EUROPE MARKETS: European Stocks Surge On U.S.-China Trade Breakthrough

December 03 2018 - 7:07AM

Dow Jones News

By Emily Horton

Autos, miners, oil stocks lead the way higher

Euroepan stock markets tracked a global relief rally on Monday,

after the U.S and China agreed ease trade tensions at the G-20 this

weekend in Argentina.

Resource, oil and auto stocks led the surge, with German

equities experiencing their strongest one-day gain since April.

What are markets doing?

The Stoxx Europe 600 jumped 1.3% to 362.13 after ending down

1.1% on 357.5 late on Friday.

Germany's DAX (DAX) was the biggest gainer rising 2.2% to

11,506.67, marking its biggest one-day rise since earlier this

year, Italy's FTSE MIB was up 1.9% to 19,551.22 and France's CAC 40

rose by 1% to 5,054.11. The U.K.'s FTSE 100 climbed by 1.8% to

7,104.51 having ended down 0.8% on Friday.

The euro rose to $1.1336 from $1.1320 late Friday in New York,

while the British pound grew to $1.2798 from $1.2752 late on

Friday.

What is driving the market?

Stocks around the globe rallied after Donald Trump and Chinese

President Xi Jinping agreed to a ceasefire at the weekend G-20

meeting, with the U.S. promising not to implement planned tariff

increases on a batch of scheduled Chinese exports worth $200

billion to the U.S.

Both leaders agreed to a 90-day truce between U.S. and China to

allow for further time to progress trade talks between the two

countries. Trump also said on Twitter that China will "reduce and

remove" tariffs on U.S. cars.

(http://www.marketwatch.com/story/trump-says-china-will-reduce-and-remove-40-tariffs-on-us-auto-imports-2018-12-02)

Also supporting major indexes, crude prices rallied 4%

(http://www.marketwatch.com/story/crude-prices-rally-4-as-russia-saudis-signal-output-curbs-2018-12-03),

driven by a surprise decision by Canadian producers to cut output,

and comments from Russian President Vladimir Putin at the weekend

G-20. Putin said he and his Saudi Arabia counterpart have agreed to

extend their oil deal to manage supply, which drove optimism for

the end-week OPEC meeting.

Which stocks were active?

German stocks saw the strongest one-day gain since April so far,

with both Daimler AG (DAI.XE) and BMW AG (BMW.XE) up 5% each and

Volkswagen AG (VOW.XE) surging 4%.

As China is a big user of natural resources, those stocks also

saw a strong day, with Antofagasta PLC (ANTO.LN) up 7.4% and Rio

Tinto PLC (RIO.LN) up over 5%.

Oil majors also helped drive gains for European indexes, as

crude prices rallied 4%. BP PLC (BP.LN) up by 2%, Royal Dutch Shell

PLC (RDSA.LN) was up by almost 3% and Total S.A. (TOT) rose 2%.

(END) Dow Jones Newswires

December 03, 2018 07:52 ET (12:52 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

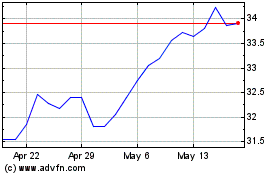

Global X Funds Global X ... (NASDAQ:DAX)

Historical Stock Chart

From Nov 2024 to Dec 2024

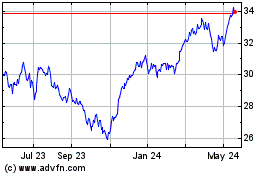

Global X Funds Global X ... (NASDAQ:DAX)

Historical Stock Chart

From Dec 2023 to Dec 2024