Destination XL Group, Inc. (NASDAQ: DXLG), the leading

integrated-commerce specialty retailer of Big + Tall men’s clothing

and shoes, today reported operating results for the third quarter

of fiscal 2024, and updated sales and earnings guidance for the

fiscal year.

Third Quarter Financial Highlights

- Total sales for the third quarter were $107.5 million, down

9.8% from $119.2 million in the third quarter of fiscal 2023.

Comparable sales for the third quarter of fiscal 2024 decreased

11.3% as compared to the third quarter of fiscal 2023.

- Net loss for the third quarter was $(0.03) per diluted share,

as compared to net income of $0.06 per diluted share in the third

quarter of fiscal 2023.

- Adjusted EBITDA (a non-GAAP measure) for the third quarter was

$1.0 million, or 1.0% of sales, as compared to $8.6 million, or

7.3% of sales in the third quarter of fiscal 2023.

- Total cash and investments were $43.0 million at November 2,

2024, as compared to $60.4 million at October 28, 2023, with no

outstanding debt for either period.

- Repurchased 3.6 million shares of common stock for $10.2

million, or an average cost of $2.85 per share, pursuant to a $15.0

million stock repurchase program approved during the third quarter

of fiscal 2024.

Management’s Comments

"DXL’s business continued to be challenged in the third quarter

by consumer spending headwinds which resulted in lower traffic to

our stores and lower conversion online. The consumer has been

very price conscious, and our customers are gravitating toward our

more moderate and entry-level price points. Despite these

challenges, we have maintained our disciplined operating regimen,

and we have avoided a material erosion in merchandise margin, while

keeping our inventory position healthy and controlling our

operating expenses," said Harvey Kanter, President and Chief

Executive Officer.

"As we head into the fourth quarter, we will remain focused on

achieving profitable sales, generating free cash flow and

maintaining a healthy balance sheet. While we expect that consumer

spending headwinds will persist into the fourth quarter, we are

optimistic. With inflation stabilizing, interest rates coming down

and the election now behind us, we believe that consumer sentiment

will recover over time. Until our Big + Tall consumer is ready to

more actively engage with DXL, we will continue to look for

opportunities to drive sales through a mix of promotional

activities and limited advertising. As I provide an update on our

strategic initiates, it is important to note that we are proceeding

cautiously until the macroenvironment improves by pausing our brand

campaign and slowing the velocity of new store openings.

Marketing & Brand

Building: In the

second quarter of fiscal 2024, we launched our new brand

advertising campaign to build awareness of our brand. The campaign

ran in a three-matched-market test in Boston, Detroit, and St.

Louis and the results were positive in all three markets, with

increased traffic, sessions, and customer acquisition. However, as

we previously disclosed, given current market conditions, we have

paused our brand campaign at this time and are instead investing

our marketing dollars back into our traditional marketing channels

that will be more productive, including a video campaign on various

social media platforms.

Store

Development: Our initiative to open new stores was

driven by insights into the frustrations our customers have with

limited access to our stores. Consumers told us that they do not

shop with us because no store is near or convenient to them. During

the third quarter, we opened two new stores for a total of four new

stores year to date, with four additional stores opening in the

fourth quarter. We are developing our fiscal 2025 store development

schedule and are targeting 8 new store openings, down from our

previous expectation of 10 new store openings.

New Website

Platform: We are

making significant progress in our transition to a new and improved

eCommerce platform, with 100% of the site traffic now on our new

platform. The platform addresses friction online and will drive a

richer and simpler consumer experience, as well as drive measurably

greater speed and agility. During the third quarter, we completed

the second phase of this project, which included catalog pages,

product detail pages, and a new site search experience. The last

phase, which will improve the checkout process and other user

experiences is scheduled to be completed in early 2025.

