Third quarter total sales increased 10.1%;

comparable store sales up 7.4%

Quarterly earnings per share of $0.05 this

year versus $(0.06) loss last year

Citi Trends, Inc. (NASDAQ:CTRN) today reported results for the

third quarter of fiscal 2017.

Financial Highlights – Third quarter

ended October 28, 2017

Total sales in the third quarter ended October 28, 2017

increased 10.1% to $176.9 million compared with $160.7 million in

the third quarter ended October 29, 2016. Comparable store sales

increased 7.4% in the quarter.

The Company had net income of $0.6 million, or $0.05 per diluted

share, in the third quarter of 2017, compared with a net loss of

$(0.8) million, or $(0.06) per diluted share, in last year’s third

quarter.

During the third quarter, the Company opened five new stores,

relocated or expanded two stores, and closed one store.

Financial Highlights – First three

quarters ended October 28, 2017

Total sales in the first three quarters of fiscal 2017 increased

6.6% to $543.1 million compared with $509.7 million in the same

period of fiscal 2016. Comparable store sales increased 4.1% in the

first three quarters of this year.

The Company had net income of $9.3 million, or $11.1 million

when adjusted for proxy contest-related expenses*, in the first

three quarters of 2017, compared with $7.8 million in the same

period last year. Earnings per diluted share in the first three

quarters of 2017 were $0.65, or $0.77 when adjusted for proxy

contest-related expenses*, compared with $0.53 in the first three

quarters of 2016.

Bruce Smith, Acting Chief Executive Officer, commented, “We are

extremely pleased to report strong sales and operating results for

the third quarter. The momentum that we saw in recent quarters

continued at an accelerated pace in the third quarter and is being

driven by our delivery of fashion-right, value-priced merchandise

to our customers. Comparable store sales growth was consistently

strong throughout the quarter, with a 7% increase in August and 8%

increases in both September and October. Importantly, all five of

our major merchandise categories once again contributed to the

sales increases.

“In addition to 10% total sales growth in the third quarter, we

were pleased with an improvement in gross margin and significant

expense leverage, all of which led to operating margin expansion of

140 basis points and a $1.4 million increase in net income.

“We believe that we have entered the fourth quarter in a

high-quality, liquid inventory position. Early reads on the holiday

season have been positive, as comparable store sales for

the first three weeks of November have been up 7% on top of a

6% increase in the same three weeks last year.”

Investor Conference Call and

Webcast

Citi Trends will host a conference call today at 9:00 a.m. ET.

The number to call for the live interactive teleconference is

(212) 231-2932. A replay of the conference call will be

available until November 28, 2017, by dialing (402) 977-9140

and entering the passcode, 21861316.

The live broadcast of Citi Trends' conference call will be

available online at the Company's website, www.cititrends.com,

under the Investor Relations section, beginning today at 9:00 a.m.

ET. The online replay will follow shortly after the call and will

be available for replay for one year.

During the conference call, the Company may discuss and answer

questions concerning business and financial developments and trends

that have occurred after quarter-end. The Company’s responses to

questions, as well as other matters discussed during the conference

call, may contain or constitute information that has not been

disclosed previously.

About Citi Trends

Citi Trends, Inc. is a value-priced retailer of urban fashion

apparel and accessories for the entire family. The Company operates

549 stores located in 31 states. Citi Trends’ website address is

www.cititrends.com. CTRN-G

*Non-GAAP Financial

Measure

The non-GAAP financial measures discussed herein are reconciled

to their corresponding GAAP measures at the end of this press

release.

Forward-Looking

Statements

All statements other than historical facts contained in this

news release, including statements regarding our future financial

results and position, business policy and plans, objectives of

management for future operations and our intentions and ability to

pay dividends and complete any share repurchase authorizations, are

forward-looking statements that are subject to material risks and

uncertainties. The words "believe," "may," "could," "plans,"

"estimate," "continue," "anticipate," "intend," "expect" and

similar expressions, as they relate to Citi Trends, are intended to

identify forward-looking statements, although not all

forward-looking statements contain such language. Statements with

respect to earnings guidance are forward-looking statements.

