The Herzfeld Caribbean Basin Fund, Inc. (NASDAQ: CUBA) (the “Fund”)

today announced that Thomas J. Herzfeld, Chairman of the Board of

Directors has resigned from the Board as of December 31, 2024. Mr.

Herzfeld has also resigned as Portfolio Manager for the Fund

effective as of the same date. Mr. Herzfeld has held the position

of Chairman since the Fund’s launch in 1994. He will retain the

position of Chairman Emeritus and participate in board meetings on

a non-voting basis.

The Board has elected Cecilia Gondor to serve as Chairperson

effective December 31, 2024. Ms. Gondor has served on the Board of

Directors since 2014. She also served as Executive Vice President

of Thomas J. Herzfeld Advisors, Inc. (the Fund’s investment

manager) from 1984 through May 2014. During her years at the

investment manager, her research analysis garnered her the

reputation as being one of the most knowledgeable analysts in the

industry. Additionally, she was the Executive Vice President of

Thomas J. Herzfeld & Co., Inc., a broker-dealer, from 1984

through 2010. Ms. Gondor currently is an owner and the Managing

Member of L&M Management LLC group of partnerships, a

residential and commercial office space investor located in

Alexandria, Virginia.

In addition, the Board has named Brigitta Herzfeld to fill the

board vacancy created by Mr. Herzfeld’s resignation. Ms. Herzfeld

is a current member of the investment manager’s executive committee

and will join the Board as of December 31, 2024. She is a graduate

of Bowdoin College (BA), Stanford University (MA) and Massachusetts

Institute of Technology – MIT Sloan School of Management (MBA) and

Wharton-Singapore Management University (Executive Management

Program). She has held positions at Goldman, Sachs & Co and

Lehman Brothers Japan, Inc.

Mr. Herzfeld commented: “It has been my privilege and honor to

serve on the Board of Directors of The Herzfeld Caribbean Basin

Fund for its entire history. As I approach my 80th birthday, it is

with much pride that I turn the leadership of the Fund over to a

new generation. Cecilia Gondor has been a consistent source of

expert guidance for the Fund for many years and is a great choice

to take over the chair position. And Brigitta Herzfeld’s financial

background and long history with our firm will be an invaluable

source of expertise for the board. While I will remain active with

the management company, it is clear that the time has come for me

to step down from active leadership of the Fund. As Chairman

Emeritus I will be working harder than ever to ensure that we

maximize shareholder value; we are currently exploring several

options that we think will be beneficial to our shareholders.”

Mr. Herzfeld has had a long and illustrious career and is

generally considered to be “the father of closed-end fund

investing”. Mr. Herzfeld wrote the first of his six books on the

subject of closed-end funds in 1979. He is the publisher

of The Investor's Guide to Closed-End Funds monthly research

report and is quoted and interviewed on the subject of closed-end

funds by the world’s most renowned financial papers. He has

served as a contributing editor for the Global Guide to

Investing (published by Financial Times), and The

Encyclopedia of Investments.

Ms. Gondor responded to her election to Chairperson: “To follow

in the footsteps of Tom Herzfeld is a very humbling experience. He

has been a mentor to me and many others in the closed-end fund

industry. I look forward to working with Brigitta Herzfeld and the

other board members to continue the work that Tom started 30 years

ago and am honored to contribute to the legacy he has built in any

way that I can.”

A graduate of Philadelphia University in 1966, Mr. Herzfeld

served in the United States Army Reserve from 1966-1972,

and on active duty in 1967. He received an honorary Doctor of

Humane Letters (LHD) from Philadelphia University in

2008.

He joined the Wall Street firm Reynolds & Co., in 1968 and

began a specialization in closed-end funds. He formed the NYSE

member firm of Carlino, Herzfeld and Kemm in 1970 and served as the

firm's Senior Partner at the age of 25. He also became an Allied

Member of the NYSE, an Associate Member of the AMEX and a senior

register options principal.

In 1981, he formed a stock brokerage firm, Thomas J. Herzfeld

& Co., Inc., that was the first to specialize in the field of

closed-end funds.

He created the industry's first and only Closed-End Fund Index,

"The Herzfeld Average," which has been published

in Barron’s weekly since its establishment in 1987. He

also coined the term “lifeboat provisions” used in the industry to

define tactics funds take to narrow discounts and keep prices

afloat.

About Thomas J. Herzfeld Advisors, Inc.