Alliances &

Collaborations: In the second

quarter of fiscal 2024, we launched our DXL Big + Tall merchandise

assortment on Nordstrom's digital marketplace platform and

currently have 37 brands and over 1,400 styles available on the

platform, with plans for an additional 500 styles in the next

month. We believe this collaboration will allow us to bring the DXL

experience beyond our four walls and directly to the Nordstrom

customer, thereby further extending DXL’s relationship with the

female consumer."

"Pulling back on parts of our initiatives was prudent to ensure

that we remain fiscally responsible with our investment spending

and remain focused on near-term profitability and positive free

cash flow," Kanter concluded.

Third Quarter Results

Sales

Total sales for the third quarter of fiscal 2024 were $107.5

million, as compared to $119.2 million in the third quarter of

fiscal 2023. The decrease in total sales was primarily attributable

to a decrease in comparable sales for the third quarter of 11.3%,

partially offset by an increase in non-comparable sales.

The comparable sales decrease of 11.3% consisted of comparable

sales from our stores down 9.9% and our direct business down 14.7%.

This third quarter decline was consistent with the trend from the

first half of fiscal 2024, with the decrease in comparable sales

principally driven by a decrease in traffic in our stores and

decreased conversion in our direct business. We continued to see a

shift toward our private-label merchandise, as opposed to our

national brands, as customers continued to be cost-conscious with

their discretionary spending.

Gross Margin

For the third quarter of fiscal 2024, our gross margin rate,

inclusive of occupancy costs, was 45.1% as compared to a gross

margin rate of 47.5% for the third quarter of fiscal

2023.

Our gross margin rate decreased by 240 basis points, which was

driven by an increase of 220 basis points in occupancy costs, as a

percentage of sales, primarily due to the deleveraging of sales and

increased rents as a result of lease extensions. Merchandise margin

for the third quarter decreased by 20 basis points, as compared to

the third quarter of fiscal 2023, primarily due to an increase in

markdown activity on seasonal merchandise as well as an increase in

inbound freight. These increases were partially offset by favorable

outbound shipping costs, a decrease in loyalty expense and a shift

in product mix. For 2024, we expect gross margin rates to be

approximately 130 to 180 basis points lower than fiscal 2023

primarily related to the deleveraging of occupancy on a lower sales

base.

Selling, General & Administrative

As a percentage of sales, SG&A (selling, general and

administrative) expenses for the third quarter of fiscal 2024 were

44.1% as compared to 40.2% for the third quarter of fiscal

2023.

On a dollar basis, SG&A expenses decreased by $0.6 million

as compared to the third quarter of fiscal 2023. The decrease was

primarily due to a decrease in marketing of $1.4 million as

compared to the prior year's third quarter, partially offset by

increases in healthcare costs, technology costs and professional

services. On a percentage of sales basis, SG&A expenses

increased due to the decrease in sales for the third quarter of

fiscal 2024 as compared to the third quarter of fiscal 2023.

Marketing costs were 5.7% of sales for the third quarter of

fiscal 2024 as compared to 6.3% of sales for the third quarter of

fiscal 2023. For fiscal 2024, marketing costs are expected to be

approximately 6.8%.

Management views SG&A expenses through two primary cost

centers: Customer Facing Costs and Corporate Support Costs.

Customer Facing Costs, which include store payroll, marketing and

other store and direct operating costs, represented 24.2% of sales

in the third quarter of fiscal 2024 as compared to 22.5% of sales

in the third quarter of fiscal 2023. Corporate Support Costs, which

include the distribution center and corporate overhead costs,

represented 19.9% of sales in the third quarter of fiscal 2024 as

compared to 17.7% of sales in the third quarter of fiscal 2023.

Interest Income, Net

Net interest income for the third quarter of fiscal 2024 was

$0.6 million, which was flat as compared to the third quarter of

fiscal 2023. For both periods, interest income was earned from

investments in U.S. government-backed investments and money market

accounts. Interest costs for both periods were minimal because we

had no outstanding debt and no borrowings under our credit

facility.

