nordstrom Rack store comps. Fiscal 2012 comps registered growth of

7.3% compared to a 7.2% increase last year.

Moreover, Nordstrom's comps (including full-line and direct

businesses) strengthened 6.1% during the quarter, driven by robust

performance in Men's Apparel, Cosmetics, Women’s Apparel and Kids'

Apparel categories.

Operational Update

Driven by the increased expenses related to the Fashion Rewards

program that aims at enhancing customer relations, offset by

markdown gains, Nordstrom's gross profit margin for the quarter

contracted 10 basis points to 39.5% compared to 39.6% in the

year-ago quarter.

Further, retail selling, general and administrative expenses

elevated 11.5% to $912 million in the quarter. However, as a

percentage of total revenue, it contracted 40 basis points to 24.6%

from the year-ago quarter, mainly due to leverage on higher sales,

partly offset by higher fulfillment costs related to accelerating

the delivery for shipped sales.

On the other hand, credit selling, general and administrative

expenses declined 8.6% year over year to $53 million.

Consequently, Nordstrom's operating income augmented 20% to $498

million compared with $417 million reported in the prior-year

period, while operating margin expanded 70 bps to 13.5%.

Balance Sheet and Cash Flow

Nordstrom ended the year with cash and cash equivalents of $1,285

million compared with $1,877 million at the end of fiscal 2011.

Long-term debt at year-end stood at $3,124 million. During fiscal

2012, Nordstrom generated $1,110 million in cash from

operations.

Capital expenditures as of Feb 2, 2013 were $513 million. During

the fourth quarter, the company bought back nearly 4.2 million

shares for about $219 million.

Guidance

Looking ahead, the company forecasts fiscal 2013 earnings per share

excluding the impact of future share repurchases, in the range of

$3.65 – $3.80 per share, based on estimated sales growth of 4.5% to

6.5%. The current Zacks Consensus Estimate is pegged at $3.96 per

share. The company projects total same-store sales growth in the

range of 3.5% – 5.5%.

Moreover, management projects retail selling, general and

administrative expenses, as a percentage of retail sales, to

decline 10 to 30 basis points. Further, gross margin is expected to

contract between 10 bps and 30 bps year over year.

In fiscal 2013, the company expects capital expenditure, net of

property incentives, to be in the range of $750 – $790 million,

which are slated towards the development of its Rack and full-line

stores as well as enhancement of its e-Commerce sales.

Our Take

We believe that this upscale department store chain will continue

to report better financial results in the near future. It is also

expected to continue attracting more shoppers with its various

sales channels as well as offers. Nordstrom currently has a Zacks

Rank #2 (Buy).

Other stocks that are performing well in the retail-apparel/shoe

sector include Express Inc. (EXPR), Citi

Trends Inc. (CTRN) and Abercrombie & Fitch

Co. (ANF), all of which carry a Zacks Rank #1 (Strong

Buy).

ABERCROMBIE (ANF): Free Stock Analysis Report

CITI TRENDS INC (CTRN): Free Stock Analysis Report

EXPRESS INC (EXPR): Free Stock Analysis Report

NORDSTROM INC (JWN): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

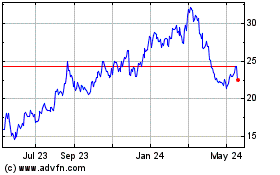

Citi Trends (NASDAQ:CTRN)

Historical Stock Chart

From Jun 2024 to Jul 2024

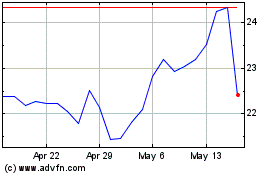

Citi Trends (NASDAQ:CTRN)

Historical Stock Chart

From Jul 2023 to Jul 2024