EUROPE MARKETS: European Stocks End Lower For Third Consecutive Day

October 14 2015 - 11:48AM

Dow Jones News

By Carla Mozee and Victor Reklaitis, MarketWatch

Notable decliners: LVMH, Vonovia, ASML, Skanska

European stocks finished with losses Wednesday and pushed the

broad European benchmark to its third daily drop in a row, as weak

Chinese economic data highlighted worries about sluggish global

growth.

The Stoxx Europe 600 index fell 0.7% to close at 355.81, though

it managed to come off its intraday low of 354.50. The index ended

lower on Monday and Tuesday after logging six consecutive winning

sessions.

Investors started the session with official Chinese figures

showing consumer inflation decelerated in September

(http://www.marketwatch.com/story/chinas-consumer-inflation-eases-to-16-2015-10-14)

as food prices fell. China's consumer-price index rose 1.6% from a

year earlier. That was slower than a 2% rise in August and less

than the 1.8% gain expected by economists polled by The Wall Street

Journal.

Shares of luxury-goods companies, which count China as a key

market, were lower Wednesday, with losses coming on the back of

disappointing Chinese trade data released Tuesday. LVMH Moët

Hennessy Louis Vuitton SE (LVMUY) fell 1.2%, and Gucci parent

Kering SA (KER.FR) gave up 1.3%, with the moves weighing on the

France's CAC 40 . The index was down 0.7% to end at 4,609.03.

European stocks remained lower after data showed industrial

output in the eurozone fell in August

(http://www.marketwatch.com/story/eurozone-industrial-output-falls-in-august-2015-10-14-5485827),

signaling that slower growth in China and cooling activity in other

developing economies are beginning to hurt the currency bloc.

In Germany, the DAX 30 index finished down 1.2% at 9,915.85, and

the U.K.'s FTSE 100 lost 1.2% to end at 6,269.61.

Movers: Vonovia SE (VNA.XE) shares were at the bottom of the DAX

30 index, closing down 5.2% after the real-estate company said it

plans to bid for rival Deutsche Wohnen AG

(http://www.marketwatch.com/story/germanys-vonovia-offers-16-billion-for-rival-2015-10-14-248597)(DWNI.XE)

with a 14 billion-euro ($15.95 billion) offer.

ASML Holding NV (ASML.AE)(ASML.AE) fell 4.4% after the Dutch

chip-equipment maker forecast fourth-quarter sales will fall

(http://www.marketwatch.com/story/asml-on-track-for-record-sales-as-profit-jumps-2015-10-14-14855030)

to around EUR1.4 billion, in part as foundry customers have become

somewhat more cautious in their investment plans. ASML did post a

jump in third-quarter net profit and said it still expects to log

record sales this year.

Skanska AB (SKA-B.SK) skidded lower by 8.9% after the Swedish

construction firm said it would book a 630 million Swedish kronor

($77.5 million) charge

(http://www.marketwatch.com/story/skanska-books-775-million-us-related-charge-2015-10-14)

from its U.S. operations in the third quarter.

Subscribe to WSJ: http://online.wsj.com?mod=djnwires

(END) Dow Jones Newswires

October 14, 2015 12:33 ET (16:33 GMT)

Copyright (c) 2015 Dow Jones & Company, Inc.

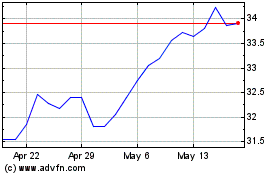

Global X Funds Global X ... (NASDAQ:DAX)

Historical Stock Chart

From Nov 2024 to Dec 2024

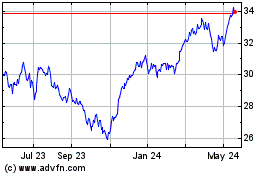

Global X Funds Global X ... (NASDAQ:DAX)

Historical Stock Chart

From Dec 2023 to Dec 2024