Income Taxes

Our tax provision for income taxes for interim periods is

determined using an estimate of our annual effective tax rate,

adjusted for discrete items, if any. Each quarter, we update our

estimate of the annual effective tax rate and make a year-to-date

adjustment to the provision.

For the third quarter of fiscal 2024, the effective tax rate was

9.2% as compared to an effective tax rate of 30.2% for the third

quarter of fiscal 2023. The difference in the effective tax rate

for the third quarter of fiscal 2024, as compared to the third

quarter of fiscal 2023, was due to the net loss reported during the

third quarter of fiscal 2024 and its impact on our estimated annual

effective tax rate for fiscal 2024. For the fiscal year, we expect

an increase in the effective tax rate primarily due to permanent

book-to-tax differences combined with a lower pretax income as

compared to fiscal 2023.

Net Income (Loss)

For the third quarter of fiscal 2024, net loss was $1.8 million,

or $(0.03) per diluted share, as compared to net income for the

third quarter of fiscal 2023 of $4.0 million, or $0.06 per diluted

share.

Adjusted EBITDA

Adjusted EBITDA, a non-GAAP measure, for the third quarter of

fiscal 2024 was $1.0 million, as compared to $8.6 million for the

third quarter of fiscal 2023.

Cash Flow

Cash flow from operations for the first nine months of fiscal

2024 was $12.5 million as compared to $33.1 million for the first

nine months of fiscal 2023.

Free cash flow, before capital expenditures for store

development, a non-GAAP measure, was $2.5 million for the first

nine months of fiscal 2024 as compared to $26.5 million for the

first nine months of fiscal 2023.

Free cash flow, a non-GAAP measure, was $(7.0) million for the

first nine months of fiscal 2024 as compared to $22.7 million for

the first nine months of fiscal 2023. The decrease in free cash

flow was primarily due to a decrease in operating income as well as

increases in capital expenditures of $5.6 million for store

development and other capital projects of $3.4 million.

|

|

|

For the nine months ended |

| (in

millions) |

|

November 2, 2024 |

|

|

October 28, 2023 |

|

|

|

Cash flow from operating activities (GAAP basis) |

|

$ |

12.5 |

|

|

$ |

33.1 |

|

|

|

Capital expenditures, excluding store development |

|

|

(10.0 |

) |

|

|

(6.6 |

) |

|

|

Free Cash Flow before capital expenditures for store development

(non-GAAP basis) |

|

$ |

2.5 |

|

|

$ |

26.5 |

|

|

|

Capital expenditures for store development |

|

|

(9.4 |

) |

|

|

(3.8 |

) |

|

|

Free Cash Flow (non-GAAP basis) |

|

$ |

(7.0 |

) |

|

$ |

22.7 |

|

|

Non-GAAP Measures

Adjusted EBITDA, adjusted EBITDA margin, free cash flow before

capital expenditures for store development and free cash flow are

non-GAAP financial measures. Please see “Non-GAAP Measures” below

and reconciliations of these non-GAAP measures to the comparable

GAAP measures that follow in the tables below.

Balance Sheet & Liquidity

As of November 2, 2024, we had cash and investments of $43.0

million as compared to $60.4 million as of October 28, 2023, with

no outstanding debt in either period. We did not have any

borrowings under our credit facility during either period and, as

of November 2, 2024, the availability under our credit facility was

$78.1 million, as compared to $87.6 million as of October 28, 2023.

Availability under our credit facility is primarily driven by our

available inventory.

As of November 2, 2024, our inventory decreased approximately

$10.7 million to $89.1 million, as compared to $99.9 million as of

October 28, 2023. We continue to take proactive measures to manage

our inventory and adjust our receipt plan given the ongoing

macroeconomic factors affecting consumer spending. At November 2,

2024, our clearance inventory was 9.2% of our total inventory, as

compared to 9.7% at October 28, 2023. Our inventory position is

very strong and our clearance levels are in line with our benchmark

of 10% even with the 10.7% decrease in total inventory. Our

inventory turnover rate has improved by over 30% from fiscal

2019.