Investors are cautioned that any such forward-looking statements

are subject to the finalization of the Company’s quarter-end

financial and accounting procedures, are not guarantees of future

performance or results and are inherently subject to risks and

uncertainties, some of which cannot be predicted or quantified.

Actual results or developments may differ materially from those

included in the forward-looking statements as a result of various

factors which are discussed in Citi Trends, Inc. filings with the

Securities and Exchange Commission. These risks and uncertainties

include, but are not limited to, uncertainties relating to economic

conditions, growth risks, consumer spending patterns, competition

within the industry, competition in our markets and the ability to

anticipate and respond to fashion trends. Any forward-looking

statements by the Company, with respect to earnings guidance, the

Company’s intention to declare and pay dividends, the repurchase of

shares pursuant to a share repurchase program, or otherwise, are

intended to speak only as of the date such statements are made.

Except as required by applicable law, including the securities laws

of the United States and the rules and regulations of the

Securities and Exchange Commission, Citi Trends does not undertake

to publicly update any forward-looking statements in this news

release or with respect to matters described herein, whether as a

result of any new information, future events or otherwise.

CITI TRENDS, INC. CONDENSED CONSOLIDATED

STATEMENTS OF OPERATIONS (unaudited) (in thousands, except

per share data) Thirteen Weeks Ended

Thirteen Weeks Ended October 28, 2017 October 29,

2016 (unaudited) (unaudited) Net sales $ 176,943 $ 160,716

Cost of sales (exclusive of depreciation shown separately

below) (110,094 ) (100,386 ) Selling, general and administrative

expenses (61,118 ) (57,637 ) Depreciation (4,976 ) (4,223 ) Asset

impairment - (61 ) Income (loss) from

operations 755 (1,591 ) Interest income 216 146 Interest expense

(38 ) (39 ) Income (loss) before income taxes 933

(1,484 ) Income tax (expense) benefit (286 ) 648

Net income (loss) $ 647 $ (836 ) Basic net

income (loss) per common share $ 0.05 $ (0.06 ) Diluted net

income (loss) per common share $ 0.05 $ (0.06 )

Weighted average number of shares outstanding Basic 13,563

14,677 Diluted 13,614

14,677

Thirty-Nine Weeks Ended

Thirty-Nine Weeks Ended October 28, 2017 October

29, 2016 (unaudited) (unaudited) Net sales $ 543,098 $ 509,664

Cost of sales (exclusive of depreciation shown separately

below) (334,659 ) (313,345 ) Selling, general and administrative

expenses (181,439 ) (172,073 ) Depreciation (13,863 ) (12,961 )

Asset impairment (77 ) (282 ) Income from operations

13,060 11,003 Interest income 617 408 Interest expense (112

) (120 ) Income before income taxes 13,565 11,291 Income tax

expense (4,238 ) (3,510 ) Net income $ 9,327 $

7,781 Basic net income per common share $ 0.66

$ 0.53 Diluted net income per common share $ 0.65 $

0.53 Weighted average number of shares outstanding

Basic 14,221 14,649 Diluted

14,270 14,652

CITI TRENDS,

INC. CONDENSED CONSOLIDATED BALANCE SHEETS (unaudited)

