Citi Trends' 1Q Earnings Disappoint - Analyst Blog

May 23 2013 - 10:00AM

Zacks

Value-priced retailer of urban

fashion apparel and accessories, Citi Trends Inc.

(CTRN) reported first-quarter fiscal 2013 earnings per share of 42

cents, missing the Zacks Consensus Estimate of 57 cents and down

39.1% from 69 cents earned in the year-ago quarter.

Turning to

Numbers

Citi Trends reported first-quarter

sales of $181.8 million, marking a decrease of 8.0% from $197.7

million in the prior-year quarter. The company’s first-quarter

sales also missed the Zacks Consensus Estimate of $198 million.

Comparable store sales in the

quarter was down 4.1% compared to the year-ago quarter, driven

mainly by weak sales at the company’s stores in February and March,

followed by a recovery in April as weather turned warmer after

Easter.

On the basis of months, the

company’s comparable store sales dipped 7% in February and 8% in

March, while it gained 9% in April. Comps remained weak in March

primarily due to shift in timing of Easter this year to March

against April last year. This shift caused March comps to decline

2% while April comps gained 3%.

Citi Trends' gross profit for the

quarter declined 9.8% to $67.3 million from $74.7 million in the

year-ago quarter, whereas gross margin contracted 80 basis points

to 37.0%. The decline in gross margin was equally distributed

between core merchandise margin, freight expense and shrinkage.

Selling, general and administrative

expenses in the quarter decreased 1.5% year over year to $51.9

million, while depreciation and amortization expenses waned 8.2% to

$5.6 million. The company's operating income came in at $9.8

million, a significant decline of 38.4% from $15.9 million in the

year-ago period.

Financials

Citi Trends had no debt on its

balance sheet at the end of the first quarter. Cash and cash

equivalents were $64.1 million compared with $64.0 million at the

end of first quarter fiscal 2012. Shareholders' equity totaled

$202.2 million compared with $206.3 million in the prior-year

period.

Store Count

Following a conservative store

growth strategy in 2013, Citi Trends opened only 1 new store in the

first quarter. In furtherance of streamlining its stores, the

company shuttered 6 troubled stores. This brought the company’s

total store count to 508 at the end of first-quarter fiscal

2013.

Stepping into the second quarter,

the company closed 2 more stores, with its current store count

reaching 506. The company operates across 29 states in the

Southeast, Mid-Atlantic and Midwest regions as well as in the

states of Texas and Calif.

Outlook

Looking into fiscal 2013, the

company continues to be focused on improving its sales via

enhancing the variety of its ladies business. Though the

significance of the company’s Urban Brands continues to decline and

non-branded business is not poised to make loss from the branded

business, the company expects to gain from better focus on its

ladies business in 2013.

A Look at Zacks

Rank

Citi Trends currently holds a Zacks

Rank #3 (Hold). Stocks that are performing well among apparel-shoe

retailers include Buckle Inc. (BKE), Gap

Inc. (GPS) and Zumiez Inc. (ZUMZ) , all

of which carry a Zacks Rank #2 (Buy).

BUCKLE INC (BKE): Free Stock Analysis Report

CITI TRENDS INC (CTRN): Free Stock Analysis Report

GAP INC (GPS): Free Stock Analysis Report

ZUMIEZ INC (ZUMZ): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

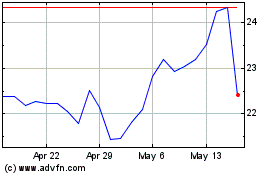

Citi Trends (NASDAQ:CTRN)

Historical Stock Chart

From Jun 2024 to Jul 2024

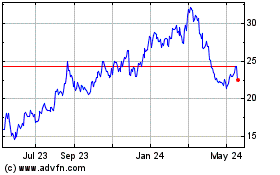

Citi Trends (NASDAQ:CTRN)

Historical Stock Chart

From Jul 2023 to Jul 2024