Stock Repurchase Program

In September 2024, our Board of Directors approved a stock

repurchase program. Under the stock repurchase program, we may

repurchase up to $15.0 million of our common stock, including

excise tax, through open market and privately negotiated

transactions. The stock repurchase program will expire on February

1, 2025. During the third quarter of fiscal 2024, we repurchased

3.6 million shares at a total cost, including fees, of $10.2

million under this stock repurchase program.

Retail Store Information

The following is a summary of our retail square footage since

the end of fiscal 2021 through the end of the third quarter of

fiscal 2024:

|

|

At November 2, 2024 |

|

Year End 2023 |

|

Year End 2022 |

|

Year End 2021 |

|

|

|

# of Stores |

|

Sq Ft. (000’s) |

|

# of Stores |

|

Sq Ft. (000’s) |

|

# of Stores |

|

Sq Ft. (000’s) |

|

# of Stores |

|

Sq Ft. (000’s) |

|

|

DXL retail |

|

239 |

|

|

1,753 |

|

|

232 |

|

|

1,725 |

|

|

218 |

|

|

1,663 |

|

|

220 |

|

|

1,678 |

|

| DXL

outlets |

|

15 |

|

|

76 |

|

|

15 |

|

|

76 |

|

|

16 |

|

|

80 |

|

|

16 |

|

|

80 |

|

|

CMXL retail |

|

12 |

|

|

37 |

|

|

17 |

|

|

55 |

|

|

28 |

|

|

92 |

|

|

35 |

|

|

115 |

|

|

CMXL outlets |

|

19 |

|

|

57 |

|

|

19 |

|

|

57 |

|

|

19 |

|

|

57 |

|

|

19 |

|

|

57 |

|

|

Total |

|

285 |

|

|

1,923 |

|

|

283 |

|

|

1,913 |

|

|

281 |

|

|

1,892 |

|

|

290 |

|

|

1,930 |

|

During the first nine months of fiscal 2024, we opened four new

DXL stores, relocated one DXL store, converted four Casual Male XL

stores to the DXL format, completed four DXL remodels, closed one

Casual Male XL store and one DXL store. We expect to open four

additional DXL stores, convert another Casual Male store to the DXL

store format and complete one additional DXL remodel before the end

of fiscal 2024. We expect our capital expenditures to range

from $21.0 million to $24.0 million, net of tenant

incentives, in fiscal 2024. Over the next five years, we

believe we could potentially open approximately 50 net new DXL

stores across the country, which could average 6,000 square feet or

300,000 sq. ft. in total, a 15% increase over our current square

footage. We are currently planning to open 8 stores in fiscal

2025.

Digital Commerce Information

We distribute our national brands and own brand merchandise

directly to consumers through our stores, website, app, and

third-party marketplaces. Digital commerce sales, which we also

refer to as direct sales, are defined as sales that originate

online, whether through our website, at the store level or through

a third-party marketplace. Our direct business is a critical

component of our business and an area of significant growth

opportunity for us. For the third quarter of fiscal 2024, our

direct sales were $31.3 million, or 29.1% of retail segment sales,

as compared to $36.2 million, or 30.4% of retail segment sales in

the third quarter of fiscal 2023.

Financial Outlook

As a result of continuing headwinds in men's apparel and our

sales results through the first nine months of fiscal 2024, we are

revising our full year guidance, with expected sales for fiscal

2024 to be at the low end of our previous guidance, which is

approximately $470.0 million. We have lowered our adjusted EBITDA

guidance to 4.5% from 6.0%, primarily as a result of the

deleveraging of costs on the lower sales base. Sales guidance for

fiscal 2024 reflects a comparable sales decrease of approximately

10%.

Conference Call

The Company will hold a conference call to review its financial

results on Friday, November 22, 2024, at 9:00 a.m. ET.

To participate in the live webcast, please pre-register at:

https://register.vevent.com/register/BI086e2ca09b4247779965833973a12671

Upon registering, you will be emailed a dial-in number, and

unique PIN.