(in thousands) October 28, 2017

October 29, 2016 (unaudited) (unaudited) Assets: Cash and

cash equivalents $ 34,866 $ 36,956 Short-term investment securities

30,298 34,132 Inventory 133,245 130,752 Prepaid and other current

assets 16,405 18,570 Property and equipment, net 63,571 54,478

Long-term investment securities 26,117 29,183 Other noncurrent

assets 8,171 9,211 Total assets $ 312,673 $ 313,282

Liabilities and Stockholders' Equity: Accounts payable $

68,047 $ 59,098 Accrued liabilities 28,921 25,718 Other current

liabilities 1,913 1,974 Noncurrent liabilities 8,786

8,130 Total liabilities 107,667 94,920 Total stockholders'

equity 205,006 218,362 Total liabilities and

stockholders' equity $ 312,673 $ 313,282

CITI

TRENDS, INC. RECONCILIATION OF GAAP BASIS OPERATING

RESULTS TO ADJUSTED NON-GAAP OPERATING RESULTS

(unaudited) (in thousands, except per share data)

The Company makes reference in this

release to net income adjusted for proxy contest expenses and

earnings per diluted share adjusted for proxy contest expenses. The

Company believes that excluding proxy contest expenses and their

related tax effects from its financial results reflects operating

results that are more indicative of the Company's ongoing operating

performance while improving comparability to prior periods, and as

such, may provide investors with an enhanced understanding of the

Company's past financial performance and prospects for the future.

This information is not intended to be considered in isolation or

as a substitute for net income, earnings per common share, or

expense information prepared in accordance with generally accepted

accounting principles (GAAP).

Thirteen Weeks Ended October 28, 2017 As

Reported Adjustment (1) As Adjusted

(unaudited) (unaudited) (unaudited) Net sales

$ 176,943 $ - $ 176,943 Cost of sales (exclusive of

depreciation shown separately below) (110,094 ) - (110,094 )

Selling, general and administrative expenses (61,118 ) - (61,118 )

Depreciation (4,976 ) - (4,976 ) Asset impairment -

- - Income from

operations 755 - 755 Interest income 216 - 216 Interest expense

(38 ) - (38 )

Income before income taxes 933 - 933 Income tax expense (286

) - (286 ) Net income $

647 $ - $ 647

Basic net income per common share $ 0.05 $ 0.05

Diluted net income per common share $ 0.05 $ 0.05

Weighted average number of shares outstanding Basic

13,563 13,563 Diluted 13,614

13,614

Thirty-Nine Weeks Ended

October 28, 2017 As Reported Adjustment

(1) As Adjusted (unaudited) (unaudited)

(unaudited) Net sales $ 543,098 $ - $ 543,098 Cost of

sales (exclusive of depreciation shown separately below) (334,659 )

- (334,659 ) Selling, general and administrative expenses (181,439

) 2,516 (178,923 ) Depreciation (13,863 ) - (13,863 ) Asset

impairment (77 ) -

(77 ) Income from operations 13,060 2,516 15,576 Interest income

617 - 617 Interest expense (112 ) -

(112 ) Income before income taxes 13,565 2,516

16,081 Income tax expense (4,238 ) (786

)

(5,024 ) Net income $ 9,327 $ 1,730

$ 11,057 Basic net income per

common share $ 0.66 $ 0.78 Diluted net income per

common share $ 0.65 $ 0.77 Weighted average

number of shares outstanding Basic 14,221

14,221 Diluted 14,270 14,270

(1) Proxy contest expenses and related tax effects

View source

version on businesswire.com: http://www.businesswire.com/news/home/20171121005069/en/

Citi Trends, Inc.Bruce Smith, (912) 443-2075Acting Chief

Executive Officer,Chief Operating Officer andChief Financial

Officer

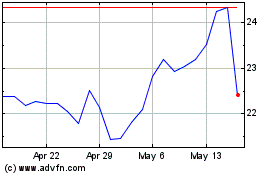

Citi Trends (NASDAQ:CTRN)

Historical Stock Chart

From Jun 2024 to Jul 2024

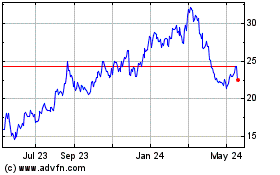

Citi Trends (NASDAQ:CTRN)

Historical Stock Chart

From Jul 2023 to Jul 2024