Thomas J. Herzfeld Advisors, Inc., founded in 1984, is an SEC

registered investment advisor, specializing in investment analysis

and account management in closed-end funds. The Firm also

specializes in investment in the Caribbean Basin. The HERZFELD/CUBA

division of Thomas J. Herzfeld Advisors, Inc. serves as the

investment advisor to The Herzfeld Caribbean Basin Fund, Inc. a

publicly traded closed-end fund (NASDAQ: CUBA).

More information about the advisor can be found at

www.herzfeld.com.

Past performance is no guarantee of future performance. An

investment in the Fund is subject to certain risks, including

market risk. In general, shares of closed-end funds often trade at

a discount from their net asset value and at the time of sale may

be trading on the exchange at a price which is more or less than

the original purchase price or the net asset value. An investor

should carefully consider the Fund’s investment objective, risks,

charges and expenses. Please read the Fund’s disclosure documents

before investing.

Forward-Looking Statements

This press release, and other statements that TJHA or the Fund

may make, may contain forward looking statements within the meaning

of the Private Securities Litigation Reform Act, with respect to

the Fund’s or TJHA’s future financial or business performance,

strategies or expectations. Forward-looking statements are

typically identified by words or phrases such as “trend,”

“potential,” “opportunity,” “pipeline,” “believe,” “comfortable,”

“expect,” “anticipate,” “current,” “intention,” “estimate,”

“position,” “assume,” “outlook,” “continue,” “remain,” “maintain,”

“sustain,” “seek,” “achieve,” and similar expressions, or future or

conditional verbs such as “will,” “would,” “should,” “could,” “may”

or similar expressions. TJHA and the Fund caution that

forward-looking statements are subject to numerous assumptions,

risks and uncertainties, which change over time. Forward-looking

statements speak only as of the date they are made, and TJHA and

the Fund assume no duty to and do not undertake to update

forward-looking statements. Actual results could differ materially

from those anticipated in forward-looking statements and future

results could differ materially from historical performance. With

respect to the Fund, the following factors, among others, could

cause actual events to differ materially from forward-looking

statements or historical performance: (1) changes and volatility in

political, economic or industry conditions, particularly with

respect to Cuba and other Caribbean Basin countries, the interest

rate environment, foreign exchange rates or financial and capital

markets, which could result in changes in demand for the Fund or in

the Fund’s net asset value; (2) the relative and absolute

investment performance of the Fund and its investments; (3) the

impact of increased competition; (4) the unfavorable resolution of

any legal proceedings; (5) the extent and timing of any

distributions or share repurchases; (6) the impact, extent and

timing of technological changes; (7) the impact of legislative and

regulatory actions and reforms, including the Dodd-Frank Wall

Street Reform and Consumer Protection Act, and regulatory,

supervisory or enforcement actions of government agencies relating

to the Fund or TJHA, as applicable; (8) terrorist activities,

international hostilities and natural disasters, which may

adversely affect the general economy, domestic and local financial

and capital markets, specific industries or TJHA or the Fund; (9)

TJHA’s and the Fund’s ability to attract and retain highly talented

professionals; (10) the impact of TJHA electing to provide support

to its products from time to time; (11) the impact of problems at

other financial institutions or the failure or negative performance

of products at other financial institutions; and (12) the effects

of an epidemic, pandemic or public health emergency, including

without limitation, COVID-19. Annual and Semi-Annual Reports and

other regulatory filings of the Fund with the SEC are accessible on

the SEC’s website at www.sec.gov and on TJHA’s website at

www.herzfeld.com/cuba, and may discuss these or other factors that

affect the Fund. The information contained on TJHA’s website is not

a part of this press release.

Contact:Tom MorganChief Compliance OfficerThomas J. Herzfeld

Advisors, Inc.1-305-777-1660

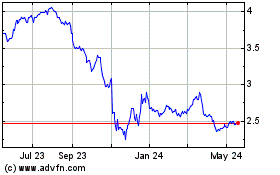

Herzfeld Caribbean Basin (NASDAQ:CUBA)

Historical Stock Chart

From Dec 2024 to Jan 2025

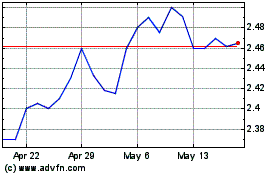

Herzfeld Caribbean Basin (NASDAQ:CUBA)

Historical Stock Chart

From Jan 2024 to Jan 2025