For listen-only, please join and register

at: https://edge.media-server.com/mmc/p/x2e2arje. An archived

version of the webcast may be accessed by visiting the "Events"

section of the Company's investor relations website for up to one

year.

During the conference call, the Company may discuss and answer

questions concerning business and financial developments and

trends. The Company’s responses to questions, as well as other

matters discussed during the conference call, may contain or

constitute information that has not been disclosed previously.

Non-GAAP Measures

In addition to financial measures prepared in accordance with

U.S. generally accepted accounting principles (“GAAP”), this press

release contains non-GAAP financial measures, including adjusted

EBITDA, adjusted EBITDA margin, free cash flow before capital

expenditures for store development, and free cash flow. The

presentation of these non-GAAP measures is not in accordance with

GAAP and should not be considered superior to or as a substitute

for net income (loss), net income (loss) per diluted share or cash

flows from operating activities or any other measure of performance

derived in accordance with GAAP. In addition, not all companies

calculate non-GAAP financial measures in the same manner and,

accordingly, the non-GAAP measures presented in this release may

not be comparable to similar measures used by other companies. The

Company believes the inclusion of these non-GAAP measures help

investors gain a better understanding of the Company’s performance,

especially when comparing such results to previous periods, and

that they are useful as an additional means for investors to

evaluate the Company's operating results, when reviewed in

conjunction with the Company's GAAP financial statements.

Reconciliations of these non-GAAP measures to their comparable GAAP

measures are provided in the tables below.

Adjusted EBITDA is calculated as earnings before interest,

taxes, depreciation and amortization and adjusted for asset

impairment charges (gain) and the loss from the termination of

retirement plans, if any. Adjusted EBITDA margin is calculated as

adjusted EBITDA divided by total sales. The Company believes that

providing adjusted EBITDA and adjusted EBITDA margin is useful to

investors to evaluate the Company’s performance and are key metrics

to measure profitability and economic productivity.

Free cash flow is a metric that management uses to monitor

liquidity. Management believes this metric is important to

investors because it demonstrates the Company’s ability to

strengthen liquidity while supporting its capital projects and new

store development. Free cash flow is calculated as cash flow from

operating activities, less capital expenditures and excludes the

mandatory and discretionary repayment of debt. Free cash flow

before capital expenditures for store development is calculated as

cash flow from operating activities less capital expenditures other

than capital expenditures for store development. Capital

expenditures for store development includes capital expenditures

for new stores, conversions of Casual Male XL stores to DXL and

remodels. Capital expenditures related to store relocations and

maintenance are not included in store development.

About Destination XL Group, Inc.

Destination XL Group, Inc. is the leading retailer of Men’s Big

+ Tall apparel that provides the Big + Tall man the freedom to

choose his own style. Subsidiaries of Destination XL Group, Inc.

operate DXL Big + Tall retail and outlet stores and Casual Male XL

retail and outlet stores throughout the United States, and an

e-commerce website, DXL.COM, and mobile app, which offer a

multi-channel solution similar to the DXL store experience with the

most extensive selection of online products available anywhere for

Big + Tall men. The Company is headquartered in Canton,

Massachusetts, and its common stock is listed on the Nasdaq Global

Market under the symbol "DXLG." For more information, please visit

the Company's investor relations website:

https://investor.dxl.com.

Forward-Looking Statements Certain statements

and information contained in this press release constitute

forward-looking statements under the federal securities laws,

including statements regarding our guidance for fiscal 2024,

including expected sales, gross margin rate and adjusted EBITDA

margin; expected sales trends for fiscal 2024; expected marketing

costs and expected capital expenditures in fiscal 2024; expected

store openings and store conversions in the remainder of fiscal

2024 and fiscal 2025; our long-range strategic plan and the

expected impact of our strategic initiatives on future growth,

including with respect to marketing efforts and raising brand

awareness, store development and future alliances and

collaborations; our ability to manage inventory; expected changes

in our store portfolio and long-term plans for new or relocated

stores; the expected completion of our rollout of our improved

eCommerce platform; and our ability to achieve profitable sales and

generate free cash flow. The discussion of forward-looking

information requires the management of the Company to make certain

estimates and assumptions regarding the Company's strategic

direction and the effect of such plans on the Company's financial

results. The Company's actual results and the implementation of its

plans and operations may differ materially from forward-looking

statements made by the Company. The Company encourages readers of

forward-looking information concerning the Company to refer to its

filings with the Securities and Exchange Commission, including

without limitation, its Annual Report on Form 10-K filed on March

21, 2024, its Quarterly Reports on Form 10-Q and other filings with

the Securities and Exchange Commission that set forth certain risks

and uncertainties that may have an impact on future results and the

direction of the Company, including risks relating to: changes in

consumer spending in response to economic factors; the impact of

inflation with rising costs and high interest rates; the impact of

ongoing worldwide conflicts on the global economy, including the

Israel-Hamas conflict and the ongoing Russian invasion of Ukraine;

potential labor shortages; and the Company’s ability to execute on

its marketing, digital, store and collaboration strategies, ability

to grow its market share, predict customer tastes and fashion

trends, forecast sales growth trends and compete successfully in

the United States men’s big and tall apparel market.

Forward-looking statements contained in this press release speak

only as of the date of this release. Subsequent events or

circumstances occurring after such date may render these statements

incomplete or out of date. The Company undertakes no obligation and

expressly disclaims any duty to update such statements occurring

after such date may render these statements incomplete or out of

date. The Company undertakes no obligation and expressly disclaims

any duty to update such statements.

|

DESTINATION XL GROUP, INC. |

|

CONSOLIDATED STATEMENTS OF OPERATIONS |

|

(In thousands, except per share data) |

|

(unaudited) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

For the three months ended |

For the nine months ended |

|

|

|

November 2, 2024 |

|

|

October 28, 2023 |

|

|

November 2, 2024 |

|

|

October 28, 2023 |

|

|

Sales |

|

$ |

107,503 |

|

|

$ |

119,188 |

|

|

$ |

347,812 |

|

|

$ |

384,673 |

|

|

Cost of goods sold including occupancy |

|

|

59,064 |

|

|

|

62,577 |

|

|

|

183,520 |

|

|

|

196,767 |

|

|

Gross profit |

|

|

48,439 |

|

|

|

56,611 |

|

|

|

164,292 |

|

|

|

187,906 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

|

Selling, general and administrative |

|

|

47,409 |

|

|

|

47,962 |

|

|

|

148,594 |

|

|

|

143,689 |

|

|

Depreciation and amortization |

|

|

3,569 |

|

|

|

3,393 |

|

|

|

10,232 |

|

|

|

10,338 |

|

|

Total expenses |

|

|

50,978 |

|

|

|

51,355 |

|

|

|

158,826 |

|

|

|

154,027 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating income (loss) |

|

|

(2,539 |

) |

|

|

5,256 |

|

|

|

5,466 |

|

|

|

33,879 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Loss on termination of retirement plans |

|

|

— |

|

|

|

(57 |

) |

|

|

— |

|

|

|

(4,231 |

) |

|

Interest income, net |

|

|

552 |

|

|

|

564 |

|

|

|

1,673 |

|

|

|

1,408 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Income (loss) before provision (benefit) for income taxes |

|

|

(1,987 |

) |

|

|

5,763 |

|

|

|

7,139 |

|

|

|

31,056 |

|

|

Provision (benefit) for income taxes |

|

|

(182 |

) |

|

|

1,743 |

|

|

|

2,768 |

|

|

|

8,436 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net

income (loss) |

|

$ |

(1,805 |

) |

|

$ |

4,020 |

|

|

$ |

4,371 |

|

|

$ |

22,620 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net

income (loss) per share: |

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic |

|

$ |

(0.03 |

) |

|

$ |

0.07 |

|

|

$ |

0.08 |

|

|

$ |

0.37 |

|

|

Diluted |

|

$ |

(0.03 |

) |

|

$ |

0.06 |

|

|

$ |

0.07 |

|

|

$ |

0.35 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Weighted-average number of common shares outstanding: |

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic |

|

|

57,135 |

|

|

|

60,169 |

|

|

|

57,801 |

|

|

|

61,612 |

|

|

Diluted |

|

|

57,135 |

|

|

|

63,464 |

|

|

|

60,642 |

|

|

|

64,995 |

|

|

DESTINATION XL GROUP, INC. |

|

CONDENSED CONSOLIDATED BALANCE SHEETS |

|

November 2, 2024, February 3, 2024 and October 28, 2023 |

|

(In thousands) |

|

(unaudited) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

November 2, |

|

|

February 3, |

|

|

October 28, |

|

|

|

2024 |

|

|

2024 |

|

|

2023 |

|

ASSETS |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cash and cash equivalents |

|

$ |

7,108 |

|

|

$ |

27,590 |

|

|

$ |

10,723 |

|

Short-term investments |

|

|

35,851 |

|

|

|

32,459 |

|

|

|

49,632 |

|

Inventories |

|

|

89,139 |

|

|

|

80,968 |

|

|

|

99,858 |

|

Other current assets |

|

|

8,159 |

|

|

|

12,228 |

|

|

|

10,287 |

|

Property and equipment, net |

|

|

51,988 |

|

|

|

43,238 |

|

|

|

38,429 |

|

Operating lease right-of-use assets |

|

|

167,814 |

|

|

|

138,118 |

|

|

|

139,907 |

|

Intangible assets |

|

|

1,150 |

|

|

|

1,150 |

|

|

|

1,150 |

|

Deferred tax assets, net of valuation allowance |

|

|

19,609 |

|

|

|

21,533 |

|

|

|

22,223 |

|

Other assets |

|

|

503 |

|

|

|

457 |

|

|

|

451 |

|

Total assets |

|

$ |

381,321 |

|

|

$ |

357,741 |

|

|

$ |

372,660 |

|

|

|

|

|

|

|

|

|

|

|

LIABILITIES AND STOCKHOLDERS' EQUITY |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Accounts payable |

|

$ |

28,013 |

|

|

$ |

17,353 |

|

|

$ |

28,256 |

|

Accrued expenses and other liabilities |

|

|

26,728 |

|

|

|

36,898 |

|

|

|

33,297 |

|

Operating leases |

|

|

181,124 |

|

|

|

154,537 |

|

|

|

160,340 |

|

Stockholders' equity |

|

|

145,456 |

|

|

|

148,953 |

|

|

|

150,767 |

|

Total liabilities and stockholders' equity |

|

$ |

381,321 |

|

|

$ |

357,741 |

|

|

$ |

372,660 |

CERTAIN COLUMNS IN THE FOLLOWING TABLES MAY NOT

FOOT DUE TO ROUNDING

|

GAAP TO NON-GAAP RECONCILIATION OF ADJUSTED EBITDA AND

ADJUSTED EBITDA MARGIN(unaudited) |

|

|

|

|

|

For the three months ended |

|

|

For the nine months ended |

|

|

|

|

November 2, 2024 |

|

|

October 28, 2023 |

|

|

November 2, 2024 |

|

|

October 28, 2023 |

|

| (in

millions) |

|

|

|

|

|

|

|

|

|

|

|

|

|

Net income (loss) (GAAP basis) |

|

$ |

(1.8 |

) |

|

$ |

4.0 |

|

|

$ |

4.4 |

|

|

$ |

22.6 |

|

| Add

back: |

|

|

|

|

|

|

|

|

|

|

|

|

|

Loss on termination of retirement plans |

|

|

— |

|

|

|

0.1 |

|

|

|

— |

|

|

|

4.2 |

|

|

Provision (benefit) for income taxes |

|

|

(0.2 |

) |

|

|

1.7 |

|

|

|

2.8 |

|

|

|

8.4 |

|

|

Interest income, net |

|

|

(0.6 |

) |

|

|

(0.6 |

) |

|

|

(1.7 |

) |

|

|

(1.4 |

) |

|

Depreciation and amortization |

|

|

3.6 |

|

|

|

3.4 |

|

|

|

10.2 |

|

|

|

10.3 |

|

|

Adjusted EBITDA (non-GAAP basis) |

|

$ |

1.0 |

|

|

$ |

8.6 |

|

|

$ |

15.7 |

|

|

$ |

44.2 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Sales |

|

$ |

107.5 |

|

|

$ |

119.2 |

|

|

$ |

347.8 |

|

|

$ |

384.7 |

|

|

Adjusted EBITDA margin (non-GAAP), as a percentage of sales |

|

|

1.0 |

% |

|

|

7.3 |

% |

|

|

4.5 |

% |

|

|

11.5 |

% |

|

GAAP TO NON-GAAP RECONCILIATION OF FREE CASH

FLOW(unaudited) |

|

|

|

|

|

|

|

For the nine months ended |

| (in

millions) |

|

November 2, 2024 |

|

|

October 28, 2023 |

|

|

Cash flow from operating activities (GAAP basis) |

|

$ |

12.5 |

|

|

$ |

33.1 |

|

|

Capital expenditures, excluding store development |

|

|

(10.0 |

) |

|

|

(6.6 |

) |

|

Free Cash Flow before capital expenditures for store development

(non-GAAP basis) |

|

$ |

2.5 |

|

|

$ |

26.5 |

|

|

Capital expenditures for store development |

|

|

(9.4 |

) |

|

|

(3.8 |

) |

|

Free Cash Flow (non-GAAP basis) |

|

$ |

(7.0 |

) |

|

$ |

22.7 |

|

|

FISCAL 2024 FORECAST GAAP TO NON-GAAP

ADJUSTED EBITDA AND ADJUSTED EBITDA MARGIN RECONCILIATION

(unaudited) |

|

|

|

|

|

|

|

|

|

|

Projected |

|

|

|

|

|

|

Fiscal 2024 |

|

|

|

| (in

millions, except per share data and percentages) |

|

|

|

|

per diluted share |

|

Sales (low-end of guidance) |

|

$ |

470.0 |

|

|

|

|

Net income (GAAP basis) |

|

|

5.6 |

|

|

$ |

0.09 |

| Add

back: |

|

|

|

|

|

|

Provision for income taxes |

|

|

3.4 |

|

|

|

|

Interest income, net |

|

|

(2.3 |

) |

|

|

|

Depreciation and amortization |

|

|

14.5 |

|

|

|

|

Adjusted EBITDA (non-GAAP basis) |

|

$ |

21.2 |

|

|

|

|

Adjusted EBITDA margin as a percentage of sales (non-GAAP

basis) |

|

|

4.5 |

% |

|

|

|

|

|

|

|

|

|

|

Weighted average common shares outstanding - diluted |

|

|

60.0 |

|

|

|

| *

forecasted weighted average common shares outstanding does not

reflect share repurchase activity |

|

|

|

|

|

|

|

|

|

|

|

|

Investor Contact: investor.relations@dxlg.com

(603) 933-0541

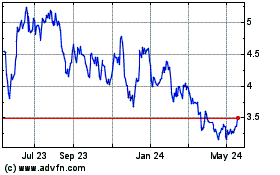

Destination XL (NASDAQ:DXLG)

Historical Stock Chart

From Dec 2024 to Jan 2025

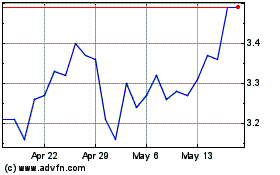

Destination XL (NASDAQ:DXLG)

Historical Stock Chart

From Jan 2024 to Jan 2025